The best trading platform forex is a vital tool for any forex trader, offering access to global markets, advanced charting tools, and real-time data. Choosing the right platform can significantly impact your trading success, so it’s crucial to understand the key features and considerations before making a decision.

This guide will explore the essential aspects of forex trading platforms, including the types available, key features to consider, and how to select the best platform for your individual needs and trading style. We’ll also delve into security and regulation, educational resources, customer support, and trading costs to help you make an informed choice.

Understanding Forex Trading Platforms

A Forex trading platform is your gateway to the global currency market. It’s an essential tool for any trader, providing access to real-time market data, order execution, and various analytical tools.

User-Friendly Interfaces and Intuitive Navigation

A Forex trading platform should be easy to use and navigate, regardless of your trading experience. A user-friendly interface simplifies the trading process, allowing you to quickly find the information you need and execute trades efficiently. Look for platforms with intuitive menus, clear layouts, and customizable dashboards.

Advanced Charting Tools and Technical Indicators

Technical analysis plays a crucial role in Forex trading, and a robust charting platform is essential. Advanced charting tools enable you to visualize price movements, identify trends, and apply technical indicators to make informed trading decisions.

Technical indicators are mathematical calculations based on historical price data that help traders identify potential buy or sell signals.

- Moving Averages: Calculate the average price of a currency pair over a specific period, helping identify trends and potential support or resistance levels.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market.

- Bollinger Bands: A volatility indicator that shows price fluctuations relative to a moving average, providing insight into potential breakouts or reversals.

Key Features to Consider

Choosing the right Forex trading platform is crucial for your success in the market. It should provide you with the necessary tools and resources to make informed trading decisions and execute your strategies efficiently. Here are some key features to look for in a top-rated Forex trading platform.

Real-Time Market Data

Real-time market data is essential for making informed trading decisions. It provides you with up-to-the-minute information on currency prices, economic indicators, and other market events. This data can help you identify trading opportunities and make informed decisions about when to enter and exit trades.

- Currency Quotes: Real-time quotes for all major and minor currency pairs, including bid and ask prices, spread, and volume.

- Economic Calendar: A calendar that displays upcoming economic releases, such as interest rate decisions, inflation reports, and employment data. This information can have a significant impact on currency prices.

- Market News: Access to real-time news feeds from reputable sources, providing insights into market events and their potential impact on currency prices.

Order Execution Speed

Order execution speed is crucial for minimizing slippage and maximizing profits. A fast execution speed ensures that your orders are filled at the desired price, even in volatile market conditions.

- Low Latency: The platform should have low latency, meaning it takes minimal time to process and execute your orders. This is particularly important for scalping and high-frequency trading strategies.

- Slippage Control: The platform should offer tools to help you control slippage, which is the difference between the price you expect to get and the price you actually get when your order is filled.

Trading Tools

A comprehensive set of trading tools can enhance your trading experience and improve your performance. These tools can help you analyze market trends, identify trading opportunities, and manage your risk.

- Technical Indicators: Tools that help you analyze price charts and identify potential trading opportunities based on technical patterns and trends.

- Charting Tools: Advanced charting tools that allow you to create and customize charts, draw technical indicators, and analyze market data visually.

- Trading Strategies: Pre-built trading strategies that you can use to automate your trading or as a starting point for developing your own strategies.

- Backtesting: The ability to backtest your trading strategies on historical data to assess their performance and identify potential areas for improvement.

Security Measures and Regulatory Compliance

Security is paramount when choosing a Forex trading platform. You need to ensure that your funds and personal information are protected from unauthorized access. Regulatory compliance is also essential to ensure that the platform operates ethically and transparently.

- Data Encryption: The platform should use industry-standard encryption technologies to protect your personal information and trading data.

- Two-Factor Authentication: This adds an extra layer of security to your account by requiring you to enter a code from your mobile device in addition to your password.

- Regulatory Compliance: The platform should be regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. This ensures that the platform adheres to strict financial regulations and consumer protection laws.

Types of Forex Trading Platforms

Choosing the right forex trading platform is crucial for a successful trading experience. Different platforms cater to varying needs and preferences, offering diverse features and functionalities. Understanding the different types of platforms available will help you make an informed decision.

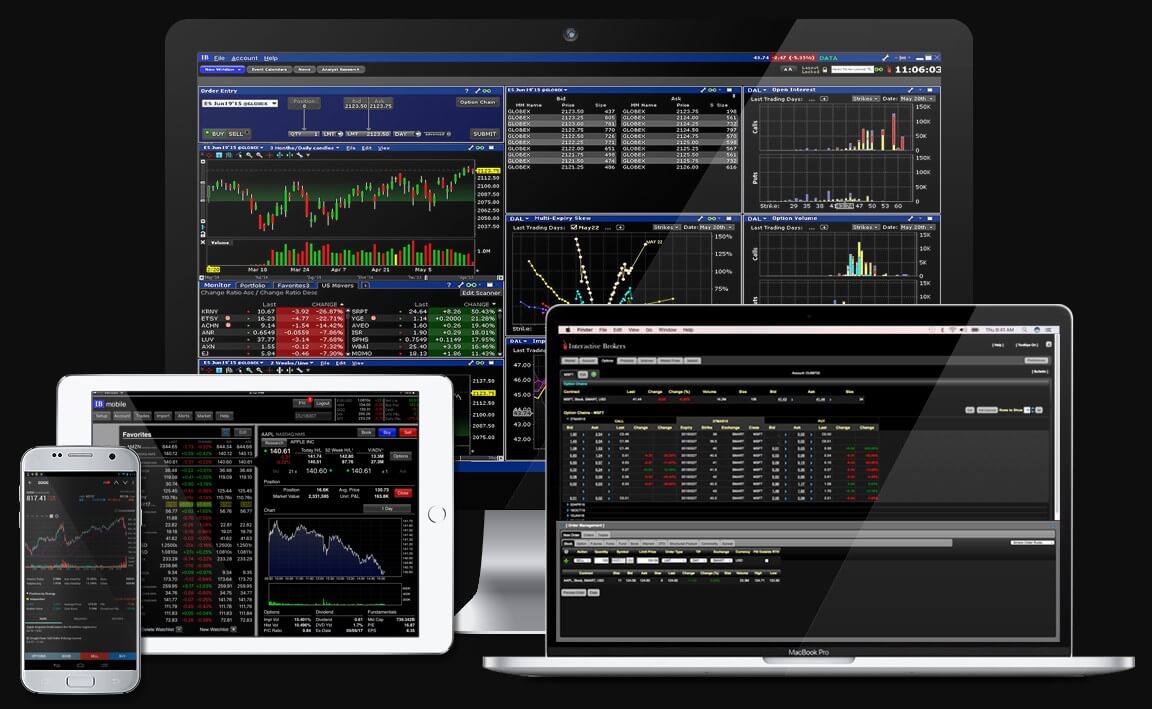

Desktop Platforms

Desktop platforms are downloadable software applications that offer a comprehensive and feature-rich trading experience. These platforms provide advanced charting tools, technical indicators, real-time market data, and order execution capabilities. They are typically designed for experienced traders who require a high level of customization and control over their trading strategies.

- Advantages:

- Extensive features and customization options

- Advanced charting tools and technical indicators

- Faster order execution speeds

- Greater stability and reliability

- Disadvantages:

- Requires downloading and installation

- Limited accessibility from multiple devices

- Potentially resource-intensive, requiring a powerful computer

Examples: MetaTrader 4 (MT4), MetaTrader 5 (MT5), NinjaTrader, TradeStation

Web-Based Platforms

Web-based platforms are accessible through any web browser, eliminating the need for downloads or installations. These platforms are user-friendly and provide a streamlined trading experience, making them ideal for beginners. They typically offer a limited set of features compared to desktop platforms, but they are convenient and accessible from any device with an internet connection.

- Advantages:

- No downloads or installations required

- Accessible from any device with an internet connection

- User-friendly and intuitive interface

- Often free to use

- Disadvantages:

- Limited features compared to desktop platforms

- Potentially slower order execution speeds

- May require a stable internet connection for optimal performance

Examples: TradingView, cTrader Web, FXTM WebTrader

Mobile Platforms

Mobile platforms are optimized for smartphones and tablets, allowing traders to access the market on the go. These platforms offer a simplified trading experience, with core features designed for mobile devices. They are convenient for quick trades and monitoring market movements, but they may have limited functionalities compared to desktop or web-based platforms.

- Advantages:

- Convenience and accessibility from anywhere

- Real-time market data and order execution capabilities

- Push notifications for important market updates

- Disadvantages:

- Limited features compared to desktop or web-based platforms

- Smaller screen size may hinder technical analysis

- Potentially slower order execution speeds

Examples: MetaTrader 4 (MT4) Mobile, MetaTrader 5 (MT5) Mobile, cTrader Mobile, FXTM Mobile Trader

Choosing the Right Platform

Finding the perfect Forex trading platform can feel like searching for a needle in a haystack. With so many options available, each boasting unique features and functionalities, it’s crucial to have a systematic approach to make the right choice. This involves considering your individual needs, trading style, and budget.

A Decision-Making Framework

The key to finding the best Forex trading platform lies in understanding your individual requirements. A decision-making framework can guide you through this process.

- Trading Style: Are you a scalper, day trader, swing trader, or long-term investor? Each trading style demands specific platform features, such as speed of execution, charting tools, and order types.

- Trading Frequency: Do you trade frequently or only occasionally? Frequent traders may prioritize platforms with advanced charting and analysis tools, while occasional traders may focus on ease of use and low fees.

- Budget: How much are you willing to spend on trading commissions, platform fees, and other expenses? Consider the minimum deposit requirements and trading volume needed to avoid hefty fees.

- Technical Features: What specific features are essential for your trading style? Consider charting tools, order types, real-time data, and indicators.

- Customer Support: How responsive and helpful is the platform’s customer support? Look for platforms with 24/5 support channels like phone, email, and live chat.

- Educational Resources: Does the platform offer educational materials, tutorials, or webinars to help you improve your trading skills?

Comparing Key Features

Once you’ve identified your needs, it’s time to compare different platforms. A comprehensive table can help you assess key features and functionalities.

| Platform | Minimum Deposit | Spreads | Order Types | Charting Tools | Educational Resources | Customer Support |

|—|—|—|—|—|—|—|

| MetaTrader 4 (MT4) | Varies by broker | Competitive | Market, Limit, Stop | Advanced charting tools | Limited | 24/5 |

| MetaTrader 5 (MT5) | Varies by broker | Competitive | Market, Limit, Stop, Pending | Advanced charting tools | Limited | 24/5 |

| cTrader | Varies by broker | Competitive | Market, Limit, Stop, Pending | Advanced charting tools | Limited | 24/5 |

| TradingView | Free (limited features) | Not applicable | Not applicable | Advanced charting tools | Extensive | Limited |

| NinjaTrader | $0 | Varies by broker | Market, Limit, Stop, Pending | Advanced charting tools | Extensive | 24/5 |

Evaluating Customer Support, Educational Resources, and Trading Costs

Customer support is crucial for any trading platform. Look for platforms with multiple support channels, quick response times, and helpful staff.

- Phone support: Provides immediate assistance for urgent issues.

- Email support: Suitable for non-urgent inquiries or complex issues.

- Live chat: Offers quick responses for general questions or technical issues.

Educational resources can significantly enhance your trading knowledge. Look for platforms that offer:

- Tutorials: Step-by-step guides on various trading concepts.

- Webinars: Live sessions with experienced traders covering specific topics.

- Trading courses: Comprehensive programs designed to improve your trading skills.

Trading costs are a significant factor to consider. Compare different platforms based on:

- Spreads: The difference between the bid and ask price.

- Commissions: Fees charged for executing trades.

- Platform fees: Monthly or annual charges for using the platform.

Top Forex Trading Platforms: Best Trading Platform Forex

Choosing the right Forex trading platform is crucial for success in the market. There are many platforms available, each with its own strengths and weaknesses. This section will delve into some of the top-rated Forex trading platforms based on industry recognition and user reviews.

Top Forex Trading Platforms

Here’s a list of some of the top Forex trading platforms, highlighting their unique features and functionalities:

-

MetaTrader 4 (MT4): MT4 is a popular and widely used platform known for its user-friendly interface, advanced charting tools, and extensive customization options.

- Strengths:

- Widely available and supported by many brokers.

- Powerful charting tools with various indicators and technical analysis features.

- Extensive customization options to personalize the platform.

- Supports automated trading with Expert Advisors (EAs).

- Weaknesses:

- Older platform with limited mobile functionality compared to newer platforms.

- Some features may be outdated or lack modern functionality.

- Strengths:

-

MetaTrader 5 (MT5): MT5 is the successor to MT4, offering a more comprehensive set of features, including a wider range of order types, improved charting capabilities, and a more robust backtesting engine.

- Strengths:

- Advanced trading tools and functionalities, including more order types and improved charting.

- Supports multiple asset classes, including stocks, futures, and options, in addition to Forex.

- Enhanced backtesting capabilities for more reliable strategy development.

- Weaknesses:

- Steeper learning curve compared to MT4.

- Not as widely available as MT4, with fewer brokers offering it.

- Strengths:

-

cTrader: cTrader is a platform known for its speed, depth of market, and advanced order execution capabilities. It is particularly popular among scalpers and high-frequency traders.

- Strengths:

- Fast order execution with minimal slippage.

- Deep liquidity and access to a wide range of trading instruments.

- Advanced charting and technical analysis tools.

- Weaknesses:

- Less customization options compared to MT4 and MT5.

- Not as widely available as other platforms.

- Strengths:

-

TradingView: TradingView is a popular web-based platform that provides advanced charting, technical analysis tools, and social trading features.

- Strengths:

- Free version available with basic features.

- Powerful charting tools with a wide range of indicators and drawing tools.

- Social trading features allow users to share ideas and strategies.

- Integration with various brokers for live trading.

- Weaknesses:

- Limited order execution capabilities in the free version.

- Not as comprehensive as dedicated trading platforms for advanced traders.

- Strengths:

-

NinjaTrader: NinjaTrader is a powerful platform designed for both beginner and advanced traders, offering a wide range of features and tools.

- Strengths:

- Comprehensive suite of tools for technical analysis, strategy development, and order management.

- Supports automated trading with NinjaScript, a proprietary programming language.

- Free version available with limited features.

- Weaknesses:

- Steeper learning curve compared to some platforms.

- Not as widely available as other platforms.

- Strengths:

Security and Regulation

When choosing a Forex trading platform, security and regulation are paramount. A regulated platform provides peace of mind, knowing your funds and trading activities are protected.

Importance of Regulated Platforms

Choosing a regulated Forex trading platform is crucial for safeguarding your funds and ensuring fair trading practices. Regulatory bodies play a vital role in maintaining the integrity and stability of the financial markets, protecting investors from fraud and malpractice.

Role of Regulatory Bodies

Reputable regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, and the Australian Securities and Investments Commission (ASIC) in Australia, establish and enforce strict rules and regulations for Forex brokers. These regulations cover various aspects, including:

- Capital adequacy requirements: Brokers must maintain sufficient capital reserves to cover potential losses, ensuring financial stability and protecting investors’ funds.

- Client segregation of funds: Client funds must be kept separate from the broker’s own funds, preventing the broker from using client money for its own operations and safeguarding funds in case of insolvency.

- Transparency and reporting: Brokers are required to provide clear and accurate information about their services, fees, and trading conditions, promoting transparency and accountability.

- Dispute resolution mechanisms: Regulatory bodies provide dispute resolution mechanisms to help resolve any conflicts between clients and brokers, ensuring fair and impartial resolutions.

Examples of Regulatory Frameworks and Licenses

Regulatory frameworks and licenses serve as indicators of a platform’s trustworthiness. Some examples include:

- FCA authorization: In the UK, brokers must be authorized and regulated by the FCA, which ensures compliance with strict financial regulations and client protection standards.

- SEC registration: In the US, brokers must be registered with the SEC, subject to comprehensive regulations covering capital adequacy, client protection, and anti-money laundering measures.

- ASIC license: In Australia, brokers must hold an ASIC license, demonstrating compliance with Australian financial regulations and investor protection laws.

Educational Resources

Many Forex trading platforms recognize the importance of educating their users, providing valuable resources to help traders of all levels improve their skills and knowledge. These resources range from basic tutorials for beginners to advanced analysis reports for experienced traders.

Types of Educational Resources

Forex trading platforms offer a variety of educational resources to cater to different learning styles and preferences.

- Tutorials and Courses: These resources provide step-by-step instructions on various aspects of Forex trading, covering topics such as fundamental and technical analysis, risk management, and trading strategies. Some platforms offer interactive courses with quizzes and exercises to reinforce learning.

- Webinars and Live Trading Sessions: Webinars and live trading sessions allow traders to learn from experienced professionals in real-time. These sessions often cover current market trends, trading strategies, and analysis techniques.

- Market Analysis Reports: Platforms may provide daily, weekly, or monthly market analysis reports that offer insights into current market conditions, economic indicators, and potential trading opportunities.

- Glossary of Terms: Forex trading involves a specialized vocabulary. Many platforms offer comprehensive glossaries to help traders understand key terms and concepts.

- Trading Calculators: Trading calculators can be helpful tools for calculating profit and loss, stop-loss levels, and other important trading metrics.

- Economic Calendars: Economic calendars provide information on upcoming economic events and their potential impact on the Forex market.

Benefits of Educational Resources, Best trading platform forex

Educational resources offered by Forex trading platforms provide numerous benefits for traders, including:

- Improved Trading Skills: Access to tutorials, webinars, and analysis reports helps traders develop a deeper understanding of Forex trading principles and strategies.

- Increased Confidence: Learning about Forex trading can boost traders’ confidence in their abilities and help them make more informed trading decisions.

- Reduced Risk: Educational resources often emphasize the importance of risk management, which can help traders minimize their losses and protect their capital.

- Enhanced Profitability: By acquiring new skills and knowledge, traders can potentially improve their trading performance and increase their profitability.

Platforms with Comprehensive Educational Support

Several Forex trading platforms offer comprehensive educational support for both beginners and experienced traders.

- FXTM: FXTM provides a wide range of educational resources, including video tutorials, webinars, and market analysis reports. They also offer a dedicated education center with a comprehensive library of articles, eBooks, and trading guides.

- XM: XM is known for its extensive educational program, which includes webinars, seminars, and trading courses. They also provide personalized support through their dedicated account managers.

- AvaTrade: AvaTrade offers a variety of educational resources, including video tutorials, webinars, and trading simulations. They also have a dedicated education center with articles, eBooks, and trading guides.

Customer Support

Navigating the Forex market can be complex, and traders often encounter questions or issues that require assistance. This is where reliable customer support plays a crucial role in enhancing the overall trading experience.

A responsive and helpful customer support team can be a valuable asset for Forex traders, offering guidance, troubleshooting assistance, and timely resolutions to any problems that may arise.

Customer Support Channels

Forex trading platforms typically offer a range of customer support channels to cater to different preferences and needs.

- Email Support: This channel is suitable for non-urgent inquiries or detailed questions that require a written response. Traders can expect a response within a reasonable timeframe, typically within 24-48 hours.

- Phone Support: For urgent matters or situations requiring immediate assistance, phone support provides a direct line to a customer service representative. This option is ideal for resolving issues that require immediate attention, such as account access problems or order execution errors.

- Live Chat: Live chat offers real-time communication with a customer support agent. This channel is particularly helpful for quick answers to simple questions, account verification issues, or technical problems that need immediate resolution.

Responsiveness and Helpfulness

The responsiveness and helpfulness of customer support teams are critical factors to consider when choosing a Forex trading platform.

- Response Time: A reliable platform should have a customer support team that responds promptly to inquiries, regardless of the chosen channel. Look for platforms that boast average response times within a reasonable timeframe, such as within minutes for live chat, within hours for email, and within a day for phone support.

- Knowledge and Expertise: Customer support representatives should be knowledgeable about the platform’s features, trading instruments, and market conditions. They should be able to provide accurate information, helpful guidance, and effective solutions to trader concerns.

- Problem Resolution: A good customer support team should be able to resolve issues efficiently and effectively. They should be proactive in identifying potential problems, offer practical solutions, and follow up to ensure customer satisfaction.

Trading Costs and Fees

Understanding the costs associated with forex trading is crucial for maximizing your profitability. Forex trading platforms charge various fees, which can significantly impact your overall returns. This section will delve into the different types of fees, how they are structured, and strategies for minimizing these costs.

Spreads

Spreads are the difference between the bid and ask prices of a currency pair. The bid price is the price at which a broker is willing to buy a currency, while the ask price is the price at which they are willing to sell. The spread is the broker’s profit margin and is typically expressed in pips (points in percentage).

For example, if the EUR/USD bid price is 1.1200 and the ask price is 1.1205, the spread is 5 pips.

Spreads can vary depending on the currency pair, the time of day, and the trading volume.

- Variable spreads: These spreads fluctuate based on market volatility and liquidity. They are typically wider during periods of high volatility and narrower during calmer market conditions. Variable spreads can offer the potential for lower trading costs during periods of low volatility.

- Fixed spreads: These spreads remain constant regardless of market conditions. Fixed spreads provide predictability and transparency but may be wider than variable spreads, particularly during volatile market periods.

Commissions

Some forex brokers charge commissions on trades, which are a fixed fee per trade or a percentage of the trade volume. Commissions are typically charged in addition to spreads.

- Commission-based brokers: These brokers typically offer tighter spreads but charge commissions on trades. They are often preferred by high-volume traders who can offset the commission costs with their trading activity.

- Spread-based brokers: These brokers incorporate the commission into the spread, meaning there is no separate commission fee. They are generally preferred by smaller traders who may not have the volume to justify commission-based trading.

Inactivity Fees

Some brokers charge inactivity fees if an account remains dormant for a specific period. These fees are typically small but can add up over time if an account is not actively traded.

It is important to review the broker’s fee schedule to understand the inactivity fee policy and avoid incurring unnecessary charges.

Other Fees

- Deposit and withdrawal fees: Some brokers charge fees for depositing or withdrawing funds from your trading account. These fees vary depending on the payment method used.

- Overnight fees: These fees are charged for holding positions open overnight, reflecting the interest rate differential between the two currencies in a pair.

- Swap fees: These fees are charged for holding positions open over the weekend, reflecting the interest rate differential between the two currencies in a pair.

Minimizing Trading Costs

- Choose a broker with low spreads: Compare spreads across different brokers to find the best rates for the currency pairs you trade.

- Consider commission-based brokers: If you are a high-volume trader, commission-based brokers can offer lower overall costs.

- Trade during periods of low volatility: Spreads are typically narrower during periods of low volatility, so try to trade during these times.

- Avoid inactivity fees: If you are not actively trading, consider closing your account or transferring your funds to a different broker that does not charge inactivity fees.

- Use a demo account: Practice your trading strategies and experiment with different brokers and platforms using a demo account before committing real capital.

Summary

Navigating the world of forex trading platforms can be overwhelming, but by understanding the key features, comparing different options, and considering your individual needs, you can find the platform that empowers you to achieve your trading goals. Remember to prioritize security, user-friendliness, and a platform that provides the tools and resources you need to succeed.

Commonly Asked Questions

What are the benefits of using a forex trading platform?

Forex trading platforms offer several benefits, including access to global markets, real-time data, advanced charting tools, order execution speed, security measures, and educational resources.

How do I choose the best forex trading platform for me?

Consider your trading style, experience level, budget, and the features you need. Research different platforms, compare their offerings, and read reviews to make an informed decision.

What are the different types of forex trading platforms?

Forex trading platforms come in various types, including desktop, web-based, and mobile platforms. Each type offers different advantages and disadvantages, so choose the one that best suits your needs.

Is it safe to use a forex trading platform?

It’s crucial to choose a regulated forex trading platform with robust security measures to protect your funds and ensure fair trading practices.

What are the costs associated with forex trading?

Forex trading costs include spreads, commissions, and inactivity fees. Compare the fee structures of different platforms to minimize your trading expenses.