Best time for forex trading is a crucial factor for success in this dynamic market. The forex market, unlike traditional stock markets, operates 24 hours a day, five days a week, offering traders around the globe opportunities to capitalize on currency fluctuations. However, navigating the complexities of global trading hours, economic events, and market volatility requires a strategic approach. Understanding the best times to trade forex, considering different trading styles, and mastering the art of trading psychology are essential for maximizing profitability and minimizing risk.

This comprehensive guide delves into the intricacies of forex trading hours, exploring the impact of major trading sessions like New York, London, and Tokyo on market volatility. We’ll analyze how economic releases, news events, and technical indicators influence currency movements, providing you with valuable insights into identifying the most opportune trading times. We’ll also explore different trading strategies and their suitability for specific timeframes, equipping you with the knowledge to make informed decisions based on your individual goals and risk tolerance.

Best Times for Specific Trading Styles

The forex market operates 24 hours a day, five days a week, providing ample opportunities for traders of all styles. However, the best times for trading depend on your chosen strategy and the market’s liquidity and volatility.

Scalping

Scalping is a short-term trading strategy that aims to profit from small price fluctuations. Scalpers typically hold trades for a few seconds or minutes, aiming to capture quick profits. The best times for scalping are during periods of high liquidity and volatility, when prices move rapidly.

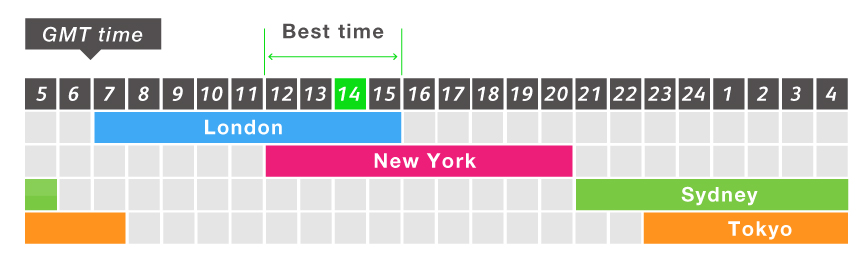

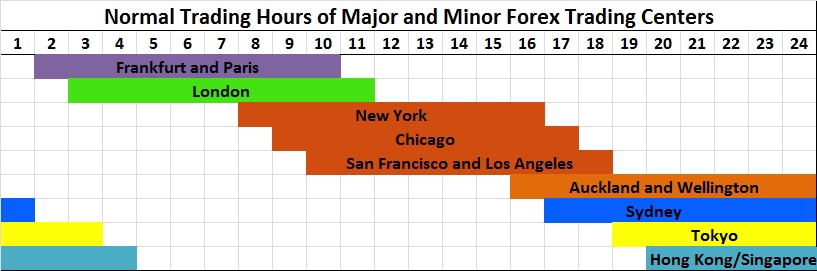

- London Session (8:00 AM – 12:00 PM GMT): This session is characterized by high liquidity and volatility, making it ideal for scalping. Major European banks and institutions are active during this time, leading to significant price movements.

- New York Session (1:00 PM – 5:00 PM GMT): The New York session is also a popular time for scalping, with high volume and volatility driven by American traders and institutions.

- Overlapping Sessions (1:00 PM – 4:00 PM GMT): The overlap between the London and New York sessions creates a period of heightened activity, with increased liquidity and volatility.

Day Trading, Best time for forex trading

Day traders aim to profit from price movements within a single trading day, typically closing all positions before the market closes. The best times for day trading are during periods of high liquidity and volatility, when there are ample trading opportunities.

- London Session (8:00 AM – 12:00 PM GMT): This session offers high liquidity and volatility, making it a prime time for day trading.

- New York Session (1:00 PM – 5:00 PM GMT): The New York session is also a popular time for day trading, with high volume and volatility driven by American traders and institutions.

- Tokyo Session (11:00 PM – 7:00 AM GMT): While the Tokyo session is less volatile than the London and New York sessions, it can still offer opportunities for day traders, particularly during economic releases.

Swing Trading

Swing traders aim to capture price movements over a few days or weeks, holding trades for longer periods than scalpers or day traders. Swing traders typically focus on identifying and riding trends, looking for opportunities to enter at support and resistance levels.

- Economic Releases: Major economic releases, such as Non-Farm Payrolls or inflation data, can trigger significant price movements, providing opportunities for swing traders to enter long or short positions.

- Trend Changes: Swing traders often look for trend changes, using technical indicators to identify potential reversals.

- Market Openings: The opening of major trading sessions, such as the London and New York sessions, can provide opportunities for swing traders to enter trades based on initial price movements.

Trading Calendar and Market Events

Understanding the influence of economic events on forex markets is crucial for successful trading. A trading calendar serves as a valuable tool, helping traders identify significant economic releases and their potential impact on currency pairs.

Key Economic Releases and Their Impact

Economic releases, such as interest rate decisions, inflation reports, and employment data, can significantly affect currency values. These releases often cause market volatility, presenting opportunities and risks for traders.

- Interest Rate Decisions: Central banks adjust interest rates to control inflation and stimulate economic growth. Higher interest rates generally attract foreign investment, strengthening the currency. For example, the US Federal Reserve’s interest rate decisions can significantly impact the US dollar (USD) against other currencies.

- Inflation Reports: Inflation measures the rate of price increases in goods and services. High inflation can weaken a currency, as it erodes purchasing power. Conversely, low inflation can strengthen a currency. For instance, a higher-than-expected inflation report in the Eurozone could weaken the euro (EUR) against other currencies.

- Employment Data: Employment figures, such as unemployment rates and non-farm payrolls, provide insights into the health of a country’s economy. Strong employment data typically strengthens a currency, while weak data can weaken it. For example, a strong US non-farm payrolls report could boost the USD against other currencies.

Market Holidays and Their Influence

Market holidays can significantly affect trading volume and volatility. During holidays, trading activity often decreases, leading to thinner markets and potentially wider price swings.

- Reduced Trading Volume: Fewer participants in the market during holidays can lead to lower trading volume, resulting in less liquidity and potentially wider price gaps. For instance, during the Christmas holidays, trading volume in the forex market often declines, making it challenging to execute trades at desired prices.

- Increased Volatility: With reduced liquidity, price movements can become more volatile during holidays. News events or unexpected economic releases can have a greater impact on currency prices when trading volume is low. For example, a surprise announcement from a central bank during a holiday period could cause significant price swings in the affected currency.

Final Thoughts: Best Time For Forex Trading

Mastering the art of identifying the best time for forex trading is a journey that requires continuous learning and adaptation. By understanding the nuances of global trading hours, leveraging technical and fundamental analysis, and embracing sound trading psychology, you can position yourself for success in this dynamic and rewarding market. Remember, the key to profitable forex trading lies in a combination of knowledge, discipline, and a willingness to learn and adapt.

FAQ Insights

What are the most volatile times for forex trading?

The most volatile times for forex trading are typically during the overlap periods of major trading sessions, such as when the London session overlaps with the New York session. These periods are characterized by high liquidity and increased trading activity, leading to wider price swings.

Is it better to trade forex during the day or night?

The best time to trade forex depends on your individual trading style and preferences. Day traders typically prefer trading during the major trading sessions when liquidity is high. Night traders, on the other hand, may find opportunities during the quieter periods when volatility is lower.

What are some tips for managing trading psychology?

To manage trading psychology, it’s crucial to develop a disciplined approach, stick to your trading plan, avoid emotional trading, and manage your risk effectively. Regularly reviewing your trading performance and seeking guidance from experienced traders can also be beneficial.