- Ameritrade Forex Overview

- Account Types and Trading Platforms

- Trading Tools and Resources

- Trading Strategies and Techniques

- Forex Education and Support

- Risk Management and Security

- Customer Reviews and Testimonials: Ameritrade Forex

- Ameritrade Forex: A Comprehensive Guide

- Conclusive Thoughts

- Clarifying Questions

Ameritrade Forex offers a comprehensive platform for traders of all levels, providing access to a wide range of currency pairs, leverage options, and trading tools. Whether you’re a seasoned professional or just starting out, Ameritrade’s platform aims to empower you with the resources and support needed to navigate the dynamic world of forex trading.

The platform boasts user-friendly interfaces, robust charting tools, and educational resources designed to enhance your trading knowledge and skills. Ameritrade also emphasizes risk management, providing tools and guidance to help you mitigate potential losses and protect your investments.

Ameritrade Forex Overview

Ameritrade, a prominent name in the financial services industry, has established itself as a significant player in the forex market. With its robust platform, diverse offerings, and commitment to user-friendly technology, Ameritrade has become a popular choice for forex traders of all experience levels.

History and Evolution of Ameritrade’s Forex Trading Platform, Ameritrade forex

Ameritrade’s journey in the forex market began in the early 2000s, initially offering forex trading through its established brokerage platform. Over the years, the company has continuously refined and expanded its forex offerings, responding to the growing demand for advanced trading tools and technology. This evolution has resulted in the development of a comprehensive and sophisticated forex trading platform that caters to the needs of both novice and seasoned traders.

Ameritrade’s Forex Offerings

Ameritrade provides a wide range of forex offerings, encompassing a diverse selection of currency pairs, flexible leverage options, and comprehensive trading tools.

Currency Pairs

Ameritrade offers a wide selection of currency pairs, covering major, minor, and exotic currencies. This diverse range allows traders to access a wide spectrum of trading opportunities and capitalize on market movements across different currency combinations. Some popular currency pairs available on the Ameritrade platform include:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

Leverage Options

Leverage is a powerful tool in forex trading, enabling traders to amplify their potential profits or losses. Ameritrade provides a range of leverage options, allowing traders to customize their risk exposure based on their trading style and risk tolerance. It’s important to note that leverage can also magnify losses, so it’s crucial to use it responsibly and with a thorough understanding of its implications.

Trading Tools

Ameritrade equips traders with a suite of powerful trading tools designed to enhance their trading experience and facilitate informed decision-making. These tools include:

- Real-time Market Data: Access to real-time market data is crucial for making informed trading decisions. Ameritrade provides real-time quotes, charts, and news feeds to keep traders abreast of market movements and events.

- Advanced Charting: Ameritrade’s platform offers advanced charting capabilities, allowing traders to analyze price patterns, identify trends, and develop trading strategies. This includes various charting tools, indicators, and drawing features.

- Technical Analysis Tools: Technical analysis is an integral part of forex trading, and Ameritrade provides a range of tools to support this approach. These tools include moving averages, oscillators, and other indicators that help traders identify trends and potential trading opportunities.

- Order Types: Ameritrade offers a variety of order types, including market orders, limit orders, stop orders, and trailing stops, allowing traders to execute trades based on their specific needs and risk tolerance.

- Trading Strategies: Ameritrade offers educational resources and trading strategies to help traders develop their skills and improve their trading performance. These resources include articles, videos, and webinars covering various trading concepts and strategies.

Key Features and Benefits of Trading Forex with Ameritrade

Ameritrade presents several key features and benefits that make it an attractive option for forex traders:

User-Friendly Platform

Ameritrade’s trading platform is designed with user-friendliness in mind, making it accessible to traders of all experience levels. The platform features a clean and intuitive interface, allowing traders to navigate easily and access the tools and information they need.

Strong Reputation and Reliability

Ameritrade is a reputable and established financial institution with a long history of providing reliable and secure trading services. This reputation for stability and trustworthiness is crucial for traders seeking a secure and dependable platform for their forex trading activities.

Competitive Pricing

Ameritrade offers competitive pricing, including low spreads and commissions, which can help traders maximize their profits. The platform’s transparent pricing structure allows traders to understand the costs associated with their trades and make informed decisions.

Excellent Customer Support

Ameritrade provides responsive and comprehensive customer support, available through various channels, including phone, email, and live chat. This support can be invaluable for traders who need assistance with navigating the platform, understanding trading concepts, or resolving any issues they may encounter.

Educational Resources

Ameritrade recognizes the importance of education in forex trading and offers a wealth of resources to help traders develop their skills and knowledge. These resources include articles, videos, webinars, and trading simulations that cover various aspects of forex trading.

Mobile Trading App

Ameritrade’s mobile trading app allows traders to access their accounts and manage their trades from anywhere with an internet connection. The app features a user-friendly interface, real-time market data, and a range of trading tools, providing traders with the flexibility to trade on the go.

Strengths and Weaknesses of Ameritrade’s Forex Offerings

Ameritrade’s forex offerings have both strengths and weaknesses, which traders should consider before choosing the platform.

Strengths:

- User-Friendly Platform: Ameritrade’s platform is known for its user-friendliness, making it accessible to traders of all experience levels.

- Wide Range of Offerings: Ameritrade offers a diverse selection of currency pairs, leverage options, and trading tools to cater to various trading styles and preferences.

- Competitive Pricing: Ameritrade’s pricing structure is competitive, with low spreads and commissions, which can help traders maximize their profits.

- Excellent Customer Support: Ameritrade provides responsive and comprehensive customer support, available through various channels.

- Educational Resources: Ameritrade offers a wealth of educational resources to help traders develop their skills and knowledge.

Weaknesses:

- Limited Research Tools: While Ameritrade provides some research tools, its offerings in this area may be less comprehensive compared to some other forex brokers.

- No Copy Trading: Ameritrade does not currently offer copy trading features, which allow traders to automatically copy the trades of experienced traders.

Account Types and Trading Platforms

Ameritrade offers a single account type for forex trading, catering to a wide range of traders. This unified approach simplifies the account selection process and focuses on providing a comprehensive trading experience.

Ameritrade Forex Account

Ameritrade’s forex account offers access to a diverse range of currency pairs, competitive spreads, and advanced trading tools. It’s designed to meet the needs of both novice and experienced traders.

Key Features

- Minimum Deposit: There is no minimum deposit requirement to open an Ameritrade forex account, making it accessible to traders with varying capital levels.

- Trading Fees: Ameritrade charges a commission per lot traded, with the exact fee varying depending on the currency pair and trading volume. This commission structure is transparent and allows traders to calculate their trading costs accurately.

- Spreads: Ameritrade offers competitive spreads on major currency pairs, starting from 0.8 pips. Spreads can fluctuate based on market conditions and the chosen currency pair.

- Leverage: Traders can access leverage up to 50:1, allowing them to control larger positions with a smaller initial investment. Leverage can amplify both profits and losses, so it’s crucial to understand its implications and manage risk effectively.

- Trading Platform: Ameritrade’s forex trading platform, Thinkorswim, provides a robust and feature-rich environment for executing trades, analyzing markets, and managing risk.

Thinkorswim Trading Platform

Thinkorswim is a comprehensive and intuitive trading platform designed for both beginners and seasoned traders. It offers a wide range of features and tools to support various trading styles.

User Interface

The platform boasts a user-friendly interface with customizable layouts and multiple charting options. Traders can easily navigate the platform and access essential trading tools.

Key Features

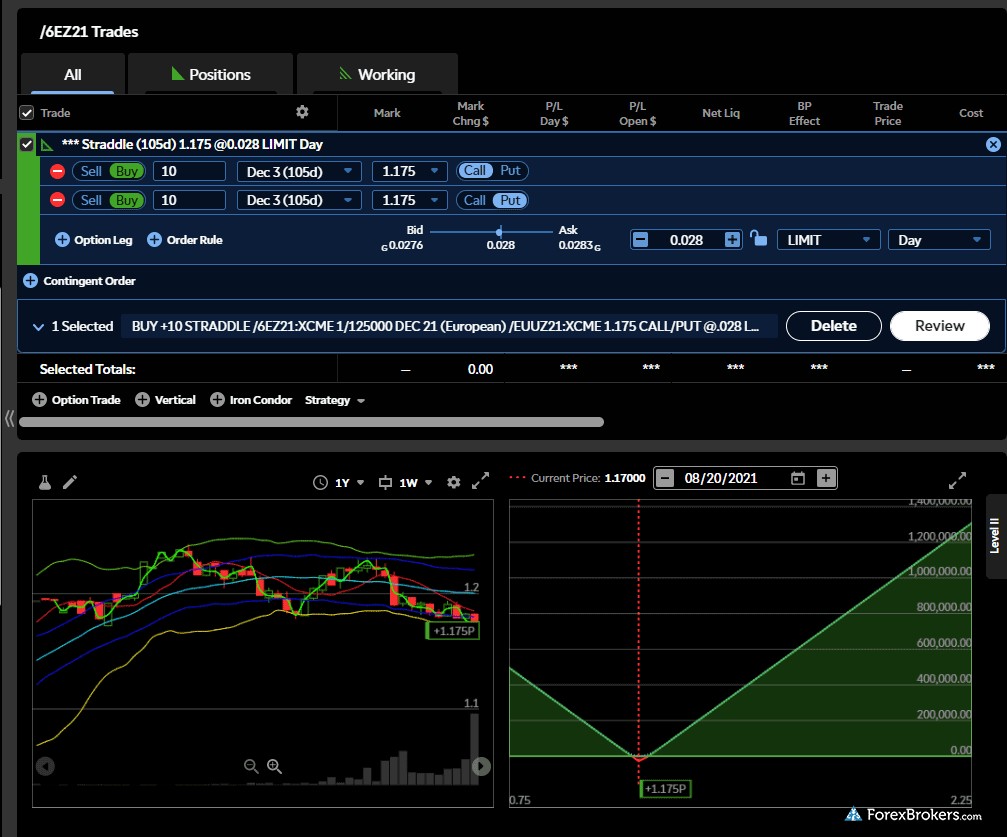

- Advanced Charting: Thinkorswim offers a wide range of charting tools, including technical indicators, drawing tools, and real-time market data. Traders can analyze price patterns and identify potential trading opportunities.

- Order Types: The platform supports various order types, including market orders, limit orders, stop orders, and trailing stops, allowing traders to execute trades according to their specific strategies.

- Trading Tools: Thinkorswim provides advanced trading tools like watchlists, scanners, and alerts, helping traders monitor market activity and identify potential trading opportunities.

- Research and Analysis: The platform offers access to fundamental and technical analysis tools, including economic calendars, news feeds, and market research reports, enabling traders to make informed trading decisions.

- Mobile App: Thinkorswim is also available as a mobile app, allowing traders to access their accounts and trade from anywhere with an internet connection.

Comparison with Other Platforms

Ameritrade’s Thinkorswim platform compares favorably to other popular forex trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Key Differences

- Thinkorswim is known for its comprehensive charting tools, advanced trading features, and user-friendly interface. It offers a wider range of research and analysis tools compared to MT4 and MT5.

- MT4 and MT5 are popular among forex traders due to their widespread adoption and extensive customization options. They are also known for their robust charting capabilities and a wide range of trading tools.

Trading Tools and Resources

Ameritrade offers a comprehensive suite of trading tools and resources designed to empower forex traders of all levels. These tools provide insights, analysis, and educational materials that can help traders make informed decisions and enhance their trading strategies.

Charting Tools

Ameritrade’s charting tools provide traders with a visual representation of price movements, enabling them to identify trends, patterns, and potential trading opportunities. Traders can access a variety of charting styles, including candlestick, line, and bar charts, along with customizable indicators and drawing tools. This allows traders to personalize their charts to suit their individual trading styles and analysis preferences.

Technical Indicators

Technical indicators are mathematical calculations based on historical price data that help traders identify trends, momentum, and potential buy or sell signals. Ameritrade offers a wide range of technical indicators, including moving averages, oscillators, and volatility indicators. Traders can use these indicators to gain insights into market sentiment, identify overbought or oversold conditions, and confirm potential trading setups.

Educational Materials

Ameritrade recognizes the importance of education in forex trading and provides a wealth of educational materials to help traders improve their knowledge and skills. These materials include articles, videos, webinars, and online courses covering various topics, such as fundamental analysis, technical analysis, risk management, and trading psychology. Traders can access these resources through Ameritrade’s website, trading platform, and mobile app.

Trading Strategies

Traders can leverage Ameritrade’s tools and resources to develop and refine their trading strategies. For example, a trader could use technical indicators to identify potential entry and exit points, while using charting tools to visualize price action and confirm trading setups. They could then use educational materials to learn about risk management strategies and develop a plan for managing their trades.

Trading Strategies and Techniques

Forex trading offers a variety of strategies and techniques to suit different risk appetites and trading styles. Ameritrade provides tools and resources that enable traders to implement these strategies effectively. Here are some popular forex trading strategies that can be applied on the Ameritrade platform.

Scalping

Scalping is a high-frequency trading strategy that aims to profit from small price fluctuations in the forex market. Scalpers typically hold trades for a very short period, often just a few seconds or minutes, and aim to make numerous small profits. Scalping is well-suited for traders who are comfortable with high-risk, high-reward situations and who have access to fast and reliable trading platforms.

Scalping can be implemented using Ameritrade’s advanced charting tools and real-time market data. Scalpers can use technical indicators to identify short-term price trends and entry and exit points. For example, scalpers may use moving averages or Bollinger Bands to identify overbought or oversold conditions.

- Risks: Scalping carries significant risk due to the high volume of trades and the short holding periods. Market volatility can quickly wipe out profits or lead to substantial losses. Scalping also requires a high level of focus and discipline, as even small mistakes can have a significant impact on profitability.

- Rewards: Scalping offers the potential for high returns in a short period. Scalpers can make numerous small profits over the course of a trading day, which can add up to substantial gains over time.

Day Trading

Day trading involves buying and selling currencies within the same trading day. Day traders typically focus on short-term price movements and aim to profit from intraday price fluctuations. Unlike scalpers, day traders may hold trades for a few hours or even the entire trading day.

Ameritrade provides a range of tools and resources that can be helpful for day trading, including advanced charting tools, real-time market data, and customizable watchlists. Day traders can use technical indicators, fundamental analysis, and news events to identify trading opportunities. For example, a day trader might use a moving average crossover to identify a potential buy or sell signal.

- Risks: Day trading is a risky strategy that requires a high level of skill and experience. Traders need to be able to identify trends and entry and exit points quickly and accurately. Day trading also requires a significant amount of time and attention, as traders need to monitor the market constantly.

- Rewards: Day trading offers the potential for significant profits if executed correctly. Day traders can capitalize on short-term price movements and make multiple trades throughout the day. However, it’s important to note that losses are also possible, and day traders need to be prepared to manage their risk effectively.

Swing Trading

Swing trading is a strategy that aims to capture price swings in the forex market over a longer period, typically a few days to a few weeks. Swing traders use technical analysis to identify potential support and resistance levels and look for price breakouts or breakdowns. Swing traders often use a combination of technical indicators and fundamental analysis to identify trading opportunities.

Ameritrade’s charting tools and real-time market data can be used to identify potential swing trading opportunities. Swing traders can use indicators such as moving averages, MACD, and RSI to identify trends and momentum. They can also use fundamental analysis to understand the economic factors that may influence currency prices. For example, a swing trader might identify a potential long position in the EUR/USD if they believe that the euro is likely to appreciate against the US dollar due to strong economic growth in the eurozone.

- Risks: Swing trading is less risky than scalping or day trading because traders hold positions for a longer period. However, swing trading still carries risks, as market conditions can change quickly. Swing traders need to be able to manage their risk effectively and be prepared to exit positions if the market moves against them.

- Rewards: Swing trading offers the potential for larger profits than scalping or day trading because traders hold positions for a longer period. Swing traders can capture significant price swings in the forex market, which can lead to substantial gains.

Forex Education and Support

Ameritrade recognizes the importance of continuous learning and provides a comprehensive suite of educational resources and support to help traders of all levels improve their forex knowledge and skills. These resources are designed to equip traders with the tools and understanding necessary to navigate the complexities of the forex market and make informed trading decisions.

Webinars and Tutorials

Webinars and tutorials offer an interactive and engaging way to learn about forex trading. Ameritrade provides a wide range of webinars covering various aspects of forex, including fundamental and technical analysis, trading strategies, risk management, and market psychology. These webinars are led by experienced forex traders and analysts who share their insights and expertise. Tutorials are available on-demand and cover specific topics in detail, providing step-by-step instructions and practical examples.

Risk Management and Security

Forex trading, while offering significant potential for profit, is inherently risky. Understanding and effectively managing risk is crucial for any trader, especially in the volatile forex market. Ameritrade provides a comprehensive suite of tools and resources designed to help traders navigate the risks associated with forex trading and protect their capital.

Risk Management Strategies

Risk management is the process of identifying, assessing, and controlling potential risks. In forex trading, risk management strategies are essential for safeguarding your capital and ensuring that your trading decisions are based on sound financial principles. Ameritrade offers various features and tools to support traders in implementing effective risk management strategies.

- Stop-loss orders: Stop-loss orders are automated orders that automatically close a trade when the price reaches a predetermined level, limiting potential losses.

- Trailing stop-loss orders: Trailing stop-loss orders automatically adjust the stop-loss level based on price movements, allowing traders to lock in profits while minimizing losses.

- Margin requirements: Ameritrade’s margin requirements ensure that traders have sufficient funds to cover potential losses.

- Account balance monitoring: Traders can monitor their account balances in real-time, enabling them to track their risk exposure and adjust their trading strategies accordingly.

Security Measures

Ameritrade prioritizes the security of its customers’ accounts and trading data. The company employs robust security measures to protect against unauthorized access and cyber threats.

- Encryption: Ameritrade uses industry-standard encryption protocols to protect customer data transmitted over the internet.

- Two-factor authentication: Two-factor authentication adds an extra layer of security by requiring users to provide a second form of authentication, such as a code sent to their mobile device, in addition to their password.

- Firewall protection: Ameritrade’s network is protected by advanced firewalls to prevent unauthorized access.

- Regular security audits: Ameritrade conducts regular security audits to identify and address any potential vulnerabilities.

Potential Risks of Forex Trading

Forex trading, while offering potential rewards, also carries inherent risks. Understanding these risks is essential for making informed trading decisions.

- Market volatility: The forex market is highly volatile, meaning prices can fluctuate significantly in a short period. This volatility can lead to sudden and unexpected losses.

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses.

- Geopolitical events: Global events, such as political instability or economic crises, can significantly impact currency prices.

- Counterparty risk: Counterparty risk refers to the risk that the other party in a trade may not fulfill their obligations. This can occur in forex trading when dealing with brokers or other market participants.

Customer Reviews and Testimonials: Ameritrade Forex

Ameritrade’s forex trading platform has garnered a mix of positive and negative reviews from traders. It’s essential to analyze these reviews to understand the strengths and weaknesses of the platform and what factors contribute to customer satisfaction or dissatisfaction.

Analysis of Customer Reviews

Customer reviews provide valuable insights into the overall user experience with Ameritrade’s forex trading platform. Analyzing these reviews helps understand the strengths and weaknesses of the platform and identify areas for improvement.

- Positive Feedback: Many traders praise Ameritrade for its user-friendly platform, competitive pricing, and excellent customer support. The platform’s intuitive interface and comprehensive trading tools are highly regarded, making it accessible to both novice and experienced traders.

- Negative Feedback: Some traders have expressed concerns about the platform’s limited research tools, slow order execution speeds, and occasional technical glitches. While these issues are not widespread, they can impact the trading experience and contribute to dissatisfaction.

Factors Influencing Customer Satisfaction

Several factors contribute to customer satisfaction with Ameritrade’s forex services:

- Platform Usability: A user-friendly and intuitive platform is crucial for a positive trading experience. Ameritrade’s platform is generally well-received for its ease of use, even for novice traders.

- Trading Tools and Resources: Access to comprehensive trading tools, including charting, analysis, and research resources, is essential for informed trading decisions. Ameritrade offers a range of tools, though some traders may find the selection limited compared to other platforms.

- Customer Support: Responsive and helpful customer support is critical for addressing any issues or concerns. Ameritrade generally receives positive feedback for its customer support, which is available through various channels.

- Pricing and Fees: Competitive pricing and transparent fee structures are essential for traders to maximize their profits. Ameritrade’s pricing is generally considered competitive, but traders should carefully review the fee structure before making a decision.

Ameritrade Forex: A Comprehensive Guide

Ameritrade, a reputable and well-established online brokerage firm, offers a robust platform for forex trading. This guide provides a comprehensive overview of Ameritrade’s forex offerings, encompassing account types, trading platforms, tools, strategies, education, risk management, and customer feedback.

Trading Conditions and Fees

Ameritrade provides competitive trading conditions for forex traders. These conditions include:

- Spreads: Ameritrade offers tight spreads on major currency pairs, starting from 0.7 pips. Spreads for minor and exotic pairs may be wider.

- Commissions: Ameritrade does not charge commissions on forex trades. The only cost associated with trading is the spread.

- Minimum Deposit: Ameritrade does not have a minimum deposit requirement for forex accounts. However, it’s advisable to deposit a sufficient amount to cover margin requirements and trading expenses.

- Leverage: Ameritrade offers leverage of up to 50:1 for forex trading, which can amplify both profits and losses. Leverage should be used cautiously and with proper risk management strategies.

Conclusive Thoughts

With its diverse account types, advanced trading tools, and commitment to education and support, Ameritrade Forex presents a compelling option for traders seeking a comprehensive and user-friendly platform. Whether you’re a seasoned professional or just starting out, Ameritrade provides the resources and support you need to navigate the exciting and potentially rewarding world of forex trading.

Clarifying Questions

What is the minimum deposit required to open an Ameritrade Forex account?

The minimum deposit requirement for Ameritrade Forex accounts varies depending on the account type. It’s best to check their website or contact their customer support for the most up-to-date information.

Does Ameritrade offer any educational resources for forex traders?

Yes, Ameritrade provides a variety of educational resources, including webinars, tutorials, and articles covering forex trading fundamentals, strategies, and risk management. You can access these resources through their website or trading platform.

Is Ameritrade Forex regulated?

Yes, Ameritrade is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), ensuring compliance with industry standards and investor protection.