- Introduction to Forex Trading

- MetaTrader 4 (MT4) Platform

- Setting Up a MT4 Account

- Forex Trading Strategies and Techniques

- Risk Management in Forex Trading

- Trading Orders and Execution

- Analyzing Trading Performance

- Advanced MT4 Features

- Resources and Support

- Concluding Remarks: Forex Trading Mt4

- Question & Answer Hub

Forex Trading MT4 takes center stage as a powerful platform for navigating the dynamic world of foreign exchange. The MetaTrader 4 platform, renowned for its user-friendly interface and robust features, empowers traders of all levels to analyze market trends, execute trades, and manage risk with confidence. Whether you’re a seasoned investor or a newcomer to the forex market, MT4 provides a comprehensive toolkit for unlocking the potential of this global financial market.

This guide will delve into the fundamentals of forex trading, exploring the key concepts, strategies, and tools that are essential for success. We’ll cover everything from understanding currency pairs and exchange rates to mastering technical analysis techniques and navigating the intricacies of risk management. With MT4 as our guide, we’ll embark on a journey to equip you with the knowledge and skills needed to confidently navigate the exciting and challenging world of forex trading.

Introduction to Forex Trading

Forex trading, short for foreign exchange trading, is the simultaneous buying of one currency and selling of another. It is the largest and most liquid financial market globally, with trillions of dollars exchanged daily. Forex trading allows individuals and institutions to profit from fluctuations in currency exchange rates.

The fundamental concept in Forex trading is the currency pair. A currency pair represents the price of one currency in relation to another. For example, the EUR/USD pair represents the price of one Euro in US Dollars. The first currency in the pair is called the base currency, while the second is the quote currency. Exchange rates constantly fluctuate based on various factors, such as economic data releases, political events, and market sentiment.

Currency Pairs and Exchange Rates

Currency pairs are the foundation of Forex trading. They represent the relative value of one currency against another. Understanding how currency pairs work is crucial for successful trading.

The exchange rate reflects the price of one currency in terms of another. For instance, an EUR/USD exchange rate of 1.1000 means that one Euro is worth 1.1000 US Dollars. Exchange rates are constantly changing, driven by various factors, including:

- Economic Indicators: Economic data releases, such as GDP growth, inflation rates, and unemployment figures, can significantly impact currency values. For example, a strong GDP growth report for a country may strengthen its currency.

- Political Events: Political events, such as elections, policy changes, or geopolitical tensions, can influence currency movements. For instance, a change in government policy that affects trade or investment could impact a country’s currency.

- Market Sentiment: Market sentiment refers to the overall mood of investors and traders. If investors are optimistic about a particular currency, its value may rise. Conversely, if sentiment is negative, the currency may weaken.

Advantages of Forex Trading

Forex trading offers several advantages over other financial markets:

- High Liquidity: Forex is the most liquid financial market globally, meaning that currencies can be bought and sold quickly and easily. This high liquidity allows traders to enter and exit positions with minimal slippage, which is the difference between the expected price and the actual execution price.

- 24/5 Trading: Forex markets operate 24 hours a day, five days a week, allowing traders to trade at any time that suits them. This accessibility provides flexibility and allows traders to capitalize on global market movements.

- Leverage: Forex trading allows traders to use leverage, which enables them to control a larger position with a smaller amount of capital. Leverage can amplify profits but also losses, so it’s crucial to manage risk effectively.

- Low Trading Costs: Compared to other financial markets, Forex trading generally has lower transaction fees and spreads, making it more affordable for traders.

Disadvantages of Forex Trading

While Forex trading offers numerous advantages, it also has some disadvantages:

- High Volatility: Forex markets are highly volatile, meaning that currency prices can fluctuate rapidly and unpredictably. This volatility can lead to significant losses if not managed properly.

- Risk of Leverage: Leverage can amplify both profits and losses. While it can enhance potential returns, it also increases the risk of substantial losses.

- Market Manipulation: Large institutions and governments can sometimes influence currency markets, potentially creating unfair trading conditions.

- Complexity: Forex trading involves a high level of technical analysis and understanding of global economic and political events. It can be complex for beginners to learn and master.

MetaTrader 4 (MT4) Platform

MetaTrader 4 (MT4) is a popular and widely-used trading platform for Forex and other financial markets. It’s renowned for its user-friendly interface, advanced charting tools, and a wide range of technical analysis indicators.

Platform Features and Functionalities

MT4 provides a comprehensive set of features and functionalities designed to empower traders with the tools they need for successful trading.

Charting and Technical Analysis

MT4 offers a wide variety of charting tools, allowing traders to visualize price movements and identify patterns. These tools include:

- Multiple Chart Types: Line, bar, candlestick, and others.

- Timeframes: From 1-minute to monthly, providing flexibility in analyzing market trends.

- Technical Indicators: Over 50 built-in indicators, such as moving averages, MACD, RSI, and Bollinger Bands.

- Drawing Tools: Trend lines, Fibonacci retracements, channels, and more, for pattern recognition.

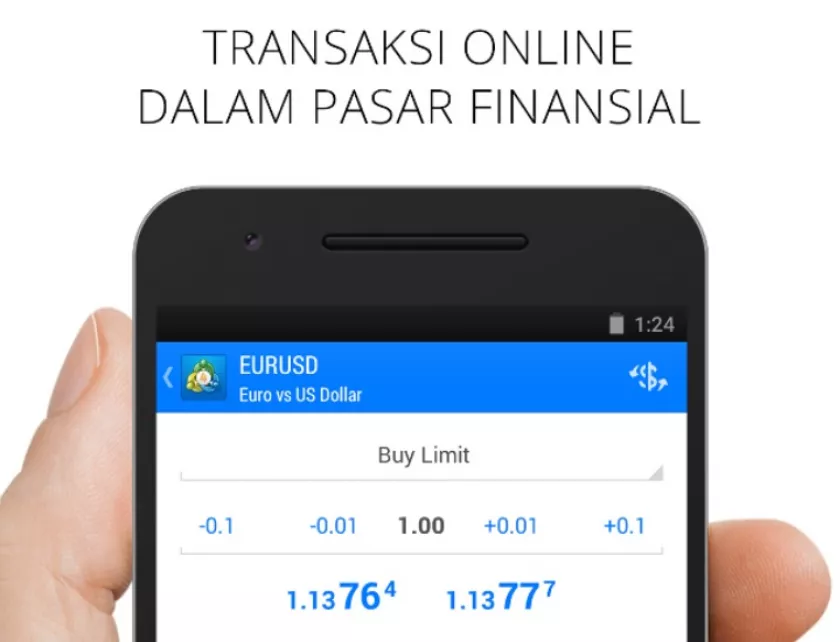

Order Execution

MT4 allows traders to execute orders quickly and efficiently, with features like:

- Market Orders: Immediate execution at the current market price.

- Limit Orders: Orders placed at a specific price level, ensuring entry at a desired point.

- Stop Orders: Orders placed to limit potential losses or lock in profits.

- Trailing Stop Orders: Dynamic stop orders that adjust based on price movements, helping to manage risk.

Other Features

MT4 also offers a range of other features, including:

- Expert Advisors (EAs): Automated trading robots that can execute trades based on predefined rules.

- Custom Indicators: Ability to create and use custom indicators to analyze market data.

- News Feeds: Access to real-time market news and economic data.

- Trading Signals: Receive alerts and recommendations based on technical analysis and market conditions.

User Interface and Navigation

MT4’s user interface is intuitive and easy to navigate, making it accessible to traders of all experience levels. The platform’s layout is designed to be efficient and user-friendly, with key features easily accessible.

Main Window

The main window of MT4 displays the trading charts, order book, and various trading tools.

Toolbars

MT4 features toolbars with quick access to frequently used tools, such as charting tools, indicators, and order execution functions.

Navigation Pane

The navigation pane on the left side of the platform allows users to manage their accounts, access trading history, and customize settings.

Contextual Menus

Right-clicking on charts or other elements provides access to contextual menus with relevant options for specific tasks.

Setting Up a MT4 Account

To begin your Forex trading journey, you’ll need to open an account with a broker that supports the MetaTrader 4 (MT4) platform. This platform provides the tools and interface for placing trades, analyzing market data, and managing your account.

Choosing a Forex Broker

Choosing the right Forex broker is crucial. Consider factors such as regulation, trading conditions, account types, and customer support. Reputable brokers are regulated by financial authorities, ensuring they operate within legal frameworks and adhere to industry standards.

Account Types

Forex brokers offer various account types to cater to different trading styles and experience levels. Common account types include:

* Standard Account: This is the most basic account type, typically suitable for beginners. It often has a lower minimum deposit requirement and may offer fixed spreads.

* Micro Account: Designed for traders with smaller capital, micro accounts allow trading with smaller lot sizes, enabling them to manage risk effectively.

* ECN Account: ECN (Electronic Communication Network) accounts offer direct access to the interbank market, often with tighter spreads and faster execution speeds.

* STP Account: STP (Straight Through Processing) accounts connect traders directly to liquidity providers, offering transparency and potentially better execution speeds.

Downloading and Installing MT4

Once you’ve chosen a broker, you can download and install the MT4 platform on your computer or mobile device.

* Computer: Visit the broker’s website and navigate to the MT4 download section. Choose the appropriate version for your operating system (Windows, Mac, or Linux). Follow the installation instructions provided.

* Mobile Device: Download the MT4 app from the App Store (iOS) or Google Play Store (Android). The app offers most of the features available on the desktop version.

After installation, you can log in to your MT4 account using the credentials provided by your broker. The platform will then provide you with a user-friendly interface to access trading tools, charts, and market data.

Forex Trading Strategies and Techniques

Forex trading strategies and techniques are essential for navigating the dynamic and volatile forex market. Understanding different strategies, technical analysis tools, and their applications can significantly improve your trading outcomes.

Forex Trading Strategies

Different trading strategies cater to various trading styles and risk appetites.

- Scalping: This strategy involves profiting from small price fluctuations, aiming for quick and frequent trades. Scalpers use technical indicators and chart patterns to identify short-term price movements.

- Day Trading: Day traders hold positions for a shorter duration, typically within a single trading day. They focus on intraday price movements and aim to capitalize on market volatility.

- Swing Trading: This strategy involves holding positions for a longer period, typically a few days to several weeks. Swing traders identify and ride price swings, aiming to capture larger price movements.

Technical Analysis Tools in MT4, Forex trading mt4

Technical analysis is crucial for forex trading, helping traders identify trends, support and resistance levels, and potential entry and exit points.

- Indicators: These are mathematical calculations based on historical price data, providing insights into price trends and momentum. Common indicators include:

- Moving Averages (MA): Smooth out price fluctuations, indicating trend direction and potential support/resistance levels.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Identifies trend changes and potential buy/sell signals based on the relationship between two moving averages.

- Oscillators: Oscillators measure the speed and magnitude of price changes, indicating potential overbought or oversold conditions. Common oscillators include:

- Stochastic Oscillator: Compares a security’s closing price to its price range over a given period, highlighting potential overbought or oversold conditions.

- Rate of Change (ROC): Measures the percentage change in price over a specified period, indicating momentum and potential trend reversals.

- Chart Patterns: These are recognizable formations on price charts that can signal potential price movements. Common chart patterns include:

- Head and Shoulders: A reversal pattern that suggests a trend reversal is likely.

- Double Top/Bottom: A pattern that indicates a potential price reversal after reaching a resistance or support level.

- Triangle: A consolidation pattern that can signal a breakout in either direction.

Applying Strategies and Tools

Combining trading strategies and technical analysis tools can enhance your trading decisions.

- Scalping with Indicators: Scalpers can use indicators like moving averages and RSI to identify short-term price movements and potential entry and exit points.

- Day Trading with Chart Patterns: Day traders can use chart patterns like head and shoulders or double top/bottom to identify potential price reversals and capitalize on intraday volatility.

- Swing Trading with Oscillators: Swing traders can use oscillators like the Stochastic Oscillator to identify overbought or oversold conditions and potential trend reversals.

Risk Management in Forex Trading

Risk management is an essential aspect of Forex trading. It involves strategies and techniques to minimize potential losses while maximizing profit potential. Effective risk management practices are crucial for protecting your capital and ensuring sustainable trading success.

Stop-Loss Orders

Stop-loss orders are crucial tools for limiting potential losses on Forex trades. They are pre-set orders that automatically close a trade when the price reaches a specified level. Stop-loss orders help traders control their risk by preventing significant losses from exceeding a predetermined limit. For example, if you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your trade will automatically close if the price falls to 1.0950, limiting your potential loss to 50 pips.

Position Sizing

Position sizing is the process of determining the appropriate amount of money to allocate to a specific trade. It involves considering your risk tolerance, account balance, and the potential risk-reward ratio of the trade. By calculating the right position size, you can ensure that individual trades do not jeopardize your overall trading capital. For instance, if you have a $10,000 account and are willing to risk 2% per trade, your position size should be $200. This means that if your trade goes against you, you will lose a maximum of $200, or 2% of your account balance.

Diversification

Diversification is a risk management technique that involves spreading your investments across different assets or currencies. By diversifying your Forex portfolio, you can reduce the overall risk of your trading activities. For example, instead of focusing solely on major currency pairs like EUR/USD, you could also include other currency pairs, such as GBP/JPY or AUD/USD, in your portfolio. Diversification helps to mitigate the impact of adverse price movements in any single currency pair.

Leverage

Leverage is a powerful tool in Forex trading that allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also magnify losses. Understanding and managing leverage is crucial for responsible risk management. For instance, if you have a $10,000 account and use 100:1 leverage, you can control a position worth $1 million. However, if the market moves against you, your losses can be amplified by the leverage factor. It is essential to use leverage cautiously and always consider the potential risks involved.

Trading Orders and Execution

In Forex trading, placing and executing orders are crucial for capturing opportunities and managing risk. MT4 offers various order types, each tailored for different trading scenarios. Understanding these order types and the execution process is essential for successful Forex trading.

Order Types in MT4

MT4 provides traders with a variety of order types to suit different trading strategies and risk tolerances. Here are the most common order types:

- Market Orders: Market orders are executed immediately at the best available market price. They are ideal for traders who want to enter a trade quickly, regardless of the price. However, market orders may result in price slippage, especially during periods of high volatility.

- Limit Orders: Limit orders are placed at a specific price or better. They are used to buy or sell an asset at a predetermined price level. Limit orders can help traders manage their risk by ensuring they only enter a trade at their desired price level. However, there is no guarantee that a limit order will be executed, as the market price may not reach the specified limit price.

- Stop Orders: Stop orders are placed at a specific price level and are triggered when the market price reaches that level. They are used to limit losses or to enter a trade at a specific price level. Stop orders can help traders manage their risk by automatically exiting a trade if the market moves against their position. However, stop orders can also be triggered by sudden price fluctuations, leading to unexpected exits.

Order Execution Process

The order execution process in MT4 involves several steps:

- Order Placement: The trader places an order through the MT4 platform, specifying the order type, symbol, volume, and other parameters.

- Order Routing: The order is routed to the broker’s trading server, where it is matched with available orders from other traders.

- Order Execution: If the order is matched, it is executed at the best available market price. The trader’s account is then updated to reflect the trade.

Factors Affecting Order Fill

Several factors can affect order fill, including:

- Market Volatility: During periods of high volatility, market prices can fluctuate rapidly, making it difficult to get an order filled at the desired price. This can lead to price slippage.

- Liquidity: Liquidity refers to the ease with which an asset can be bought or sold. In markets with low liquidity, it may be difficult to get an order filled quickly, especially for large orders.

- Broker Execution Speed: The speed at which a broker executes orders can also affect order fill. Brokers with fast execution speeds are able to fill orders more quickly, reducing the risk of price slippage.

Slippage

Slippage is the difference between the expected execution price of an order and the actual price at which it is executed. Slippage can occur due to market volatility, low liquidity, or slow broker execution speeds. It can have a significant impact on trading results, especially for large orders or during periods of high volatility.

Example: A trader places a market order to buy 1 lot of EUR/USD at 1.1000. However, due to high market volatility, the order is filled at 1.1005. The trader has experienced slippage of 5 pips.

Analyzing Trading Performance

Understanding how your trading is performing is crucial for improvement and profitability. MT4 provides tools to track and analyze your trading activity, helping you identify areas for improvement and optimize your strategy.

Trading Journal

Keeping a detailed trading journal is essential for analyzing your performance. It provides a record of your trades, including entry and exit points, stop-loss and take-profit levels, and the rationale behind each trade. This information allows you to:

- Identify patterns in your trading decisions.

- Track your profitability and losses.

- Analyze the effectiveness of your trading strategies.

- Evaluate your risk management practices.

Monitoring Trading Statistics

MT4 offers built-in features for monitoring trading statistics, providing insights into your overall performance. These statistics include:

- Profit/Loss (P/L): Total profit or loss generated from your trades.

- Win/Loss Ratio: Percentage of winning trades compared to losing trades.

- Average Profit/Loss: Average profit or loss per trade.

- Maximum Drawdown: Maximum amount of money lost during a losing streak.

- Profit Factor: Ratio of total profit to total loss.

Key Performance Indicators (KPIs)

Several key performance indicators (KPIs) can help assess your trading performance:

- Risk-Reward Ratio: This ratio measures the potential profit compared to the potential loss on a trade. A higher risk-reward ratio indicates a greater potential for profit. For example, a risk-reward ratio of 1:2 means that for every $1 risked, you aim to make $2 in profit.

- Average Trade Duration: This metric helps understand how long your trades typically last. A shorter average trade duration might indicate a more scalping-based strategy, while a longer duration might suggest a longer-term swing trading approach.

- Number of Trades: Tracking the number of trades you execute can provide insights into your trading frequency. A higher number of trades might suggest a more active trading style, while a lower number could indicate a more selective approach.

- Accuracy: This metric reflects the percentage of your trades that are profitable. A higher accuracy rate generally indicates a more effective trading strategy.

Advanced MT4 Features

MetaTrader 4 (MT4) offers a range of advanced features that empower traders to automate their strategies, enhance their analysis, and ultimately improve their trading performance. These features are primarily focused on customization, allowing traders to tailor their trading experience to their specific needs and preferences.

Expert Advisors (EAs)

Expert advisors (EAs) are automated trading programs that can execute trades based on predefined rules and parameters. They operate independently, freeing traders from constantly monitoring the market. EAs can be developed using the MQL4 programming language, allowing traders to create custom strategies and automate their trading.

- Predefined Strategies: EAs can be programmed to follow various pre-defined trading strategies, such as trend-following, breakout, or scalping strategies.

- Customizable Parameters: Traders can adjust the parameters of EAs to fine-tune their trading logic, such as entry and exit points, stop-loss and take-profit levels, and risk management settings.

- Backtesting and Optimization: EAs can be backtested against historical data to evaluate their performance and optimize their parameters before deploying them in live trading.

EAs can help traders automate their trading strategies, reduce emotional biases, and potentially increase trading efficiency. However, it’s crucial to carefully backtest and monitor EAs to ensure their effectiveness and manage potential risks.

Custom Indicators

Custom indicators are tools that provide traders with additional insights into market data, beyond the standard indicators offered by MT4. They can be developed using the MQL4 programming language to analyze specific patterns, calculate custom technical indicators, or generate trading signals.

- Tailored Analysis: Custom indicators allow traders to focus on specific market aspects or technical patterns that are relevant to their trading strategies.

- Visual Representation: Custom indicators can be visualized on the MT4 charts, providing traders with a clear representation of the data and insights they provide.

- Alert Signals: Custom indicators can be programmed to generate alerts when specific conditions are met, notifying traders of potential trading opportunities or risks.

Custom indicators can provide traders with valuable insights and enhance their trading analysis. However, it’s important to use indicators responsibly and avoid over-reliance on any single indicator, as they may not always be accurate or reliable.

Scripting

MT4 allows traders to write scripts using the MQL4 programming language. Scripts are small programs that can automate specific trading tasks or perform one-time actions.

- Trade Execution: Scripts can be used to execute trades based on predefined conditions or to manage existing trades.

- Data Analysis: Scripts can be used to analyze market data, generate reports, or perform other data-related tasks.

- Customizations: Scripts can be used to customize the MT4 interface or to automate specific tasks that are not supported by built-in features.

Scripts can automate trading tasks, enhance trading efficiency, and provide traders with greater control over their trading environment. However, it’s crucial to ensure that scripts are properly tested and documented to avoid unintended consequences.

Resources and Support

The Forex market is vast and complex, and ongoing learning is essential for success. Fortunately, there are numerous resources and support systems available to traders of all levels.

This section explores some of the most valuable resources available, from reputable websites and forums to the customer support provided by brokers and MT4 developers.

Reputable Forex Trading Resources

The internet offers a wealth of information on Forex trading. However, it’s crucial to rely on credible sources to ensure the accuracy and relevance of the information you’re consuming. Here are some examples of valuable resources:

- Websites: Websites like Investopedia, Babypips, and DailyFX offer educational articles, tutorials, and market analysis. They provide a comprehensive understanding of Forex fundamentals, trading strategies, and market trends.

- Forums: Online forums like Forex Factory and FXStreet allow traders to engage in discussions, share insights, and learn from experienced traders. These platforms provide a valuable space for networking and exchanging knowledge.

- Educational Materials: Many brokers offer free educational materials, including ebooks, webinars, and video tutorials, covering various aspects of Forex trading. Additionally, there are dedicated educational platforms like TradingView and Myfxbook that offer courses and analysis tools.

Broker and MT4 Support

Brokers and MT4 developers provide various support options to assist traders. These services are crucial for resolving technical issues, accessing account information, and seeking guidance on platform features.

- Broker Support: Most brokers offer 24/5 customer support via phone, email, and live chat. They provide assistance with account setup, trading execution, deposit and withdrawal procedures, and any technical issues related to their platform.

- MT4 Developer Support: MetaQuotes Software Corp., the developer of MT4, offers extensive documentation, FAQs, and a dedicated support forum. This resource is particularly helpful for addressing technical issues related to the platform itself, including indicator development and custom script creation.

Importance of Ongoing Learning

The Forex market is constantly evolving, influenced by economic events, geopolitical developments, and technological advancements. Continuous learning is essential to adapt to changing market conditions and stay ahead of the curve.

- Stay Updated on Market Trends: Regularly follow financial news, economic indicators, and market analysis to understand the factors influencing currency movements.

- Explore New Strategies and Techniques: Forex trading offers a wide range of strategies and techniques. Continuously exploring new approaches and refining existing ones can enhance your trading performance.

- Develop Your Trading Psychology: Understanding your emotions and how they affect your trading decisions is crucial for success. Seeking guidance from experienced traders or coaches can help you develop a disciplined and profitable trading mindset.

Concluding Remarks: Forex Trading Mt4

As you delve deeper into the world of forex trading with MT4, remember that consistent learning, strategic planning, and disciplined execution are the cornerstones of success. By embracing the principles Artikeld in this guide, you can equip yourself with the knowledge and skills to navigate the complexities of the forex market with confidence. The journey may have its challenges, but with the right tools, strategies, and mindset, you can unlock the potential of this global financial market and achieve your trading goals.

Question & Answer Hub

What is the difference between a demo account and a live account in MT4?

A demo account allows you to practice forex trading with virtual funds, while a live account uses real money and allows you to trade in the actual market.

How can I secure my MT4 account from unauthorized access?

Enable two-factor authentication (2FA) for an extra layer of security. Regularly update your MT4 software and use a strong password.

What are the best indicators for beginners to use in MT4?

Beginners can start with simple indicators like moving averages, MACD, and RSI to understand basic price trends and momentum.

Is it possible to automate trading strategies in MT4?

Yes, MT4 allows you to use expert advisors (EAs) to automate trading strategies based on predefined rules and parameters.

Where can I find reliable educational resources for forex trading and MT4?

Explore online courses, trading forums, and reputable websites that offer educational materials and tutorials on forex trading and MT4.