Is forex market open today – Is the Forex market open today? This question is a crucial one for traders and investors alike. The Forex market, unlike traditional stock markets, operates 24 hours a day, five days a week. This global nature allows for continuous trading opportunities, but it also requires a keen understanding of market hours and trading sessions.

The Forex market operates across different time zones, with major trading centers opening and closing at specific times. These timings are influenced by factors like local banking hours, economic releases, and market activity. Understanding these nuances is essential for maximizing trading efficiency and minimizing risks.

Understanding Forex Market Hours

The Forex market, also known as the foreign exchange market, operates 24 hours a day, five days a week, unlike traditional stock markets that have specific opening and closing times. This continuous trading nature is due to the global nature of the Forex market, with trading activity occurring across different time zones around the world.

Factors Influencing Forex Market Hours

The opening and closing times of the Forex market are influenced by the trading hours of major financial centers worldwide. These centers, which act as hubs for Forex trading, have their own specific operating hours, dictating the overall Forex market activity.

Forex Market Hours for Major Trading Centers

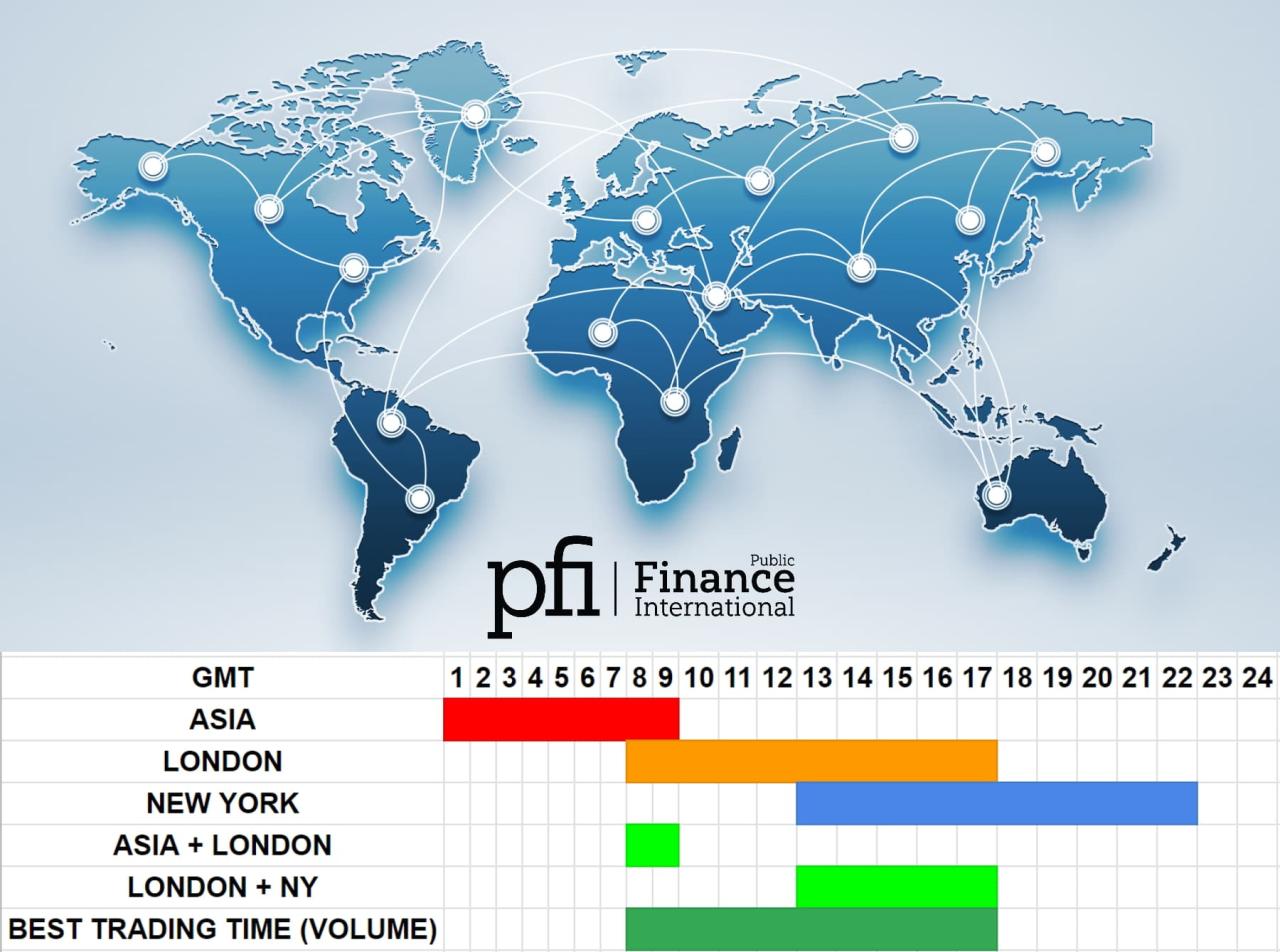

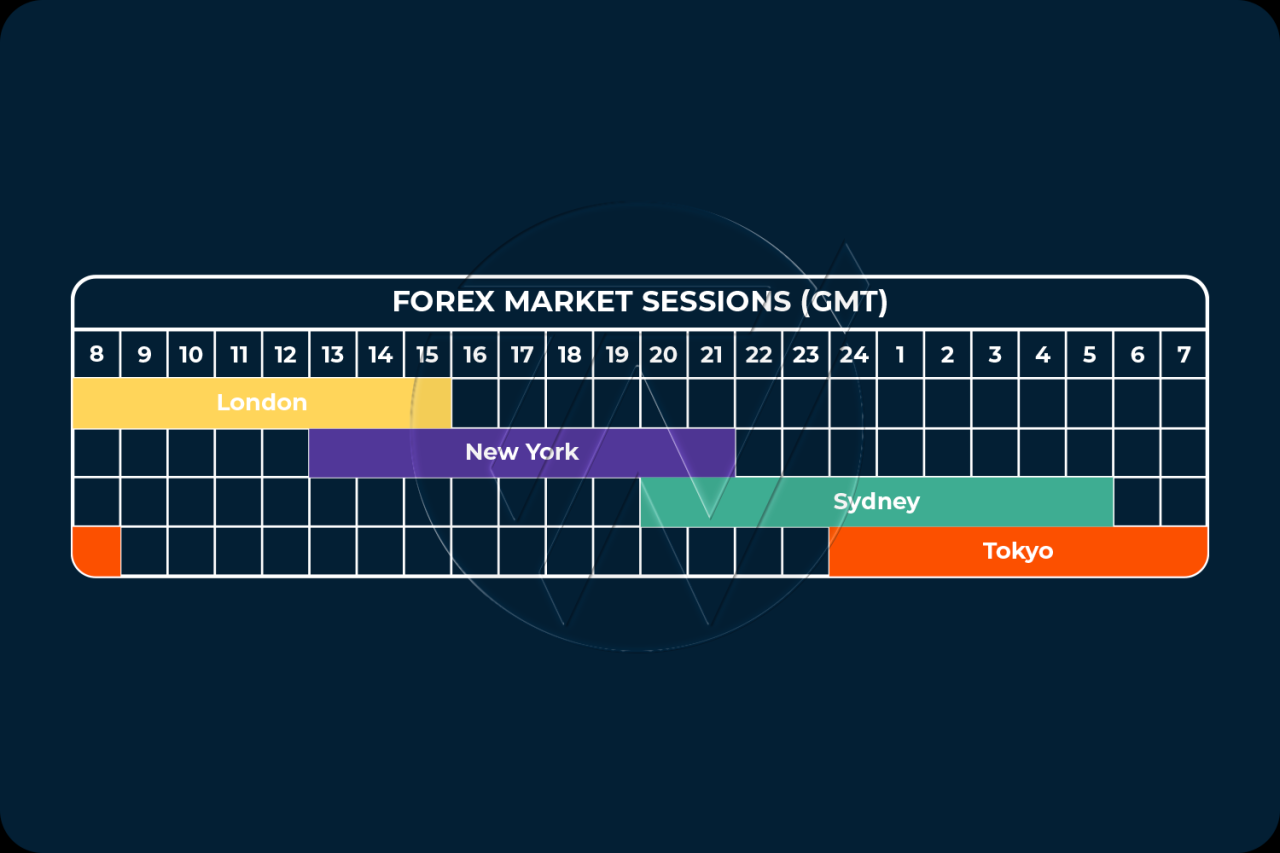

The following table provides an overview of the Forex market hours for major trading centers around the world:

| Trading Center | Opening Time | Closing Time | Time Zone |

|---|---|---|---|

| Sydney | 5:00 AM GMT | 2:00 PM GMT | Australian Eastern Standard Time (AEST) |

| Tokyo | 7:00 AM GMT | 4:00 PM GMT | Japan Standard Time (JST) |

| London | 8:00 AM GMT | 5:00 PM GMT | Greenwich Mean Time (GMT) |

| New York | 1:00 PM GMT | 10:00 PM GMT | Eastern Standard Time (EST) |

Checking Forex Market Status

It’s crucial to know the current status of the Forex market before making any trades. This ensures you’re trading during active market hours and avoid potential issues. Here’s a guide on how to verify the market’s status and the resources available to help you.

Reliable Resources for Checking Forex Market Status

Several reliable sources provide real-time information on the Forex market’s opening and closing times. These resources can help you determine if the market is open today and plan your trading activities accordingly.

- Broker Platforms: Most reputable Forex brokers provide real-time market information on their trading platforms. This includes details on market hours, current exchange rates, and trading volume. For example, platforms like MetaTrader 4 and 5 often display market status indicators.

- Financial Websites: Many financial websites, such as Investing.com, Yahoo Finance, and Google Finance, provide detailed market data, including Forex market hours. These websites often offer interactive charts and calendars that highlight market opening and closing times for different currency pairs.

- Economic Calendars: Economic calendars, like those found on Forex Factory or DailyFX, are invaluable for traders. They provide information on scheduled economic events and announcements that can significantly impact market volatility. These calendars also often display market hours for different currency pairs.

- Forex News Websites: Several Forex-specific news websites, such as ForexLive and FXStreet, provide real-time market updates and analysis. They also often include sections dedicated to market hours and trading sessions.

Importance of Verifying Market Hours, Is forex market open today

Knowing the market’s opening and closing times is essential for several reasons:

- Avoiding Trading Outside Market Hours: Trading outside market hours can lead to slippage, meaning your orders may be executed at a different price than intended. This can result in losses and affect your trading strategy.

- Ensuring Order Execution: Orders placed during non-market hours may not be executed immediately. Brokers typically hold these orders until the market opens, which can delay your trades and potentially miss out on opportunities.

- Understanding Market Volatility: Market volatility can change significantly depending on the time of day. Knowing market hours helps you understand the potential for price fluctuations and adjust your trading strategy accordingly.

Examples of Using Resources to Determine Market Status

Here are some examples of how to use the resources mentioned earlier to determine if the Forex market is open today:

- Broker Platforms: If you’re using a platform like MetaTrader 4, check the “Market Watch” window for the currency pair you’re interested in. The platform usually displays the current status, indicating whether the market is open or closed.

- Financial Websites: On Investing.com, navigate to the “Forex” section and select the currency pair you want to trade. The website typically displays the current market hours and the time remaining until the next session.

- Economic Calendars: Forex Factory’s economic calendar provides detailed information on market hours for different currency pairs. You can filter the calendar by currency and view the current market status.

- Forex News Websites: ForexLive often includes a “Market Hours” section on its website, providing an overview of the current market status for major currency pairs.

Impact of Market Openings and Closings

The opening and closing times of the Forex market have a significant impact on trading activities. Understanding these times is crucial for traders to make informed decisions about when to enter and exit trades.

Advantages and Disadvantages of Trading During Specific Market Hours

Trading during specific market hours can offer both advantages and disadvantages. Here’s a breakdown:

Advantages

- Increased Liquidity: When major Forex markets are open, the volume of trading activity is higher, leading to increased liquidity. This allows traders to execute orders quickly and at favorable prices.

- Higher Volatility: Market openings and closings often coincide with the release of economic news and data, leading to increased volatility. This presents opportunities for traders to profit from price fluctuations.

- Wider Trading Range: As more market participants are active during these periods, the price range tends to be wider, offering more potential for profit.

Disadvantages

- Increased Risk: Higher volatility during market openings and closings can also increase the risk of losses for traders. Unexpected price movements can quickly erode profits or even lead to significant losses.

- Gaps and Slippage: Price gaps can occur when the market opens or closes, creating discrepancies between the expected price and the actual execution price. Slippage, the difference between the intended price and the actual execution price, can also be more prevalent during these periods.

- News-Driven Volatility: Market openings and closings are often influenced by economic news releases, which can create sudden and unpredictable price swings. Traders need to be aware of these potential events and adjust their trading strategies accordingly.

Impact on Currency Volatility and Trading Opportunities

Market openings and closings can significantly influence currency volatility and trading opportunities. Here’s a closer look:

Volatility

- Increased Volatility at Openings and Closings: As mentioned earlier, market openings and closings often coincide with the release of economic news and data, which can lead to increased volatility. This is because traders react to the news and adjust their positions, creating price swings.

- Volatility Patterns: Volatility patterns can vary depending on the specific market and the economic events taking place. For example, the release of US non-farm payroll data can cause significant volatility in the USD/JPY pair.

- Impact on Trading Strategies: Understanding volatility patterns can help traders develop appropriate trading strategies. For instance, scalping strategies may be more effective during periods of high volatility, while trend-following strategies may be more suitable during periods of low volatility.

Trading Opportunities

- News-Driven Opportunities: Market openings and closings often present opportunities for traders to profit from news-driven volatility. For example, a positive economic report released during the London session can lead to a surge in the GBP/USD pair.

- Breakouts and Pullbacks: Market openings and closings can also create breakout and pullback opportunities. A breakout occurs when the price breaks through a resistance level, while a pullback occurs when the price retraces after a strong move.

- Gap Trading: Gap trading involves profiting from price gaps that occur during market openings and closings. This strategy requires a keen understanding of market dynamics and the ability to identify potential gap opportunities.

Understanding Trading Sessions

The Forex market operates around the clock, but trading activity is not evenly distributed throughout the day. Instead, the market is divided into distinct trading sessions, each characterized by different levels of liquidity, volatility, and trading activity. These sessions are primarily driven by the business hours of major financial centers around the world.

Trading Sessions and Their Characteristics

Understanding the different trading sessions is crucial for Forex traders as it allows them to capitalize on specific market conditions and optimize their trading strategies.

- Asian Session: This session begins around 7:00 PM EST and ends around 4:00 AM EST. It is primarily driven by the trading activity in Tokyo, Hong Kong, and Singapore. This session is generally characterized by lower volatility and liquidity compared to other sessions. However, it can be quite active during economic releases from major Asian economies.

- London Session: The London session starts around 3:00 AM EST and ends around 12:00 PM EST. This is the most active session in the Forex market, as it coincides with the business hours of the largest financial center in the world. The London session is known for its high liquidity and volatility, making it a popular choice for scalpers and day traders.

- New York Session: This session begins around 8:00 AM EST and ends around 5:00 PM EST, overlapping with the London session for a significant portion of the day. The New York session is also characterized by high liquidity and volatility, as it coincides with the business hours of the second-largest financial center in the world. The overlap between the London and New York sessions creates a period of high trading activity and volatility.

Visual Representation of Forex Trading Sessions

The following image depicts the overlapping periods of the three major Forex trading sessions:

[Image of overlapping Forex trading sessions]

The image clearly shows the overlapping periods of the Asian, London, and New York sessions. The overlap between the London and New York sessions is particularly significant, creating a period of high liquidity and volatility.

Market Holidays and Closures

The Forex market operates 24 hours a day, five days a week, but it’s important to note that certain holidays and events can impact trading hours and activity. Understanding these closures is crucial for traders to avoid potential disruptions to their trading strategies and to anticipate potential market volatility.

Impact of Market Holidays on Trading

Market holidays can significantly affect trading activity and currency prices. When a major financial center observes a holiday, its corresponding currency may experience increased volatility as trading volume decreases. This can lead to wider spreads, making it more expensive to enter and exit trades. Additionally, news releases and economic data that are typically released during these periods may be delayed or canceled, further impacting market sentiment and price movements.

Major Forex Market Holidays

Here is a list of major Forex market holidays throughout the year that can impact trading activity:

| Date | Holiday/Event | Affected Markets | Impact on Trading |

|---|---|---|---|

| January 1st | New Year’s Day | Global | Reduced trading volume, potential for increased volatility |

| January 20th | Martin Luther King Jr. Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| February 14th | Valentine’s Day | Global | Minimal impact, but may see increased volatility in certain pairs |

| February 21st | Presidents’ Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| March 17th | St. Patrick’s Day | Global | Minimal impact, but may see increased volatility in certain pairs |

| April 1st | April Fools’ Day | Global | Minimal impact, but may see increased volatility in certain pairs |

| April 15th | Tax Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| May 1st | May Day | Global | Minimal impact, but may see increased volatility in certain pairs |

| May 29th | Memorial Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| July 4th | Independence Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| September 5th | Labor Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| October 31st | Halloween | Global | Minimal impact, but may see increased volatility in certain pairs |

| November 11th | Veterans Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| November 24th | Thanksgiving Day (US) | US Dollar | Reduced trading volume, potential for increased volatility |

| December 25th | Christmas Day | Global | Reduced trading volume, potential for increased volatility |

| December 26th | Boxing Day | Global | Reduced trading volume, potential for increased volatility |

| December 31st | New Year’s Eve | Global | Reduced trading volume, potential for increased volatility |

Outcome Summary

Navigating the Forex market requires awareness of its global nature and the implications of different trading sessions. By understanding market hours, traders can capitalize on opportunities, mitigate risks, and make informed decisions. Remember to always verify the current status of the market before initiating any trades, ensuring a smooth and successful trading experience.

FAQ Resource: Is Forex Market Open Today

What are the major Forex trading centers?

The major Forex trading centers include London, New York, Tokyo, Sydney, and Frankfurt. Each center has its own opening and closing times.

What is the impact of market holidays on Forex trading?

Market holidays can significantly impact Forex trading by reducing liquidity and increasing volatility. It’s essential to be aware of these holidays and adjust trading strategies accordingly.

How can I find reliable resources for checking Forex market status?

You can find reliable resources for checking Forex market status on reputable financial websites, trading platforms, and forex news outlets.