Best times to trade forex sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The forex market, operating 24 hours a day, five days a week, presents a unique challenge for traders. Identifying the best times to trade, when volatility is high, liquidity is abundant, and market trends are most pronounced, is crucial for maximizing trading opportunities and minimizing risk.

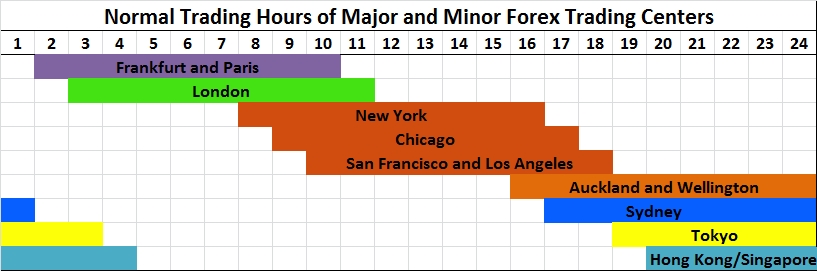

Understanding the global nature of the forex market and its continuous trading hours is paramount. Trading sessions, like the New York, London, Tokyo, and Sydney sessions, each bring their unique characteristics and opportunities. These sessions overlap, creating periods of heightened volatility and liquidity that savvy traders can leverage.

Understanding Forex Trading Hours

The forex market is a global marketplace, operating 24 hours a day, five days a week. This continuous trading allows traders to participate at any time, regardless of their location. However, understanding the concept of trading sessions is crucial for maximizing trading opportunities and managing risk effectively.

Trading Sessions

Trading sessions are periods of high trading activity, driven by the economic and financial activity of specific geographic regions. These sessions are characterized by increased volatility and liquidity, providing traders with better opportunities to execute trades and potentially generate profits. Understanding the major trading sessions and their respective trading times is essential for forex traders.

- Sydney Session: The Sydney session is the first to open, beginning at 5:00 PM GMT on Sunday and closing at 2:00 AM GMT on Monday. This session is typically less volatile compared to other sessions, as it coincides with the Asian trading day. However, it can be influenced by economic releases from Australia and other Asian countries.

- Tokyo Session: The Tokyo session overlaps with the Sydney session and begins at 7:00 PM GMT on Sunday, closing at 4:00 AM GMT on Monday. This session is known for its high trading volume and volatility, driven by the economic activity of Japan and other Asian countries.

- London Session: The London session is the largest and most active forex trading session, beginning at 8:00 AM GMT and closing at 5:00 PM GMT. This session is characterized by high liquidity and volatility, influenced by economic releases from the UK and other European countries.

- New York Session: The New York session overlaps with the London session and begins at 1:00 PM GMT and closes at 10:00 PM GMT. This session is also characterized by high trading volume and volatility, driven by economic releases from the US and other North American countries.

Understanding the trading sessions and their respective trading times can help traders identify periods of high volatility and liquidity, providing better opportunities to execute trades and potentially generate profits.

Identifying High Volatility Periods

Forex volatility is a key factor to consider when trading, as it can significantly impact your profits or losses. Volatility refers to the degree of price fluctuations in a currency pair over a given period. Understanding the periods of high volatility can help you identify opportunities to capitalize on price swings or avoid potential risks.

Economic News Releases and Volatility

Economic news releases are a major driver of forex volatility. When significant economic data is released, it can significantly impact market sentiment and cause sudden price movements. These releases often provide insights into the health of an economy, influencing traders’ expectations for future interest rates and economic policies.

“Economic news releases are a major driver of forex volatility.”

The relationship between economic news releases and forex volatility is directly proportional. When important economic data is released, traders react quickly, leading to increased buying or selling pressure, which in turn drives price fluctuations.

Key Economic Indicators and Their Impact

Several key economic indicators can influence forex volatility. These indicators provide valuable information about the economic health of a country, affecting investor confidence and currency valuations. Here are some examples:

- Gross Domestic Product (GDP): This indicator measures the total value of goods and services produced in a country. A strong GDP growth rate generally indicates a healthy economy, which can boost the value of the country’s currency.

- Inflation Rate: This indicator measures the rate at which prices for goods and services increase over time. High inflation can erode purchasing power and weaken a currency’s value.

- Interest Rates: Central banks set interest rates to influence economic activity. Higher interest rates can attract foreign investment, boosting demand for the currency.

- Unemployment Rate: This indicator measures the percentage of the labor force that is unemployed. A low unemployment rate indicates a strong economy, which can support currency appreciation.

For example, if the US releases a strong GDP report, it can indicate a robust economy, leading to increased demand for the US dollar. This increased demand can cause the USD to appreciate against other currencies, resulting in higher volatility in USD pairs.

Conversely, if the Eurozone releases a weak inflation report, it can signal concerns about the economic health of the region, potentially leading to a decline in the Euro’s value. This decline can result in higher volatility in EUR pairs.

Recognizing Market Liquidity

Liquidity in forex trading refers to the ease with which you can buy or sell a currency pair without significantly impacting its price. A highly liquid market allows traders to execute orders quickly and efficiently, with minimal slippage. Slippage occurs when the price you get for your trade is different from the price you initially intended to trade at.

Liquidity is crucial for forex traders because it directly impacts trading opportunities. High liquidity provides favorable conditions for entering and exiting trades, minimizing risk and maximizing potential profits. Conversely, low liquidity can lead to price fluctuations, making it challenging to execute trades at desired levels.

Trading Sessions with High and Low Liquidity

The forex market is open 24 hours a day, five days a week, with different trading sessions experiencing varying levels of liquidity.

The most liquid trading sessions are:

- London Session: This session, which overlaps with the New York session, is generally considered the most liquid due to the large number of financial institutions and traders operating in the London market.

- New York Session: This session is also highly liquid, driven by the significant volume of trading activity from US-based institutions and individual investors.

The least liquid trading sessions are:

- Tokyo Session: While the Tokyo session is important for Asian markets, it has lower liquidity compared to the London and New York sessions.

- Sydney Session: The Sydney session is the least liquid, with the lowest trading volume among the major forex trading centers.

It’s important to note that liquidity can fluctuate throughout the day, influenced by factors like economic releases, geopolitical events, and market sentiment. Therefore, traders need to stay informed about current market conditions and adjust their trading strategies accordingly.

Analyzing Forex Market Trends

Identifying and capitalizing on forex market trends is crucial for successful trading. Understanding how to recognize these trends and implementing strategies to take advantage of them can significantly improve your trading outcomes.

Identifying Major Forex Market Trends

Identifying major forex market trends involves observing price movements over an extended period. Trends can be categorized as uptrends, downtrends, or sideways trends.

- Uptrend: Prices are consistently making higher highs and higher lows.

- Downtrend: Prices are consistently making lower highs and lower lows.

- Sideways Trend: Prices are moving within a defined range, neither making significant upward nor downward movements.

Several technical indicators and fundamental analysis techniques can help traders identify major trends.

Utilizing Technical Indicators

Technical indicators provide insights into price action and momentum, aiding in trend identification. Some commonly used indicators include:

- Moving Averages: Moving averages smooth out price fluctuations, highlighting the underlying trend. A popular example is the 200-day moving average, often used to identify long-term trends.

- MACD (Moving Average Convergence Divergence): The MACD indicator compares two moving averages, indicating momentum and potential trend changes. Crossovers between the MACD line and signal line can signal buy or sell opportunities.

- RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 suggest overbought conditions, while readings below 30 indicate oversold conditions. These signals can help identify potential trend reversals.

Leveraging Fundamental Analysis, Best times to trade forex

Fundamental analysis examines economic data, political events, and other factors influencing currency values. By understanding these factors, traders can anticipate potential shifts in market sentiment and identify emerging trends.

- Economic Data Releases: Significant economic data releases, such as GDP reports, inflation figures, and employment data, can impact currency values. Stronger-than-expected data can boost a currency, while weaker-than-expected data can weaken it.

- Central Bank Policies: Central bank decisions on interest rates and monetary policy can influence currency values. For example, a central bank raising interest rates can attract foreign investment, strengthening the currency.

- Geopolitical Events: Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact currency markets. These events can create volatility and lead to significant trend shifts.

Leveraging Economic Calendars

Economic calendars are indispensable tools for forex traders, offering insights into upcoming economic events and their potential impact on currency movements. These calendars provide a comprehensive overview of scheduled releases, including their importance, anticipated impact, and historical data. By understanding these events and their potential influence on market sentiment, traders can make informed decisions and capitalize on potential trading opportunities.

Key Economic Events and Their Impact

Economic events, such as interest rate decisions, inflation data, and employment reports, can significantly influence currency valuations. These events provide valuable information about a country’s economic health, which in turn impacts investor confidence and currency demand.

For example, a surprise interest rate hike by a central bank could strengthen the respective currency as investors anticipate higher returns. Conversely, a disappointing employment report might weaken the currency due to concerns about economic growth.

- Interest Rate Decisions: These decisions by central banks influence borrowing costs and economic growth. Higher interest rates typically attract foreign investment, strengthening the currency.

- Inflation Data: Inflation reports reflect the rate at which prices for goods and services are rising. High inflation can erode purchasing power and lead to currency depreciation.

- Employment Reports: These reports provide insights into the labor market’s health, which is a crucial indicator of economic growth. Strong employment numbers generally support a currency.

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country. Strong GDP growth typically strengthens a currency.

- Trade Balance: This data reflects the difference between a country’s exports and imports. A trade surplus (exports exceeding imports) usually supports a currency.

- Consumer Confidence Index: This index gauges consumer sentiment and spending intentions. High consumer confidence often indicates economic optimism and a strong currency.

Economic Calendar Table

| Event | Release Time (GMT) | Impact on Forex |

|---|---|---|

| US Non-Farm Payrolls | 12:30 | High |

| US Consumer Price Index (CPI) | 12:30 | High |

| Eurozone Interest Rate Decision | 13:45 | High |

| UK Gross Domestic Product (GDP) | 09:30 | Medium |

| Japanese Consumer Confidence Index | 23:50 | Medium |

Managing Risk and Trading Psychology

Forex trading, while potentially lucrative, is inherently risky. Understanding and managing risk is crucial for long-term success in this market. Equally important is understanding your own trading psychology, as emotions can significantly impact decision-making and lead to costly mistakes.

Risk Management Strategies

Risk management in forex trading involves implementing strategies to limit potential losses and protect your capital. It’s a crucial aspect of trading that helps you stay in the game, even during periods of market volatility.

- Set Stop-Loss Orders: Stop-loss orders are pre-determined price levels that automatically close your position when the market moves against you. This helps limit potential losses by preventing large drawdowns.

- Determine Position Size: Calculate the appropriate position size based on your risk tolerance and account balance. This ensures that a losing trade doesn’t wipe out a significant portion of your capital.

- Diversify Your Portfolio: Spread your investments across different currency pairs to reduce exposure to any single market. This helps mitigate risk and potentially increase returns.

- Use Leverage Wisely: Leverage can amplify both profits and losses. Use it judiciously, understanding that higher leverage increases risk.

Managing Trading Emotions

Emotions play a significant role in trading. Fear, greed, and overconfidence can lead to impulsive decisions and poor trading outcomes. Learning to manage these emotions is essential for disciplined and profitable trading.

- Recognize Emotional Biases: Be aware of common emotional biases like confirmation bias (seeking information that confirms your existing beliefs), anchoring bias (over-reliance on the first piece of information received), and herd mentality (following the crowd).

- Develop a Trading Plan: A well-defined trading plan helps you stay focused and avoid emotional trading. It Artikels your entry and exit points, risk management strategies, and profit targets.

- Keep a Trading Journal: Record your trades, including your reasoning, emotions, and outcomes. This helps identify patterns and areas for improvement.

- Take Breaks: When feeling overwhelmed or emotional, step away from the markets. A clear mind makes better trading decisions.

Discipline and Patience

Discipline and patience are two of the most important traits for successful forex traders. They help you stick to your trading plan, avoid impulsive decisions, and ride out market fluctuations.

- Stick to Your Trading Plan: Discipline is essential to follow your trading plan, even when tempted to deviate from it.

- Avoid Chasing Losses: When a trade goes against you, avoid the temptation to chase losses by increasing your position size or holding on to a losing trade for too long.

- Be Patient: Forex trading is a marathon, not a sprint. Be patient and allow your trading strategy to play out over time.

Final Summary: Best Times To Trade Forex

Navigating the forex market effectively requires a strategic approach that considers both technical and fundamental factors. By understanding the nuances of trading sessions, volatility patterns, liquidity dynamics, and economic calendar releases, traders can identify the best times to trade, capitalize on market trends, and enhance their overall trading performance. Remember, risk management and a disciplined approach are essential for success in this dynamic and rewarding world of forex trading.

Question & Answer Hub

What is the best time to trade forex for beginners?

For beginners, it’s recommended to start during the London and New York sessions, as they offer higher liquidity and volatility, making it easier to learn the market dynamics.

How can I find out about upcoming economic releases that might impact forex prices?

You can use economic calendars available on various financial websites to stay informed about upcoming economic releases and their potential impact on forex prices.

Is it possible to trade forex on weekends?

No, the forex market is typically closed on weekends, with limited trading activity available in certain exotic currency pairs.