Demo account for forex trading offers a risk-free environment to learn the ropes of this dynamic market. It’s your virtual playground to experiment with strategies, analyze market trends, and refine your trading skills without risking real money.

Imagine having access to real-time market data, a variety of trading platforms, and virtual funds to practice with. That’s exactly what a forex demo account provides. It’s a powerful tool for both beginners and seasoned traders to hone their skills and gain confidence before venturing into the live market.

What is a Forex Demo Account?

A Forex demo account is a virtual trading environment that allows you to practice Forex trading without risking real money. It provides a safe and risk-free way to learn the basics of Forex trading, test trading strategies, and gain experience before you start trading with real funds.

Purpose of a Forex Demo Account

Demo accounts are designed to bridge the gap between theoretical knowledge and practical application in Forex trading. They offer a simulated trading environment where you can experiment with different trading strategies, understand market dynamics, and develop your trading skills without any financial risk.

Features of a Forex Demo Account

- Virtual Funds: Demo accounts provide you with virtual funds that you can use to trade Forex pairs. These funds are not real money, so you can’t lose anything if your trades are unsuccessful.

- Real-Time Market Data: Demo accounts offer access to real-time market data, including price quotes, charts, and trading signals. This allows you to experience the dynamic nature of the Forex market and make informed trading decisions.

- Trading Platforms: Most Forex brokers offer demo accounts that are compatible with their live trading platforms. This allows you to familiarize yourself with the trading platform’s interface, features, and tools before you start trading with real money.

Benefits of Using a Forex Demo Account

- Risk-Free Learning: Demo accounts allow you to learn Forex trading without risking any of your own money. You can experiment with different strategies and make mistakes without incurring any financial losses.

- Develop Trading Skills: By practicing on a demo account, you can develop your trading skills, such as market analysis, order execution, risk management, and trading psychology. This experience can be invaluable when you start trading with real money.

- Test Trading Strategies: Demo accounts provide a platform to test and refine your trading strategies before implementing them in a live trading environment. You can identify what works and what doesn’t without risking your capital.

- Gain Confidence: Trading on a demo account can help you build confidence in your trading abilities. As you become more comfortable with the trading process, you can transition to live trading with greater assurance.

How to Choose a Forex Demo Account

A Forex demo account is an invaluable tool for aspiring traders. It allows you to experiment with different trading strategies, learn the ins and outs of the Forex market, and gain confidence before risking real money. But with so many demo accounts available, choosing the right one can be a daunting task. Here are some factors to consider when selecting a Forex demo account.

Broker Reputation

The reputation of the broker is crucial when choosing a demo account. A reputable broker will have a proven track record of fairness, transparency, and customer support. You can research a broker’s reputation by reading reviews, checking their regulatory status, and looking for any complaints or scandals.

Platform Features

The platform used for the demo account should be user-friendly and offer the features you need to trade effectively. Look for a platform that provides real-time quotes, charting tools, technical indicators, order types, and other essential trading features.

Available Assets

A demo account should offer a wide range of assets to trade, including currency pairs, commodities, indices, and cryptocurrencies. This will allow you to experiment with different asset classes and develop a diverse trading strategy.

Demo Account Types, Demo account for forex trading

There are different types of Forex demo accounts, each with its own strengths and weaknesses.

- Standard Demo Accounts: These are the most common type of demo account. They offer a virtual trading environment with a set amount of virtual funds. The main advantage of standard demo accounts is their simplicity and ease of use. The disadvantage is that they may not accurately reflect real market conditions, as they typically use simulated data.

- Live Market Demo Accounts: These demo accounts use real-time market data, providing a more realistic trading experience. They offer a more accurate representation of real market conditions and can help you better prepare for live trading. The disadvantage is that they may be more complex to use and may require a higher level of trading experience.

- Funded Demo Accounts: These demo accounts provide a small amount of real money to trade with. This allows you to experience the thrill of real trading without risking your own capital. The advantage is that they offer a realistic trading experience with real market data and real profits. The disadvantage is that they may have limitations on the amount of money you can trade and the assets you can access.

Alignment with Trading Goals and Experience Level

Choosing a demo account that aligns with your trading goals and experience level is crucial. If you are a beginner, you may want to start with a standard demo account that provides a simple and straightforward trading environment. If you are an experienced trader, you may want to choose a live market demo account that offers a more realistic trading experience.

Getting Started with a Forex Demo Account: Demo Account For Forex Trading

A Forex demo account is a valuable tool for aspiring traders. It allows you to practice trading in a risk-free environment using virtual funds. By understanding how to open and navigate a demo account, you can develop your trading skills and gain confidence before risking real money.

Opening and Setting Up a Forex Demo Account

Opening a Forex demo account is a straightforward process. It usually involves these steps:

- Choose a Forex Broker: Select a reputable broker that offers a demo account. Consider factors like platform features, trading instruments, and customer support.

- Register for an Account: Visit the broker’s website and fill out the registration form. You will typically need to provide your email address, name, and phone number.

- Verify Your Email: The broker will send you an email with a verification link. Click on the link to confirm your email address and complete the registration process.

- Download and Install the Trading Platform: Most brokers offer downloadable platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Download and install the platform on your computer or mobile device.

- Log in to Your Demo Account: Use your login credentials to access the demo account. The platform will usually provide you with virtual funds to start trading.

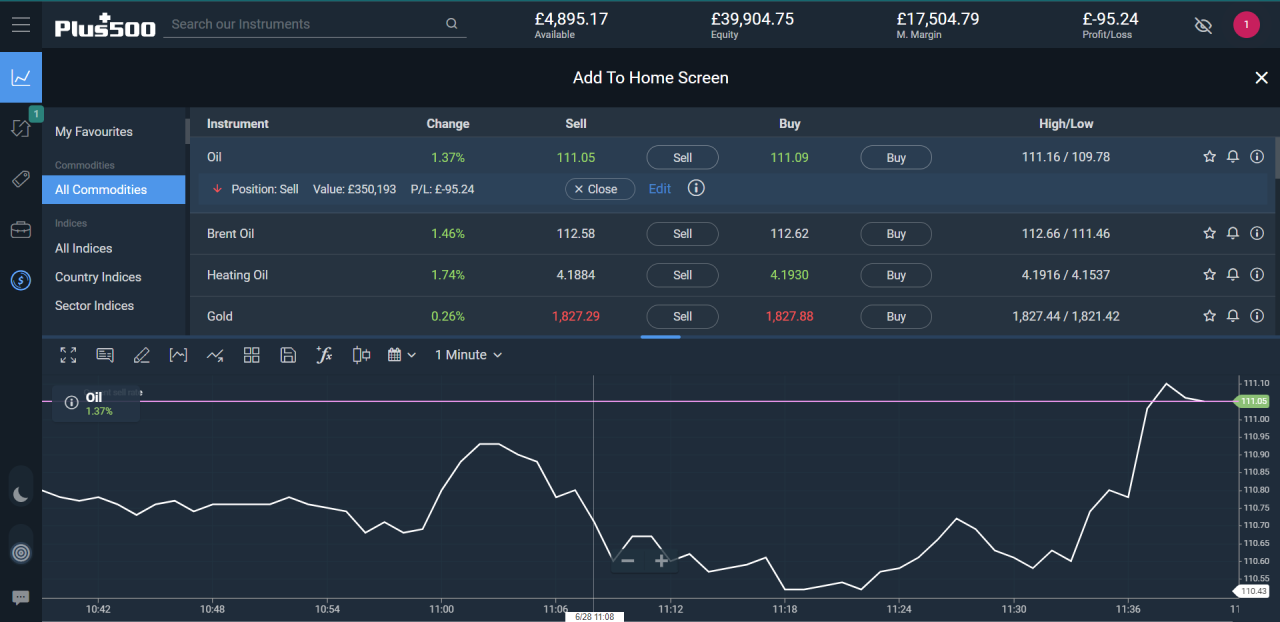

Navigating the Trading Platform and Placing Trades

The trading platform is your interface for accessing the Forex market. It allows you to monitor currency pairs, place orders, and manage your trades.

- Market Watch: This window displays a list of available currency pairs with their current prices and other relevant information. You can add or remove currency pairs from the list.

- Charting Tools: The platform offers various charting tools, including candlestick charts, line charts, and bar charts. You can use these tools to analyze price trends and identify potential trading opportunities.

- Technical Indicators: Technical indicators are mathematical formulas that can be applied to charts to generate trading signals. The platform provides a range of indicators, such as moving averages, MACD, and RSI.

- Order Placement: To place a trade, you need to open a buy or sell order. You can set the entry price, stop-loss order, and take-profit order. A stop-loss order limits your potential losses, while a take-profit order automatically closes your trade when your target profit is reached.

Tips for Maximizing the Learning Experience on a Demo Account

A Forex demo account offers a valuable opportunity to learn and experiment without financial risk.

- Develop a Trading Strategy: Before starting to trade, define your trading strategy, including your risk tolerance, entry and exit points, and profit targets. This will help you make consistent trading decisions.

- Practice Different Trading Styles: Explore various trading styles, such as scalping, day trading, and swing trading. This will help you identify the style that best suits your personality and trading goals.

- Backtest Your Strategies: Use historical data to backtest your trading strategies and assess their performance. This will help you refine your strategies and identify potential flaws.

- Experiment with Different Indicators: Explore different technical indicators and learn how they can be used to generate trading signals. Remember to test the indicators on historical data before applying them in live trading.

- Manage Your Risk: Even though you are trading with virtual funds, it’s essential to manage your risk. Set stop-loss orders to limit your potential losses on each trade.

- Stay Informed: Keep up-to-date with market news and events that can affect currency prices. This will help you make informed trading decisions.

Using a Forex Demo Account for Practice and Learning

A forex demo account is a valuable tool for aspiring and experienced traders alike. It provides a risk-free environment to experiment with different trading strategies, learn the intricacies of the forex market, and refine trading skills before risking real capital.

Practicing Trading Strategies and Techniques

A demo account allows traders to test various trading strategies and techniques without the fear of losing real money. It’s a playground where you can explore different indicators, chart patterns, and trading systems. You can experiment with different timeframes, order types, and risk management techniques to find what works best for you.

For example, you can test a scalping strategy that focuses on small profits from quick trades or a swing trading strategy that aims to capitalize on larger price movements over a longer timeframe. You can also experiment with different technical indicators, such as moving averages, Bollinger Bands, and MACD, to identify potential trading opportunities.

Analyzing Market Data and Identifying Trading Opportunities

A demo account allows traders to familiarize themselves with the various tools and resources available for analyzing market data. It provides access to real-time price charts, economic news, and market sentiment indicators, enabling traders to identify potential trading opportunities.

Traders can practice using technical analysis to identify trends, support and resistance levels, and chart patterns. They can also explore fundamental analysis to understand the economic factors influencing currency movements.

For example, a trader can analyze the relationship between interest rate differentials and currency values. They can observe how a central bank’s monetary policy decisions can impact a currency’s price. By understanding these relationships, traders can identify potential trading opportunities based on economic fundamentals.

Managing Risk and Developing Trading Discipline

Managing risk is crucial in forex trading, and a demo account provides a safe space to practice and develop effective risk management strategies. Traders can experiment with different position sizing techniques, stop-loss orders, and take-profit levels to find what works best for them.

A demo account also helps traders develop trading discipline, which is essential for long-term success. By practicing in a risk-free environment, traders can learn to control their emotions, avoid impulsive decisions, and stick to their trading plan.

For example, a trader can practice entering and exiting trades based on pre-defined criteria, even if their initial instincts might be to hold onto a losing trade or enter a trade without a clear plan. This discipline helps traders avoid emotional trading decisions that can lead to losses.

Transitioning from a Demo Account to Live Trading

Congratulations! You’ve mastered the basics of Forex trading using a demo account. Now, you’re ready to take the leap and start trading with real money. Transitioning from a demo to a live account requires careful preparation and a strategic approach to ensure success.

Understanding the Differences Between Demo and Live Trading

Demo accounts provide a risk-free environment to experiment with trading strategies, learn about Forex markets, and get familiar with trading platforms. However, live trading introduces several key differences that require adjustments in your approach.

- Emotional Impact: Live trading involves real money, which can trigger emotions like fear, greed, and anxiety. These emotions can cloud judgment and lead to impulsive decisions.

- Market Volatility: Live markets are constantly fluctuating, presenting unpredictable price movements that can be challenging to navigate.

- Real-Time Data: In live trading, you’ll be exposed to real-time market data, including news announcements and economic events, which can impact currency prices.

- Trading Costs: Live trading involves fees like spreads, commissions, and overnight financing charges, which are not reflected in demo accounts.

Preparing for Live Trading

Before venturing into live trading, it’s crucial to prepare thoroughly to minimize risks and maximize your chances of success.

- Define Your Trading Goals: Establish clear and realistic goals, such as profit targets, risk tolerance, and time commitment.

- Develop a Trading Plan: Create a detailed trading plan that Artikels your entry and exit strategies, risk management techniques, and trading style.

- Master Risk Management: Risk management is crucial in Forex trading. Set stop-loss orders to limit potential losses and never risk more than you can afford to lose.

- Understand Leverage: Leverage allows you to control larger positions with smaller amounts of capital. While it can amplify profits, it can also magnify losses. Use leverage wisely and avoid excessive leverage.

- Practice Patience: Forex trading is not a get-rich-quick scheme. Be patient and focus on long-term growth rather than chasing quick profits.

- Emotional Control: Develop emotional discipline to avoid impulsive decisions driven by fear or greed.

- Continuous Learning: Forex markets are constantly evolving. Stay updated on market trends, news events, and economic indicators to make informed trading decisions.

Steps to Transition from Demo to Live Trading

Transitioning from a demo account to live trading involves a series of steps to ensure a smooth and successful transition.

- Choose a Reputable Broker: Select a regulated and reliable Forex broker that offers competitive trading conditions, advanced trading tools, and excellent customer support.

- Open a Live Trading Account: Once you’ve chosen a broker, open a live trading account and verify your identity.

- Fund Your Account: Deposit funds into your live trading account using a secure and convenient payment method.

- Start Small: Begin with a small initial investment to test your strategies and gain experience in real market conditions.

- Monitor and Evaluate: Track your trading performance, analyze your wins and losses, and adjust your strategies as needed.

Epilogue

A forex demo account is your key to unlocking the potential of forex trading. It’s a safe space to learn, practice, and develop your trading expertise. Whether you’re a novice or a seasoned trader, a demo account can be a valuable resource to refine your strategies, manage risk, and ultimately achieve your trading goals. So, why wait? Start exploring the world of forex trading today with a demo account and embark on your journey to success.

Quick FAQs

Is a demo account free?

Yes, forex demo accounts are typically free to use. Brokers offer them as a way to attract potential clients and provide a valuable learning tool.

How long can I use a demo account?

Most brokers don’t have a time limit on using a demo account. You can access it as long as you need to practice and gain confidence.

Do demo accounts reflect real market conditions?

Yes, demo accounts are designed to mimic real market conditions as closely as possible. You’ll see the same price fluctuations, trading platforms, and order execution as you would in a live account.

What are the differences between a demo and a live account?

The main difference is that you use virtual funds in a demo account, while you use real money in a live account. This means there’s no risk of losing your own money in a demo account.