Free forex demo accounts provide a risk-free environment to learn and practice trading strategies before venturing into the live market. They offer a realistic simulation of the forex market, allowing traders to familiarize themselves with trading platforms, understand market dynamics, and develop their trading skills without risking real money.

A free forex demo account is an invaluable tool for both beginners and experienced traders. Beginners can use it to gain a foundational understanding of forex trading, while experienced traders can test new strategies and refine their trading techniques. These accounts offer a safe space to experiment with different trading styles, analyze market data, and learn from their mistakes without any financial consequences.

What is a Free Forex Demo Account?

A free Forex demo account is a simulated trading environment that allows traders to practice trading Forex without risking real money. It provides a realistic platform for learning and testing trading strategies, understanding market dynamics, and developing skills before entering the live market.

Purpose of a Free Forex Demo Account

A free Forex demo account serves as a valuable tool for both novice and experienced traders. It provides a safe and risk-free environment to:

- Learn the basics of Forex trading: This includes understanding currency pairs, trading terminology, and the mechanics of placing orders.

- Test trading strategies: Traders can experiment with different strategies and see how they perform in real-time market conditions without risking their capital.

- Develop trading skills: Demo accounts allow traders to practice their trading skills, such as risk management, order execution, and market analysis, in a simulated environment.

- Gain confidence before live trading: By familiarizing themselves with the trading platform and market dynamics, traders can gain confidence and reduce the fear of entering the live market.

Key Features of a Free Forex Demo Account

Free Forex demo accounts typically offer the following features:

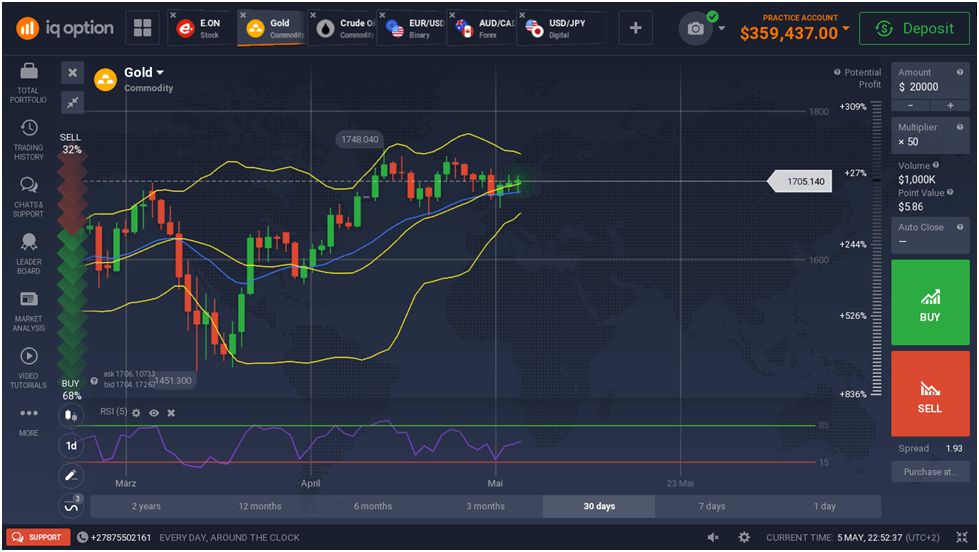

- Access to real-time market data: This includes live price feeds, charts, and economic indicators, providing a realistic trading experience.

- Virtual trading capital: Demo accounts provide a virtual balance that traders can use to execute trades without risking their own money.

- Full trading functionality: Most demo accounts offer the same trading tools and features as live accounts, including order types, technical indicators, and charting tools.

- Educational resources: Many brokers provide educational resources and tutorials to help traders learn the basics of Forex trading and develop their skills.

Benefits of Using a Free Forex Demo Account

There are numerous benefits to using a free Forex demo account, including:

- Risk-free trading: Traders can practice and experiment without risking their own capital, allowing them to learn from mistakes without financial consequences.

- Improved trading skills: The simulated environment allows traders to develop their trading skills, including risk management, order execution, and market analysis, before entering the live market.

- Increased confidence: By familiarizing themselves with the trading platform and market dynamics, traders can gain confidence and reduce the fear of entering the live market.

- Reduced trading costs: Demo accounts are free to use, eliminating the need to pay trading commissions or fees.

- Access to advanced features: Demo accounts often provide access to advanced trading features, such as automated trading robots and expert advisors, that may not be available in live accounts.

How to Choose the Right Free Forex Demo Account

A free Forex demo account is a valuable tool for learning the ropes of Forex trading without risking real money. It allows you to experiment with different strategies, understand market dynamics, and gain confidence before venturing into live trading. But with so many brokers offering free demo accounts, choosing the right one can be a daunting task. This section will guide you through the process of selecting a demo account that aligns with your learning goals and trading style.

Types of Free Forex Demo Accounts

The type of free Forex demo account you choose will depend on your specific needs and trading preferences. Here’s a breakdown of the most common types:

- Standard Demo Account: This is the most basic type of demo account, offering a realistic trading environment with virtual funds. It typically includes a range of currency pairs, trading tools, and charting features.

- Advanced Demo Account: This type of demo account goes beyond the basics, offering features like advanced charting tools, technical indicators, and access to real-time market data. It’s suitable for traders who want to delve deeper into technical analysis and refine their trading strategies.

- Simulative Demo Account: This type of demo account simulates real-time market conditions, including slippage and order execution delays. It’s designed to provide a more realistic trading experience and prepare traders for the challenges of live trading.

Key Factors to Consider

When choosing a free Forex demo account, consider these key factors:

- Trading Platform: The trading platform should be user-friendly, intuitive, and offer the features you need. Consider the platform’s charting capabilities, technical indicators, order types, and ease of navigation.

- Available Instruments: Ensure the demo account offers the currency pairs and other instruments you want to trade. Some brokers may limit the selection in demo accounts, so check before signing up.

- Virtual Funds: The amount of virtual funds provided should be sufficient for your trading needs. You should be able to test various strategies and trade sizes without running out of funds.

- Expiry Date: Some demo accounts have an expiry date, while others are permanent. If you’re planning to use the demo account for an extended period, choose one that doesn’t expire or has a long expiration date.

- Customer Support: A reputable broker will offer reliable customer support, even for demo account users. Ensure you can reach out to them for assistance with any questions or issues you may encounter.

Selecting a Reputable Broker

Choosing a reputable broker is crucial for a successful trading experience. Here are some tips for selecting a broker offering free Forex demo accounts:

- Check Broker Regulation: Look for brokers regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. Regulation ensures that the broker adheres to certain standards and protects customer funds.

- Read Reviews and Testimonials: Check online reviews and testimonials from other traders to get an idea of the broker’s reputation and customer satisfaction levels. Be sure to look for both positive and negative reviews to get a balanced perspective.

- Compare Demo Account Features: Compare the features offered by different brokers to find one that aligns with your needs and trading style. Consider the trading platform, available instruments, virtual funds, and other features discussed earlier.

- Try a Demo Account: Before committing to a live account, try out the broker’s demo account. This will give you a feel for the trading platform, execution speed, and overall user experience.

Using a Free Forex Demo Account for Practice

A free Forex demo account is a valuable tool for learning and practicing Forex trading without risking real money. It allows you to familiarize yourself with the platform, experiment with different trading strategies, and develop your skills before entering the live market.

Opening and Navigating a Free Forex Demo Account

Opening a free Forex demo account is usually a straightforward process. You typically need to provide some basic information, such as your name, email address, and phone number. Once your account is created, you will be provided with a virtual trading platform and a set amount of virtual funds to practice with. The platform will often have a similar interface to the live trading platform, allowing you to become familiar with the tools and features.

- Step 1: Choose a Broker: Select a reputable Forex broker that offers a free demo account. Consider factors such as the platform’s user-friendliness, available trading instruments, and customer support.

- Step 2: Register for a Demo Account: Visit the broker’s website and locate the “Demo Account” or “Free Trial” section. Follow the registration instructions, which typically involve providing basic personal information.

- Step 3: Download and Install the Platform: Download and install the trading platform provided by the broker. This platform will allow you to access your demo account and start practicing.

- Step 4: Familiarize Yourself with the Platform: Explore the platform’s features, including the charts, order types, and trading tools. Use the demo funds to place practice trades and get comfortable with the trading process.

Practicing Trading Strategies

A free Forex demo account is an excellent opportunity to test and refine your trading strategies without risking real money. This allows you to experiment with different indicators, technical analysis techniques, and risk management approaches.

- Identify Your Trading Style: Determine your preferred trading style, such as scalping, day trading, or swing trading. This will help you focus on strategies that align with your risk tolerance and time commitment.

- Choose Trading Strategies: Research and select trading strategies that are suitable for your chosen trading style. Some popular strategies include moving average crossover, support and resistance trading, and candlestick patterns.

- Backtest Your Strategies: Use historical data to test your chosen strategies and assess their performance. This will help you identify potential flaws and refine your approach.

- Practice on the Demo Account: Implement your strategies on the demo account using the virtual funds. This will allow you to gain experience in executing trades and managing risk in a simulated environment.

- Analyze Your Results: Regularly review your trading performance on the demo account. Identify areas for improvement and adjust your strategies accordingly.

Trading Scenarios and Strategies for Practice

Here are some common trading scenarios and strategies that can be practiced on a free Forex demo account:

- Trend Trading: Identify trends in the market using indicators like moving averages or MACD. Enter trades in the direction of the trend and exit when the trend reverses.

- Support and Resistance Trading: Identify support and resistance levels on the chart, which are areas where price is likely to bounce or break. Enter trades near these levels, anticipating a price reversal.

- Scalping: Take advantage of small price fluctuations by entering and exiting trades quickly. This strategy requires high attention and fast execution.

- News Trading: Use economic news releases to identify potential price movements. Analyze the impact of news events on currency pairs and place trades accordingly.

- Risk Management Practice: Implement risk management techniques such as stop-loss orders and position sizing to limit potential losses on your trades.

Transitioning from a Free Forex Demo Account to Live Trading

After mastering the art of forex trading on a demo account, the next step is to transition to live trading. This transition is crucial, as it marks the shift from simulated trading to real-world financial markets. While a demo account provides a risk-free environment to practice, live trading involves real money and requires a different mindset and approach.

Key Differences Between Demo and Live Trading Environments

The key difference between demo and live trading lies in the consequences of your trading decisions. In a demo account, losses are not real, and there is no emotional attachment to the virtual funds. Live trading, however, involves real money, and every trade carries the potential for both profit and loss. This difference necessitates a shift in perspective, requiring traders to approach live trading with a greater level of discipline and risk management.

Checklist for Transitioning from a Free Forex Demo Account to Live Trading

Transitioning from a demo to a live account requires a structured approach to ensure a smooth and successful transition. Here is a checklist to help you prepare:

- Define Your Trading Strategy: Before transitioning to live trading, it’s crucial to have a well-defined trading strategy. This strategy should Artikel your entry and exit points, risk management plan, and trading goals.

- Develop a Trading Plan: A trading plan Artikels your trading objectives, risk tolerance, and time commitment. It serves as a guide to ensure disciplined trading decisions.

- Choose the Right Broker: Selecting a reputable and reliable broker is essential for live trading. Consider factors like regulation, trading platform, customer support, and fees.

- Start with a Small Account: Begin with a small capital amount to minimize potential losses and gain experience in live trading.

- Practice with a Micro Account: Some brokers offer micro accounts, which allow you to trade with smaller lot sizes, reducing the risk associated with each trade.

- Monitor Your Performance: Keep a detailed trading journal to track your trades, analyze your performance, and identify areas for improvement.

- Be Patient and Consistent: Trading is a marathon, not a sprint. Be patient and consistent with your approach, and avoid impulsive decisions.

Managing Risk and Emotions During the Transition to Live Trading

Transitioning to live trading can be emotionally challenging, especially when dealing with real money. Managing risk and emotions is crucial for success.

- Set Stop-Loss Orders: Stop-loss orders limit your potential losses on a trade by automatically closing your position when the price reaches a predetermined level.

- Control Your Position Size: Avoid overtrading by managing your position size, ensuring that each trade represents a small percentage of your overall capital.

- Avoid Emotional Trading: Avoid making trading decisions based on fear or greed. Stick to your trading plan and avoid chasing losses or riding winners too long.

- Seek Professional Guidance: If you’re struggling to manage your emotions or risk, consider seeking guidance from an experienced forex trader or mentor.

End of Discussion

In conclusion, free forex demo accounts offer a valuable opportunity to learn, practice, and refine your forex trading skills before committing real capital. By utilizing these accounts effectively, traders can gain confidence, develop a solid trading strategy, and ultimately increase their chances of success in the live market.

FAQ Overview: Free Forex Demo Account

How long can I use a free forex demo account?

Most brokers offer free forex demo accounts with unlimited access, allowing you to practice for as long as you need.

Do free forex demo accounts offer real-time market data?

Yes, free forex demo accounts typically provide access to real-time market data, giving you a realistic trading experience.

Are there any limitations to free forex demo accounts?

Some brokers may impose limitations on the number of trading instruments available or the amount of virtual funds provided in a free demo account. However, these limitations are usually sufficient for practice purposes.