Broker for forex trading sets the stage for this enthralling narrative, offering readers a glimpse into a world where financial markets come alive. This guide delves into the intricate landscape of forex brokers, illuminating the key aspects of their role in facilitating global currency trading.

From understanding the different types of brokers and their services to choosing the right platform and navigating the regulatory landscape, we explore the essential elements of successful forex trading. Join us as we unravel the complexities of this dynamic market and empower you with the knowledge to make informed decisions.

Understanding Forex Brokers

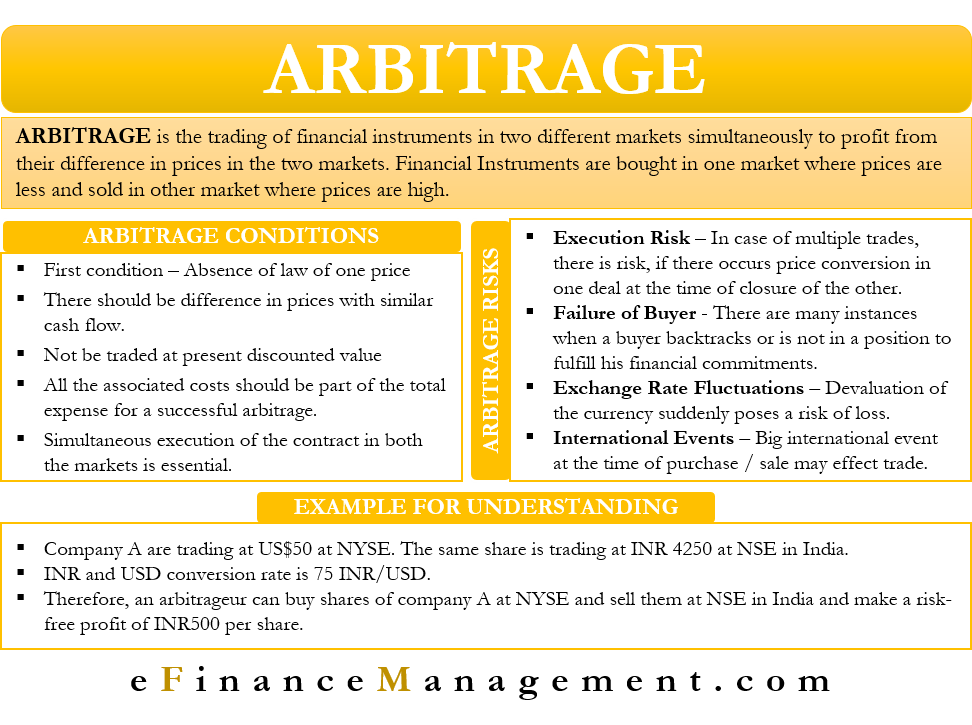

Forex brokers play a crucial role in facilitating trading in the foreign exchange market. They act as intermediaries between traders and the global forex market, providing access to trading platforms, execution services, and other essential tools.

Types of Forex Brokers

Forex brokers can be categorized into different types based on their trading models and execution methods. The three main types are:

- Market Makers: These brokers provide quotes for currency pairs and execute trades directly with their clients. They profit from the spread, which is the difference between the bid and ask prices. Market makers offer a convenient and often faster trading experience but may have potential conflicts of interest.

- Electronic Communication Networks (ECNs): ECNs are platforms that connect traders directly with other market participants, such as banks and institutional investors. They offer a more transparent and competitive trading environment, with lower spreads and faster execution speeds. However, ECNs may have higher minimum deposit requirements and more complex trading interfaces.

- Straight-Through Processing (STP): STP brokers act as intermediaries, routing trades to liquidity providers, such as banks and other brokers. They typically offer tighter spreads and faster execution than market makers but may have higher fees.

Essential Features of a Reputable Forex Broker, Broker for forex trading

When choosing a forex broker, it is crucial to consider several essential features that indicate their reliability and trustworthiness. These include:

- Regulation and Licensing: A reputable broker should be regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. Regulation ensures that brokers adhere to certain standards of conduct and financial stability.

- Trading Platform: The trading platform should be user-friendly, reliable, and offer a wide range of features, including charting tools, technical indicators, and order types. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Spreads and Fees: Brokers charge spreads, which are the difference between the bid and ask prices, and other fees, such as commission fees. It is important to compare spreads and fees across different brokers to find the most competitive option.

- Account Types: Brokers offer different account types to cater to various trading styles and risk appetites. These may include demo accounts, micro accounts, standard accounts, and professional accounts.

- Customer Support: A reliable broker should provide responsive and helpful customer support through multiple channels, such as phone, email, and live chat.

- Security Measures: Security is paramount when trading online. Brokers should use encryption technology and other security measures to protect client funds and personal information.

- Educational Resources: Reputable brokers often provide educational resources, such as webinars, articles, and tutorials, to help traders improve their knowledge and skills.

Advantages and Disadvantages of Using a Forex Broker

Using a forex broker offers several advantages, but it also comes with certain disadvantages:

- Advantages:

- Access to the Forex Market: Forex brokers provide traders with access to the global forex market, which is the largest and most liquid financial market in the world.

- Leverage: Forex brokers offer leverage, which allows traders to control larger positions with a smaller initial investment. Leverage can amplify both profits and losses.

- Trading Platforms and Tools: Brokers provide sophisticated trading platforms and tools, including charting software, technical indicators, and order types, to enhance trading capabilities.

- Customer Support: Forex brokers offer customer support to assist traders with any questions or issues they may encounter.

- Disadvantages:

- Fees and Spreads: Forex brokers charge fees and spreads, which can erode profits.

- Counterparty Risk: There is a risk that a broker may default on its obligations, leading to potential losses for traders.

- Leverage Risk: Leverage can amplify both profits and losses, so it is important to use leverage responsibly and manage risk effectively.

- Potential Conflicts of Interest: Some brokers may have conflicts of interest, such as market making, which could potentially impact trading outcomes.

Choosing the Right Forex Broker

Choosing the right forex broker is crucial for your trading success. It’s like choosing the right tools for a job – the wrong tools can make things difficult and even lead to mistakes. A good forex broker provides a reliable platform, competitive pricing, and excellent customer support, allowing you to focus on your trading strategies.

Evaluating Broker Reliability and Trustworthiness

A reliable and trustworthy forex broker is essential for protecting your investments and ensuring a smooth trading experience. Here are some key factors to consider:

- Regulation: Look for brokers regulated by reputable financial authorities like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Commodity Futures Trading Commission (CFTC) in the US. Regulation provides a layer of protection for traders, ensuring brokers adhere to specific standards and practices.

- Financial Stability: Check the broker’s financial history and track record. Look for brokers with a strong capital base and a proven track record of stability. You can often find this information on their website or through independent financial news sources.

- Transparency: A trustworthy broker will be transparent about its fees, trading conditions, and risk disclosures. They should clearly Artikel their policies and procedures in an easy-to-understand manner.

- Client Reviews and Testimonials: Read reviews and testimonials from other traders to gain insights into the broker’s reputation and customer service. Websites like ForexPeaceArmy and Trustpilot can be valuable resources for this information.

Essential Criteria for Evaluating a Forex Broker

To evaluate a forex broker’s suitability, consider these key factors:

- Trading Platform: The trading platform is your interface with the market. Look for a platform that is user-friendly, offers advanced charting tools, and provides real-time market data. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Spreads: Spreads are the difference between the bid and ask prices, representing the broker’s profit. Lower spreads are generally more favorable, as they reduce your trading costs. Compare spreads across different brokers and account types.

- Leverage: Leverage allows you to control a larger position with a smaller investment. While leverage can amplify profits, it can also magnify losses. Choose a broker that offers appropriate leverage levels based on your trading experience and risk tolerance.

- Customer Support: Reliable customer support is essential, especially when you have questions or encounter issues. Look for brokers with responsive and knowledgeable support teams available through multiple channels like phone, email, and live chat.

Checklist of Questions to Ask Potential Forex Brokers

Before opening an account with a forex broker, ask these questions:

- What are your regulatory licenses and authorizations?

- What are your trading platform options and features?

- What are your spreads and commissions?

- What leverage levels do you offer?

- What are your deposit and withdrawal methods and fees?

- What is your customer support availability and contact information?

- Do you offer educational resources and trading tools?

- What are your risk management policies and procedures?

Forex Broker Services and Features

Forex brokers offer a wide range of services and features to cater to the diverse needs of traders. Understanding these services and features is crucial for choosing the right broker and optimizing your trading experience.

Account Types

Forex brokers typically offer various account types to accommodate different trading styles and capital levels.

- Demo Accounts: These accounts provide a risk-free environment to practice trading strategies and familiarize yourself with the trading platform without risking real money. Demo accounts are typically funded with virtual currency and reflect real-time market conditions. They are ideal for beginners or traders who want to test new strategies before risking real capital.

- Standard Accounts: These accounts are the most common type and are suitable for a wide range of traders. They typically have lower minimum deposit requirements and offer competitive trading conditions. Standard accounts often have fixed spreads and may offer access to advanced trading tools and research resources.

- Premium Accounts: These accounts cater to experienced traders with larger capital investments. They often come with lower spreads, faster execution speeds, and access to exclusive benefits such as dedicated account managers and personalized trading insights. Premium accounts may also offer higher leverage options, which can amplify both profits and losses.

Trading Platforms

The trading platform is the software interface through which traders interact with the market and execute orders. Different brokers offer a variety of platforms, each with its own strengths and weaknesses.

- MetaTrader 4 (MT4): One of the most popular trading platforms in the forex market, MT4 is known for its user-friendly interface, advanced charting capabilities, and a wide range of technical indicators and trading tools. It also supports automated trading strategies through Expert Advisors (EAs).

- MetaTrader 5 (MT5): The successor to MT4, MT5 offers enhanced features such as increased charting capabilities, more technical indicators, and support for multiple asset classes, including stocks and futures. However, it may have a steeper learning curve compared to MT4.

- cTrader: This platform is popular among scalpers and high-frequency traders due to its fast execution speeds and advanced order types. cTrader also offers customizable charts and a wide range of technical analysis tools.

Leverage in Forex Trading

Leverage is a powerful tool that allows traders to control a larger position in the market with a smaller initial investment. For example, a leverage ratio of 1:100 means that a trader can control $100,000 worth of currency with a $1,000 investment.

Leverage can amplify both profits and losses, making it a double-edged sword. While it can enhance potential returns, it can also lead to significant losses if not managed carefully.

Leverage is a crucial factor in risk management, and traders must carefully consider their risk tolerance and trading strategy before using leverage.

Trading Tools and Resources

Forex brokers often provide a range of tools and resources to support traders in their decision-making and trading activities.

| Tool/Resource | Description |

|---|---|

| Educational Materials | Many brokers offer a variety of educational resources, such as articles, tutorials, webinars, and courses, to help traders learn about forex trading and develop their skills. |

| Market Analysis | Brokers may provide market research reports, economic calendars, and technical analysis tools to help traders understand market trends and make informed trading decisions. |

| Trading Signals | Some brokers offer trading signals generated by algorithms or expert analysts, providing buy or sell recommendations based on technical or fundamental analysis. |

| Trading Calculators | Calculators can help traders determine profit and loss potential, calculate margin requirements, and analyze the impact of leverage on their trades. |

Forex Broker Regulations and Security

The forex market is a vast and complex environment, and it’s essential to understand the regulations and security measures that govern it. Choosing a reputable and regulated broker is crucial for protecting your investments and ensuring a safe trading experience.

Regulatory Oversight in the Forex Industry

Regulatory oversight plays a vital role in ensuring the integrity and stability of the forex market. Regulatory bodies set standards for brokers, monitor their activities, and protect traders from fraudulent practices.

Key Regulatory Bodies

- Financial Conduct Authority (FCA): The FCA is the UK’s financial regulator, responsible for overseeing the forex market and protecting investors. Brokers regulated by the FCA are subject to strict capital requirements, risk management rules, and client protection measures.

- National Futures Association (NFA): The NFA is a self-regulatory organization (SRO) in the United States that oversees futures and forex brokers. NFA-regulated brokers are required to adhere to specific rules and regulations, including financial reporting, customer protection, and conflict of interest management.

- Australian Securities and Investments Commission (ASIC): ASIC is the Australian government’s corporate regulator, responsible for overseeing the forex market and ensuring fair and transparent trading practices. ASIC-regulated brokers must meet certain capital adequacy requirements, comply with anti-money laundering (AML) regulations, and provide investor protection.

- Cyprus Securities and Exchange Commission (CySEC): CySEC is the regulatory body for financial markets in Cyprus. CySEC-regulated brokers are subject to strict rules and regulations, including capital requirements, client fund segregation, and reporting requirements.

Security of Client Funds and Data

Reputable forex brokers prioritize the security of client funds and data. They employ various measures to protect their clients’ assets and ensure data privacy.

- Client Fund Segregation: Regulated brokers are required to segregate client funds from their own operating capital. This means that client funds are held in separate accounts, preventing the broker from using them for their own purposes.

- Negative Balance Protection: Some brokers offer negative balance protection, which prevents traders from losing more money than their initial investment. This feature safeguards clients from unexpected losses and ensures that they don’t incur debts.

- Data Encryption: Reputable brokers use advanced encryption technologies to protect client data, including personal information, trading history, and account details. This ensures that sensitive information is secure and cannot be accessed by unauthorized individuals.

Protecting Yourself from Scams

While the forex market offers opportunities for profit, it also attracts scammers. Here are some tips to protect yourself from fraudulent brokers:

- Verify Regulation: Always check if a broker is regulated by a reputable authority. Look for information about the broker’s license and regulatory status on their website or on the regulatory body’s website.

- Research the Broker’s Reputation: Read reviews and testimonials from other traders to get an idea of the broker’s reputation and reliability. Look for reviews on independent websites and forums.

- Be Wary of High-Pressure Sales Tactics: Legitimate brokers will not pressure you into making quick decisions. If a broker is using aggressive tactics, it could be a sign of a scam.

- Avoid Brokers Offering Unrealistic Returns: Be cautious of brokers promising exceptionally high returns or guaranteed profits. Forex trading involves risk, and no broker can guarantee profitability.

The Future of Forex Brokerage

The forex brokerage industry is constantly evolving, driven by technological advancements and changing investor preferences. As we look towards the future, several emerging trends are shaping the landscape of forex trading, impacting the role of brokers and the way investors interact with the market.

AI-Powered Trading and Automation

The integration of artificial intelligence (AI) is revolutionizing forex trading, offering both opportunities and challenges for brokers. AI-powered trading platforms can analyze vast amounts of data, identify patterns, and execute trades with speed and precision surpassing human capabilities. This automation empowers traders with enhanced decision-making tools and increased efficiency.

- Automated Trading Strategies: AI algorithms can develop and execute complex trading strategies based on real-time market data, allowing traders to automate their trading processes and free up time for other tasks.

- Personalized Trading Recommendations: AI-powered platforms can analyze individual trading styles and risk tolerance, providing personalized recommendations and insights to enhance trading decisions.

- Risk Management and Optimization: AI can help brokers optimize risk management strategies by identifying potential risks and developing automated responses to mitigate losses.

Cryptocurrency Integration

The rise of cryptocurrencies has significantly impacted the financial landscape, and forex brokerage is no exception. Crypto-based trading is becoming increasingly popular, with brokers offering access to a wider range of assets, including cryptocurrencies, alongside traditional forex pairs.

- Cryptocurrency Trading Platforms: Brokers are incorporating cryptocurrency trading platforms into their offerings, providing a seamless experience for investors to trade both traditional and digital assets.

- Cryptocurrency Payment Options: Brokers are accepting cryptocurrency payments, enhancing convenience and accessibility for crypto-savvy investors.

- Cryptocurrency-Based Derivatives: Brokers are offering cryptocurrency-based derivatives, such as futures and options, allowing investors to leverage the volatility of the crypto market.

Technological Advancements and the Role of Brokers

Technological advancements are transforming the role of forex brokers, moving them from traditional intermediaries to technology-driven partners. Brokers are leveraging technology to enhance their services, improve client experience, and adapt to the evolving needs of investors.

- Enhanced Trading Platforms: Brokers are investing in user-friendly and feature-rich trading platforms, providing real-time market data, advanced charting tools, and customizable trading interfaces.

- Mobile Trading Apps: Brokers are developing mobile trading apps, enabling investors to access their accounts and execute trades from anywhere, anytime.

- Personalized Customer Support: Brokers are utilizing AI-powered chatbots and virtual assistants to provide personalized customer support, addressing queries and resolving issues efficiently.

Challenges and Opportunities

The future of forex brokerage presents both challenges and opportunities. Brokers need to adapt to the rapidly changing market dynamics, embrace technological advancements, and cater to the evolving needs of investors.

- Staying Ahead of Technological Advancements: Brokers must continuously invest in research and development to stay ahead of the technological curve and provide innovative solutions to their clients.

- Ensuring Security and Compliance: As the forex market becomes increasingly complex, brokers must prioritize security measures to protect client funds and comply with regulatory requirements.

- Attracting and Retaining Clients: Brokers need to differentiate themselves by offering competitive pricing, advanced trading tools, and exceptional customer service to attract and retain clients.

Epilogue: Broker For Forex Trading

As the world of forex trading continues to evolve, understanding the role of brokers is crucial for navigating this dynamic landscape. This guide has provided you with a comprehensive overview of the key factors to consider, empowering you to make informed decisions and maximize your trading potential. Remember, the right broker can be your partner in achieving your financial goals in the exciting world of forex trading.

Common Queries

What is a forex broker?

A forex broker acts as an intermediary between traders and the global currency market. They provide access to trading platforms, facilitate transactions, and offer various services to support traders.

How do forex brokers make money?

Forex brokers generate revenue through various means, including spreads (the difference between the buy and sell prices), commissions on trades, and interest on margin accounts.

Are forex brokers regulated?

Yes, reputable forex brokers are regulated by financial authorities in their respective jurisdictions. Regulation ensures that brokers operate fairly and transparently, protecting traders’ funds and data.

How do I choose the right forex broker?

Consider factors like regulation, trading platform, spreads, leverage, customer support, and educational resources. Research and compare different brokers before making a decision.

Is forex trading safe?

Forex trading involves inherent risks, but it can be safe if you trade responsibly. Choose a regulated broker, manage your risk effectively, and educate yourself about the market.