Application trading forex has revolutionized how individuals engage with the global currency market. This digital realm offers a dynamic platform where traders can access real-time data, execute trades, and manage their portfolios with unparalleled convenience. Whether you are a seasoned investor or a curious newcomer, the world of forex trading applications provides a gateway to a vast and potentially lucrative market.

These applications serve as powerful tools, enabling traders to analyze market trends, identify opportunities, and execute trades with precision. They offer a range of features, from sophisticated charting tools and technical indicators to automated trading systems and comprehensive risk management features. The accessibility and versatility of these platforms have made forex trading more accessible to a wider audience, allowing individuals to participate in this dynamic market from anywhere in the world.

Introduction to Forex Trading Applications: Application Trading Forex

In today’s digital world, forex trading applications have become indispensable tools for traders of all levels, offering a wide range of features and functionalities that streamline the trading process and enhance trading outcomes. These applications play a crucial role in connecting traders to the global forex market, providing them with access to real-time market data, trading platforms, and analytical tools.

The benefits of utilizing forex trading applications are numerous, making them essential for both novice and experienced traders.

Benefits of Forex Trading Applications

Applications simplify forex trading by providing a user-friendly interface, allowing traders to execute trades, manage their accounts, and monitor market movements with ease.

Types of Forex Trading Applications

Forex trading applications come in various forms, each catering to specific needs and preferences.

- Mobile Apps: These applications allow traders to access the forex market from their smartphones or tablets, providing on-the-go trading capabilities and real-time market updates.

- Desktop Platforms: Desktop platforms offer more advanced features and functionalities, including charting tools, technical indicators, and order management systems.

- Web-Based Platforms: Web-based platforms are accessible through any web browser, eliminating the need for downloads or installations. They provide a convenient and flexible trading experience, allowing traders to access their accounts from any location with an internet connection.

Key Features of Forex Trading Applications

Forex trading applications are essential tools for traders of all levels, providing access to the global currency market and a range of features that can enhance trading strategies. These applications offer a diverse set of features, each designed to meet specific needs and enhance the trading experience.

Order Execution Speed

Order execution speed is crucial for forex traders, as even a fraction of a second delay can impact profitability, especially in fast-moving markets. Forex trading applications strive to provide rapid order execution, minimizing slippage and ensuring trades are executed at the desired price.

- Direct Market Access (DMA): Some applications offer DMA, allowing traders to connect directly to the forex market, bypassing brokers and minimizing latency.

- Low Latency Servers: Applications often utilize servers located in close proximity to major forex exchanges, reducing the distance data travels and minimizing execution time.

- Advanced Order Types: Applications often provide advanced order types like stop-loss and take-profit orders, which can help manage risk and automate trade execution.

Charting Tools

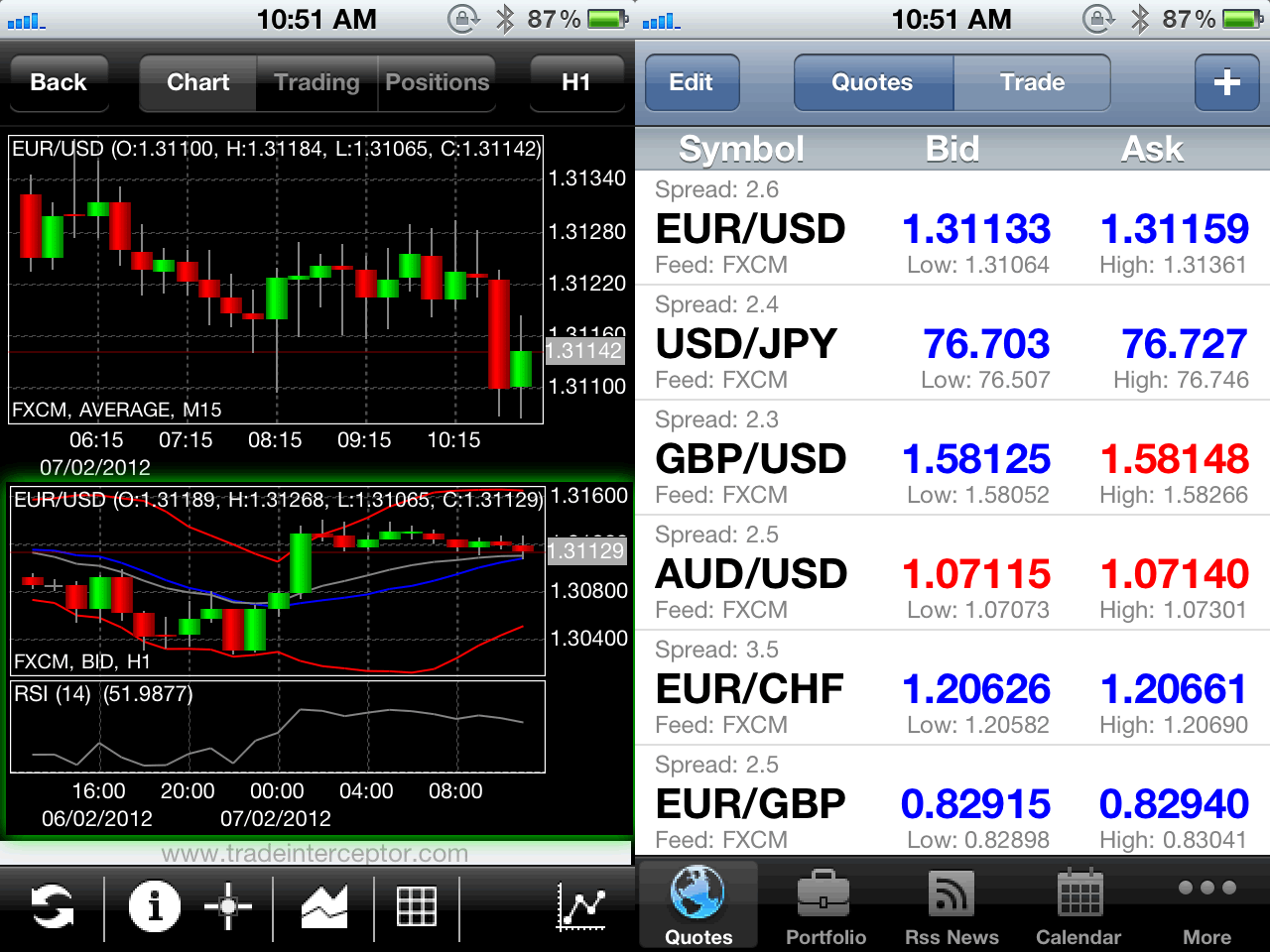

Charting tools are fundamental for analyzing market trends, identifying patterns, and making informed trading decisions. Forex trading applications offer a variety of charting tools, including:

- Multiple Timeframes: Traders can analyze price action across different timeframes, from short-term to long-term, to identify trends and potential trading opportunities.

- Technical Indicators: Applications often include a wide array of technical indicators, such as moving averages, MACD, and Bollinger Bands, which can provide insights into market momentum, volatility, and potential support and resistance levels.

- Drawing Tools: Traders can draw lines, channels, and other shapes on charts to identify patterns, support and resistance levels, and potential trend reversals.

- Customizable Layouts: Many applications allow traders to customize chart layouts, adding or removing indicators and tools as needed.

Real-Time Market Data

Access to real-time market data is crucial for making timely trading decisions. Forex trading applications provide various data feeds, including:

- Live Quotes: Applications display real-time currency prices, allowing traders to monitor market movements and identify potential trading opportunities.

- News Feeds: Some applications integrate news feeds, providing traders with up-to-the-minute economic and political events that can impact currency prices.

- Economic Calendars: Economic calendars list upcoming economic releases, such as inflation data and interest rate decisions, which can significantly influence currency movements.

Features Comparison

Different forex trading applications offer varying levels of functionality and features. Some applications are designed for beginners, while others cater to advanced traders.

- Beginner-Friendly Applications: These applications typically have simplified interfaces, limited charting tools, and basic technical indicators, making them suitable for new traders.

- Advanced Applications: These applications provide advanced charting tools, technical indicators, real-time market data, and other features for experienced traders.

- Mobile Applications: Many forex trading applications offer mobile versions, allowing traders to access their accounts and trade on the go.

- Social Trading Features: Some applications offer social trading features, allowing traders to connect with other traders, share ideas, and copy trading strategies.

Choosing the Right Forex Trading Application

Choosing the right forex trading application is crucial for successful trading. With so many options available, navigating the market and selecting the platform that best suits your needs can be challenging. This section will guide you through the essential factors to consider when choosing a forex trading application.

Factors to Consider When Selecting a Forex Trading Application

Selecting the right forex trading application involves a careful evaluation of various factors. The ideal application should align with your trading style, risk tolerance, and overall trading goals.

- Platform Security: Security is paramount in forex trading. Your chosen platform should offer robust security measures to safeguard your funds and personal information. Look for features like two-factor authentication, encryption protocols, and reputable regulatory oversight.

- User Interface: A user-friendly interface is essential for a smooth and efficient trading experience. The platform should be intuitive, easy to navigate, and offer customizable layouts to suit your preferences.

- Customer Support: Reliable customer support is crucial for resolving issues, accessing technical assistance, and getting answers to your queries. Look for platforms that offer 24/5 multi-lingual support through various channels, including live chat, email, and phone.

- Compatibility with Trading Strategies: The application should be compatible with your preferred trading strategies. Consider features like charting tools, technical indicators, order types, and backtesting capabilities to ensure your chosen platform supports your trading approach.

- Trading Tools and Resources: A comprehensive set of trading tools and resources can significantly enhance your trading experience. Look for platforms that offer features like real-time market data, economic calendars, news feeds, educational materials, and trading signals.

- Fees and Commissions: Trading fees and commissions can significantly impact your profitability. Compare different platforms and consider factors like spread, inactivity fees, and withdrawal fees.

- Mobile App Availability: A mobile app is essential for staying connected to the markets and managing your trades on the go. Look for platforms that offer a user-friendly and feature-rich mobile app.

- Regulation and Licensing: Ensure the platform is regulated by reputable financial authorities. Regulatory oversight provides an extra layer of protection for traders.

Comparison of Popular Forex Trading Applications

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader | TradingView |

|---|---|---|---|---|

| Platform Security | High | High | High | High |

| User Interface | Classic and familiar | Modern and intuitive | Sleek and user-friendly | Highly customizable and interactive |

| Customer Support | Good | Good | Excellent | Good |

| Trading Tools and Resources | Extensive | Extensive | Comprehensive | Extensive |

| Fees and Commissions | Competitive | Competitive | Competitive | N/A (Not a trading platform) |

| Mobile App Availability | Yes | Yes | Yes | Yes |

| Regulation and Licensing | Regulated by various authorities | Regulated by various authorities | Regulated by various authorities | Not a trading platform |

Using Forex Trading Applications for Analysis

Forex trading applications offer a wide range of tools and features that can be used to perform technical analysis, helping traders identify potential trading opportunities. Technical analysis involves studying historical price data and market trends to predict future price movements.

Technical Indicators

Technical indicators are mathematical calculations based on historical price data that provide insights into market trends and momentum. Forex trading applications often include a wide variety of indicators, such as:

- Moving Averages (MA): Moving averages smooth out price fluctuations and highlight trends. Different types of moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA), are used to identify support and resistance levels and signal potential buy or sell opportunities.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought and oversold conditions in the market. It ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 suggesting oversold conditions.

- Bollinger Bands: Bollinger Bands are a volatility indicator that measures price fluctuations around a moving average. They provide a visual representation of price volatility and can help identify potential breakouts or reversals.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that compares two moving averages to identify potential buy and sell signals.

Charting Tools

Forex trading applications provide a variety of charting tools that allow traders to visualize price data and identify patterns. These tools include:

- Candlestick Charts: Candlestick charts display price data for a specific time period, showing the open, high, low, and close prices. Different candlestick patterns can indicate potential buy or sell signals.

- Line Charts: Line charts connect closing prices for each period, providing a simple visual representation of price trends.

- Bar Charts: Bar charts display the high, low, open, and close prices for each period, providing a more detailed view of price fluctuations.

- Drawing Tools: Many applications include drawing tools that allow traders to add trend lines, support and resistance levels, Fibonacci retracements, and other technical indicators to charts.

Using Technical Analysis to Identify Trading Opportunities

Traders can use technical indicators and charting tools to identify potential trading opportunities by:

- Identifying Trend Reversals: Technical indicators can help traders identify potential trend reversals by detecting overbought or oversold conditions. For example, an RSI reading above 70 may suggest that the market is overbought and a potential reversal is likely.

- Finding Support and Resistance Levels: Support and resistance levels are price levels where buying or selling pressure is expected to be strong. Technical indicators can help traders identify these levels, which can provide potential entry and exit points.

- Confirming Trading Signals: Technical indicators can be used to confirm trading signals from other sources, such as news events or fundamental analysis.

Managing Risk with Forex Trading Applications

Forex trading, while potentially lucrative, involves inherent risk. Using the right forex trading application can significantly aid in managing this risk, allowing you to make informed decisions and protect your capital.

Importance of Stop-Loss Orders

Stop-loss orders are essential tools for managing risk in forex trading. They are automated instructions to close a trade when the price reaches a predetermined level, limiting potential losses.

- Stop-loss orders act as a safety net, preventing your losses from spiraling out of control.

- By setting a stop-loss order, you define your maximum acceptable loss for each trade.

- They can help you stay disciplined and avoid emotional trading decisions when the market moves against your position.

Position Sizing

Position sizing is a crucial aspect of risk management, determining how much capital to allocate to each trade.

- Proper position sizing ensures that individual trades do not jeopardize your overall trading account.

- A general rule of thumb is to risk no more than 1-2% of your account balance on any single trade.

- Forex trading applications often have built-in position sizing calculators to help you determine appropriate trade sizes.

Risk Management Tools

Many forex trading applications offer advanced risk management tools to help you control your exposure and minimize potential losses.

- Trailing Stop-Loss Orders: These orders automatically adjust the stop-loss level as the price moves in your favor, helping you lock in profits while minimizing potential losses.

- Risk-Reward Ratios: Some applications allow you to set risk-reward ratios, helping you identify trades with a favorable risk-reward profile.

- Margin Calls: Forex trading applications often issue margin calls when your account balance falls below a certain level, prompting you to add more funds or close positions to avoid liquidation.

Setting Up Risk Management Parameters

Different forex trading applications offer varying levels of customization for risk management settings.

- Stop-Loss Orders: Most applications allow you to set stop-loss orders at specific price levels or a percentage distance from the entry price.

- Position Sizing: You can often define the maximum percentage of your account balance you are willing to risk on a single trade.

- Trailing Stop-Loss Orders: Some applications allow you to configure trailing stop-loss orders with adjustable parameters like the trailing distance and the percentage of profit you want to lock in.

Forex Trading Application Security

In the world of forex trading, where financial transactions occur at lightning speed, ensuring the security of your trading application is paramount. Your trading application is the gateway to your funds, and a compromised application can lead to significant financial losses.

Security Measures, Application trading forex

A robust forex trading application incorporates multiple security measures to protect your account and sensitive data. These measures are essential for safeguarding your investments and maintaining trust in the platform.

- Two-factor authentication (2FA) adds an extra layer of security by requiring you to enter a unique code generated by a mobile app or email in addition to your password. This makes it significantly harder for unauthorized individuals to access your account, even if they obtain your password.

- Encryption is the process of converting data into an unreadable format, making it incomprehensible to anyone without the decryption key. Forex trading applications use encryption to protect your trading data, account information, and financial transactions while they are being transmitted over the internet. This ensures that even if someone intercepts your data, they cannot access its contents.

- Data protection encompasses various measures to safeguard your personal and financial information from unauthorized access, use, disclosure, alteration, or destruction. Forex trading applications implement data protection policies and procedures to ensure that your data is stored securely and only accessible to authorized personnel.

Security Considerations When Choosing a Forex Trading Application

When selecting a forex trading application, consider the following security aspects:

- Reputation and track record: Choose a reputable forex broker with a proven history of security and reliability. Research the broker’s security practices, certifications, and customer reviews to assess their commitment to protecting user data.

- Security features: Ensure that the application offers robust security features like two-factor authentication, encryption, and data protection measures. Look for features like secure login protocols, anti-virus protection, and regular security updates.

- Regulatory compliance: Select a broker that is regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. These regulatory bodies impose strict security standards on brokers, ensuring that they meet certain security requirements.

- Customer support: A reliable forex broker should provide responsive and helpful customer support, especially when it comes to security concerns. They should be able to answer your questions and address any security issues promptly and professionally.

The Future of Forex Trading Applications

The forex trading landscape is constantly evolving, driven by technological advancements and changing trader preferences. Forex trading applications are at the forefront of this evolution, with innovative features and functionalities emerging regularly.

Artificial Intelligence Integration

Artificial intelligence (AI) is poised to revolutionize forex trading applications. AI algorithms can analyze vast amounts of data, identify patterns, and generate trading signals with remarkable accuracy.

- AI-powered sentiment analysis tools can monitor news articles, social media posts, and other online sources to gauge market sentiment and predict price movements.

- AI-driven risk management systems can help traders optimize their risk profiles and minimize potential losses.

- AI chatbots can provide personalized trading advice and support, answering questions and offering insights based on individual trader needs.

Final Review

As the forex trading landscape continues to evolve, application trading forex will undoubtedly play an increasingly prominent role. With the integration of artificial intelligence, advanced analytics, and automated trading capabilities, these platforms are poised to redefine the future of global currency trading. Whether you are a seasoned trader or a curious newcomer, the world of forex trading applications offers a gateway to a vast and potentially lucrative market. Explore the possibilities, learn the intricacies, and embrace the exciting world of application trading forex.

FAQ Corner

What are the risks associated with forex trading applications?

Forex trading involves inherent risks, and it is crucial to understand these risks before engaging in any trading activities. These risks include market volatility, leverage, and potential losses. It is essential to conduct thorough research, manage your risk effectively, and use reputable platforms.

How do I choose the right forex trading application for me?

When selecting a forex trading application, consider factors such as platform security, user interface, customer support, compatibility with your trading strategy, and available features. Research different platforms, read reviews, and choose one that aligns with your trading goals and risk tolerance.

Is forex trading application trading legal?

Forex trading applications are legal, but it is essential to ensure that the platform you choose is regulated and licensed in your jurisdiction. Check for regulatory compliance and avoid platforms that lack transparency or legitimacy.