MT4 Forex is a powerful trading platform that has revolutionized the way forex traders operate. With its user-friendly interface, robust analytical tools, and automated trading capabilities, MT4 has become a go-to platform for both beginners and seasoned traders.

This comprehensive guide will delve into the world of MT4 Forex, exploring its features, functionalities, and best practices. From understanding the basics of order execution and technical analysis to navigating the platform’s intricate menus and utilizing automated trading strategies, we’ll equip you with the knowledge and skills to thrive in the dynamic forex market.

MT4 Interface and Navigation

The MetaTrader 4 (MT4) platform is a popular choice for forex traders due to its user-friendly interface and comprehensive features. Understanding the layout and navigation of MT4 is crucial for efficient trading.

Platform Layout

The MT4 platform is designed with a user-friendly interface that consists of several key components:

- Toolbar: The toolbar is located at the top of the platform and provides quick access to essential functions such as opening new charts, placing orders, and managing accounts.

- Navigation Panel: The navigation panel is located on the left side of the platform and displays a list of trading instruments, accounts, and other platform features.

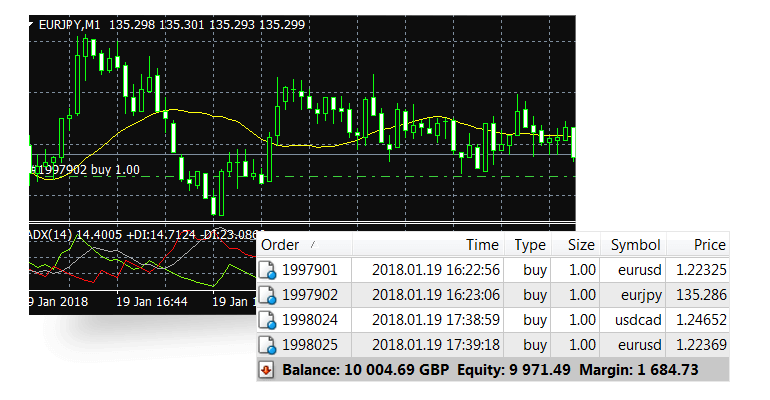

- Chart Window: The chart window occupies the central portion of the platform and displays real-time price data for the selected trading instrument.

- Terminal Window: The terminal window is located at the bottom of the platform and provides access to trade history, order management, and other essential information.

- Toolbox: The toolbox is located on the right side of the platform and contains a variety of tools for technical analysis, such as indicators and drawing tools.

Navigating Through the Platform

Navigating through the MT4 platform is straightforward. Here’s a step-by-step guide:

- Opening a New Chart: To open a new chart, click on the “New Chart” button in the toolbar or right-click on a trading instrument in the navigation panel and select “Chart Window.”

- Selecting a Trading Instrument: To select a trading instrument, click on the instrument name in the navigation panel or search for it using the search bar.

- Placing an Order: To place an order, click on the “New Order” button in the toolbar or right-click on the chart and select “New Order.”

- Managing Orders: To manage existing orders, click on the “Trade” tab in the terminal window or right-click on the order in the “Trade” tab and select “Modify Order” or “Close Order.”

- Adding Indicators: To add indicators to a chart, click on the “Insert” menu and select “Indicators” or drag and drop the desired indicator from the toolbox onto the chart.

- Using Drawing Tools: To use drawing tools, click on the “Insert” menu and select “Drawing Tools” or drag and drop the desired tool from the toolbox onto the chart.

Trading Orders and Execution

Trading orders are the heart of forex trading in MT4, allowing you to buy or sell currencies based on your market analysis. MT4 offers a variety of order types, each with its own characteristics and benefits. Understanding these order types is crucial for successful trading.

Order Types

MT4 provides a range of order types to suit different trading strategies and risk profiles. The most common order types include:

- Market Order: This is the most straightforward order type, executing at the current market price. It’s ideal for traders who want to enter a trade immediately, regardless of the price. However, it can lead to slippage, where the execution price deviates from the desired price, especially during volatile market conditions.

- Limit Order: This order type allows you to specify a maximum price for buying or a minimum price for selling. The order will only be executed if the market price reaches your desired limit. This type of order helps control your entry price and limit potential losses. However, it may not be executed if the market price doesn’t reach your limit before the order expires.

- Stop Order: A stop order is used to limit losses or lock in profits. It’s placed at a price level above the current market price for a buy order or below for a sell order. When the market price reaches your stop price, the order is automatically converted to a market order, entering the trade at the prevailing market price. This helps to mitigate risk by setting a maximum loss or profit target.

- Stop-Limit Order: This order type combines the features of a stop and a limit order. It sets both a stop price and a limit price. The order will be triggered when the market price reaches the stop price, but it will only be executed if the market price is at or better than the limit price. This helps to manage risk and control the entry price.

Order Execution Process

The order execution process in MT4 is generally seamless and efficient. When you place an order, it is sent to the broker’s trading server. The broker then attempts to execute the order at the best available price, taking into account the order type and market conditions. The order execution process is usually completed within milliseconds.

Placing and Managing Trading Orders

Placing and managing trading orders in MT4 is a straightforward process. To place an order, you can use the “New Order” window, which can be accessed from the “Trade” menu or by right-clicking on the chart. In the “New Order” window, you can select the order type, enter the desired volume, and specify the entry or stop price.

To manage existing orders, you can use the “Trade” window, which displays all your open positions and pending orders. From the “Trade” window, you can modify, close, or delete orders as needed.

Example: Placing a Stop-Limit Order

Suppose you want to buy EUR/USD at a price of 1.1000, but you want to limit your risk by setting a stop price at 1.0950 and a limit price at 1.1020.

1. Open the “New Order” window.

2. Select “Stop-Limit” as the order type.

3. Enter the desired volume.

4. Set the stop price to 1.0950.

5. Set the limit price to 1.1020.

6. Click “Place Order”.

This order will be triggered when the market price reaches 1.0950, but it will only be executed if the market price is at or better than 1.1020.

Technical Analysis Tools in MT4

Technical analysis is a method of forecasting future price movements by analyzing past price data. It is based on the idea that history repeats itself and that past price patterns can be used to predict future price movements. MT4 offers a wide range of technical analysis tools that traders can use to identify trading opportunities.

Technical Indicators

Technical indicators are mathematical calculations based on historical price data that are used to identify trading signals. They can be used to identify trends, support and resistance levels, and overbought and oversold conditions. Here are some of the most common technical indicators available in MT4:

- Moving Averages (MA): MAs are trend-following indicators that smooth out price fluctuations and help identify the direction of the trend. Common MAs include the simple moving average (SMA), the exponential moving average (EMA), and the weighted moving average (WMA).

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. Values above 70 are considered overbought, while values below 30 are considered oversold.

- Stochastic Oscillator: The stochastic oscillator is a momentum indicator that compares a closing price to a range of prices over a given period. It is used to identify overbought and oversold conditions and potential trend reversals.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. It is used to identify trend changes, potential buy and sell signals, and overbought and oversold conditions.

- Bollinger Bands: Bollinger Bands are a volatility indicator that shows the price range of an asset based on its standard deviation. They are used to identify overbought and oversold conditions, as well as potential trend reversals.

Using Technical Indicators to Identify Trading Opportunities

Technical indicators can be used to identify trading opportunities by:

- Identifying trend changes: Moving averages, MACD, and other trend-following indicators can help identify when a trend is changing direction. This can be used to enter a trade in the direction of the new trend or to exit a trade that is no longer profitable.

- Finding support and resistance levels: Support and resistance levels are price levels where the price of an asset has historically bounced off. Bollinger Bands and other volatility indicators can help identify these levels. When the price of an asset approaches a support or resistance level, it can be an opportunity to enter a trade in the direction of the bounce.

- Identifying overbought and oversold conditions: RSI, Stochastic Oscillator, and other momentum indicators can help identify when an asset is overbought or oversold. This can be used to enter a trade in the opposite direction of the current trend, or to exit a trade that is becoming too risky.

Examples of Applying Technical Analysis in MT4

- Identifying a trend change using a moving average crossover: A trader might use a 20-period moving average (MA) and a 50-period MA to identify a trend change. When the 20-period MA crosses above the 50-period MA, it is a bullish signal that suggests the price is likely to continue moving higher. Conversely, when the 20-period MA crosses below the 50-period MA, it is a bearish signal that suggests the price is likely to continue moving lower.

- Finding support and resistance levels using Bollinger Bands: A trader might use Bollinger Bands to identify support and resistance levels. When the price of an asset touches the upper Bollinger Band, it is considered overbought and likely to pull back. Conversely, when the price of an asset touches the lower Bollinger Band, it is considered oversold and likely to bounce back up.

- Identifying overbought and oversold conditions using the RSI: A trader might use the RSI to identify overbought and oversold conditions. When the RSI reaches above 70, it is considered overbought and likely to pull back. Conversely, when the RSI reaches below 30, it is considered oversold and likely to bounce back up.

Charting and Visualization: Mt4 Forex

MT4 provides a comprehensive charting system that allows traders to visualize price movements, identify patterns, and make informed trading decisions. This section explores the different chart types available in MT4, explains how to customize charts and add indicators, and provides examples of using charts for analysis and trading decisions.

Chart Types

MT4 offers a variety of chart types, each with its own strengths and weaknesses. The most common chart types include:

- Line Chart: The line chart connects closing prices of a financial instrument over a specific period, providing a simple visual representation of price trends.

- Bar Chart: The bar chart displays the open, high, low, and close (OHLC) prices of a financial instrument for each time period. The vertical bar represents the price range, while the left and right sides of the bar indicate the open and close prices, respectively.

- Candlestick Chart: The candlestick chart is a popular chart type that visually represents the OHLC prices of a financial instrument for each time period. The candlestick body indicates the price range between the open and close, while the wicks (shadows) represent the high and low prices.

Chart Customization

MT4 allows traders to customize their charts to suit their individual needs and preferences. This includes:

- Timeframe: Traders can choose the time frame for their charts, ranging from one minute to one month, allowing them to analyze price movements at different time scales.

- Color Schemes: MT4 offers a variety of color schemes for charts, allowing traders to customize the appearance of price bars, candlesticks, and other chart elements.

- Chart Styles: Traders can choose from different chart styles, including line, bar, and candlestick charts. They can also adjust the size and shape of chart elements.

Adding Indicators

Indicators are mathematical calculations that are plotted on charts to provide additional insights into price movements. MT4 offers a wide range of built-in indicators, including:

- Moving Averages: Moving averages smooth out price fluctuations, providing a trend indication. Popular moving averages include the simple moving average (SMA) and the exponential moving average (EMA).

- Oscillators: Oscillators measure the momentum of price movements, providing insights into overbought and oversold conditions. Popular oscillators include the Relative Strength Index (RSI) and the Stochastic Oscillator.

- Volume Indicators: Volume indicators measure the trading volume of a financial instrument, providing insights into the strength of price movements. Popular volume indicators include the On-Balance Volume (OBV) and the Chaikin Money Flow (CMF).

Chart Analysis and Trading Decisions

Charts can be used to identify patterns, trends, and support and resistance levels, providing valuable insights for making trading decisions.

- Trend Identification: Charts can be used to identify the overall trend of a financial instrument, whether it is bullish, bearish, or ranging.

- Pattern Recognition: Charts can be used to identify common price patterns, such as head and shoulders, double tops, and triangles. These patterns can provide insights into potential price reversals or continuations.

- Support and Resistance Levels: Charts can be used to identify support and resistance levels, which are price levels where buying or selling pressure is expected to be strong. These levels can be used to set entry and exit points for trades.

Automated Trading and Expert Advisors

Automated trading in MT4 allows you to execute trades based on predefined rules without manual intervention. This is achieved through Expert Advisors (EAs), which are programs that analyze market data and execute trades according to your trading strategy.

Creating and Using EAs, Mt4 forex

EAs can be created using the MQL4 programming language, which is specifically designed for MT4. You can either code your own EAs from scratch or use pre-built EAs available online.

- Creating an EA from scratch involves writing code that defines the trading logic, such as entry and exit points, stop-loss and take-profit levels, and risk management parameters. This requires a good understanding of MQL4 programming and forex trading strategies.

- Using pre-built EAs is a simpler option for those without programming experience. These EAs are typically developed by experienced traders or developers and can be purchased or downloaded for free. However, it’s crucial to carefully evaluate the EA’s performance and reputation before using it.

Once you have an EA, you can attach it to a chart and configure its settings. You can also set the EA to run automatically or manually activate it when desired.

Benefits of Automated Trading

Automated trading offers several benefits:

- Emotional detachment: EAs remove the emotional element from trading, preventing impulsive decisions based on fear or greed.

- Speed and efficiency: EAs can execute trades faster than humans, potentially capturing fleeting opportunities.

- Backtesting and optimization: EAs can be backtested on historical data to evaluate their performance and optimize their parameters.

- 24/7 trading: EAs can monitor the market and execute trades even when you’re not available.

Risks of Automated Trading

While automated trading offers benefits, it also carries risks:

- Over-optimization: EAs optimized on historical data may not perform as well in real-time due to market changes.

- Unexpected market events: EAs may not be able to handle unexpected market events, such as flash crashes or news releases.

- Security risks: Malicious EAs can compromise your trading account.

- Loss of control: Relying solely on an EA can lead to a loss of control over your trading decisions.

Managing Risk and Money Management

Risk management is crucial in forex trading, as it helps you protect your capital and prevent significant losses. It involves strategies to minimize potential losses while maximizing profits. This section explores common risk management techniques used in MT4, including setting stop-loss orders and position sizing.

Stop-Loss Orders

Stop-loss orders are essential for managing risk in forex trading. They automatically close a trade when the price reaches a predetermined level, limiting potential losses. These orders are crucial because they help traders to:

* Limit Potential Losses: They automatically exit a trade when the price moves against the trader’s position, preventing further losses.

* Protect Profits: Stop-loss orders can also be used to lock in profits by setting them above the entry price.

* Reduce Emotional Trading: By setting stop-loss orders, traders can remove emotions from trading decisions, as the trade will be automatically closed when the predetermined level is reached.

Setting Stop-Loss Orders in MT4

To set a stop-loss order in MT4, you need to:

1. Open a trade: Once you’ve opened a trade, right-click on the trade in the “Trade” window.

2. Select “Modify or Delete Order”: This will open a new window where you can adjust the order’s parameters.

3. Set the Stop Loss Level: Enter the desired stop-loss level in the “Stop Loss” field. This level should be set at a price point that is acceptable to you, considering your risk tolerance.

4. Confirm the Order: Click “OK” to confirm the stop-loss order.

Example of Setting a Stop-Loss Order

Let’s say you buy 1 lot of EUR/USD at 1.1000. You decide to set a stop-loss order at 1.0950. This means that if the price of EUR/USD drops to 1.0950, your trade will be automatically closed, limiting your potential loss to 50 pips (1.1000 – 1.0950 = 0.0050).

Position Sizing

Position sizing is another crucial aspect of risk management in forex trading. It involves determining the appropriate amount of capital to allocate to each trade based on your risk tolerance and account balance. The primary goal of position sizing is to:

* Manage Risk Per Trade: It helps you control the amount of capital at risk in each trade, preventing significant losses.

* Maintain a Sustainable Trading Strategy: By appropriately sizing your positions, you can avoid over-leveraging your account, ensuring a sustainable trading approach.

* Optimize Profit Potential: While minimizing risk, position sizing also helps you optimize profit potential by allowing you to capitalize on favorable market conditions.

Calculating Position Size in MT4

There are several methods for calculating position size, but one common approach is the “risk per trade” method. This method involves determining the maximum amount of money you are willing to risk on a single trade.

Risk per Trade = Account Balance x Risk Percentage

For example, if your account balance is $10,000 and you’re willing to risk 1% per trade, your risk per trade would be $100 (10,000 x 0.01 = 100).

Example of Position Sizing

Let’s say you’re trading EUR/USD with a risk per trade of $100. You decide to set a stop-loss order at 1.0950, and the current price is 1.1000. This means that your potential loss per pip is $10 (100 / (1.1000 – 1.0950) = 10).

To calculate the maximum lot size you can trade without exceeding your risk per trade, you can use the following formula:

Maximum Lot Size = Risk per Trade / Potential Loss per Pip

In this example, the maximum lot size would be 0.1 lots (100 / 10 = 0.1).

MT4 Resources and Support

Navigating the world of MT4 can sometimes feel overwhelming, especially for beginners. But fear not! There are numerous resources and support options available to help you master this powerful trading platform. Whether you’re a seasoned trader or just starting, these resources can enhance your understanding and guide you through the intricacies of MT4.

Learning Resources

Learning resources provide valuable insights into MT4’s features and functionalities. They cater to different learning styles and experience levels, offering a comprehensive understanding of the platform.

- Official MT4 Documentation: This is the ultimate source for understanding MT4’s features, functions, and technical details. The documentation is well-structured, comprehensive, and updated regularly. You can find detailed information on everything from setting up your trading account to using advanced trading tools.

- Online Tutorials and Courses: Numerous websites and online platforms offer free and paid tutorials and courses on MT4. These resources cover various aspects of the platform, from basic navigation to advanced strategies and expert advisor development. Look for reputable sources with experienced instructors and clear explanations.

- MT4 Books and eBooks: Many books and eBooks are dedicated to teaching MT4, covering topics like trading strategies, technical analysis, and automated trading. These resources provide in-depth knowledge and practical examples to enhance your understanding of the platform.

- Trading Communities and Forums: Engaging with the MT4 community can be a valuable learning experience. Online forums and trading communities offer a platform to ask questions, share experiences, and learn from other traders. You can find discussions on various topics, including trading strategies, technical indicators, and platform customization.

Support Options

When you encounter challenges or have questions about MT4, several support options are available to assist you. These options ensure that you receive timely and effective assistance, enabling you to resolve issues and continue your trading journey.

- Broker Support: Your forex broker usually provides support for MT4. They offer assistance with account setup, platform installation, and troubleshooting. Contact their customer support team through phone, email, or live chat for prompt resolution of any issues.

- MT4 Developer Support: If you encounter technical issues related to MT4’s core functionalities, you can contact the MT4 developers for support. They provide assistance with platform updates, bug fixes, and technical inquiries. You can find their contact information on the official MT4 website.

- Online Forums and Communities: As mentioned earlier, online forums and trading communities are excellent resources for seeking help from fellow traders. You can post your questions or concerns and receive advice and support from experienced users.

Outcome Summary

Mastering MT4 Forex unlocks a world of opportunities for traders of all levels. By understanding the platform’s capabilities, leveraging its analytical tools, and implementing sound risk management strategies, you can confidently navigate the forex market and achieve your trading goals.

FAQ Compilation

Is MT4 Forex free to use?

While the MT4 platform itself is often free to download and use, brokers may charge fees for certain features or services. It’s important to check with your broker for specific pricing details.

What are the minimum requirements to use MT4 Forex?

MT4 Forex has minimal system requirements. You’ll need a computer with a decent internet connection and a compatible operating system (Windows, macOS, or Android).

Is MT4 Forex suitable for beginners?

Yes, MT4 Forex is a beginner-friendly platform with a user-friendly interface and a wealth of resources available to help you learn. However, it’s always advisable to start with a demo account to practice and gain experience before trading with real money.