TD Ameritrade Forex offers a robust platform for traders of all experience levels. The platform boasts a wide range of currency pairs, advanced trading tools, and educational resources to help you navigate the exciting world of forex trading. Whether you’re a seasoned professional or just starting out, TD Ameritrade provides the tools and support you need to succeed.

From its history and evolution to the intricacies of its trading features, this guide explores the key aspects of TD Ameritrade Forex, covering everything from account types and fees to security measures and customer support. We’ll also delve into the advantages and disadvantages of using TD Ameritrade for your forex trading endeavors, helping you make an informed decision.

Trading Instruments and Markets

TD Ameritrade provides access to a wide range of forex currency pairs, allowing traders to capitalize on fluctuations in exchange rates. The platform offers various order types, empowering traders to execute trades based on their specific trading strategies.

Currency Pairs

TD Ameritrade offers a comprehensive selection of currency pairs, including major, minor, and exotic pairs.

- Major Pairs: These pairs are the most actively traded and involve the US dollar (USD) against other major currencies, such as the euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss franc (CHF), Canadian dollar (CAD), and Australian dollar (AUD).

- Minor Pairs: These pairs involve two currencies that are not the US dollar. Examples include EUR/GBP, GBP/JPY, and AUD/CAD.

- Exotic Pairs: These pairs involve a major currency against a currency from a developing or emerging market. Examples include USD/TRY (Turkish lira), USD/ZAR (South African rand), and USD/RUB (Russian ruble).

Order Types

TD Ameritrade offers various order types, enabling traders to manage risk and execute trades based on their preferred strategies.

- Market Orders: These orders are executed immediately at the best available price in the market.

- Limit Orders: These orders are executed only when the market price reaches a specific price level set by the trader.

- Stop Orders: These orders are triggered when the market price reaches a specific price level set by the trader. They can be used to limit losses or lock in profits.

- Stop-Limit Orders: These orders combine the features of stop and limit orders. They are triggered when the market price reaches a specific price level (stop price), but they will only be executed at a specific price level (limit price) or better.

Trading Hours

The trading hours for forex currency pairs on TD Ameritrade are generally from Sunday evening to Friday evening, based on the time zone of the primary currency in the pair.

| Currency Pair | Trading Hours (GMT) |

|---|---|

| EUR/USD | Sunday 22:00 – Friday 22:00 |

| GBP/USD | Sunday 22:00 – Friday 22:00 |

| USD/JPY | Sunday 23:00 – Friday 23:00 |

| USD/CHF | Sunday 22:00 – Friday 22:00 |

| AUD/USD | Sunday 22:00 – Friday 22:00 |

| NZD/USD | Sunday 22:00 – Friday 22:00 |

| USD/CAD | Sunday 22:00 – Friday 22:00 |

Trading Tools and Resources

TD Ameritrade provides a robust suite of trading tools and resources designed to empower forex traders of all levels. These tools are crucial for conducting technical analysis, understanding market dynamics, and ultimately making informed trading decisions.

Technical Analysis Tools and Indicators

Technical analysis plays a pivotal role in forex trading, helping traders identify trends, predict price movements, and determine optimal entry and exit points. TD Ameritrade offers a wide range of technical analysis tools and indicators, enabling traders to conduct in-depth market analysis.

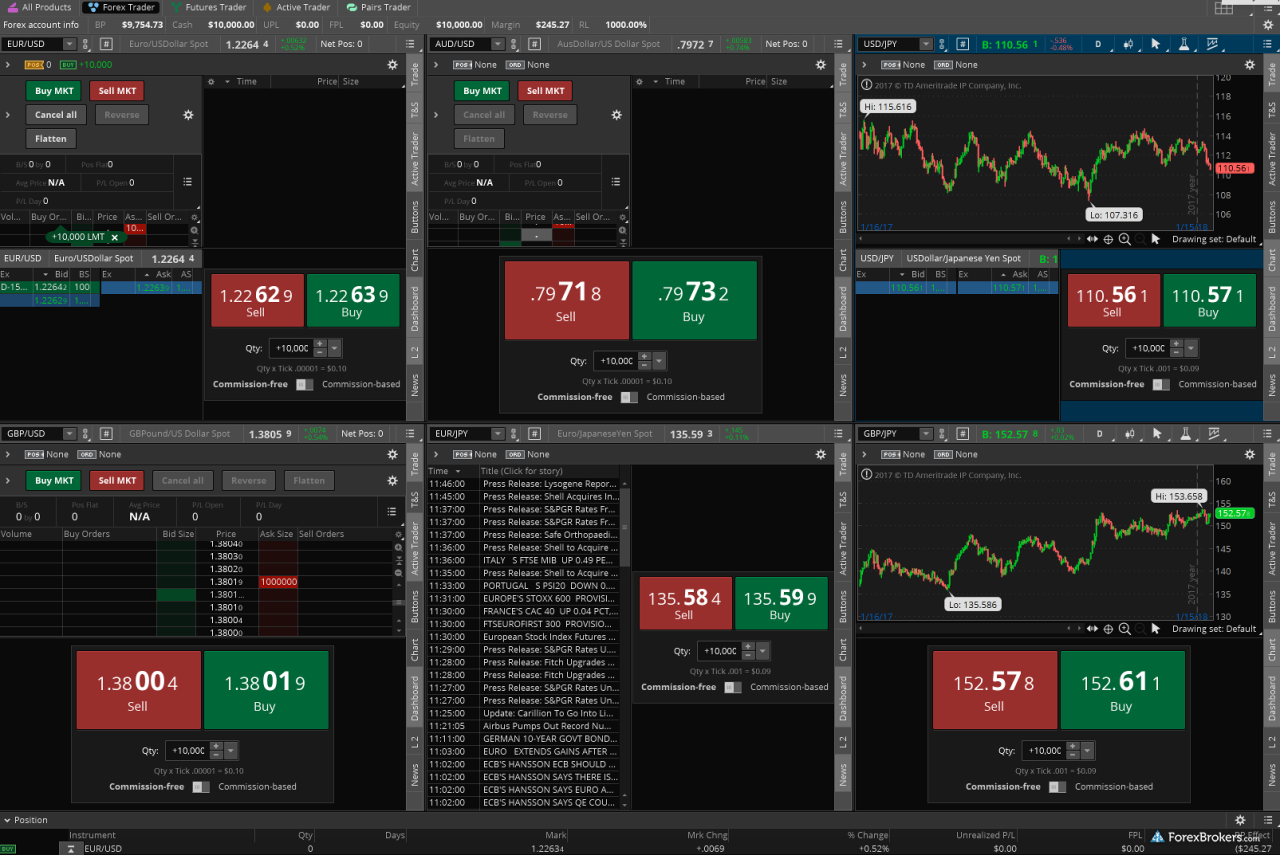

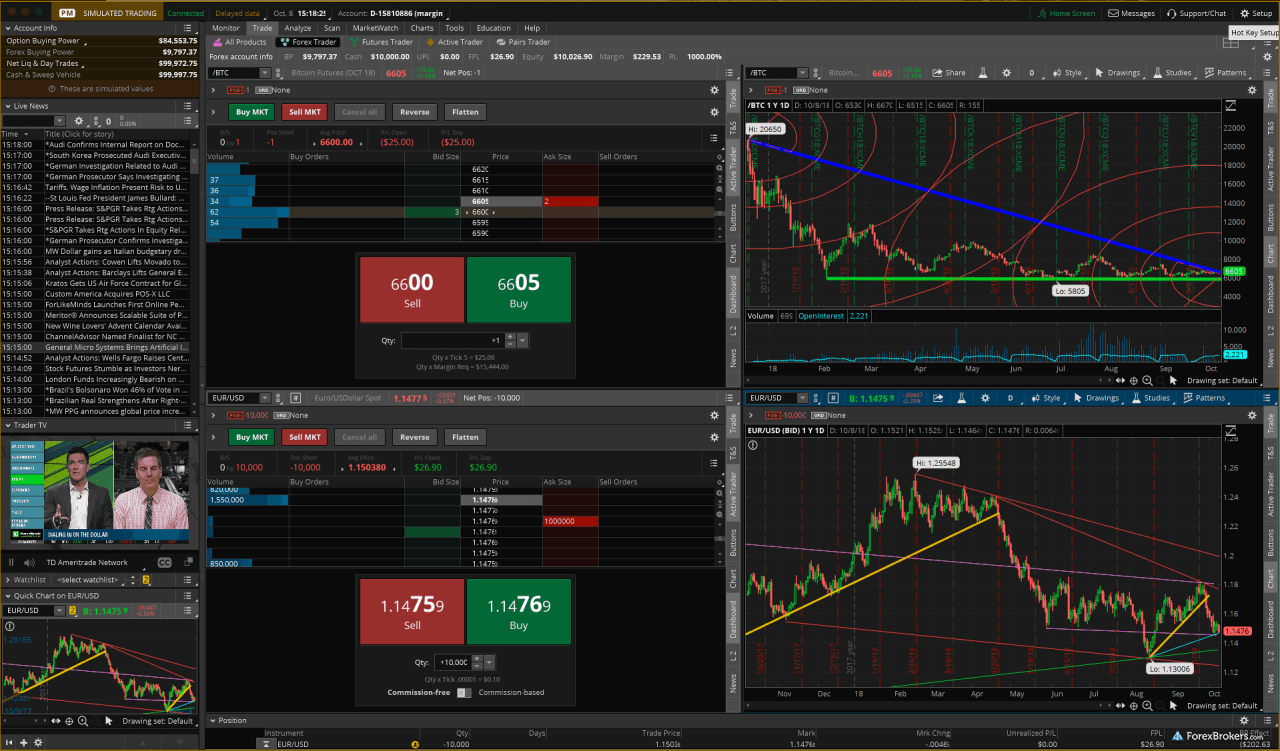

- Charting Tools: TD Ameritrade’s platform provides advanced charting capabilities, allowing traders to visualize price movements and identify patterns using various chart types, including line charts, bar charts, candlestick charts, and point and figure charts. These charts can be customized with different timeframes, indicators, and drawing tools to suit individual trading styles.

- Technical Indicators: The platform offers a comprehensive library of technical indicators, categorized into trend indicators, momentum indicators, volatility indicators, and volume indicators. Popular indicators include Moving Averages (MA), Relative Strength Index (RSI), Bollinger Bands, MACD, and Stochastic Oscillator. These indicators provide insights into market sentiment, momentum, and volatility, helping traders identify potential trading opportunities.

- Drawing Tools: TD Ameritrade provides a range of drawing tools, such as trend lines, support and resistance levels, Fibonacci retracements, and channels. These tools help traders identify key price levels, potential turning points, and support and resistance areas, providing valuable information for decision-making.

Educational Resources and Learning Materials

TD Ameritrade recognizes the importance of continuous learning for forex traders. The platform offers a wealth of educational resources and learning materials to help traders enhance their knowledge and skills.

- Trading Education Center: TD Ameritrade’s Trading Education Center provides a comprehensive library of articles, videos, and webinars covering various aspects of forex trading, including fundamental analysis, technical analysis, risk management, and trading psychology. This resource is valuable for traders of all experience levels, offering insights and guidance on different trading strategies and concepts.

- Interactive Learning Tools: The platform offers interactive learning tools, such as quizzes, simulations, and trading games, to reinforce key concepts and provide hands-on experience. These tools help traders apply their knowledge in a simulated trading environment, fostering confidence and improving decision-making skills.

- Expert Insights and Market Analysis: TD Ameritrade provides access to expert insights and market analysis from experienced traders and analysts. This information can help traders stay informed about market trends, economic events, and geopolitical developments that may impact forex prices. Access to these resources can enhance trading strategies and improve decision-making.

Account Types and Fees: Td Ameritrade Forex

TD Ameritrade offers two main account types for forex trading: a standard account and a premium account. Each account type comes with different features, fees, and minimum deposit requirements.

Account Types

TD Ameritrade offers two main account types for forex trading:

- Standard Account: The standard account is a good option for beginner forex traders. It offers access to a wide range of currency pairs and trading tools, but it has a higher commission structure than the premium account.

- Premium Account: The premium account is designed for experienced forex traders who want access to advanced trading tools and lower commissions. It offers a wider range of trading instruments, including exotic currency pairs, and access to advanced charting and analysis tools.

Fees

TD Ameritrade charges a variety of fees for forex trading, including:

- Commissions: The commission structure for forex trading on TD Ameritrade depends on the account type. Standard accounts have a higher commission structure than premium accounts.

- Spreads: Spreads are the difference between the bid and ask price of a currency pair. TD Ameritrade’s spreads are competitive, but they can vary depending on market conditions.

- Inactivity Charges: TD Ameritrade charges an inactivity fee if your account is inactive for a certain period.

Minimum Deposit Requirements

The minimum deposit requirements for TD Ameritrade forex accounts vary depending on the account type.

| Account Type | Minimum Deposit |

|---|---|

| Standard Account | $2,000 |

| Premium Account | $10,000 |

Security and Regulation

TD Ameritrade’s forex operations are subject to a robust regulatory framework that prioritizes the safety and security of customer funds and data. The platform’s commitment to transparency and compliance ensures a secure and reliable trading environment.

Regulatory Oversight

TD Ameritrade’s forex operations are overseen by several regulatory bodies, including the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). These organizations ensure that TD Ameritrade adheres to strict standards for financial reporting, customer protection, and trading practices.

Security Measures, Td ameritrade forex

TD Ameritrade employs a multi-layered security approach to protect customer funds and data from unauthorized access. These measures include:

- Advanced Encryption: All customer data, including financial information and trading activity, is encrypted using industry-standard protocols to prevent unauthorized access.

- Two-Factor Authentication: TD Ameritrade requires two-factor authentication for account access, adding an extra layer of security by requiring users to provide both a password and a unique code generated by a mobile device or email.

- Firewall Protection: TD Ameritrade’s trading platform is protected by advanced firewalls that block unauthorized access and malicious attacks.

- Regular Security Audits: TD Ameritrade conducts regular security audits to identify and address potential vulnerabilities in its systems and infrastructure.

Customer Support

TD Ameritrade offers a comprehensive range of customer support options for forex traders, including:

- 24/5 Phone Support: Customers can reach a dedicated customer support team via phone for assistance with account-related inquiries, trading issues, or any other concerns.

- Live Chat: TD Ameritrade provides real-time chat support for quick and convenient assistance with basic questions and account management.

- Email Support: Customers can submit inquiries via email for more detailed or complex issues that require further investigation.

- Comprehensive Help Center: TD Ameritrade offers an extensive online help center with articles, FAQs, and tutorials covering various aspects of forex trading, account management, and platform features.

Advantages and Disadvantages

TD Ameritrade offers a range of features and tools for forex traders, but it’s essential to consider both the advantages and potential drawbacks before making a decision. This section will explore the benefits and limitations of using TD Ameritrade for forex trading, providing you with a comprehensive understanding of its strengths and weaknesses.

Advantages of TD Ameritrade for Forex Trading

TD Ameritrade offers several advantages for forex traders, including:

- User-friendly platform: TD Ameritrade’s Thinkorswim platform is known for its intuitive interface and comprehensive features, making it easy for both novice and experienced traders to navigate.

- Wide range of trading tools: The platform offers a variety of technical analysis tools, charting capabilities, and real-time market data, allowing traders to make informed decisions.

- Competitive pricing: TD Ameritrade offers competitive spreads and commissions, making it a cost-effective option for forex trading.

- Strong customer support: TD Ameritrade provides excellent customer support through phone, email, and live chat, ensuring traders have access to assistance when needed.

- Educational resources: The platform offers a wealth of educational resources, including articles, videos, and webinars, helping traders enhance their knowledge and skills.

Disadvantages of TD Ameritrade for Forex Trading

While TD Ameritrade offers numerous advantages, it’s essential to acknowledge potential drawbacks:

- Limited forex instruments: Compared to some other forex brokers, TD Ameritrade offers a more limited selection of currency pairs, which might not meet the needs of all traders.

- Higher minimum deposit requirements: TD Ameritrade has a higher minimum deposit requirement for forex trading compared to some other brokers, which may deter some traders.

- No dedicated forex trading platform: While Thinkorswim is a robust platform, it’s not specifically designed for forex trading, which may not be ideal for traders seeking specialized features.

- Limited research and analysis: While TD Ameritrade offers some research tools, it might not be as comprehensive as other platforms dedicated to forex trading.

Comparison with Other Forex Platforms

TD Ameritrade’s forex offering compares favorably to other popular platforms, but it’s crucial to consider individual needs and preferences.

- FXCM: FXCM is known for its advanced forex trading platform, offering a wider range of currency pairs and advanced features. However, it may have higher fees than TD Ameritrade.

- Oanda: Oanda is another popular platform with a user-friendly interface and competitive pricing. It offers a broader selection of forex instruments and tools but may not have the same level of educational resources as TD Ameritrade.

- Interactive Brokers: Interactive Brokers is a comprehensive platform offering access to various markets, including forex. However, it might be more complex for beginners and may have higher minimum deposit requirements.

Closure

Ultimately, choosing the right forex broker is a personal decision. TD Ameritrade offers a compelling combination of features, tools, and resources that cater to a wide range of traders. By understanding the nuances of its platform and weighing the advantages and disadvantages, you can determine if TD Ameritrade is the right fit for your forex trading journey.

Essential FAQs

What are the minimum deposit requirements for a TD Ameritrade forex account?

There is no minimum deposit requirement for opening a TD Ameritrade forex account. However, you’ll need to have sufficient funds to cover your trades and margin requirements.

Does TD Ameritrade offer any educational resources for forex trading?

Yes, TD Ameritrade provides a wealth of educational resources, including articles, videos, webinars, and a dedicated forex learning center. These resources cover various aspects of forex trading, from fundamental analysis to technical indicators.

Is TD Ameritrade regulated?

Yes, TD Ameritrade is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). This ensures that your funds are protected and the platform operates within a robust regulatory framework.