Aboki Forex Today sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The term “Aboki Forex” refers to the informal currency exchange market in Nigeria, a system that operates outside the traditional banking channels. This intricate network of individuals and businesses plays a crucial role in facilitating foreign exchange transactions, particularly for those seeking alternative options to formal banking services.

In Nigeria, where the demand for foreign currency often outpaces supply, Aboki Forex has emerged as a significant player, catering to a diverse range of individuals and businesses. From everyday citizens seeking to send money to family abroad to importers needing to settle international payments, the informal market offers a convenient and accessible solution. The origins of Aboki Forex can be traced back to the early days of Nigeria’s economic development, where informal networks facilitated currency exchange as a means of circumventing bureaucratic hurdles and accessing foreign currency more readily. Over time, the market has evolved, incorporating technology and adapting to the changing dynamics of the Nigerian economy.

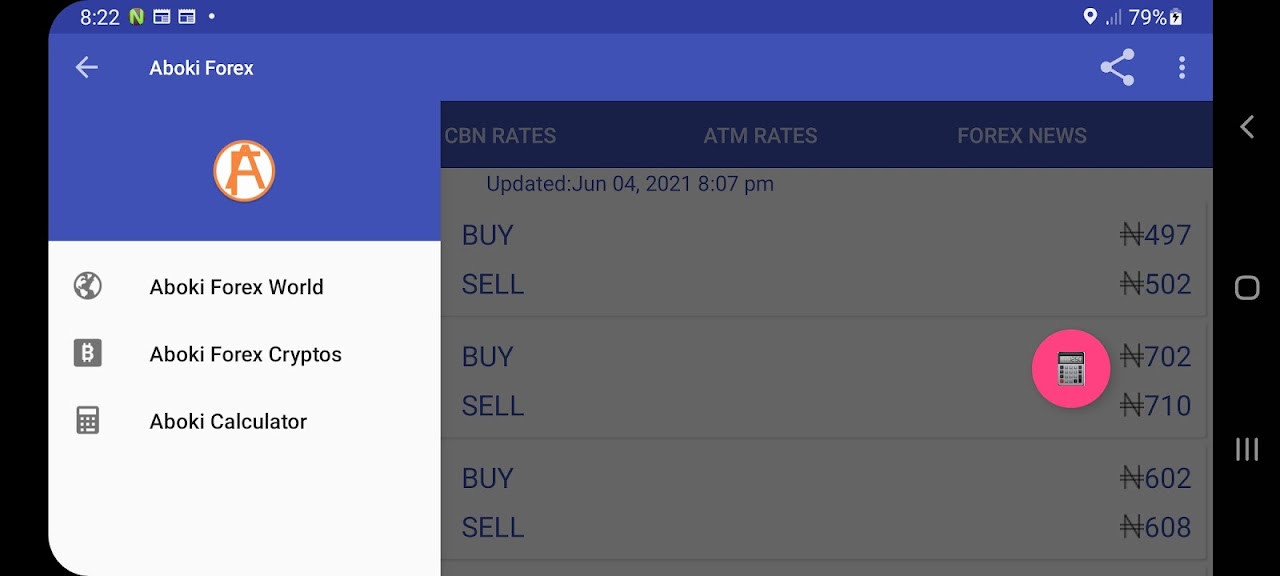

Aboki Forex

Aboki Forex is an informal, decentralized system of foreign exchange trading prevalent in Nigeria. It operates outside the regulated financial system, relying on word-of-mouth and personal connections to facilitate currency exchange transactions. This system has gained significant traction, particularly among individuals and small businesses seeking alternative avenues for foreign currency transactions, especially when official channels are perceived as cumbersome or expensive.

History and Evolution of Aboki Forex

The origins of Aboki Forex can be traced back to the early days of Nigeria’s economic development. The informal sector has always played a crucial role in the country’s economy, and currency exchange was no exception. The term “Aboki” is a Hausa word that generally refers to a friend or acquaintance, highlighting the informal nature of these transactions. Over time, the system has evolved, becoming more sophisticated and widespread.

Target Audience and Motivations

Aboki Forex caters to a diverse range of individuals and businesses, each with their own motivations for utilizing this informal system. The primary target audience includes:

- Individuals with remittances from abroad: Many Nigerians receive remittances from family members or friends living overseas. Aboki Forex offers a convenient and potentially more cost-effective alternative to traditional bank transfers.

- Small businesses engaged in international trade: Small businesses often find it difficult to navigate the complexities and costs associated with formal banking channels for international transactions. Aboki Forex provides a simpler and faster way to exchange currencies for their business needs.

- Individuals seeking to avoid official channels: Some individuals may choose Aboki Forex due to concerns about documentation, fees, or potential scrutiny from financial institutions.

How Aboki Forex Works

Aboki Forex is an informal system of currency exchange that operates outside the traditional banking sector. It is commonly found in many African countries, particularly in Nigeria, where it serves as an alternative for individuals who need to exchange currencies quickly and conveniently.

Exchange Rates

Aboki Forex operators typically offer exchange rates that are different from the official rates offered by banks. They often use a “spread” – the difference between the buying and selling rates – to generate profit.

The spread is often higher than what banks offer, making the exchange rate less favorable for customers.

However, Aboki Forex can be beneficial for people who need to exchange currencies urgently, as they often have more flexible operating hours and are accessible in various locations.

Methods of Transaction

There are several methods used for transacting with Aboki Forex operators. These methods include:

- Cash Transactions: This is the most common method. Customers can exchange currencies in person by handing over cash to the operator and receiving the equivalent amount in another currency.

- Online Platforms: Some Aboki Forex operators have transitioned to online platforms, allowing customers to exchange currencies remotely. This is often done through mobile applications or websites.

Benefits and Drawbacks of Aboki Forex: Aboki Forex Today

Aboki Forex, an informal system of currency exchange prevalent in many African countries, offers a convenient alternative to traditional banking services. However, it also comes with its own set of advantages and disadvantages. Understanding these aspects is crucial for anyone considering using Aboki Forex.

Convenience and Accessibility

Aboki Forex provides a convenient and accessible way to exchange currencies, particularly in regions with limited access to formal banking services. The informal nature of the system allows individuals to exchange currencies quickly and easily, often without the need for extensive documentation or procedures.

- Wide Availability: Aboki Forex operators, commonly known as “Aboki,” are widely available in local markets, streets, and even public transportation hubs, making it easy to find someone to exchange currencies. This accessibility is particularly beneficial in areas with limited banking infrastructure.

- Simplified Process: The exchange process is generally straightforward, involving minimal paperwork and quick transactions. This is a significant advantage for individuals seeking a hassle-free currency exchange experience.

- Flexibility: Aboki Forex operators often offer flexible exchange rates and are willing to accommodate smaller transactions, which can be advantageous for individuals with limited amounts of money to exchange.

Risks Associated with Unofficial Exchange Rates

One of the primary drawbacks of Aboki Forex is the risk associated with unofficial exchange rates. Unlike official exchange rates set by banks or financial institutions, Aboki Forex rates are determined by market forces and can fluctuate significantly, potentially leading to losses for individuals.

- Fluctuating Rates: Aboki Forex rates can change rapidly based on supply and demand, market sentiment, and other factors. This volatility can result in unfavorable exchange rates for individuals, particularly during periods of economic instability or currency fluctuations.

- Lack of Transparency: The absence of a regulated framework means that Aboki Forex rates are often opaque, making it difficult for individuals to compare rates and ensure they are getting a fair deal.

- Potential for Manipulation: The informal nature of Aboki Forex creates opportunities for manipulation and price gouging. Individuals may be subjected to inflated rates, particularly during periods of high demand or currency scarcity.

Security Concerns

Another major concern with Aboki Forex is the potential for security risks. Transactions are typically conducted in cash, making it vulnerable to theft, loss, or fraud.

- Cash Transactions: Aboki Forex transactions primarily involve cash, which can increase the risk of theft or loss. Individuals need to be vigilant when carrying large sums of cash, especially in crowded or unsafe environments.

- Counterfeit Currency: The informal nature of the system increases the risk of encountering counterfeit currency. Individuals should be cautious when receiving large denominations or unfamiliar banknotes and consider using a currency detector to verify authenticity.

- Lack of Regulatory Oversight: The absence of regulatory oversight in the Aboki Forex market can lead to scams and fraudulent activities. Individuals should be wary of suspicious offers or operators and exercise caution when exchanging large amounts of money.

Comparison with Traditional Banking Services

Traditional banking services offer a more regulated and secure environment for currency exchange, but they often come with higher fees and less flexibility.

- Security and Regulation: Banks and financial institutions are subject to strict regulations and oversight, providing a more secure environment for currency exchange. Transactions are typically conducted through electronic systems, reducing the risk of theft or loss.

- Transparency and Fairness: Official exchange rates are transparent and regulated, ensuring fair and competitive rates for individuals. Banks typically offer competitive rates based on market conditions and provide clear information on fees and charges.

- Convenience and Accessibility: While traditional banking services may offer less flexibility and accessibility compared to Aboki Forex, they provide a wider range of services, including online banking, mobile banking, and international money transfers.

Regulation and Legality of Aboki Forex

The informal nature of Aboki Forex makes it operate outside the regulatory framework of the Central Bank of Nigeria (CBN) and other relevant financial institutions. This lack of regulation raises concerns about the legitimacy and safety of transactions conducted through this channel.

Legal Status of Aboki Forex

The legal status of Aboki Forex in Nigeria is uncertain. While it is not explicitly prohibited, the CBN has issued guidelines for foreign exchange transactions, which Aboki Forex does not adhere to. The CBN’s regulations aim to ensure the stability of the Naira and prevent money laundering and other illicit financial activities.

Potential Risks and Challenges of Unregulated Forex Trading, Aboki forex today

The lack of regulation in Aboki Forex poses several risks and challenges for participants:

* Volatility and Fluctuations: Aboki Forex rates are determined by market forces and individual operators, leading to unpredictable fluctuations that can negatively impact the value of transactions.

* Counterparty Risk: There is no guarantee of the reliability and solvency of individuals or businesses operating within the Aboki Forex system, increasing the risk of financial loss.

* Lack of Consumer Protection: Without a regulatory framework, consumers have limited recourse in case of disputes or fraudulent activities.

* Money Laundering and Terrorism Financing: The informal nature of Aboki Forex makes it susceptible to money laundering and terrorism financing, as transactions are not subject to scrutiny or reporting requirements.

* Tax Evasion: Individuals and businesses may engage in tax evasion by conducting foreign exchange transactions through Aboki Forex, which is not subject to tax regulations.

The Impact of Aboki Forex on the Nigerian Economy

The rise of Aboki Forex, a parallel foreign exchange market operating outside official channels, has had a significant impact on the Nigerian economy, affecting the flow of foreign currency, the value of the Naira, and the overall financial landscape. This section delves into the economic implications of Aboki Forex, exploring its impact on foreign exchange markets, its potential role in promoting financial inclusion, and its potential contribution to or hindrance of economic growth.

Impact on Foreign Exchange Markets

Aboki Forex’s existence has introduced complexities to the Nigerian foreign exchange market, influencing the exchange rate dynamics and potentially contributing to market volatility. The market’s operations, driven by supply and demand factors, often fluctuate independently of the official rates set by the Central Bank of Nigeria (CBN). This can create discrepancies between the official and parallel market rates, impacting the value of the Naira and influencing businesses’ decisions regarding foreign currency transactions.

Potential Role in Financial Inclusion

Aboki Forex has been credited with playing a role in promoting financial inclusion by providing access to foreign exchange for individuals and businesses who may not have access to formal banking channels. This accessibility, particularly in rural areas where formal banking services are limited, can facilitate cross-border remittances and international trade, potentially empowering individuals and fostering economic activity.

Impact on Economic Growth

The impact of Aboki Forex on economic growth is a complex issue, with potential benefits and drawbacks. While it can facilitate trade and financial inclusion, its informal nature poses challenges to regulation and transparency. The lack of oversight can lead to market manipulation, illicit activities, and potential money laundering, hindering efforts to foster a stable and predictable economic environment. Additionally, the arbitrage opportunities between official and parallel market rates can divert foreign currency away from the formal banking system, impacting the availability of funds for investment and development.

Conclusion

The future of Aboki Forex remains uncertain, as it faces both opportunities and challenges. The rapid adoption of technology, particularly mobile payments and online platforms, has the potential to transform the market, making it more accessible and efficient. However, the lack of official regulation presents significant risks, including potential for fraud and volatility in exchange rates. The Nigerian government is faced with the challenge of balancing the need to regulate the informal market while also recognizing its importance in promoting financial inclusion. The future of Aboki Forex will likely be shaped by a combination of technological advancements, regulatory changes, and the evolving needs of the Nigerian economy.

Helpful Answers

What are the typical exchange rates offered by Aboki Forex operators?

Exchange rates offered by Aboki Forex operators can vary significantly, often deviating from official bank rates. They are influenced by factors such as supply and demand, market sentiment, and the operator’s profit margins. It’s important to compare rates from multiple operators to find the best deal.

Are there any security risks associated with using Aboki Forex?

As with any informal market, there are inherent security risks associated with using Aboki Forex. The lack of official regulation and oversight can make it difficult to ensure the authenticity of transactions and the trustworthiness of operators. It’s crucial to exercise caution and deal with reputable operators.

How does Aboki Forex compare to traditional banking services for currency exchange?

Aboki Forex offers greater convenience and accessibility, especially for those who lack access to formal banking services. However, it comes with the risks of unofficial exchange rates and security concerns. Traditional banking services provide greater security and transparency but may be less convenient or accessible for some.