A demo forex account is your key to unlocking the world of forex trading without risking your hard-earned money. It’s a virtual trading environment that replicates real market conditions, allowing you to practice strategies, test different trading platforms, and gain valuable experience before committing real capital.

Think of it as a virtual playground where you can hone your skills, experiment with various trading techniques, and learn the intricacies of the forex market without the pressure of potential losses. Whether you’re a complete beginner or a seasoned trader looking to explore new strategies, a demo account offers a safe and educational space to refine your trading approach.

What is a Demo Forex Account?

A demo forex account is a risk-free environment that simulates real forex trading. It allows traders to practice their trading strategies and get familiar with the forex market without risking any real money.

Purpose of a Demo Forex Account

Demo accounts serve as a valuable tool for both beginners and experienced traders. They provide a safe space to learn the fundamentals of forex trading, test different trading strategies, and develop their trading skills. This risk-free environment allows traders to experiment with various trading approaches, understand market dynamics, and refine their decision-making processes without incurring any financial losses.

Features and Benefits of a Demo Forex Account

- Risk-free trading: The primary benefit of a demo account is that it allows traders to practice without risking their own capital. This eliminates the financial pressure associated with real trading and allows traders to focus on developing their skills.

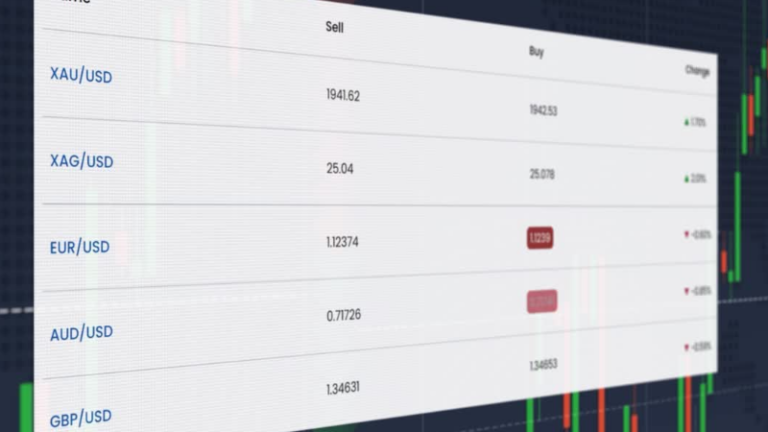

- Access to real-time market data: Demo accounts provide access to real-time market data, including price quotes, charts, and news feeds. This allows traders to analyze market trends, identify trading opportunities, and test their strategies in a realistic environment.

- Variety of trading tools and features: Demo accounts often come equipped with a wide range of trading tools and features, such as charting platforms, technical indicators, and order execution capabilities. This allows traders to explore different trading methods and find the tools that best suit their needs.

- Flexibility and convenience: Demo accounts are typically accessible 24/5, allowing traders to practice at their own pace and convenience. They can be accessed from any device with an internet connection, making them a highly flexible and convenient learning tool.

- Learn from mistakes: Demo accounts allow traders to make mistakes without facing any financial consequences. This is a valuable learning experience, as it allows traders to identify their weaknesses and improve their trading decisions.

Opening a Demo Forex Account

- Choose a reputable forex broker: Select a broker with a good reputation, a user-friendly platform, and a wide range of trading instruments. Consider factors such as regulatory compliance, trading fees, and customer support.

- Visit the broker’s website: Navigate to the broker’s website and locate the demo account section. This is usually found in the “Trading” or “Account” menu.

- Register for a demo account: Click on the “Open Demo Account” button and fill out the registration form. This typically involves providing your email address, name, and password.

- Verify your email address: The broker will send a verification email to your registered email address. Click on the verification link to activate your demo account.

- Log in to your demo account: Once your account is verified, you can log in using your credentials and start practicing trading.

Using a Demo Account for Forex Trading Education

A demo forex account is an invaluable tool for forex traders of all levels, especially beginners. It allows you to practice trading in a risk-free environment, without risking real money. This is crucial for learning the intricacies of forex trading and developing your trading skills.

Understanding Forex Trading Concepts

A demo account provides a safe space to experiment with different forex trading concepts without the pressure of financial consequences. You can explore fundamental analysis, which involves studying economic indicators and news events that can influence currency prices. For instance, you can observe how a positive economic report might impact a currency’s value or how political instability might affect a country’s currency.

You can also practice technical analysis, which focuses on chart patterns and indicators to predict future price movements. A demo account lets you test different technical indicators like moving averages, MACD, and RSI to see how they perform in different market conditions.

Practicing Trading Strategies

A demo account is a perfect platform to practice various trading strategies. You can try out different entry and exit points, stop-loss and take-profit levels, and different timeframes. For example, you can test a scalping strategy that aims to profit from small price fluctuations, or a trend-following strategy that capitalizes on long-term price movements.

Managing Risk Effectively

Risk management is crucial in forex trading, and a demo account offers a risk-free environment to practice and refine your risk management skills. You can experiment with different position sizes, leverage levels, and stop-loss orders to find the best risk management approach for your trading style.

Tips for Maximizing Educational Value

Here are some tips to make the most of your demo account:

- Set clear goals: Define what you want to learn and achieve with your demo account. This could be mastering a specific trading strategy, understanding a particular indicator, or improving your risk management skills.

- Simulate real-world trading: Treat your demo account as if it were a live account. Set realistic trading goals, manage your time effectively, and stick to your trading plan.

- Keep a trading journal: Record your trades, including entry and exit points, profit or loss, and the rationale behind your decisions. This will help you identify patterns, analyze your performance, and improve your trading skills over time.

- Seek feedback and guidance: Don’t hesitate to seek feedback from experienced traders or mentors. They can provide valuable insights and help you refine your trading approach.

Transitioning from a Demo Account to Live Trading

The transition from a demo account to live trading is a significant step in your forex trading journey. While a demo account provides a risk-free environment to practice your trading strategies, trading with real money introduces a new set of considerations and challenges.

It is crucial to approach this transition with a well-defined plan and a clear understanding of the differences between demo and live trading. This ensures a smoother and more successful transition.

Checklist for Transitioning to Live Trading

Before opening a live trading account, it is essential to have a checklist in place to ensure you are prepared for the challenges of trading with real money.

Here are some key steps to consider:

- Define your trading goals and objectives. Determine your financial goals, risk tolerance, and desired time commitment for trading. This will help you choose a suitable trading strategy and manage your expectations.

- Develop a robust trading plan. Your trading plan should Artikel your entry and exit strategies, risk management rules, and trading psychology. This plan serves as a guide to help you make informed decisions and avoid emotional trading.

- Choose a reputable forex broker. Select a broker with a good reputation, competitive trading conditions, and reliable customer support. Research different brokers and compare their features, fees, and trading platforms before making a decision.

- Fund your trading account responsibly. Start with a small amount of capital that you are comfortable risking. Avoid using funds you cannot afford to lose. It is advisable to begin with a smaller amount and gradually increase your investment as you gain experience and confidence.

- Backtest your trading strategies. Test your strategies on historical data to evaluate their performance and identify any potential weaknesses. This helps you refine your strategies and improve your chances of success.

- Practice risk management techniques. Implement stop-loss orders to limit potential losses on your trades. This helps you manage risk and protect your capital from significant losses.

- Understand the psychological aspects of trading. Forex trading can be emotionally challenging. Learn to manage your emotions, avoid impulsive decisions, and stay disciplined even during periods of market volatility.

Managing Risk and Emotions in Live Trading

Trading with real money introduces a new level of risk and emotional pressure. It is crucial to develop strategies to manage both effectively.

Managing Risk

- Use stop-loss orders: Stop-loss orders are essential for limiting potential losses on your trades. They automatically close your position when the price reaches a predetermined level, preventing further losses.

- Calculate your risk per trade: Determine the maximum amount you are willing to lose on each trade and adjust your position size accordingly. This helps you control your overall risk exposure and prevent significant losses.

- Diversify your portfolio: Spread your investments across different asset classes or trading strategies to reduce overall risk. This helps to mitigate losses if one particular asset or strategy performs poorly.

Managing Emotions

- Avoid emotional trading: Emotional trading can lead to impulsive decisions and poor risk management. It is important to remain calm and objective when making trading decisions.

- Keep a trading journal: Document your trading decisions, successes, and failures. This helps you identify patterns in your trading behavior and improve your decision-making process.

- Seek support from experienced traders: Connect with other traders and learn from their experiences. This can provide valuable insights and help you develop a more disciplined approach to trading.

Choosing the Right Demo Forex Account

Choosing the right demo forex account is crucial for beginners and seasoned traders alike. It allows you to experiment with strategies, learn the platform, and gain confidence before risking real money. To make the best decision, consider these important factors.

Broker Reputation and Regulation

A broker’s reputation and regulatory status are essential indicators of its trustworthiness and reliability. Look for brokers with a strong track record, positive reviews from other traders, and licenses from reputable regulatory bodies. Regulatory bodies ensure that brokers adhere to specific standards, safeguarding your funds and providing recourse if necessary.

Trading Platform Features and User Interface

The trading platform is your gateway to the forex market. A user-friendly interface with intuitive features is crucial for a seamless trading experience. Consider factors like:

- Charting Tools: Look for a platform that offers a variety of chart types, indicators, and drawing tools to analyze price movements.

- Order Execution: Ensure the platform allows for swift and efficient order execution, minimizing slippage and delays.

- Trading Tools: Features like stop-loss orders, take-profit orders, and trailing stops can help manage risk and maximize potential profits.

- Educational Resources: Some brokers offer valuable educational materials like tutorials, webinars, and market analysis, which can be beneficial for learning.

Account Types and Features

Different brokers offer various demo account types with different features and limitations. Some factors to consider include:

- Account Size: The virtual funds available in a demo account can influence your trading experience. A larger account balance allows you to test strategies with more realistic positions.

- Duration: Some demo accounts have an expiration date, while others are permanent. Consider the duration that aligns with your learning goals.

- Trading Instruments: Ensure the demo account offers access to the trading instruments you are interested in, such as currency pairs, commodities, or indices.

Popular Forex Brokers Offering Demo Accounts

Here’s a comparison of some popular forex brokers known for their demo account offerings:

| Broker | Platform | Demo Account Features | Regulation |

|---|---|---|---|

| MetaTrader 4 (MT4) | MetaTrader 4 | Unlimited duration, $100,000 virtual funds, wide range of trading instruments | CySEC, FCA |

| Exness | MetaTrader 4, MetaTrader 5 | Unlimited duration, $10,000 virtual funds, advanced charting tools | CySEC, FCA |

| XM | MetaTrader 4, MetaTrader 5 | Unlimited duration, $100,000 virtual funds, educational resources | CySEC, ASIC |

Tips for Finding the Best Demo Account

- Research and Compare: Take time to research different brokers and compare their demo account offerings, features, and terms.

- Read Reviews: Look for reviews from other traders to gain insights into a broker’s reputation and user experience.

- Try Multiple Demo Accounts: Experiment with demo accounts from different brokers to find the platform and features that best suit your trading style.

- Seek Guidance: If you are new to forex trading, consider seeking guidance from experienced traders or mentors to help you choose the right demo account.

Examples of Demo Forex Accounts in Action

A demo forex account provides a realistic trading environment without risking real money. It allows you to practice different trading scenarios, test trading strategies, and gain confidence before transitioning to live trading.

Using Demo Accounts to Practice Different Trading Scenarios

Demo accounts allow you to practice various trading scenarios, including opening and closing trades, managing risk, and analyzing market data. This hands-on experience helps you develop essential trading skills and gain a deeper understanding of forex trading.

- Opening and Closing Trades: You can experiment with different order types, such as market orders, limit orders, and stop-loss orders, to see how they affect your trading results.

- Managing Risk: Demo accounts enable you to practice setting stop-loss orders and take-profit targets to manage your risk effectively. This helps you understand how to limit potential losses and protect your profits.

- Analyzing Market Data: Demo accounts provide access to real-time market data, allowing you to practice analyzing charts, using technical indicators, and interpreting economic news. This experience helps you develop your analytical skills and identify trading opportunities.

Testing Trading Strategies with Demo Accounts

Demo accounts provide a safe and controlled environment to test different trading strategies before implementing them in a live trading environment. You can experiment with various strategies, such as scalping, day trading, swing trading, and trend following, to see which ones best suit your trading style and risk tolerance.

- Backtesting Strategies: Demo accounts allow you to backtest your strategies on historical data, which helps you assess their performance and identify potential weaknesses.

- Forward Testing Strategies: You can forward test your strategies on live market data in a demo account, which gives you a more realistic view of how they might perform in real-time trading conditions.

- Identifying Potential Weaknesses: By testing your strategies in a demo account, you can identify potential weaknesses and make necessary adjustments before using them in live trading.

Demo Account Features and Benefits for Different Trader Profiles, Demo forex account

| Feature | Benefit | Trader Profile |

|---|---|---|

| Real-time market data | Access to live market data for analysis and strategy development | All traders |

| Various order types | Practice using different order types to execute trades | Beginner traders |

| Risk management tools | Develop risk management skills and set stop-loss orders and take-profit targets | Beginner traders |

| Historical data | Backtest trading strategies and analyze past market trends | Experienced traders |

| Advanced charting tools | Conduct in-depth technical analysis and identify trading opportunities | Experienced traders |

Wrap-Up

Embarking on your forex trading journey with a demo account provides an invaluable opportunity to develop your skills, understand market dynamics, and build confidence before venturing into live trading. By taking advantage of the features and benefits of a demo account, you can lay a solid foundation for success in the world of forex trading. So, dive in, explore, and let the virtual markets guide you towards your trading goals.

FAQs

What is the difference between a demo and a live forex account?

A demo account uses virtual funds and simulates real market conditions, while a live account uses real money and exposes you to actual market risks.

How long can I use a demo account?

Most brokers offer unlimited access to demo accounts, allowing you to practice as long as you need.

Can I use a demo account to trade real currencies?

No, a demo account uses virtual funds, so you’re not trading with real currencies.

Do I need to provide personal information to open a demo account?

Typically, you’ll need to provide basic information like your email address and name, but not your full personal details.