Demo forex trading offers a risk-free environment to learn the intricacies of the global currency market. This practice platform allows you to explore trading strategies, test your skills, and gain valuable experience without risking real money. Whether you’re a complete beginner or an experienced trader looking to refine your techniques, a demo account can be an invaluable tool in your forex journey.

The benefits of demo trading extend beyond risk mitigation. It provides a safe space to experiment with different trading styles, analyze market data, and understand the dynamics of forex trading without the pressure of financial consequences. This hands-on experience can help you develop confidence, refine your trading strategies, and make informed decisions when you eventually transition to live trading.

Introduction to Demo Forex Trading

Demo forex trading is a risk-free way to learn and practice forex trading without using real money. It allows you to experience the trading environment, test strategies, and develop your skills before risking your own capital.

Demo accounts provide a simulated trading environment that mirrors the real forex market, giving you access to real-time market data, charts, and trading tools. You can execute trades, manage your positions, and monitor your performance without any financial risk.

Benefits of Using a Demo Account

Demo accounts offer several benefits for beginners, including:

- Risk-free learning: You can learn the fundamentals of forex trading without risking your own money.

- Practice trading strategies: You can test different trading strategies and techniques in a safe environment.

- Develop trading skills: You can develop your trading skills, including order execution, risk management, and market analysis.

- Familiarize yourself with trading platforms: You can become familiar with the trading platform and its features.

- Gain confidence: You can build confidence in your trading abilities before venturing into live trading.

Differences Between Demo and Live Trading Accounts

While demo accounts provide a valuable learning experience, there are some key differences between demo and live trading accounts:

- Real-time market data: Both demo and live accounts provide access to real-time market data, but demo accounts may have a slight delay in data updates.

- Emotional impact: Demo trading lacks the emotional impact of live trading, where real money is at stake. This can influence your decision-making and risk management.

- Trading conditions: Live accounts may have different trading conditions, such as spreads, commissions, and leverage, compared to demo accounts.

- Market volatility: Market volatility can affect trading outcomes, and demo accounts may not fully reflect the real-world volatility.

Key Features of Demo Forex Trading Platforms

Demo trading platforms provide a simulated environment that replicates real-time market conditions, enabling traders to practice their strategies and gain experience without risking actual capital. They offer various features that facilitate learning and development, enhancing the overall trading experience.

Types of Demo Trading Platforms, Demo forex trading

Demo trading platforms are typically offered by forex brokers, and they can be accessed through various mediums.

- Web-based Platforms: These platforms can be accessed directly through a web browser without requiring any downloads or installations. They are convenient for users with limited storage space or who prefer online access.

- Desktop Platforms: These platforms are downloaded and installed on a computer, offering a more comprehensive and feature-rich experience. They often provide advanced charting tools and analytical capabilities.

- Mobile Platforms: These platforms are designed for smartphones and tablets, allowing traders to access their demo accounts on the go. They offer a simplified interface and essential trading features.

Key Features of Demo Trading Platforms

These platforms are designed to provide a realistic trading experience, allowing traders to test strategies and develop skills.

- Real-time Market Data: Demo trading platforms provide real-time price feeds for various currency pairs, mirroring actual market conditions. This enables traders to analyze price movements and practice trading strategies in a dynamic environment.

- Virtual Trading Account: Users are provided with a virtual trading account, typically funded with a predetermined amount of virtual currency. This allows them to place trades without risking actual capital.

- Order Execution and Trade Management: Demo trading platforms enable users to place and manage trades just as they would in a live trading environment. This includes features like placing market orders, limit orders, stop-loss orders, and take-profit orders.

- Trading Tools and Indicators: Most demo platforms offer a range of technical analysis tools and indicators, such as moving averages, MACD, RSI, and Bollinger Bands. These tools help traders analyze price trends and identify potential trading opportunities.

- Charting and Analysis: Demo platforms provide advanced charting capabilities, allowing users to visualize price movements, analyze patterns, and apply technical indicators. They often support multiple chart types, timeframes, and drawing tools.

- Educational Resources: Some demo trading platforms offer educational resources, such as tutorials, webinars, and articles, to help traders learn about forex trading concepts and strategies.

- Customer Support: Demo trading platforms usually provide customer support services to assist users with any questions or issues they may encounter.

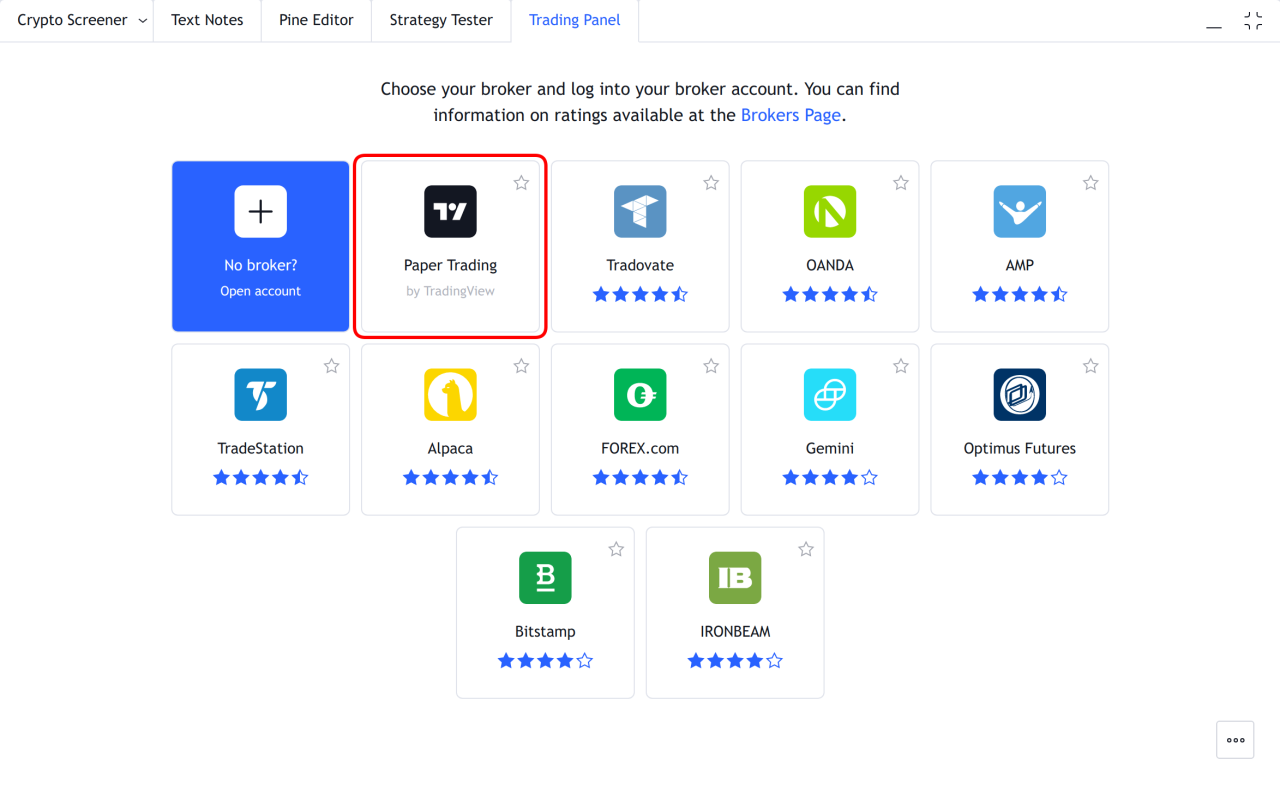

Examples of Popular Demo Trading Platforms

Several popular forex brokers offer demo trading platforms with various features and functionalities.

- MetaTrader 4 (MT4): MT4 is a widely used platform known for its advanced charting capabilities, technical indicators, and automated trading capabilities. It offers a user-friendly interface and is available as a desktop, web, and mobile platform.

- MetaTrader 5 (MT5): MT5 is the latest version of the MetaTrader platform, offering enhanced features and functionalities, including more advanced charting tools, economic calendar, and a wider range of trading instruments.

- cTrader: cTrader is a popular platform known for its high-speed order execution, advanced charting tools, and customizable interface. It is primarily targeted at professional traders.

- TradingView: TradingView is a social trading platform that offers real-time market data, charting tools, and a community of traders. It is a popular choice for technical analysis and sharing trading ideas.

Advantages and Disadvantages of Demo Trading Platforms

Demo trading platforms offer numerous benefits for traders, but they also have some limitations.

- Advantages:

- Risk-Free Practice: Demo accounts allow traders to practice their strategies without risking actual capital, providing a safe and controlled environment for learning.

- Develop Trading Skills: Traders can experiment with different trading strategies, test their risk management techniques, and improve their overall trading skills.

- Familiarize with Trading Platforms: Demo accounts allow traders to familiarize themselves with the features and functionalities of various trading platforms before committing to a live account.

- Access to Real-time Market Data: Demo platforms provide access to real-time market data, enabling traders to analyze price movements and develop their trading strategies in a dynamic environment.

- Free to Use: Demo accounts are typically free to use, providing a cost-effective way for traders to learn and practice.

- Disadvantages:

- Lack of Emotional Involvement: Demo trading lacks the emotional pressure and financial consequences associated with live trading, which can lead to unrealistic expectations and trading decisions.

- Limited Functionality: Some demo platforms may have limited functionality compared to live trading accounts, such as restricted access to certain trading instruments or features.

- Simulated Market Conditions: While demo platforms strive to replicate real-time market conditions, they cannot fully capture the complexities and nuances of live trading.

- Limited Real-World Experience: Demo trading does not provide real-world experience with factors such as slippage, order fills, and trading commissions.

Setting Up a Demo Trading Account

Opening a demo forex trading account is the first step towards experiencing the world of forex trading without risking your real money. It allows you to familiarize yourself with the trading platform, practice your strategies, and gain valuable insights into the market dynamics.

The Registration Process

The process of creating a demo forex trading account is generally straightforward and can be completed within minutes. Most reputable brokers offer a user-friendly interface and a simple registration process.

- Visit the Broker’s Website: Start by navigating to the website of your chosen forex broker. Look for a prominent “Demo Account” or “Free Trial” button or link, typically located on the homepage or in the navigation menu.

- Click on the “Demo Account” Button: Clicking this button will usually take you to a registration form where you’ll need to provide some basic information.

- Fill Out the Registration Form: The required information typically includes:

- Email Address: This is the primary way brokers communicate with you, so ensure it’s active and accessible.

- Password: Choose a strong password for security purposes.

- Country of Residence: This is necessary for regulatory compliance and may affect the trading conditions offered.

- Phone Number (Optional): Some brokers may require a phone number for verification purposes, but it’s usually optional.

- Verify Your Email: After submitting the registration form, you’ll usually receive an email with a verification link. Click on this link to confirm your email address and activate your demo account.

- Log In to Your Demo Account: Once your email is verified, you can log in to your demo account using the credentials you provided during registration.

Choosing a Demo Account Type

While many brokers offer a single demo account type, some may provide different options tailored to specific needs or trading styles.

- Standard Demo Account: This is the most common type, offering a realistic trading environment with virtual funds. It allows you to test strategies, explore the platform’s features, and get a feel for live market conditions.

- Beginner Demo Account: Some brokers may offer a beginner-friendly demo account with simplified features and educational resources. This can be helpful for new traders who are just starting their journey.

- Advanced Demo Account: For experienced traders, some brokers might offer advanced demo accounts with more features, such as access to professional tools, real-time market data, and advanced charting capabilities.

Understanding Forex Trading Basics

Before you start trading with real money, it’s essential to grasp the fundamental concepts of forex trading. This section will introduce you to key terms and concepts, helping you navigate the forex market with confidence.

Currency Pairs

Currency pairs are the foundation of forex trading. A currency pair represents the value of one currency against another. For instance, the EUR/USD pair indicates the value of the euro (EUR) against the US dollar (USD). When you buy a currency pair, you’re essentially buying the base currency (EUR in this example) and selling the quote currency (USD). Understanding the relationship between the two currencies within a pair is crucial for making informed trading decisions.

Pips

Pips (points in percentage) are the smallest unit of measurement for currency fluctuations. One pip represents a change in the fourth decimal place of a currency pair. For example, a move from 1.1234 to 1.1235 is a one-pip increase. Understanding pips is essential for calculating potential profits and losses, as well as determining the value of your trades.

Leverage

Leverage is a powerful tool that allows traders to control larger positions with a smaller initial investment. It magnifies both potential profits and losses. For example, if you trade with a leverage of 1:100, a $1,000 investment can control a $100,000 position. While leverage can amplify profits, it can also significantly increase losses. It’s crucial to understand and manage leverage effectively to avoid excessive risk.

Types of Forex Orders

Forex orders are instructions given to your broker to execute trades based on specific price levels.

Market Orders

Market orders are executed immediately at the best available market price. This is the most common type of order and is suitable for traders who want to enter a trade quickly, regardless of the price.

Limit Orders

Limit orders are placed at a specific price or better. If the market reaches your desired price, the order is executed. Limit orders allow traders to control the price at which they enter a trade.

Stop-Loss Orders

Stop-loss orders are used to limit potential losses on a trade. They are placed at a specific price level below (for a long position) or above (for a short position) your entry price. When the market reaches your stop-loss price, your position is automatically closed, limiting your losses.

Common Forex Trading Strategies

Forex trading strategies are methods used to identify potential trading opportunities and manage risk. There are numerous strategies, each with its own advantages and disadvantages. Here are some common strategies:

Trend Trading

Trend trading involves identifying and following the overall direction of the market. Traders look for long-term trends and enter trades in the direction of the trend.

Scalping

Scalping involves taking advantage of small price fluctuations in the market. Scalpers use high leverage and aim to make a profit from multiple small price movements.

News Trading

News trading involves trading based on economic news releases and events that can impact currency prices. Traders monitor economic calendars and react to news releases that may cause price volatility.

Technical Analysis

Technical analysis involves studying historical price charts and patterns to identify potential trading opportunities. Traders use technical indicators and patterns to make trading decisions.

Fundamental Analysis

Fundamental analysis involves evaluating economic data and events that can affect currency prices. Traders use economic indicators, interest rates, and political events to make trading decisions.

Practicing Trading Skills with a Demo Account

A demo trading account is a valuable tool for honing your forex trading skills without risking real money. It allows you to experiment with different strategies, learn from your mistakes, and gain confidence before venturing into live trading. To maximize the benefits of a demo account, it’s crucial to approach it with a structured plan and a focused approach.

Designing a Demo Trading Plan

A well-defined demo trading plan is essential for making the most of your practice sessions. It should Artikel your trading goals, the strategies you intend to test, and the risk management principles you will adhere to.

- Define Your Trading Goals: Before you start trading, it’s crucial to have a clear understanding of what you want to achieve. Are you aiming to learn about specific technical indicators, test a particular trading strategy, or simply get a feel for the market? Setting specific goals will help you stay focused and measure your progress.

- Choose Trading Strategies: The forex market offers a wide range of trading strategies, each with its own set of advantages and disadvantages. Select a few strategies that align with your risk tolerance, trading style, and goals. You can then experiment with these strategies on your demo account and see which ones perform best for you.

- Establish Risk Management Rules: Risk management is crucial in forex trading, and it’s essential to practice it even on a demo account. Set clear stop-loss orders, determine your maximum risk per trade, and stick to these rules consistently. This will help you develop disciplined trading habits and protect your capital in the long run.

Analyzing Forex Charts

Understanding how to analyze forex charts is fundamental to successful trading. Charts provide valuable insights into price movements, trends, and potential trading opportunities.

- Technical Analysis: Technical analysis involves studying past price patterns and using technical indicators to identify trends and predict future price movements. Some common technical indicators include moving averages, MACD, and RSI.

- Fundamental Analysis: Fundamental analysis considers economic news and events that can impact currency values. Factors such as interest rates, inflation, and economic growth can significantly influence currency movements.

- Chart Patterns: Recognizing chart patterns can help you identify potential trading opportunities. Common patterns include head and shoulders, double tops, and triangles. When these patterns appear, they can suggest a change in the direction of the price.

Identifying Trading Opportunities

Once you have a grasp of technical and fundamental analysis, you can start identifying potential trading opportunities. Look for instances where price action aligns with your chosen trading strategy and technical indicators signal a potential trend reversal or continuation.

- Support and Resistance Levels: Support and resistance levels are price points where the market has historically found difficulty breaking through. These levels can act as potential entry and exit points for trades.

- Trendlines: Trendlines connect a series of price highs or lows and can indicate the direction of the market. Trading with the trend can increase your chances of success.

- Breakouts: A breakout occurs when the price breaks through a support or resistance level. This can be a strong signal of a trend change and can present a profitable trading opportunity.

Managing Risk and Developing Trading Habits

Effective risk management is crucial for long-term success in forex trading. It involves minimizing potential losses while maximizing potential profits.

- Stop-Loss Orders: Stop-loss orders are essential for limiting your losses on a trade. They automatically close your position when the price reaches a predetermined level. This helps protect your capital from significant losses.

- Position Sizing: Position sizing refers to determining the amount of capital you allocate to each trade. It’s important to risk only a small percentage of your capital on each trade, typically 1-2%. This helps you manage risk and prevent catastrophic losses.

- Trade Journaling: Keeping a trade journal is a valuable habit that helps you track your performance, analyze your mistakes, and improve your trading decisions. Record your entry and exit points, profit and loss, and any insights you gain from each trade.

Transitioning from Demo to Live Trading: Demo Forex Trading

So, you’ve mastered the art of trading in the demo environment, consistently making profitable trades and feeling confident in your strategies. But now, the real challenge begins: transitioning to live trading. While demo trading is a valuable tool for learning the ropes, it doesn’t fully capture the emotional and financial aspects of live trading. This section will guide you through the process of transitioning from demo to live, focusing on key considerations to ensure a smooth and successful transition.

Managing the Psychological Impact of Live Trading

The transition from demo to live trading can be a significant psychological shift. In demo trading, you’re not risking real money, so emotions like fear and greed are less pronounced. However, in live trading, every trade carries the weight of real financial consequences. It’s crucial to understand and manage these emotions to avoid impulsive decisions that can lead to losses.

- Develop a Trading Plan and Stick to It: A well-defined trading plan Artikels your entry and exit points, risk management strategies, and profit targets. This plan serves as a roadmap, helping you stay disciplined and avoid emotional trading decisions.

- Practice Emotional Control: Trading can be emotionally charged, especially during periods of market volatility. It’s essential to develop emotional control and avoid letting fear and greed dictate your trading decisions. Techniques like mindfulness and meditation can be helpful in managing emotions.

- Don’t Chase Losses: A common mistake among novice traders is chasing losses, trying to recoup lost funds by taking bigger risks. This is a recipe for disaster. Stick to your trading plan and avoid making impulsive decisions in an attempt to recover losses.

- Accept Losses as Part of the Process: Even the most experienced traders experience losses. It’s crucial to accept losses as a natural part of trading and avoid dwelling on them. Focus on learning from your mistakes and improving your trading strategies.

Refining Your Trading Strategy

While demo trading allows you to test different strategies, it’s crucial to refine your approach before transitioning to live trading. Backtesting and forward testing are essential steps in this process.

- Backtesting: This involves analyzing historical data to see how your chosen strategy would have performed in the past. This helps identify potential weaknesses and areas for improvement in your strategy.

- Forward Testing: This involves applying your strategy to real-time market data, but with a smaller account size than you would use in live trading. This allows you to gauge the effectiveness of your strategy in current market conditions and make adjustments as needed.

Final Thoughts

By utilizing a demo forex trading account, you can unlock a world of learning and practice without any financial risk. It empowers you to master the fundamentals, refine your strategies, and build confidence before venturing into the real market. As you gain experience and refine your trading approach, you can seamlessly transition to live trading with a solid foundation and a clear understanding of the forex landscape.

Expert Answers

What is the difference between a demo and a live forex trading account?

A demo account uses virtual funds, allowing you to practice trading without risking real money. A live account uses real money and involves actual financial risk.

How long should I practice on a demo account before going live?

There’s no fixed timeframe. It depends on your learning pace and comfort level. Aim for consistent profitability and risk management skills before transitioning to live trading.

Can I use a demo account to test different trading strategies?

Absolutely! Demo accounts are ideal for experimenting with various strategies, identifying what works best for you, and refining your approach.