Best platform forex – Best Forex Trading Platform: Navigating the world of forex trading can be daunting, especially for newcomers. But finding the right platform can make all the difference. This guide will help you understand the key features to look for, explore top platforms, and ultimately choose the one that aligns with your trading style and goals.

Forex trading platforms are the digital gateways to the global currency markets. They provide the tools and infrastructure needed to buy and sell currencies, manage trades, and analyze market data. Choosing the right platform is crucial for success, as it can impact your trading experience, efficiency, and profitability.

Understanding Forex Trading Platforms

A forex trading platform is your gateway to the global currency market. It’s the software that connects you to brokers, allowing you to buy and sell currencies. Understanding its functionalities is crucial for successful forex trading.

Core Functionalities of a Forex Trading Platform, Best platform forex

Forex trading platforms offer a range of features designed to facilitate trading and analysis. These core functionalities include:

- Order Execution: Platforms allow you to place buy and sell orders for currency pairs. You can choose from various order types, including market orders, limit orders, and stop-loss orders, depending on your trading strategy.

- Real-Time Quotes: Access to real-time currency prices is essential for informed trading decisions. Platforms provide live quotes for various currency pairs, often with updates every few seconds.

- Charting and Technical Analysis: Platforms offer charting tools that allow you to visualize price movements and identify trends. You can use technical indicators, such as moving averages, MACD, and Bollinger Bands, to analyze price patterns and generate trading signals.

- Account Management: Platforms allow you to manage your trading account, deposit and withdraw funds, and view your trading history.

- News and Economic Data: Some platforms provide access to economic news and data releases that can influence currency movements. This information can help traders make informed decisions based on market sentiment.

Key Features that Differentiate Good Platforms from Average Ones

Choosing the right platform is crucial for your trading success. Here are some key features that distinguish a good platform from an average one:

- Speed and Reliability: A reliable platform ensures smooth order execution and access to real-time data. Delays or glitches can negatively impact your trading performance.

- User Interface and Functionality: A user-friendly interface with intuitive navigation and easy-to-use tools makes trading more efficient. Complex platforms can be overwhelming for beginners.

- Security and Regulation: Your platform should be secure and regulated to protect your funds and personal information. Look for platforms that are licensed and audited by reputable financial authorities.

- Customer Support: Reliable customer support is essential for resolving issues or seeking guidance. Look for platforms that offer 24/7 support via multiple channels, such as email, phone, and live chat.

- Educational Resources: Platforms that offer educational resources, such as tutorials, webinars, and trading guides, can help you improve your trading skills and knowledge.

Essential Tools and Indicators Available on Most Platforms

Most forex trading platforms offer a range of tools and indicators to assist traders in their analysis and decision-making. Some essential ones include:

- Moving Averages: These indicators smooth out price fluctuations and identify trends. They can help traders identify potential support and resistance levels.

- Relative Strength Index (RSI): This momentum indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. It can help traders identify potential reversals in price trends.

- Bollinger Bands: These bands measure price volatility and can help traders identify potential breakouts or reversals. They are often used in conjunction with other indicators to confirm trading signals.

- MACD (Moving Average Convergence Divergence): This indicator compares two moving averages to identify potential buy or sell signals. It can help traders identify changes in momentum and identify potential trend reversals.

Evaluating Key Platform Features

Choosing the right Forex trading platform is crucial for success in the market. While understanding the basics of Forex trading is essential, navigating the technical aspects of a platform is equally important. This section will delve into the key features that make a platform stand out and help you make an informed decision.

Trading Interface Comparison

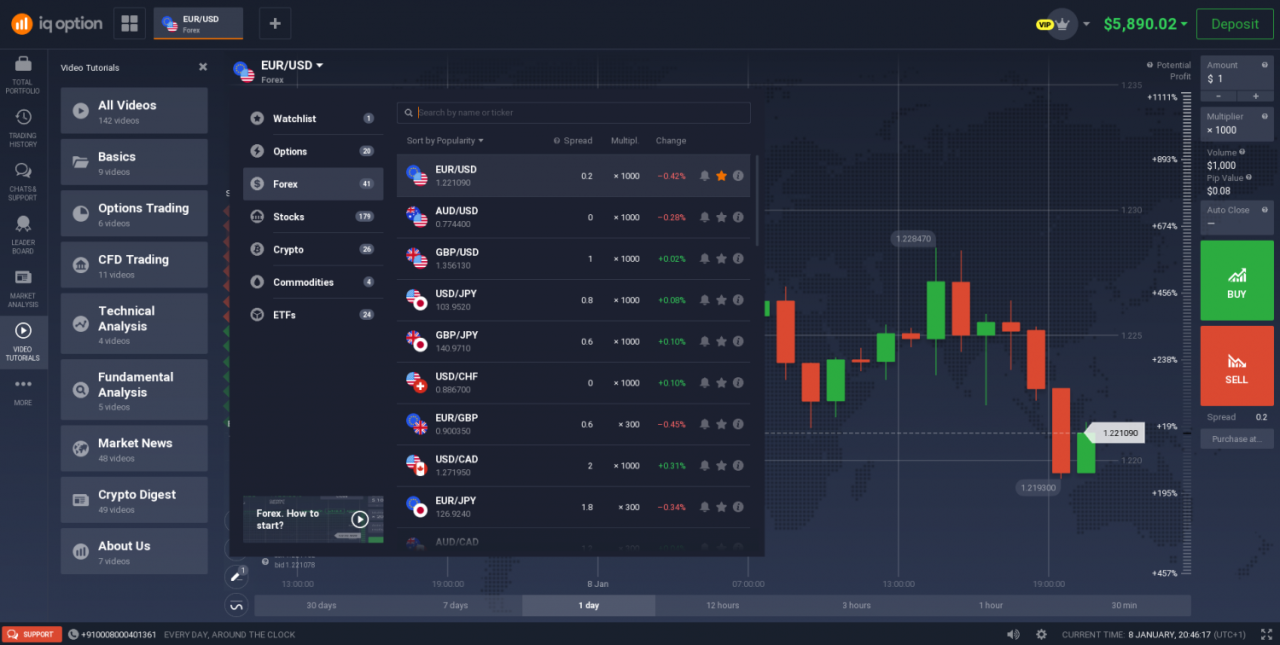

A user-friendly trading interface is paramount for efficient and effective trading. Popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader each offer distinct interfaces with their own strengths and weaknesses.

- MetaTrader 4 (MT4): MT4 boasts a classic and familiar interface, known for its simplicity and ease of use. It features a straightforward chart layout, intuitive order execution, and a range of technical indicators. However, its interface may seem outdated compared to newer platforms.

- MetaTrader 5 (MT5): MT5 is a more advanced platform with a modern and customizable interface. It offers a wider range of trading instruments, advanced charting tools, and a sophisticated order management system. While more feature-rich, its complexity can be overwhelming for beginners.

- cTrader: cTrader stands out with its highly customizable and intuitive interface. It offers advanced charting capabilities, a robust order management system, and a user-friendly experience for both novice and experienced traders. Its focus on speed and efficiency makes it a popular choice for scalping and high-frequency trading.

Platform Types: Strengths and Weaknesses

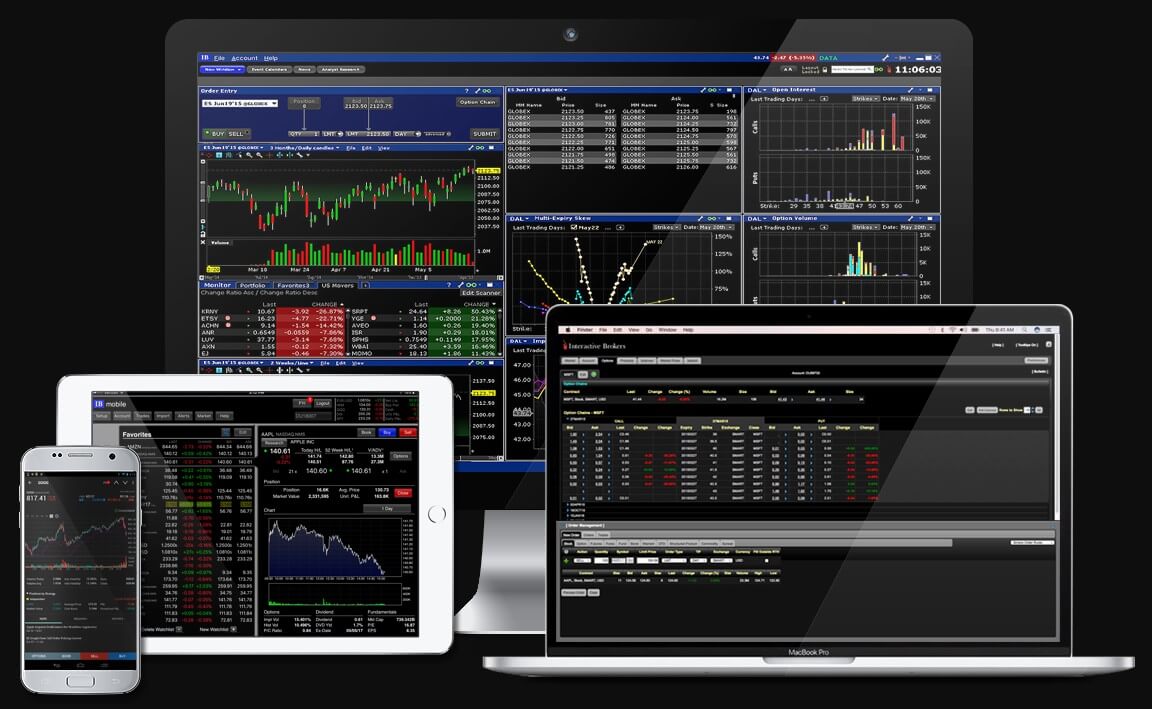

Forex trading platforms come in various forms, each with its own advantages and disadvantages. Understanding the differences between desktop, mobile, and web-based platforms can help you choose the best option for your needs.

- Desktop Platforms: Desktop platforms like MT4 and MT5 offer the most comprehensive features and functionalities. They typically provide advanced charting tools, multiple order types, and robust technical analysis capabilities. However, they require installation and are limited to a specific device.

- Mobile Platforms: Mobile platforms are designed for on-the-go trading. They offer a streamlined experience, allowing you to monitor markets and execute trades from anywhere with an internet connection. However, they may lack the advanced features found in desktop platforms.

- Web-Based Platforms: Web-based platforms are accessible through any internet browser, eliminating the need for installation. They are convenient and portable but may be limited in terms of features and performance compared to desktop platforms.

Security and Regulatory Compliance

Security and regulatory compliance are paramount in Forex trading. Choosing a platform that prioritizes these aspects is crucial for safeguarding your funds and ensuring a trustworthy trading environment.

- Security Measures: Look for platforms that employ advanced security measures such as encryption, two-factor authentication, and regular security audits. These measures help protect your personal information and trading activities from unauthorized access.

- Regulatory Compliance: Ensure the platform is regulated by reputable financial authorities. This signifies that the platform adheres to strict rules and regulations, providing a more secure and transparent trading environment. Look for licenses from authorities like the Financial Conduct Authority (FCA), the Securities and Exchange Commission (SEC), or the Australian Securities and Investments Commission (ASIC).

Top Forex Trading Platforms

Choosing the right Forex trading platform is crucial for success in the market. It’s like selecting the right tool for a job – the platform should fit your trading style, offer the features you need, and provide a user-friendly experience.

Comparison of Top Forex Trading Platforms

The following table compares five of the most popular Forex trading platforms based on key features, fees, and user experience:

| Platform | Features | Fees | User Experience |

|—|—|—|—|

| MetaTrader 4 (MT4) | Extensive charting tools, expert advisors (EAs), wide range of indicators, customizable interface | Low spreads, commission-based | Beginner-friendly, widely used, extensive community support |

| MetaTrader 5 (MT5) | More advanced features than MT4, including hedging and netting, economic calendar, market depth | Similar to MT4, but may have slightly higher spreads | More complex than MT4, but offers greater flexibility |

| cTrader | Advanced charting and order execution, deep liquidity, customizable interface | Competitive spreads, commission-based | User-friendly, ideal for scalpers and high-frequency traders |

| NinjaTrader | Powerful charting and analysis tools, backtesting capabilities, customizable interface | Commission-based, with tiered pricing | Suitable for both beginners and experienced traders, strong community support |

| TradingView | Comprehensive charting and analysis tools, social trading features, real-time data | Free plan available, paid plans offer additional features | Excellent for technical analysis and market research, intuitive interface |

Platform Strengths and Weaknesses

Here’s a breakdown of each platform’s strengths and weaknesses in terms of beginner-friendliness and advanced features:

| Platform | Beginner-Friendly | Advanced Features |

|—|—|—|

| MetaTrader 4 (MT4) | ✔️ | ✔️ |

| MetaTrader 5 (MT5) | ✔️ | ✔️ |

| cTrader | ✔️ | ✔️ |

| NinjaTrader | ✔️ | ✔️ |

| TradingView | ✔️ | ✔️ |

Platforms for Different Trading Styles

Different trading platforms cater to different trading styles. Here are some platforms suited for specific approaches:

Scalping:

* cTrader: Known for its fast order execution and deep liquidity, ideal for scalping strategies.

* MetaTrader 4 (MT4): Offers advanced charting and order management tools for scalpers.

Day Trading:

* MetaTrader 4 (MT4): Popular among day traders for its charting tools, indicators, and EAs.

* NinjaTrader: Provides advanced charting and analysis tools, along with backtesting capabilities for day trading strategies.

Swing Trading:

* TradingView: Excellent for technical analysis and market research, useful for identifying swing trading opportunities.

* MetaTrader 5 (MT5): Offers a wide range of indicators and tools for swing trading analysis.

Choosing the Right Platform for You

Selecting the right forex trading platform is crucial for your success in the market. It should align with your individual trading needs, goals, and risk tolerance. Choosing a platform that provides you with the tools and resources you need to make informed trading decisions can significantly impact your profitability and overall trading experience.

Account Types and Trading Instruments

The first step in selecting a platform is to consider your account type and the trading instruments you wish to trade. Different platforms offer various account types, each with unique features, fees, and minimum deposit requirements. Some common account types include:

- Standard accounts: These are typically suitable for beginners, offering a basic trading experience with lower minimum deposits. They often have fixed spreads, meaning the difference between the buy and sell prices is set.

- Micro accounts: These accounts allow you to trade with smaller lot sizes, making them ideal for those with limited capital or who want to start with lower risk.

- ECN accounts: These accounts offer access to the interbank market, providing tighter spreads and greater transparency. They are typically suited for experienced traders who prefer low-latency execution and direct access to liquidity.

Once you have determined your account type, you should consider the trading instruments you wish to access. Different platforms offer different instruments, including:

- Currency pairs: These are the most common trading instruments in forex, involving the exchange of one currency for another. Popular currency pairs include EUR/USD, GBP/USD, and USD/JPY.

- Precious metals: Gold and silver are popular trading instruments due to their safe-haven status and potential for price appreciation.

- Commodities: Crude oil, natural gas, and agricultural products are examples of commodities traded in forex.

- Indices: These represent the performance of a group of stocks or assets, such as the S&P 500 or the FTSE 100.

Platform Features and Functionality

After considering account types and trading instruments, you should evaluate the platform’s features and functionality. Essential features include:

- Trading platform interface: The platform should have a user-friendly interface that is easy to navigate and understand, even for beginners. It should provide access to essential features like order placement, account management, and charting tools.

- Order types: The platform should offer a variety of order types, such as market orders, limit orders, stop orders, and trailing stop orders. This allows you to execute trades based on your desired entry and exit points and manage risk effectively.

- Charting and analysis tools: Advanced charting and analysis tools can help you identify trading opportunities and make more informed decisions. Look for platforms that offer features like technical indicators, drawing tools, and historical data analysis.

- News and research: Access to real-time news feeds, economic calendars, and market analysis can help you stay informed about market movements and make more informed trading decisions.

- Customer support: Reliable customer support is essential, especially when you encounter issues or have questions. Look for platforms that offer multiple channels of support, such as live chat, email, and phone.

Benefits and Drawbacks of Advanced Charting and Analysis Tools

Advanced charting and analysis tools can significantly enhance your trading experience by providing valuable insights into market trends and patterns. However, it’s crucial to understand their potential benefits and drawbacks:

Benefits:

- Improved market analysis: These tools allow you to identify trends, patterns, and support and resistance levels, providing a more comprehensive understanding of market dynamics.

- Enhanced decision-making: By analyzing historical data and technical indicators, you can develop more informed trading strategies and make more accurate predictions about future price movements.

- Increased trading efficiency: Advanced tools can automate tasks like backtesting strategies and generating trading signals, freeing up your time to focus on other aspects of trading.

Drawbacks:

- Over-reliance on technical analysis: While technical analysis can be helpful, it’s essential to avoid relying solely on it. Other factors, such as fundamental analysis and market sentiment, can also influence price movements.

- Complexity and learning curve: Advanced charting and analysis tools can be complex and require a significant learning curve. It’s important to invest time in understanding how to use these tools effectively.

- Potential for false signals: Technical indicators can sometimes generate false signals, leading to incorrect trading decisions. It’s crucial to use these tools in conjunction with other forms of analysis and to develop a robust trading plan.

Exploring Platform Specifics

Now that you’ve gained a good understanding of the essential features of Forex trading platforms, let’s dive deeper into the specifics of some popular options. This will help you make an informed decision about which platform best suits your trading style and needs.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most widely used Forex trading platforms globally. Developed by MetaQuotes Software Corp, they offer a robust set of features and tools for both novice and experienced traders. Let’s explore their unique characteristics:

MT4

- Established and Widely Used: MT4 has been a dominant force in the Forex trading world for over a decade, boasting a vast user base and a wide range of brokers supporting it. Its popularity stems from its user-friendly interface, extensive charting capabilities, and extensive customization options.

- Expert Advisors (EAs): MT4 supports automated trading through Expert Advisors (EAs). EAs are pre-programmed trading robots that execute trades based on predefined rules, allowing for hands-free trading strategies.

- Technical Analysis Tools: The platform offers a comprehensive suite of technical indicators and drawing tools, enabling traders to analyze price charts and identify potential trading opportunities.

- MQL4 Programming Language: MT4’s MQL4 programming language allows traders to develop custom indicators, scripts, and EAs, enhancing their trading capabilities.

MT5

- Enhanced Features: MT5 is the successor to MT4, offering advanced features and improvements. It boasts a more intuitive interface, expanded charting capabilities, and an increased number of technical indicators.

- MQL5 Programming Language: MT5 utilizes the MQL5 programming language, which is more advanced than MQL4, providing greater flexibility and control over trading automation.

- Multiple Order Types: MT5 supports a wider range of order types, including pending orders, market orders, and stop-loss orders, giving traders greater flexibility in managing their trades.

- Economic Calendar and News Feed: MT5 includes an integrated economic calendar and news feed, providing traders with real-time updates on economic events that can influence market movements.

Risk Management and Order Execution

Both MT4 and MT5 provide robust tools for risk management and order execution. Here’s how you can leverage them effectively:

Setting Stop-Loss Orders

- Limit Potential Losses: Stop-loss orders are essential for risk management. They automatically close a trade when the price reaches a predefined level, limiting potential losses.

- Defining Entry and Exit Points: When setting a stop-loss order, you define the maximum amount you’re willing to lose on a trade. This helps you control your risk exposure and prevent significant losses.

- Example: If you buy a currency pair at 1.1000 and set a stop-loss order at 1.0950, the trade will automatically close if the price falls to 1.0950, limiting your loss to 50 pips.

Using Take-Profit Orders

- Lock in Profits: Take-profit orders automatically close a trade when the price reaches a predetermined profit target, securing your gains.

- Defining Profit Goals: By setting a take-profit order, you specify the desired profit level for your trade. This helps you lock in profits and avoid holding onto a trade for too long, potentially missing out on further gains or experiencing a reversal.

- Example: If you buy a currency pair at 1.1000 and set a take-profit order at 1.1050, the trade will automatically close when the price reaches 1.1050, securing a 50-pip profit.

Understanding Order Execution

- Market Orders: Market orders are executed immediately at the best available price in the market. They are suitable for quick entries and exits, but they may not always get filled at the desired price.

- Pending Orders: Pending orders are placed at a specific price level and are executed only when the market price reaches that level. They allow you to enter or exit a trade at a predefined price, providing greater control over your trades.

- Stop Orders: Stop orders are similar to pending orders, but they are triggered when the market price reaches a specific level and then executed at the best available price. They are often used to limit losses or enter a trade at a specific price level.

Setting Up and Customizing Your Platform

Once you’ve chosen a platform, it’s crucial to set it up and customize it to enhance your trading efficiency. Here are some tips:

Personalize Your Workspace

- Arrange Charts and Indicators: Organize your charts and indicators in a way that makes sense for your trading style. You can adjust chart sizes, colors, and layouts to suit your preferences.

- Add Favorite Symbols and Timeframes: Create a list of your preferred trading instruments and timeframes for quick access. This saves time and effort when navigating the platform.

- Use Shortcuts and Hotkeys: Familiarize yourself with the platform’s shortcuts and hotkeys to speed up your trading workflow.

Configure Trading Alerts

- Stay Informed: Set up alerts to notify you of important price movements, news events, or other market conditions that may affect your trades.

- Customize Alert Settings: You can configure alerts based on price levels, indicators, or other criteria. This ensures you receive timely notifications relevant to your trading strategy.

- Example: You can set an alert to notify you when a currency pair breaks above a key resistance level or when a specific indicator generates a buy signal.

Explore Additional Features

- Trading Journal: Maintain a trading journal to track your trades, analyze your performance, and identify areas for improvement.

- Economic Calendar: Use the economic calendar to stay informed about upcoming economic events that can impact market sentiment and price movements.

- News Feed: Subscribe to a news feed to stay updated on market-moving news and events.

Final Summary

The journey to finding the best forex trading platform starts with understanding your individual needs and goals. By evaluating features, comparing platforms, and considering your trading style, you can make an informed decision that empowers your forex trading journey. Remember, the right platform can be your key to unlocking the potential of the forex market.

Q&A: Best Platform Forex

What is the difference between MetaTrader 4 (MT4) and MetaTrader 5 (MT5)?

MT4 is a popular platform known for its simplicity and user-friendliness, while MT5 offers more advanced features, including a wider range of trading instruments and a more robust charting package.

Are there free forex trading platforms?

Yes, several platforms offer free demo accounts that allow you to practice trading without risking real money. However, most platforms require a deposit for live trading.

What are the risks associated with forex trading?

Forex trading involves significant risk, as currency values can fluctuate rapidly. It’s crucial to understand the risks involved and manage your trades effectively to minimize potential losses.

How do I choose the best forex trading platform for me?

Consider your trading style, experience level, budget, and the features that are most important to you. Research different platforms, compare their features, and try out demo accounts before making a decision.