Forex apps have revolutionized the way individuals engage in the global currency market, providing a convenient and accessible platform for trading. These apps, designed for both novice and experienced traders, offer a wide range of features that cater to diverse trading styles and needs.

From real-time market data and charting tools to advanced analysis capabilities and automated trading strategies, forex apps have become essential tools for navigating the complex and dynamic forex market. This guide will delve into the world of forex apps, exploring their functionalities, benefits, and the key factors to consider when choosing the right app for your trading journey.

Introduction to Forex Apps

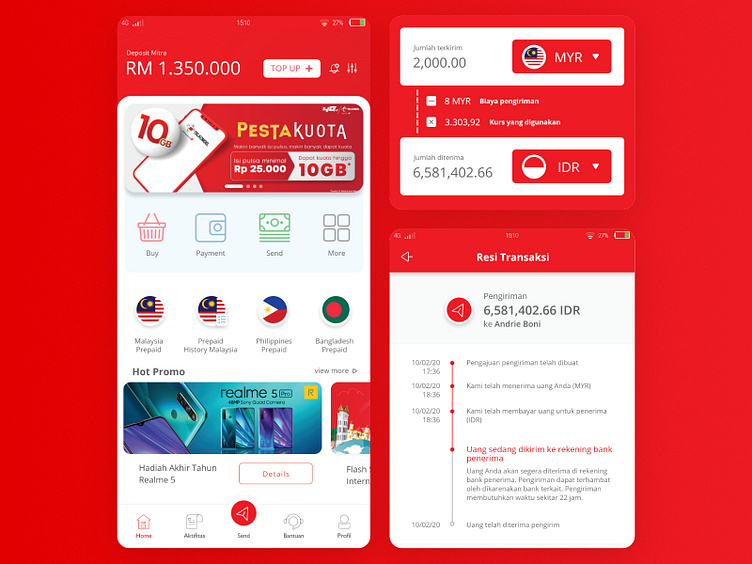

Forex apps are software applications designed to facilitate foreign exchange (forex) trading on mobile devices. These apps provide traders with access to real-time market data, trading tools, and execution capabilities, allowing them to participate in the global forex market from anywhere with an internet connection.

The history of forex trading apps can be traced back to the early days of mobile technology. As smartphones and tablets became more prevalent, forex brokers and technology providers began developing apps to cater to the growing demand for mobile trading. These early apps were often limited in functionality, but they paved the way for the sophisticated forex trading platforms we see today.

Advantages of Using Forex Apps

Using forex apps offers several advantages for traders:

- Convenience and Accessibility: Forex apps provide traders with the flexibility to trade from anywhere at any time, eliminating the need to be tethered to a desktop computer. This is particularly beneficial for busy individuals who need to manage their trades on the go.

- Real-Time Market Data: Forex apps offer access to real-time market data, including currency quotes, charts, and news feeds. This allows traders to stay up-to-date on market movements and make informed trading decisions.

- Trading Tools and Features: Forex apps are equipped with various trading tools and features designed to enhance the trading experience. These may include technical indicators, charting tools, order types, and risk management tools.

- User-Friendly Interfaces: Forex apps are designed with user-friendliness in mind, offering intuitive interfaces that are easy to navigate and understand. This makes them accessible to traders of all experience levels.

- Security and Reliability: Reputable forex brokers invest heavily in security measures to protect their users’ funds and data. Forex apps typically utilize encryption and other security protocols to ensure the safety of transactions and personal information.

Types of Forex Apps

Forex apps come in various forms, each designed to cater to specific needs and preferences of traders. They offer a range of functionalities, from executing trades to analyzing market data, providing educational resources, and managing accounts.

Trading Platforms

Trading platforms are the core of forex trading, enabling users to buy and sell currencies. These apps offer real-time market data, charting tools, order types, and execution capabilities.

- MetaTrader 4 (MT4): One of the most popular platforms, MT4 offers a wide range of features, including advanced charting, automated trading, and a vast library of indicators. It is available on multiple devices and has a strong community of users.

- MetaTrader 5 (MT5): The newer version of MT4, MT5 boasts enhanced features like more order types, expanded charting capabilities, and a built-in economic calendar. It is gaining popularity among traders seeking a more sophisticated platform.

- cTrader: Known for its speed and user-friendly interface, cTrader is a popular choice for scalpers and high-frequency traders. It offers advanced order types, real-time market depth, and a range of charting tools.

Analysis Tools

Forex analysis apps empower traders to gain insights into market trends and make informed trading decisions. They provide a range of tools for technical and fundamental analysis.

- TradingView: This popular web-based platform offers real-time charting, technical indicators, and a vast library of community-created scripts and strategies. It allows users to share their ideas and interact with other traders.

- Myfxbook: This platform allows traders to track their performance, analyze their trades, and compare their results with other traders. It also provides insights into market trends and popular trading strategies.

- FXStreet: FXStreet offers economic news, market analysis, and trading signals. It provides a comprehensive overview of market events and their potential impact on currency prices.

Educational Resources

Forex educational apps provide learning materials, tutorials, and courses to help traders develop their skills and knowledge.

- Babypips: This platform offers a comprehensive guide to forex trading, covering topics from basic concepts to advanced strategies. It provides interactive lessons, quizzes, and a supportive community.

- Forex Factory: This forum-based platform offers a wealth of educational resources, including articles, analysis, and discussions. It is a valuable source for traders seeking to learn from experienced professionals and engage with the forex community.

- Investopedia: While not exclusively focused on forex, Investopedia offers a wide range of articles, tutorials, and courses on various financial topics, including forex trading. It provides a solid foundation for beginners and advanced traders alike.

Key Features of Forex Apps

Forex apps are essential tools for traders of all levels, offering a range of features to streamline trading activities and enhance performance. These features can be broadly categorized into essential and advanced functionalities, each serving a distinct purpose in the trading process.

Essential Features

Essential features are fundamental to any forex app, providing the core functionality needed for basic trading operations. These features are common across most forex apps, ensuring a standardized trading experience.

- Real-time Quotes: Access to real-time market data is crucial for informed trading decisions. Forex apps provide live quotes on currency pairs, enabling traders to track price fluctuations and identify potential trading opportunities.

- Charting Tools: Charting tools are essential for analyzing market trends and patterns. Forex apps typically offer a variety of chart types, including line, bar, candlestick, and others. These charts can be customized with various indicators and technical analysis tools to gain insights into market behavior.

- Order Execution: Forex apps facilitate seamless order execution, allowing traders to place buy or sell orders for currency pairs. These apps typically support different order types, such as market orders, limit orders, and stop-loss orders, providing flexibility in managing trades.

- Account Management: Forex apps provide a secure platform for managing trading accounts. This includes viewing account balances, trade history, and other relevant information. Some apps also offer features for deposit and withdrawal management.

Advanced Features

Beyond essential features, some forex apps offer advanced functionalities that cater to experienced traders seeking to enhance their trading strategies and optimize performance. These features often provide sophisticated tools for analysis, automation, and risk management.

- Automated Trading: Automated trading, also known as algorithmic trading, allows traders to set predefined rules for executing trades based on specific market conditions. Forex apps with automated trading features often provide a range of pre-built trading strategies or allow users to create their own custom algorithms.

- Sentiment Analysis: Sentiment analysis tools analyze market sentiment based on news articles, social media posts, and other data sources. This information can provide insights into the overall market mood and potentially identify upcoming trends.

- Risk Management Tools: Risk management tools are essential for controlling potential losses in trading. Forex apps may offer features such as stop-loss orders, trailing stops, and position sizing tools to help traders manage their risk exposure.

Comparison of Forex App Features

The table below compares the features of different forex apps across various categories, highlighting their strengths and weaknesses:

| App Name | Real-time Quotes | Charting Tools | Order Execution | Account Management | Automated Trading | Sentiment Analysis | Risk Management Tools |

|---|---|---|---|---|---|---|---|

| MetaTrader 4 (MT4) | Yes | Yes | Yes | Yes | Yes | No | Yes |

| MetaTrader 5 (MT5) | Yes | Yes | Yes | Yes | Yes | No | Yes |

| TradingView | Yes | Yes | No | No | No | Yes | No |

| cTrader | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Thinkorswim | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Conclusion

In conclusion, forex apps have transformed the forex trading landscape, empowering individuals with the tools and resources they need to participate in this exciting and dynamic market. By understanding the different types of apps available, their key features, and how to choose the right one, you can unlock the potential of forex trading and navigate the market with confidence. As technology continues to evolve, forex apps are poised to play an even greater role in shaping the future of financial trading.

FAQ Compilation

What are the risks associated with using forex apps?

Forex trading, regardless of the platform used, carries inherent risks. It’s crucial to understand the potential for losses, leverage, and market volatility. Always invest responsibly and only what you can afford to lose.

Are forex apps regulated?

The regulatory landscape for forex apps varies depending on your location. Ensure the app you choose is regulated by a reputable financial authority to protect your funds and personal information.

How do I find a reliable forex app?

Look for apps with positive reviews, a strong reputation, and a clear regulatory framework. Consider factors like the app’s features, user interface, customer support, and security measures.

Are forex apps suitable for beginners?

Many forex apps offer educational resources, tutorials, and demo accounts that are beneficial for beginners. However, it’s important to start with a thorough understanding of forex trading basics before using any app.