- Understanding “No Forex Fee Credit Cards”

- Identifying “No Forex Fee” Credit Card Features: No Forex Fee Credit Card

- Benefits of Using “No Forex Fee” Credit Cards

- Considerations for Choosing “No Forex Fee” Credit Cards

- Finding and Applying for “No Forex Fee” Credit Cards

- Using “No Forex Fee” Credit Cards Responsibly

- Ultimate Conclusion

- Questions Often Asked

No forex fee credit cards offer a convenient way to avoid hefty foreign exchange fees when traveling or making purchases abroad. These cards can save you significant money on international transactions, especially if you frequently travel or shop online from international retailers.

These cards typically work by converting your purchases at the prevailing interbank exchange rate, eliminating the markup that traditional credit cards often charge. This can be a huge advantage, especially for larger purchases or when traveling to destinations with high exchange rates.

Understanding “No Forex Fee Credit Cards”

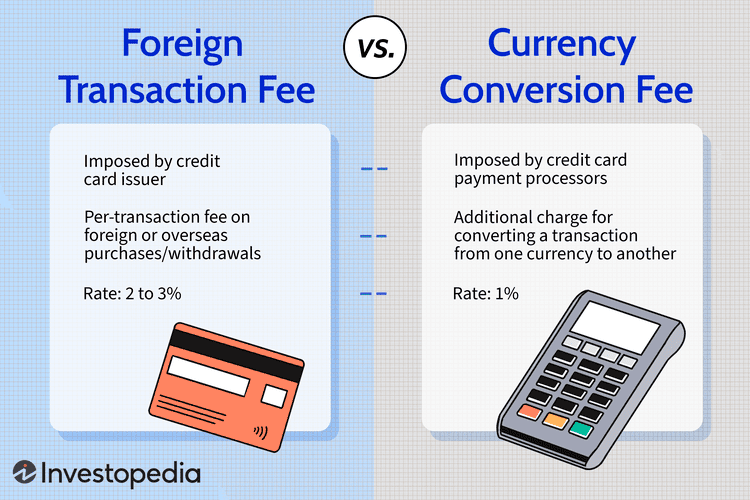

When you make a purchase in a foreign currency using a credit card, you’re likely to encounter a fee known as a foreign exchange fee, or forex fee. These fees are charged by your card issuer for converting the foreign currency into your home currency. Forex fees can add up quickly, especially for frequent travelers or online shoppers who make purchases in different currencies.

Forex Fees: A Closer Look

Forex fees are a percentage of the transaction amount, typically ranging from 1% to 3%. This percentage is applied to the amount you spend in the foreign currency after it is converted to your home currency.

For example, if you make a purchase of $100 USD in a store in Canada, and the current exchange rate is 1 USD = 1.30 CAD, your transaction will be converted to 130 CAD. If your credit card charges a 2% forex fee, you will be charged an additional 2.60 CAD (2% of 130 CAD) on top of the original 130 CAD. This means you’ll end up paying 132.60 CAD for your $100 USD purchase.

Situations Where Forex Fees Apply, No forex fee credit card

Forex fees can apply in various situations, including:

- Making purchases in foreign countries, either online or in person.

- Withdrawing cash from ATMs in foreign countries.

- Paying for goods or services online in foreign currencies.

- Transferring money to foreign bank accounts.

Benefits of Using a No Forex Fee Credit Card

Credit cards with no forex fees offer a significant advantage for travelers and international shoppers by eliminating these hidden costs. Here are some key benefits:

- Save money: The most significant benefit is avoiding the extra cost associated with forex fees. These fees can quickly add up, especially for large purchases or frequent transactions.

- Predictable spending: You can better budget your spending when you know exactly how much you’ll be charged for each transaction, without the surprise of added forex fees.

- Convenience: No forex fee cards simplify your travel and online shopping experiences by eliminating the hassle of calculating exchange rates and forex fees.

Identifying “No Forex Fee” Credit Card Features: No Forex Fee Credit Card

It’s essential to be aware of the features that truly make a credit card “no forex fee.” Don’t be fooled by misleading marketing claims. A credit card that advertises “no forex fees” might still charge hidden fees or apply exchange rates that disadvantage you. Here’s what to look for to ensure you’re getting a genuine “no forex fee” deal.

Key Features to Look For

The most important aspect of a “no forex fee” credit card is the absence of any markup on the exchange rate used for foreign transactions. This means the exchange rate applied to your transaction should be the same as the mid-market rate, which is the rate used by banks and financial institutions for currency exchanges. However, it’s crucial to look for additional features that ensure minimal or no fees associated with foreign transactions.

- No Foreign Transaction Fees: This is the most basic requirement for a “no forex fee” credit card. The card issuer should not charge any additional fees for using the card outside your home country.

- Mid-Market Exchange Rate: The card should use the mid-market rate for currency conversions, which is the most favorable rate available. Avoid cards that use a markup on the mid-market rate, as this will increase your transaction costs.

- No Balance Transfer Fees: If you need to transfer a balance from another credit card, make sure there are no associated fees, especially if the balance is in a foreign currency.

- No ATM Withdrawal Fees: While some cards offer “no forex fees” for purchases, they might still charge fees for cash withdrawals from ATMs abroad.

- Free International Travel Insurance: Some credit cards offer travel insurance as a perk, which can be valuable for international trips. Look for cards that include coverage for medical emergencies, lost luggage, and trip cancellation.

- Travel Rewards Program: A good rewards program can offset the cost of travel expenses. Look for cards that offer rewards points or miles that can be redeemed for flights, hotels, or other travel-related expenses.

Comparison of Forex Fee Features

Different credit cards offer varying features related to forex fees. Here’s a comparison of common features and their implications:

| Feature | Description | Implications |

|---|---|---|

| No Foreign Transaction Fees | The card issuer does not charge any additional fees for using the card outside your home country. | This is a basic requirement for a “no forex fee” card. |

| Mid-Market Exchange Rate | The card uses the mid-market rate for currency conversions. | This ensures you get the most favorable exchange rate. |

| Markup on Mid-Market Rate | The card applies a markup on the mid-market rate for currency conversions. | This can significantly increase your transaction costs. |

| No Balance Transfer Fees | The card issuer does not charge fees for transferring a balance from another credit card. | This is beneficial if you need to transfer a balance in a foreign currency. |

| ATM Withdrawal Fees | The card issuer charges fees for cash withdrawals from ATMs abroad. | This can add up quickly, especially for frequent travelers. |

Benefits of Using “No Forex Fee” Credit Cards

Using a credit card with no foreign transaction fees offers significant financial advantages, especially when traveling internationally or making purchases in foreign currencies. These cards can save you a substantial amount of money on travel expenses, making your trips more affordable and enjoyable.

Savings on Travel Expenses

No forex fee credit cards eliminate the additional charges that traditional credit cards impose on foreign transactions. This translates into direct savings on your travel expenses, allowing you to stretch your budget further.

- Hotel Bookings: When booking hotels in a foreign country, the lack of forex fees means you pay the actual price listed without any hidden charges.

- Restaurant Bills: Enjoy your meals without worrying about extra fees when dining out in foreign restaurants.

- Shopping Spree: Indulge in souvenirs and local products without the added burden of forex fees on your purchases.

- Transportation: Whether you’re using public transport, taxis, or rental cars, you’ll save money by avoiding forex fees on these transactions.

Potential Savings Compared to Traditional Credit Cards

Let’s illustrate the potential savings with a simple example:

| Transaction | Amount in Foreign Currency | Forex Fee (Traditional Card) | Final Cost (Traditional Card) | Final Cost (No Forex Fee Card) |

|---|---|---|---|---|

| Hotel Stay | €1000 | 3% | €1030 | €1000 |

| Restaurant Meal | $100 | 2.5% | $102.50 | $100 |

| Shopping | £500 | 1.5% | £507.50 | £500 |

As you can see, even with modest forex fees, the savings from using a no forex fee card can be substantial, especially when you consider the cumulative effect of multiple transactions.

Considerations for Choosing “No Forex Fee” Credit Cards

While “No Forex Fee” credit cards seem like a great deal, it’s crucial to consider some potential drawbacks and limitations before committing to one. These cards often come with terms and conditions that could affect the advertised benefits.

Potential Drawbacks and Limitations

It’s important to be aware of the potential drawbacks or limitations of “No Forex Fee” credit cards to make an informed decision. These cards might not be suitable for all situations.

- Hidden Fees: Although these cards waive forex fees, they might have other fees, such as annual fees, foreign transaction fees, or cash advance fees. It’s essential to read the fine print and compare fees across different cards.

- Limited Currency Conversion Rates: While these cards might not charge a forex fee, they may use their own exchange rates, which might not always be the most favorable. It’s crucial to compare the offered exchange rates with those of other providers.

- Limited Acceptance: Some “No Forex Fee” credit cards might not be accepted everywhere, particularly in smaller businesses or less-developed countries. It’s essential to check the card’s acceptance network before traveling.

- Transaction Processing Time: Transactions made with “No Forex Fee” cards might take longer to process due to the involvement of foreign currency conversion. This could be a concern if you need immediate access to funds.

Credit Card Terms and Conditions

Understanding the terms and conditions of “No Forex Fee” credit cards is crucial. These terms might influence the forex fee waivers and could affect the overall cost of using the card.

- Currency Conversion Thresholds: Some cards might waive forex fees only for transactions exceeding a certain threshold, such as a minimum amount or currency conversion rate. Transactions below the threshold could still incur forex fees.

- Exclusions: Certain transactions, such as cash advances or balance transfers, might not be eligible for forex fee waivers. It’s essential to read the terms and conditions to understand these exclusions.

- Promotional Periods: Some cards might offer forex fee waivers only during a promotional period. After the promotion ends, the card might start charging forex fees. It’s important to be aware of the duration of the promotional period.

Comparing Credit Card Offers

Comparing different credit card offers is essential before making a decision. This helps identify the best card for your needs and budget.

- Fees and Charges: Compare the annual fees, foreign transaction fees, cash advance fees, and other charges associated with each card. Consider the overall cost of using the card, including forex fees, and choose the card with the most favorable fees.

- Currency Conversion Rates: Compare the currency conversion rates offered by different cards and choose the card with the most favorable rates. Consider the difference between the offered rates and those of other providers, such as banks or money transfer services.

- Rewards and Benefits: Compare the rewards and benefits offered by different cards, such as cashback, travel points, or insurance. Choose the card that offers the most valuable rewards and benefits for your spending habits and travel needs.

Finding and Applying for “No Forex Fee” Credit Cards

Now that you understand the benefits of “No Forex Fee” credit cards, you’re likely eager to find one that suits your needs. This section will guide you through the process of finding and applying for these cards, maximizing your chances of approval.

Reputable Credit Card Providers

Several reputable financial institutions offer credit cards with no foreign transaction fees.

- Major Banks: Many major banks, such as Chase, Bank of America, and Citibank, offer credit cards with no foreign transaction fees. These cards often come with additional benefits like travel rewards, purchase protection, and extended warranties.

- Credit Unions: Credit unions are known for their competitive rates and member-focused services. Some credit unions offer “No Forex Fee” cards with perks like cash back rewards and low APRs.

- Specialty Card Issuers: Companies like Capital One and Discover offer credit cards specifically designed for international travel, often with no foreign transaction fees and travel-related benefits.

Applying for a “No Forex Fee” Credit Card

The application process is generally straightforward and can be completed online, over the phone, or in person at a branch.

- Compare Cards: Use online comparison tools or browse the websites of various card providers to compare features, benefits, and fees. Look for cards that offer no foreign transaction fees, as well as other features that align with your travel needs and spending habits.

- Check Eligibility: Before applying, check your credit score and ensure you meet the eligibility requirements for the card. Some cards have minimum income or credit score requirements. You can access your credit score through credit bureaus like Experian, Equifax, or TransUnion.

- Gather Necessary Documents: Prepare the required documents, including your Social Security number, income verification, and proof of address. Having these documents readily available will streamline the application process.

- Submit Application: Complete the online application form or contact the card issuer to apply over the phone. Provide accurate and complete information to avoid delays in processing.

- Review Approval: After submitting your application, you will receive a decision within a few days. If approved, you will receive your credit card in the mail. If denied, the issuer will provide information on the reason for the denial, which can help you improve your chances of approval in the future.

Tips for Maximizing Approval Chances

- Improve Your Credit Score: A higher credit score significantly increases your chances of approval and can help you qualify for cards with better terms and rewards. Pay your bills on time, keep credit utilization low, and avoid opening too many new accounts.

- Apply for Cards You’re Likely to Be Approved For: Research the eligibility requirements of different cards and apply for those that align with your credit history and income. Applying for too many cards in a short period can negatively impact your credit score.

- Consider a Secured Credit Card: If you have limited credit history or a low credit score, consider a secured credit card. These cards require a security deposit, which reduces the issuer’s risk and can help you build credit over time.

- Be Prepared to Provide Additional Information: Card issuers may request additional information during the application process, such as income verification or proof of residency. Have these documents readily available to expedite the approval process.

Using “No Forex Fee” Credit Cards Responsibly

While “No Forex Fee” credit cards offer significant savings, responsible usage is crucial to maximize their benefits and avoid potential pitfalls. This involves managing your spending, understanding the nuances of these cards, and ensuring you’re not accumulating unnecessary debt.

Managing Your Credit Card Usage

- Track your spending: Regularly monitor your credit card statements and online account activity to stay informed about your spending patterns and ensure you’re within your budget. Tools like budgeting apps can help you track expenses and identify areas for potential savings.

- Pay your balance in full each month: Aim to pay off your entire credit card balance before the due date to avoid accumulating interest charges. This is particularly important with “No Forex Fee” cards, as they may have high interest rates to offset the lack of foreign transaction fees.

- Avoid cash advances: Cash advances usually come with high interest rates and fees, negating the benefits of “No Forex Fee” cards. Opt for using your card for purchases and avoid cash withdrawals.

- Understand the grace period: The grace period is the time you have to pay your balance without incurring interest charges. Make full payments within the grace period to maximize savings.

- Be mindful of foreign exchange rates: While “No Forex Fee” cards eliminate transaction fees, they still use the prevailing foreign exchange rate at the time of the purchase. Be aware of fluctuations in exchange rates and their impact on your spending.

Ultimate Conclusion

By choosing a no forex fee credit card, you can enjoy the freedom of traveling and shopping internationally without the worry of hidden fees. Remember to compare different offers, consider the card’s features, and ensure it aligns with your spending habits. With a little research, you can find a no forex fee credit card that meets your needs and helps you save money on your international transactions.

Questions Often Asked

What are the typical forex fees charged by traditional credit cards?

Traditional credit cards often charge a percentage of the transaction amount as a foreign exchange fee, usually between 1% and 3%. This fee is added to the exchange rate, making your purchases more expensive.

Are there any other fees associated with no forex fee credit cards?

While no forex fee cards eliminate the foreign exchange fee, they may have other fees, such as annual fees, transaction fees, or balance transfer fees. It’s crucial to read the card’s terms and conditions carefully to understand all associated fees.

Do all no forex fee credit cards offer the same benefits?

No, no forex fee credit cards can vary in their benefits and features. Some may offer rewards programs, travel insurance, or other perks. It’s essential to compare different cards to find one that suits your needs and preferences.