Best Forex trading platforms are the gateway to the exciting world of foreign exchange markets. They offer a variety of features and functionalities that can help traders of all levels navigate the complexities of trading currencies.

From advanced charting tools and technical indicators to real-time market data and educational resources, these platforms empower traders to make informed decisions and potentially maximize their returns. But with so many options available, choosing the right platform can feel overwhelming. This guide will explore the key factors to consider when selecting a Forex trading platform, analyze the top platforms in the market, and provide insights into the features that can enhance your trading experience.

Introduction to Forex Trading Platforms

Forex trading platforms are essential tools for traders to access the foreign exchange market and execute trades. They provide a user interface to view market data, place orders, manage positions, and analyze trading strategies. Forex trading platforms are the bridge between traders and the global forex market.

Types of Forex Trading Platforms

The types of Forex trading platforms available cater to different trading styles and technological preferences.

- Desktop platforms: Desktop platforms are downloaded and installed on a computer. They offer advanced features and customization options, providing a comprehensive trading experience. These platforms are often favored by experienced traders who require in-depth analysis and charting capabilities. Popular examples include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Web-based platforms: Web-based platforms are accessed through a web browser, eliminating the need for downloads. They are convenient and accessible from any device with an internet connection. These platforms are suitable for beginners and those who prefer a simplified trading experience. Examples include TradingView and cTrader Web.

- Mobile platforms: Mobile platforms are designed for smartphones and tablets, providing traders with on-the-go access to the market. These platforms offer essential features like order placement, market data, and basic analysis tools. Mobile platforms are convenient for traders who need to monitor their trades or execute orders while away from their computers. Examples include MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile apps.

Factors to Consider When Choosing a Forex Trading Platform

Choosing the right forex trading platform is crucial for success in the market. With numerous platforms available, it can be overwhelming to decide which one suits your needs. To make an informed decision, consider several key factors, including platform security, regulation, trading tools, and your experience level.

Platform Security and Regulation

Security and regulation are paramount when choosing a forex trading platform. A secure platform protects your funds and personal information from unauthorized access. Regulatory oversight ensures the platform operates ethically and transparently, adhering to industry standards.

- Regulation: Look for platforms regulated by reputable financial authorities like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Commodity Futures Trading Commission (CFTC) in the US. Regulation provides a layer of protection for traders, ensuring the platform meets certain standards and is subject to oversight.

- Security Features: Security features like two-factor authentication (2FA), encryption, and secure data storage are essential. These measures help safeguard your account and prevent unauthorized access to your funds.

Trading Tools and Resources, Best forex trading platforms

Access to powerful trading tools and resources can significantly enhance your trading experience and potentially improve your results. Consider the platform’s offerings and how they align with your trading style and goals.

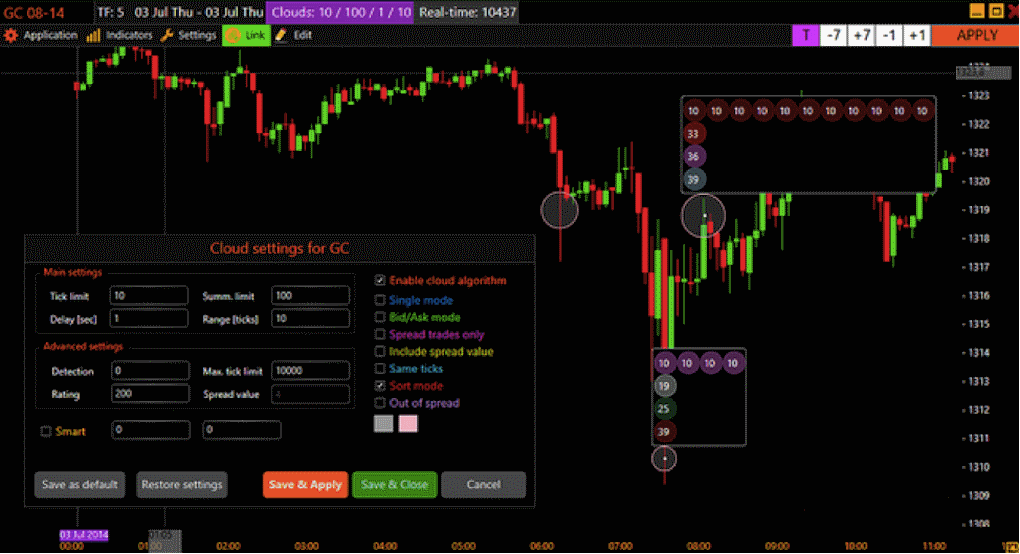

- Charting Tools: Advanced charting tools allow you to analyze price movements, identify trends, and make informed trading decisions. Look for platforms with customizable charts, technical indicators, and drawing tools to facilitate your analysis.

- Technical Indicators: Technical indicators help you identify trends, overbought or oversold conditions, and potential trading opportunities. A platform with a comprehensive selection of indicators can enhance your analysis and provide valuable insights.

- Educational Resources: Educational resources like articles, tutorials, webinars, and trading courses can be valuable for traders of all experience levels. Platforms offering comprehensive educational materials can help you learn the fundamentals of forex trading, develop your trading skills, and stay updated on market trends.

Factors for Different Experience Levels

The best forex trading platform for you will depend on your experience level and trading goals. Beginners might prioritize ease of use and educational resources, while experienced traders may seek advanced features and customization options.

- Beginners: For beginners, a user-friendly platform with intuitive navigation, educational resources, and a demo account for practice is essential. Look for platforms with clear explanations of forex trading concepts and tools to help you get started.

- Intermediate Traders: Intermediate traders might benefit from platforms with more advanced features like customizable charting tools, a wider range of technical indicators, and access to real-time market data. These features can help you refine your trading strategies and improve your decision-making.

- Advanced Traders: Experienced traders may seek platforms with advanced features like automated trading, expert advisors, and advanced order types. These features can help you execute complex strategies and potentially optimize your trading performance.

Top Forex Trading Platforms: Best Forex Trading Platforms

Choosing the right forex trading platform is crucial for your success in the market. It should offer a user-friendly interface, competitive trading fees, a wide range of assets, and robust security features. This section will explore some of the top forex trading platforms available, highlighting their key features, pros, and cons.

Top Forex Trading Platforms

| Platform | Minimum Deposit | Trading Fees | Available Assets | Key Features | Pros | Cons |

|---|---|---|---|---|---|---|

| MetaTrader 4 (MT4) | Varies by broker | Varies by broker | Forex, CFDs, Futures | Advanced charting, automated trading, expert advisors | Widely available, customizable, robust trading tools | Older interface, limited mobile features |

| MetaTrader 5 (MT5) | Varies by broker | Varies by broker | Forex, CFDs, Futures, Stocks | Advanced charting, automated trading, economic calendar | More advanced than MT4, supports multiple order types | Steeper learning curve, less widely available |

| cTrader | Varies by broker | Varies by broker | Forex, CFDs | Advanced charting, real-time market depth, order book | Fast execution speeds, excellent charting tools, intuitive interface | Less popular than MT4/MT5, limited mobile features |

| NinjaTrader | Varies by broker | Varies by broker | Forex, Futures, Stocks | Advanced charting, backtesting, automated trading | Powerful trading platform, customizable interface, comprehensive analytics | Steeper learning curve, can be resource-intensive |

| TradingView | Not applicable | Varies by broker | Forex, Stocks, Futures, Indices | Advanced charting, real-time data, social trading features | Excellent charting tools, free version available, community-driven | Limited trading functionality, fees can be high for premium features |

| eToro | $200 | Spread-based | Forex, Stocks, Cryptocurrencies, ETFs | Social trading, copy trading, educational resources | User-friendly interface, low minimum deposit, social trading features | Higher spreads than other platforms, limited advanced features |

| FXCM | $50 | Varies by instrument | Forex, CFDs, Futures | Advanced charting, real-time market data, educational resources | Competitive trading fees, reliable execution, strong customer support | Limited mobile features, complex platform for beginners |

| Oanda | $0 | Spread-based | Forex, CFDs, Precious Metals, Indices | Advanced charting, automated trading, educational resources | User-friendly interface, low minimum deposit, competitive spreads | Limited mobile features, less advanced features than MT4/MT5 |

Conclusive Thoughts

Ultimately, the best Forex trading platform for you depends on your individual needs, trading style, and experience level. By carefully considering the factors Artikeld in this guide, you can narrow down your choices and select a platform that aligns with your goals and helps you achieve success in the dynamic world of Forex trading.

Question & Answer Hub

What is a Forex trading platform?

A Forex trading platform is a software application that allows traders to buy and sell currencies online. It provides access to real-time market data, charting tools, and order execution capabilities.

How do I choose the best Forex trading platform for me?

Consider factors like regulation, security, trading tools, customer support, fees, and available assets. It’s also essential to choose a platform that suits your experience level and trading style.

Are there any free Forex trading platforms?

Many platforms offer demo accounts that allow you to practice trading with virtual funds without risking real money. However, most platforms charge fees for live trading.

What are the risks associated with Forex trading?

Forex trading involves significant risks, including the potential for losing your entire investment. It’s crucial to understand the risks involved before trading and to manage your risk effectively.

What are some popular Forex trading platforms?

Some popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. Each platform offers unique features and benefits.