Demo account forex provides a risk-free environment to hone your trading skills before venturing into the real market. This virtual trading platform allows you to experiment with various strategies, understand market dynamics, and gain confidence in your trading decisions.

Whether you’re a novice or an experienced trader, a demo account offers valuable insights and opportunities to enhance your trading prowess. By simulating real market conditions, you can test your trading strategies, refine your risk management techniques, and ultimately prepare yourself for live trading with greater confidence.

Introduction to Demo Accounts

A demo account is a practice trading account that simulates real-time market conditions, allowing you to learn and practice forex trading without risking any real money. It provides a safe and risk-free environment to develop your trading skills, experiment with different strategies, and get accustomed to the forex trading platform.

Benefits of Using a Demo Account

Demo accounts offer several advantages for both novice and experienced traders. They allow you to:

- Learn the basics of forex trading: Demo accounts provide a hands-on experience, helping you understand how forex trading works, the different order types, and the market dynamics.

- Test different trading strategies: You can experiment with various trading strategies and techniques without worrying about financial losses. This allows you to identify what works best for you and refine your approach.

- Develop your risk management skills: Demo accounts allow you to practice managing risk by setting stop-loss orders and controlling your position size. This helps you avoid significant losses when you transition to live trading.

- Gain confidence before live trading: By practicing with a demo account, you can build confidence in your trading abilities and prepare yourself for the challenges of real-time trading.

Types of Demo Accounts

Forex brokers offer different types of demo accounts, each with its unique features and benefits. Some common types include:

- Standard Demo Account: This is the most basic type of demo account, offering a realistic trading environment with access to a wide range of trading instruments and market data.

- Funded Demo Account: Some brokers provide funded demo accounts with a specific amount of virtual money to start trading. This allows you to experience the psychology of trading with a limited capital.

- Time-Limited Demo Account: These accounts have a limited duration, typically a few weeks or months. They are suitable for short-term practice and evaluation of trading strategies.

Features of a Forex Demo Account: Demo Account Forex

A demo account provides a risk-free environment to practice forex trading, allowing you to learn the ropes and refine your strategies without risking real money. This virtual trading environment replicates real market conditions, giving you a realistic feel for the trading process.

Virtual Funds

A demo account is equipped with virtual funds, often referred to as “demo money,” that you can use to place trades. These funds are not real money and are solely for practice purposes. They allow you to experience the mechanics of trading without financial risk. You can explore different trading strategies, test your risk management techniques, and get comfortable with the trading platform without any real-world financial consequences.

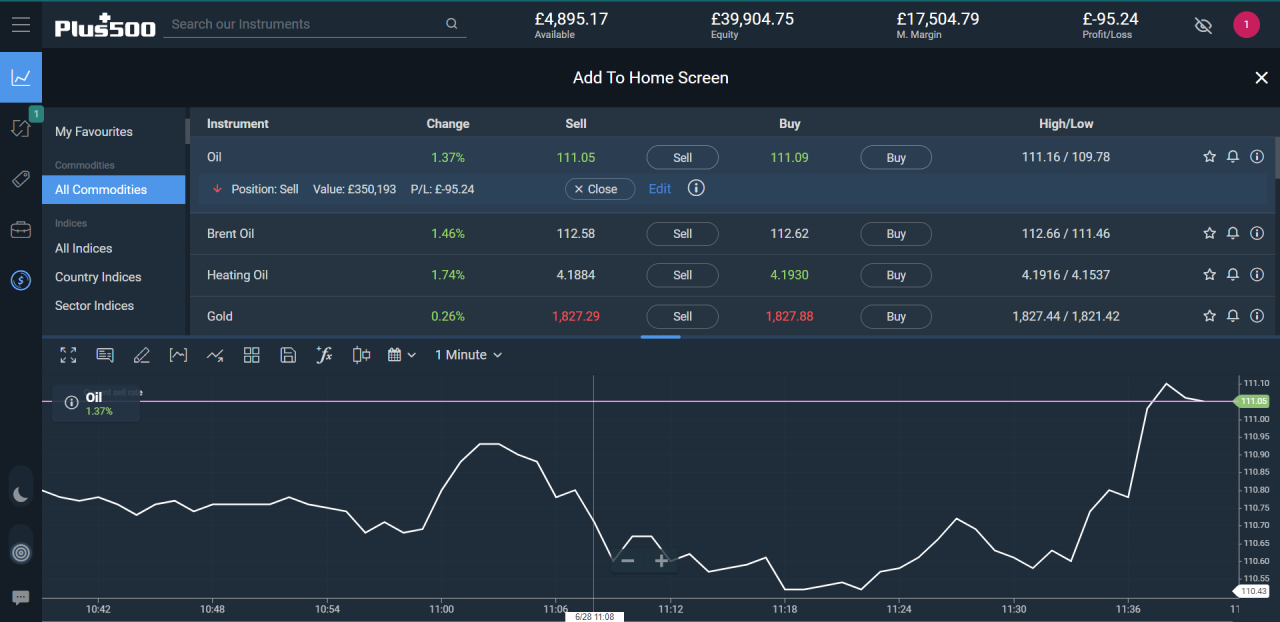

Real-Time Market Data

Demo accounts provide access to real-time market data, just like a live trading account. You can see the current prices of currency pairs, charts, and market indicators, all in real-time. This allows you to analyze market trends, identify trading opportunities, and practice your technical analysis skills.

Trading Platform Access

Demo accounts usually provide access to the same trading platform used for live trading. This means you can familiarize yourself with the platform’s features, including placing orders, managing trades, setting stop-loss and take-profit orders, and using advanced charting tools. The platform experience in a demo account mirrors the live trading environment, allowing you to gain confidence and prepare for actual trading.

Order Execution

The order execution process in a demo account simulates the actual execution of orders in a live trading environment. When you place an order on a demo account, it is processed in real-time, giving you an accurate representation of how your trades would be executed in a live market. This feature helps you understand the nuances of order execution, including slippage and order fills.

Differences Between Demo and Live Accounts

While demo accounts offer a valuable training ground, they differ from live trading accounts in several key aspects:

- Real Money vs. Virtual Funds: The most significant difference is that demo accounts use virtual funds, while live accounts require you to invest real money.

- Emotional Impact: Live trading involves real financial risk, which can trigger emotional responses like fear and greed. Demo accounts lack this emotional element, as there are no real financial consequences for your trading decisions.

- Market Conditions: While demo accounts strive to replicate real market conditions, they may not perfectly reflect the volatility and unpredictability of live markets.

- Account Features: Some advanced features, like margin trading and leverage, might not be fully accessible or may have limitations in demo accounts.

Accessing and Using a Demo Account

To access a demo account, you usually need to register with a forex broker. Most brokers offer demo accounts as part of their services. The registration process is typically straightforward and often involves providing basic personal information. Once registered, you can log in to your demo account and start practicing.

Benefits of Using a Demo Account

A demo account is a valuable tool for traders of all experience levels. It provides a risk-free environment to practice trading strategies, learn about the forex market, and gain confidence before investing real money.

Benefits for Beginners, Demo account forex

Demo accounts are especially beneficial for new traders who are unfamiliar with the forex market. They allow beginners to:

- Learn the basics of forex trading: Beginners can experiment with different order types, understand how leverage works, and familiarize themselves with trading platforms without risking any capital.

- Test trading strategies: Demo accounts provide a platform to test various trading strategies without any financial risk. This allows beginners to identify profitable strategies and refine their trading approach.

- Develop trading discipline: The risk-free environment of a demo account encourages disciplined trading habits. Beginners can practice managing their emotions and avoiding impulsive decisions that could lead to losses in a live account.

- Build confidence: Successful trading on a demo account can boost confidence and prepare beginners for the transition to live trading.

Benefits for Experienced Traders

Experienced traders can also benefit from using a demo accounts to:

- Test new trading strategies: Experienced traders can use demo accounts to evaluate new trading strategies or refine existing ones without risking real capital. This allows them to stay ahead of the curve and adapt to changing market conditions.

- Practice trading in different market conditions: Demo accounts allow traders to simulate various market conditions, such as high volatility or low liquidity. This helps them develop a comprehensive understanding of how their strategies perform in different market environments.

- Experiment with new trading tools: Demo accounts provide a safe space to explore new trading tools, indicators, and platforms without the pressure of live trading. This helps traders stay updated with the latest advancements in the forex market.

- Improve risk management skills: Demo accounts allow traders to practice risk management techniques and test different risk management strategies in a safe environment. This helps them develop a strong risk management plan and avoid significant losses in live trading.

Comparing Demo Accounts to Live Accounts

Here is a table comparing the key differences between demo and live accounts:

| Feature | Demo Account | Live Account |

|---|---|---|

| Risk | No risk | Real financial risk |

| Funds | Virtual funds | Real money |

| Market conditions | Simulated market conditions | Real-time market conditions |

| Emotions | Reduced emotional impact | Higher emotional impact |

| Trading experience | Practice trading | Real trading experience |

Limitations of Demo Accounts

While demo accounts offer significant benefits, it’s important to be aware of their limitations:

- Simulated market conditions: Demo accounts do not replicate the true dynamics of the forex market, including real-time market data, order execution delays, and slippage. These factors can influence trading outcomes and may not be accurately reflected in a demo environment.

- Lack of emotional impact: Trading on a demo account does not involve the same emotional pressure as trading with real money. This can lead to unrealistic expectations and a lack of discipline when transitioning to a live account.

- Limited access to advanced features: Some demo accounts may not offer all the features and functionalities available in a live account, such as advanced order types, complex trading tools, or access to specific market data.

Choosing a Forex Broker with a Demo Account

Choosing the right Forex broker is crucial for a successful trading journey, especially when you’re just starting out. A demo account provides a risk-free environment to practice your trading skills and get familiar with the platform before risking real money. But before you dive into the world of demo accounts, it’s essential to choose a broker that meets your needs and offers a reliable demo experience.

Choosing the Right Broker

Selecting a Forex broker with a demo account involves considering several factors to ensure a smooth and enriching learning experience. Here’s a checklist to help you navigate the process:

- Reputation and Regulation: Choose a broker with a proven track record, regulated by reputable financial authorities like the FCA (Financial Conduct Authority) in the UK or the ASIC (Australian Securities and Investments Commission) in Australia. This ensures the broker operates within a regulated framework, protecting your funds and trading activities.

- Demo Account Features: Evaluate the demo account’s features, such as the availability of various trading instruments, realistic market conditions, and the ability to access real-time market data. Look for a broker that offers a demo account with a similar experience to their live trading platform.

- Trading Platform: Assess the trading platform’s user-friendliness, functionality, and features. Consider factors like order execution speed, charting tools, technical indicators, and the availability of educational resources.

- Customer Support: Reliable customer support is essential, especially when you’re new to Forex trading. Look for a broker with responsive and knowledgeable customer support available through multiple channels, such as email, phone, or live chat.

- Account Funding and Withdrawal: Understand the broker’s account funding and withdrawal methods, fees, and processing times. Ensure the process is convenient and transparent.

- Educational Resources: Consider the availability of educational resources, such as webinars, tutorials, and market analysis reports, to enhance your learning experience and improve your trading skills.

Comparing Forex Brokers

To make an informed decision, it’s helpful to compare different Forex brokers based on key features and criteria. Here’s a table that Artikels some essential aspects to consider:

| Feature | Broker A | Broker B | Broker C |

|---|---|---|---|

| Regulation | FCA, ASIC | CySEC | FSA |

| Trading Platform | MetaTrader 4, MetaTrader 5 | cTrader | NinjaTrader |

| Demo Account Features | Realistic market conditions, full trading instruments | Limited instruments, simulated market data | Full trading instruments, real-time market data |

| Customer Support | 24/5 multi-channel support | Email and phone support | Live chat and email support |

| Educational Resources | Webinars, tutorials, market analysis reports | Limited educational materials | Comprehensive educational resources |

Reputable Forex Brokers with Demo Accounts

Here’s a list of reputable Forex brokers that offer demo accounts, allowing you to practice your trading skills and explore different trading strategies before risking real money:

- FXTM: FXTM (ForexTime) is a well-established broker regulated by multiple financial authorities. They offer a comprehensive demo account with access to various trading instruments, real-time market data, and a user-friendly trading platform.

- XM: XM is another reputable broker known for its competitive spreads and generous bonuses. Their demo account provides a realistic trading experience with full access to trading instruments and market data.

- AvaTrade: AvaTrade is a global broker regulated by multiple financial authorities, offering a wide range of trading instruments and a user-friendly trading platform. Their demo account is designed to replicate real market conditions, providing a valuable learning experience.

- IG: IG is a leading CFD broker with a strong reputation and a user-friendly platform. Their demo account allows you to practice trading various financial instruments, including Forex, shares, indices, and commodities.

How to Use a Demo Account Effectively

A demo account is a valuable tool for forex traders of all levels, from beginners to experienced professionals. It allows you to practice trading in a risk-free environment, experiment with different strategies, and gain valuable experience before risking real money.

Utilizing a Demo Account for Practice and Strategy Testing

To effectively utilize a demo account, follow these steps:

- Familiarize yourself with the platform: Before you start trading, take some time to understand the trading platform’s interface, features, and functionalities. Explore the order types, charting tools, indicators, and other resources available. This will help you navigate the platform comfortably and efficiently.

- Start with a simple strategy: When you’re new to trading, it’s best to start with a simple strategy that you can easily understand and execute. Focus on learning the basics of forex trading, such as identifying trends, placing orders, and managing your risk. As you gain more experience, you can gradually explore more complex strategies.

- Practice different order types: Forex trading offers various order types, such as market orders, limit orders, stop-loss orders, and take-profit orders. Experiment with different order types on your demo account to understand their functionalities and how they can be used to your advantage.

- Test your trading plan: Develop a trading plan that Artikels your entry and exit points, risk management strategy, and profit targets. Test your plan thoroughly on the demo account to see if it’s profitable and sustainable in real-market conditions. This process will help you refine your strategy and identify any potential weaknesses before risking real capital.

- Track your performance: Keep a record of your trades, including your entry and exit points, profit and loss, and reasons for each trade. This will help you identify your strengths and weaknesses and make necessary adjustments to your trading plan.

Learning about Different Trading Strategies

A demo account provides a safe space to explore various trading strategies without risking real money.

- Scalping: This strategy involves making small profits from short-term price fluctuations. It requires quick decision-making and a high level of discipline. On a demo account, you can practice scalping techniques and refine your entry and exit points.

- Day Trading: Day traders open and close positions within a single trading day. This strategy requires close monitoring of market movements and a high level of risk tolerance. A demo account allows you to test different day trading strategies and evaluate their effectiveness without risking your capital.

- Swing Trading: Swing traders aim to capture price movements over a few days or weeks. This strategy requires patience and a good understanding of market trends. On a demo account, you can experiment with swing trading strategies and analyze how they perform in different market conditions.

- Trend Trading: Trend traders identify and follow long-term trends in the market. This strategy requires a strong understanding of technical analysis and patience. A demo account allows you to practice identifying trends and develop a robust trend-following strategy.

Setting Realistic Goals and Managing Risk

While a demo account offers a risk-free environment, it’s crucial to set realistic goals and manage risk effectively.

- Set achievable goals: Avoid setting unrealistic expectations, such as aiming for huge profits in a short time. Instead, focus on improving your trading skills and consistency. Start with small, achievable goals and gradually increase your targets as you gain more experience.

- Manage your risk: Even though you’re not risking real money on a demo account, it’s important to practice proper risk management. This includes setting stop-loss orders to limit potential losses, using leverage responsibly, and diversifying your portfolio. By practicing these risk management techniques on a demo account, you’ll be better prepared when you start trading with real money.

Transitioning from Demo to Live Trading

The transition from a demo account to live trading can be daunting, but it’s a crucial step in becoming a successful forex trader. While a demo account provides a risk-free environment to learn the ropes, live trading involves real money and requires a different mindset and approach.

This section explores key strategies and tips for making a smooth transition from demo to live trading, emphasizing the importance of a well-defined trading plan, risk management, and emotional control.

Developing a Trading Plan

A trading plan is your roadmap to success in the forex market. It Artikels your trading goals, risk tolerance, preferred trading strategies, and exit criteria. A well-defined plan helps you stay disciplined, make informed decisions, and avoid emotional trading.

Here are key components of a successful trading plan:

- Define your trading goals: What are you aiming to achieve with forex trading? Do you want to generate passive income, grow your capital, or simply learn the market dynamics? Clearly defining your goals will help you choose the right trading strategies and manage your expectations.

- Assess your risk tolerance: How much risk are you comfortable taking with your capital? Determine your risk tolerance level and stick to it. A risk tolerance assessment can help you decide on appropriate position sizes and stop-loss levels.

- Select trading strategies: Choose trading strategies that align with your goals and risk tolerance. Research different strategies, test them on a demo account, and identify those that suit your trading style and market preferences.

- Set entry and exit criteria: Clearly define your entry and exit points for each trade. This will help you avoid emotional decisions and stick to your trading plan.

- Implement risk management rules: Establish rules for managing risk, including position sizing, stop-loss orders, and maximum drawdown limits. Risk management is crucial for preserving capital and preventing significant losses.

Managing Risk Effectively

Risk management is paramount in forex trading. It involves strategies and techniques to minimize potential losses and protect your capital. Effective risk management is crucial for both beginners and experienced traders.

Here are some essential risk management principles:

- Use stop-loss orders: Stop-loss orders are essential for limiting potential losses on each trade. They automatically close your position when the price reaches a predetermined level, preventing further losses.

- Position sizing: Determine the appropriate position size for each trade based on your risk tolerance and account balance. Avoid overtrading and risking too much capital on a single trade.

- Diversify your portfolio: Spread your investments across different currency pairs or assets to reduce overall risk. Diversification helps mitigate the impact of adverse price movements in a single asset.

- Set a maximum drawdown limit: Define the maximum percentage of your account balance you are willing to lose. This helps you avoid significant losses and manage your risk effectively.

- Regularly monitor and adjust your risk management strategy: Review your risk management approach periodically and make adjustments as needed. The market is constantly changing, and your risk management strategies should adapt accordingly.

Psychological Aspects of Trading

Trading psychology plays a crucial role in success. Emotional decisions often lead to poor trading outcomes. Mastering your emotions and developing a disciplined approach is essential for consistent profitability.

Here are some tips for managing your trading psychology:

- Avoid emotional trading: Don’t let fear, greed, or excitement influence your trading decisions. Stick to your trading plan and avoid impulsive actions.

- Develop a trading journal: Record your trades, including your rationale, entry and exit points, and outcomes. This helps you analyze your performance, identify patterns, and improve your decision-making.

- Take breaks when needed: If you feel overwhelmed or emotional, take a break from trading. It’s important to maintain a clear mind and avoid making decisions when you’re not in the right frame of mind.

- Learn from your mistakes: Don’t be afraid to acknowledge and learn from your mistakes. Analyze your losses, identify the underlying causes, and adjust your trading plan accordingly.

- Seek guidance from experienced traders: Connect with other traders, attend workshops, or join online forums to learn from their experiences and gain valuable insights.

Closing Notes

In conclusion, a demo account forex is an indispensable tool for traders of all levels. It allows you to practice, learn, and refine your trading skills in a safe and controlled environment. By leveraging the benefits of a demo account, you can significantly increase your chances of success in the dynamic world of forex trading.

Key Questions Answered

What is the difference between a demo account and a live account?

A demo account uses virtual funds and simulates real market conditions, while a live account uses real money and exposes you to actual market risks.

How long can I use a demo account?

Most forex brokers offer unlimited access to demo accounts, allowing you to practice and learn at your own pace.

Is it necessary to use a demo account before live trading?

While not mandatory, using a demo account is highly recommended to gain experience, test strategies, and develop confidence before risking real capital.