Trading with Forex sets the stage for an exploration of the global currency market, where trillions of dollars change hands daily. This dynamic marketplace offers opportunities for investors to profit from currency fluctuations, but it also presents unique challenges and risks. This guide provides a comprehensive overview of Forex trading, covering everything from the fundamentals to advanced strategies and risk management techniques.

From understanding the factors that drive currency exchange rates to mastering trading platforms and tools, we delve into the intricacies of this exciting and potentially lucrative market. Whether you are a seasoned investor or a curious beginner, this guide aims to equip you with the knowledge and insights necessary to navigate the world of Forex trading.

Introduction to Forex Trading

Forex trading, short for foreign exchange trading, involves the buying and selling of currencies in the global financial market. It is the largest and most liquid financial market globally, with trillions of dollars exchanged daily.

Forex trading offers various opportunities for individuals and institutions to profit from currency fluctuations. Understanding the dynamics of currency exchange rates and market trends is crucial for success in this dynamic market.

Key Features of Forex Trading

Forex trading presents unique characteristics that distinguish it from other financial markets. Here are some key features:

- 24/5 Accessibility: The Forex market operates 24 hours a day, five days a week, allowing traders to access it anytime, anywhere. This global accessibility enables traders to take advantage of market opportunities across different time zones.

- High Leverage Potential: Forex trading offers leverage, which allows traders to control a larger position with a smaller amount of capital. Leverage can amplify both profits and losses, making it crucial to manage risk effectively.

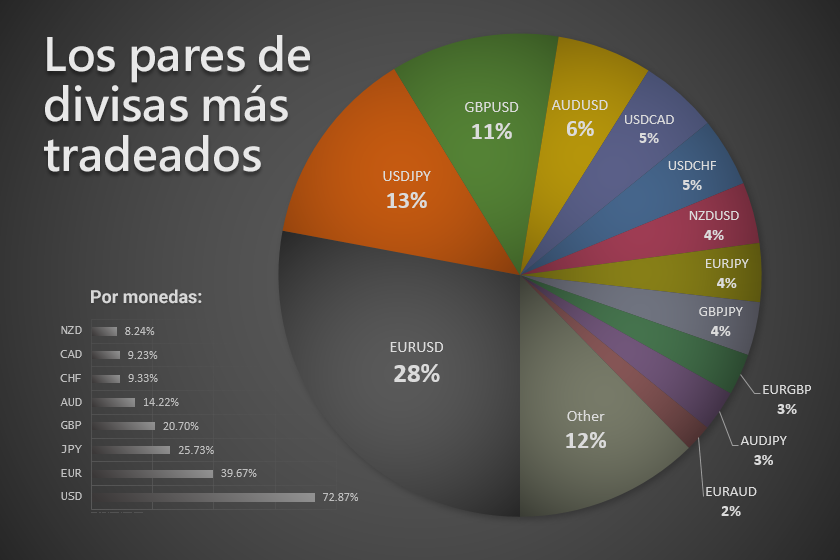

- Diverse Trading Instruments: The Forex market offers a wide range of currency pairs to trade, providing traders with diverse options to suit their trading strategies and risk tolerance. Currency pairs are combinations of two currencies, such as the Euro/US Dollar (EUR/USD) or the British Pound/Japanese Yen (GBP/JPY).

Commonly Traded Currency Pairs

The Forex market encompasses a vast array of currency pairs, each representing a specific relationship between two currencies. Here are some of the most commonly traded currency pairs:

- EUR/USD (Euro/US Dollar): The Euro/US Dollar pair is the most actively traded currency pair globally, reflecting the significant economic influence of the Eurozone and the United States.

- USD/JPY (US Dollar/Japanese Yen): The US Dollar/Japanese Yen pair is another popular choice for traders, influenced by factors such as interest rate differentials and economic growth prospects in the US and Japan.

- GBP/USD (British Pound/US Dollar): The British Pound/US Dollar pair is closely watched by traders due to its sensitivity to political and economic developments in the UK and the US.

- USD/CHF (US Dollar/Swiss Franc): The US Dollar/Swiss Franc pair is often considered a safe-haven currency pair, as the Swiss Franc is perceived as a stable and reliable currency during times of global uncertainty.

Understanding Forex Market Dynamics

The Forex market, being the world’s largest and most liquid financial market, is constantly in motion, driven by a complex interplay of factors. Understanding these dynamics is crucial for any trader seeking to navigate the intricacies of currency exchange.

Economic Indicators

Economic indicators provide insights into the health and performance of a country’s economy. These indicators, released regularly by government agencies and international organizations, influence currency values.

- Gross Domestic Product (GDP): This measures the total value of goods and services produced within a country’s borders, reflecting its economic output and growth potential. A strong GDP growth rate generally strengthens a currency, indicating a healthy economy.

- Inflation: This measures the rate at which prices for goods and services rise over time. High inflation erodes purchasing power and can weaken a currency, as investors seek investments that offer higher returns to offset inflation.

- Interest Rates: Central banks set interest rates to control inflation and stimulate economic growth. Higher interest rates attract foreign investment, increasing demand for the currency and strengthening its value. Conversely, lower interest rates can weaken a currency.

- Unemployment Rate: This reflects the percentage of the workforce that is unemployed. A low unemployment rate indicates a strong economy, boosting confidence in the currency.

- Trade Balance: This measures the difference between a country’s exports and imports. A trade surplus (exports exceeding imports) generally strengthens a currency, while a trade deficit (imports exceeding exports) can weaken it.

Political Events

Political events, including elections, government policies, and international relations, can significantly impact currency exchange rates.

- Political Stability: Countries with stable political systems and transparent governance tend to attract foreign investment, boosting their currencies. Conversely, political instability, uncertainty, or conflict can lead to currency depreciation.

- Government Policies: Fiscal and monetary policies implemented by governments can affect currency values. For example, tax cuts or increased government spending can stimulate economic growth, strengthening the currency. Conversely, austerity measures or trade wars can weaken it.

- International Relations: Geopolitical events, such as trade agreements, sanctions, or conflicts, can influence currency exchange rates. For instance, a trade war between two countries could weaken their respective currencies.

Market Sentiment

Market sentiment, the overall mood of investors and traders towards a particular currency, plays a crucial role in determining its value.

- Investor Confidence: When investors are optimistic about a country’s economic prospects, they are more likely to invest in its currency, driving up demand and strengthening its value. Conversely, negative sentiment can lead to currency depreciation.

- Risk Appetite: Investors’ willingness to take on risk influences currency values. During periods of high risk aversion, investors tend to favor safe-haven currencies like the US dollar or Japanese yen, leading to their appreciation. Conversely, risk-on sentiment can boost the value of currencies associated with emerging markets.

- News and Events: News headlines, economic releases, and political developments can trigger rapid changes in market sentiment, influencing currency movements. For example, a surprise interest rate cut by a central bank could lead to a sudden depreciation of the currency.

Fundamental Analysis

Fundamental analysis involves evaluating the economic, political, and social factors that affect a currency’s value. It helps traders identify long-term trends and make informed trading decisions.

Fundamental analysis examines the intrinsic value of a currency based on underlying economic and political factors.

Technical Analysis

Technical analysis focuses on historical price data and trading patterns to predict future price movements. It uses charts, indicators, and other tools to identify trends, support and resistance levels, and potential buy or sell signals.

Technical analysis uses historical price data and trading patterns to identify trends and predict future price movements.

Central Banks and Monetary Policies

Central banks play a vital role in influencing currency values through their monetary policies.

- Interest Rate Adjustments: Central banks use interest rate adjustments to control inflation and stimulate economic growth. Raising interest rates attracts foreign investment, increasing demand for the currency and strengthening its value. Conversely, lowering interest rates can weaken a currency.

- Quantitative Easing (QE): QE involves central banks injecting liquidity into the financial system by purchasing government bonds or other assets. This can weaken a currency by increasing the money supply and potentially leading to inflation.

- Currency Interventions: Central banks can intervene in the foreign exchange market to buy or sell their own currencies to influence their values. This is often done to stabilize a currency during periods of volatility or to prevent excessive appreciation or depreciation.

Forex Trading Strategies

Forex trading strategies are the blueprints that traders use to guide their decisions in the market. These strategies are based on different approaches to analyzing market trends, identifying trading opportunities, and managing risk. Understanding and implementing the right strategy can significantly impact a trader’s success in the forex market.

Scalping

Scalping is a high-frequency trading strategy that aims to profit from small price fluctuations in the market. Scalpers typically hold trades for a very short period, often just a few seconds or minutes. They use technical indicators and charts to identify small price movements and execute trades quickly.

Scalping requires a high level of discipline, quick reflexes, and a reliable trading platform with low latency. The strategy can be profitable, but it also carries a high risk due to the short holding times and the potential for rapid price swings.

Day Trading

Day trading involves opening and closing trades within the same trading day. Day traders typically focus on short-term price movements and use technical analysis to identify trading opportunities. They aim to capitalize on intraday price fluctuations and close their positions before the market closes.

Day trading requires a strong understanding of technical analysis, a disciplined approach to risk management, and a high level of market awareness. The strategy can be profitable, but it also requires a significant amount of time and effort to monitor the market constantly.

Swing Trading

Swing trading is a medium-term trading strategy that aims to capture price swings in the market. Swing traders typically hold trades for a few days to a few weeks, aiming to profit from larger price movements. They use a combination of technical and fundamental analysis to identify potential trading opportunities.

Swing trading requires a good understanding of market trends and a long-term perspective. The strategy is less risky than scalping or day trading, but it also offers lower potential profits.

Trend Trading, Trading with forex

Trend trading is a long-term trading strategy that involves identifying and following market trends. Trend traders typically hold trades for weeks or even months, aiming to profit from sustained price movements in a specific direction. They use a combination of technical and fundamental analysis to identify and confirm trends.

Trend trading is a less risky strategy than short-term trading, but it also requires patience and discipline. The strategy can be very profitable, but it also requires a deep understanding of market dynamics and the ability to ride out short-term fluctuations.

Hypothetical Trading Plan

Let’s imagine a hypothetical trading plan using a trend-following strategy.

Strategy: Buy the EUR/USD currency pair when it breaks above a key resistance level and set a stop-loss order below the previous swing low.

Entry Point: The EUR/USD breaks above the 1.1000 resistance level.

Exit Point: The EUR/USD reaches the 1.1200 target level or the trend reverses.

Stop-Loss Order: The stop-loss order is set at 1.0950, below the previous swing low.

Risk Management: The trader is willing to risk 2% of their account on this trade, which equates to $200.

Rationale: The EUR/USD has been trending upwards in recent weeks, and the breakout above the 1.1000 resistance level suggests that the trend is likely to continue. The stop-loss order is placed below the previous swing low to minimize potential losses.

Disclaimer: This is a hypothetical example and should not be considered investment advice. Trading forex involves significant risk and may not be suitable for all investors. It is essential to conduct thorough research and consult with a qualified financial advisor before making any trading decisions.

Forex Trading Platforms and Tools

To navigate the Forex market effectively, you need a reliable trading platform and the right tools. This section explores popular platforms and essential tools that traders use to execute trades, analyze market data, and manage their positions.

Popular Forex Trading Platforms

Forex trading platforms are software applications that allow traders to access the market, place orders, and manage their accounts. They offer a range of features, from basic order execution to advanced charting and analysis tools. Here are some of the most popular platforms:

- MetaTrader 4 (MT4): MT4 is a widely used platform known for its user-friendly interface, customizable charts, and a vast library of technical indicators. It’s popular among both beginners and experienced traders.

- MetaTrader 5 (MT5): MT5 is an updated version of MT4, offering more advanced features like depth of market (DOM) and a wider range of order types. It’s designed for more sophisticated traders and scalpers.

- cTrader: cTrader is a platform known for its speed, advanced charting capabilities, and a focus on algorithmic trading. It’s popular among traders who use automated strategies.

- TradingView: TradingView is a popular web-based platform that provides real-time charting, analysis tools, and social trading features. It’s accessible from any device and offers a free plan with limited features.

Essential Trading Tools

Forex trading tools are essential for analyzing market data, identifying trading opportunities, and managing risk. Here are some of the most important tools:

- Charts: Charts are visual representations of price movements over time. They provide insights into trends, support and resistance levels, and other patterns that can help traders make informed decisions. Common chart types include line charts, bar charts, and candlestick charts.

- Indicators: Indicators are mathematical formulas that are applied to price data to generate signals. They can help identify trends, overbought or oversold conditions, and potential entry and exit points. Some popular indicators include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands.

- Order Types: Order types determine how a trade is executed. Different order types offer various levels of control and flexibility. Common order types include market orders, limit orders, stop orders, and trailing stops.

Forex Broker Comparison

Choosing the right Forex broker is crucial for successful trading. Here’s a table comparing different brokers based on their trading conditions, fees, and customer support:

| Broker | Spreads | Commissions | Minimum Deposit | Customer Support |

|---|---|---|---|---|

| XM | From 0 pips | None | $5 | 24/5 |

| Exness | From 0 pips | None | $1 | 24/5 |

| IC Markets | From 0 pips | None | $200 | 24/5 |

| FXTM | From 0.1 pips | None | $10 | 24/5 |

Risk Management in Forex Trading

Risk management is an essential aspect of Forex trading, playing a crucial role in protecting your capital and ensuring the sustainability of your trading endeavors. It involves implementing strategies to control potential losses and maximize the likelihood of achieving profitable outcomes.

Stop-Loss Orders

Stop-loss orders are an integral part of risk management in Forex trading. They act as automatic safeguards that limit potential losses by automatically closing a position when the price of a currency pair reaches a predetermined level.

- Setting Stop-Loss Levels: When placing a stop-loss order, it’s crucial to determine the appropriate level. This level should be set at a point where you’re comfortable accepting a loss, but also at a level that doesn’t trigger the order too easily due to market fluctuations.

- Trailing Stop-Loss Orders: Trailing stop-loss orders offer a dynamic approach to risk management. They adjust the stop-loss level as the price of a currency pair moves in your favor, allowing you to lock in profits while minimizing potential losses.

Position Sizing

Position sizing refers to the amount of capital you allocate to each trade. It’s a critical risk management technique that aims to control the overall exposure of your trading account.

- Risk Percentage: A common approach to position sizing is to determine a percentage of your capital that you’re willing to risk on each trade. For example, a trader might choose to risk 1% to 2% of their account balance on each trade.

- Risk-Reward Ratio: Another important aspect of position sizing is the risk-reward ratio. This ratio compares the potential profit of a trade to the potential loss. A favorable risk-reward ratio ensures that potential profits outweigh potential losses.

Diversification

Diversification in Forex trading involves spreading your investments across multiple currency pairs, asset classes, and trading strategies. This approach helps to reduce overall risk by mitigating the impact of any single adverse event.

- Currency Pair Diversification: By trading different currency pairs, you diversify your portfolio and reduce your exposure to the movements of any single currency.

- Asset Class Diversification: Diversification can also be achieved by investing in other asset classes, such as stocks, bonds, or commodities. This helps to balance out your overall risk profile.

Real-World Examples

- Example 1: A trader enters a long position on the EUR/USD currency pair, expecting the Euro to appreciate against the US Dollar. They set a stop-loss order at 1.1000, which is a level below the entry price. If the price falls to 1.1000, the stop-loss order is triggered, automatically closing the position and limiting the potential loss.

- Example 2: A trader has a $10,000 account and decides to risk 1% per trade. This means they can allocate up to $100 per trade. They identify a trading opportunity with a potential profit of $200 and a potential loss of $100, resulting in a favorable risk-reward ratio of 2:1.

Forex Trading Psychology

The world of forex trading is not just about technical analysis and market trends. It’s also about managing your emotions, which can significantly impact your trading decisions. Understanding and controlling your psychology is crucial for consistent success in the forex market.

Understanding Psychological Factors

Understanding the psychological factors that influence trading decisions is the first step towards managing them effectively. Here are some of the most common psychological biases that can affect traders:

- Fear: Fear of losing money can lead to holding onto losing trades for too long, hoping for a recovery. This can result in even bigger losses.

- Greed: The desire for quick profits can lead to taking excessive risks and entering trades without proper analysis, often resulting in losses.

- Overconfidence: Feeling overly confident in your abilities can lead to neglecting risk management and making impulsive decisions.

- Confirmation Bias: The tendency to seek out information that confirms your existing beliefs, even if it’s inaccurate, can lead to ignoring warning signs and making poor trading decisions.

- Herd Mentality: Following the crowd without independent analysis can lead to making decisions based on emotions rather than logic.

Developing a Disciplined Trading Mindset

Developing a disciplined trading mindset is essential for managing your emotions and making rational trading decisions. Here are some strategies:

- Create a Trading Plan: A well-defined trading plan Artikels your trading goals, risk tolerance, entry and exit strategies, and money management rules. This provides a framework for making consistent decisions.

- Stick to Your Plan: Adhering to your trading plan helps avoid impulsive decisions based on emotions. This discipline helps maintain consistency and minimizes emotional trading.

- Keep a Trading Journal: Documenting your trades, including the reasoning behind each decision, helps identify patterns and areas for improvement. This helps you learn from your mistakes and refine your trading strategy.

- Practice Risk Management: Implementing stop-loss orders and position sizing techniques helps protect your capital and prevents significant losses due to emotional trading.

Managing Trading Emotions Effectively

Managing your emotions is crucial for successful trading. Here are some techniques:

- Recognize Your Emotions: Being aware of your emotions during trading is the first step towards managing them. Identifying emotions like fear, greed, or frustration helps you take a step back and make rational decisions.

- Take Breaks: Stepping away from the screen for a few minutes or taking a break from trading altogether can help you regain perspective and manage emotional impulses.

- Seek Support: Talking to a mentor or experienced trader can provide valuable insights and help you stay grounded. Support from peers can also help you stay motivated and disciplined.

Forex Education and Resources

The Forex market is vast and complex, requiring constant learning and adaptation. Accessing reliable educational resources is crucial for traders to develop their skills, improve their strategies, and navigate the dynamic market environment. This section provides a comprehensive overview of Forex education resources, encompassing books, websites, online courses, webinars, and trading communities.

Forex Books

Forex books offer a structured and in-depth approach to understanding the market, covering fundamental concepts, trading strategies, and risk management. Some recommended Forex books include:

- “Trading in the Zone” by Mark Douglas: This book focuses on the psychological aspects of trading, emphasizing emotional discipline and risk management.

- “The Disciplined Trader” by Mark Douglas: This book delves into the psychology of trading, providing insights into overcoming emotional biases and developing a disciplined trading approach.

- “Japanese Candlestick Charting Techniques” by Steve Nison: This book explains the principles and techniques of candlestick charting, a widely used tool for technical analysis in Forex trading.

Forex Websites

Numerous websites provide valuable Forex education resources, including articles, tutorials, market analysis, and trading tools. These websites offer a continuous stream of information, keeping traders updated on market trends and best practices. Some reputable Forex websites include:

- BabyPips: This website offers a comprehensive beginner’s guide to Forex trading, covering fundamental concepts, trading strategies, and risk management.

- DailyFX: This website provides market analysis, educational resources, and trading tools for Forex traders of all levels.

- ForexFactory: This website offers a forum for Forex traders to discuss market news, strategies, and trading experiences.

Online Forex Courses

Online Forex courses provide structured learning programs with interactive lessons, quizzes, and assignments. These courses offer a more comprehensive and interactive learning experience compared to books and websites. Some recommended online Forex courses include:

- Udemy: This platform offers a wide range of Forex trading courses, covering fundamental concepts, technical analysis, and trading strategies.

- Coursera: This platform provides online courses from reputable universities and institutions, including Forex trading courses.

- TradingView: This platform offers a comprehensive suite of trading tools and educational resources, including online courses on technical analysis and trading strategies.

Forex Webinars

Forex webinars provide real-time insights from experienced traders and market analysts. These webinars cover current market trends, trading strategies, and technical analysis techniques. Some platforms offering Forex webinars include:

- DailyFX: This website hosts regular webinars on various Forex topics, covering market analysis, trading strategies, and technical analysis techniques.

- ForexFactory: This website hosts webinars from experienced traders and market analysts, providing insights into current market trends and trading strategies.

- TradingView: This platform hosts webinars on various Forex topics, including technical analysis, trading strategies, and market analysis.

Forex Trading Communities and Forums

Forex trading communities and forums provide a platform for traders to connect, share knowledge, and learn from each other. These communities offer a valuable source of insights, strategies, and support. Some recommended Forex trading communities and forums include:

- ForexFactory: This website offers a forum for Forex traders to discuss market news, strategies, and trading experiences.

- Elite Trader: This website provides a forum for experienced Forex traders to share insights and strategies.

- Babypips: This website offers a forum for Forex traders of all levels to discuss trading topics and ask questions.

Importance of Continuous Learning

The Forex market is constantly evolving, requiring traders to continuously learn and adapt. Staying updated on market trends, new trading strategies, and best practices is essential for success. Traders should actively engage in learning through books, websites, online courses, webinars, and trading communities.

Conclusive Thoughts: Trading With Forex

As you embark on your Forex trading journey, remember that knowledge, discipline, and risk management are your most valuable assets. By diligently studying the market, developing sound trading strategies, and managing your risk effectively, you can increase your chances of success in this dynamic and ever-evolving world of currency trading.

FAQ Insights

What are the best Forex brokers?

The best Forex broker for you will depend on your individual needs and trading style. Consider factors like trading conditions, fees, customer support, and platform features when choosing a broker.

How much money do I need to start Forex trading?

The amount of money you need to start Forex trading varies depending on the broker and your trading strategy. Some brokers offer micro accounts with low minimum deposits, while others require larger capital.

Is Forex trading safe?

Forex trading involves inherent risks, as currency exchange rates are constantly fluctuating. However, by implementing proper risk management strategies, you can mitigate potential losses and protect your capital.