Cryptos to buy in 2024: The cryptocurrency market is in a constant state of flux, with new trends emerging and opportunities for investors constantly evolving. As we embark on a new year, it’s crucial to identify promising cryptocurrencies that have the potential to deliver significant returns. This guide delves into the key factors shaping the cryptocurrency landscape in 2024, highlighting the top contenders for investment and providing insights into emerging trends and technologies.

From the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) to the growing adoption of blockchain technology across various industries, the cryptocurrency ecosystem is teeming with innovation. This guide aims to equip investors with the knowledge and tools they need to navigate this dynamic market, understand the risks involved, and make informed investment decisions.

Market Overview and Trends: Cryptos To Buy In 2024

The cryptocurrency market has experienced a rollercoaster ride in recent years, marked by periods of explosive growth followed by sharp corrections. As we enter 2024, the landscape is evolving rapidly, driven by a confluence of factors that will shape the trajectory of this nascent asset class.

Regulatory Landscape

Regulatory clarity is a crucial factor influencing investor confidence and market stability. Governments around the world are actively crafting frameworks to govern the cryptocurrency sector, with varying approaches and degrees of stringency. While some jurisdictions are embracing innovation and seeking to attract cryptocurrency businesses, others are taking a more cautious stance, imposing stricter regulations to mitigate risks.

The impact of these regulatory changes on the cryptocurrency market in 2024 will be multifaceted.

- Clear and consistent regulations could foster a more stable and predictable environment for investors and businesses, leading to increased adoption and mainstream acceptance.

- Conversely, overly restrictive regulations could stifle innovation and hinder the growth of the cryptocurrency ecosystem, potentially driving businesses and investors to more favorable jurisdictions.

Macroeconomic Factors

The cryptocurrency market is not immune to macroeconomic forces. Factors such as inflation, interest rates, and economic growth can significantly influence investor sentiment and asset prices.

In 2024, the global economy is expected to face headwinds, including persistent inflation, rising interest rates, and geopolitical uncertainties.

These macroeconomic factors could impact the cryptocurrency market in several ways:

- During periods of economic uncertainty, investors may seek safe haven assets like gold or government bonds, potentially leading to a decline in cryptocurrency prices.

- Rising interest rates can make holding cryptocurrencies less attractive, as investors can earn higher returns on traditional investments.

- However, if inflation continues to be a concern, some investors may turn to cryptocurrencies as a hedge against inflation.

Technological Advancements

The cryptocurrency industry is constantly evolving, driven by rapid technological advancements.

These innovations are shaping the future of the ecosystem, unlocking new possibilities and creating exciting opportunities for investors and businesses alike.

Here are some key trends to watch in 2024:

- Decentralized Finance (DeFi): DeFi protocols are revolutionizing traditional financial services by offering decentralized alternatives to borrowing, lending, and trading.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that are gaining traction in various industries, from art and collectibles to gaming and virtual worlds.

- Layer-2 Scaling Solutions: Layer-2 solutions aim to address the scalability challenges of blockchain networks, enhancing transaction speed and reducing costs.

- The Metaverse: The metaverse is a burgeoning virtual world that is expected to play a significant role in the adoption of cryptocurrencies and NFTs.

Top Cryptos to Consider

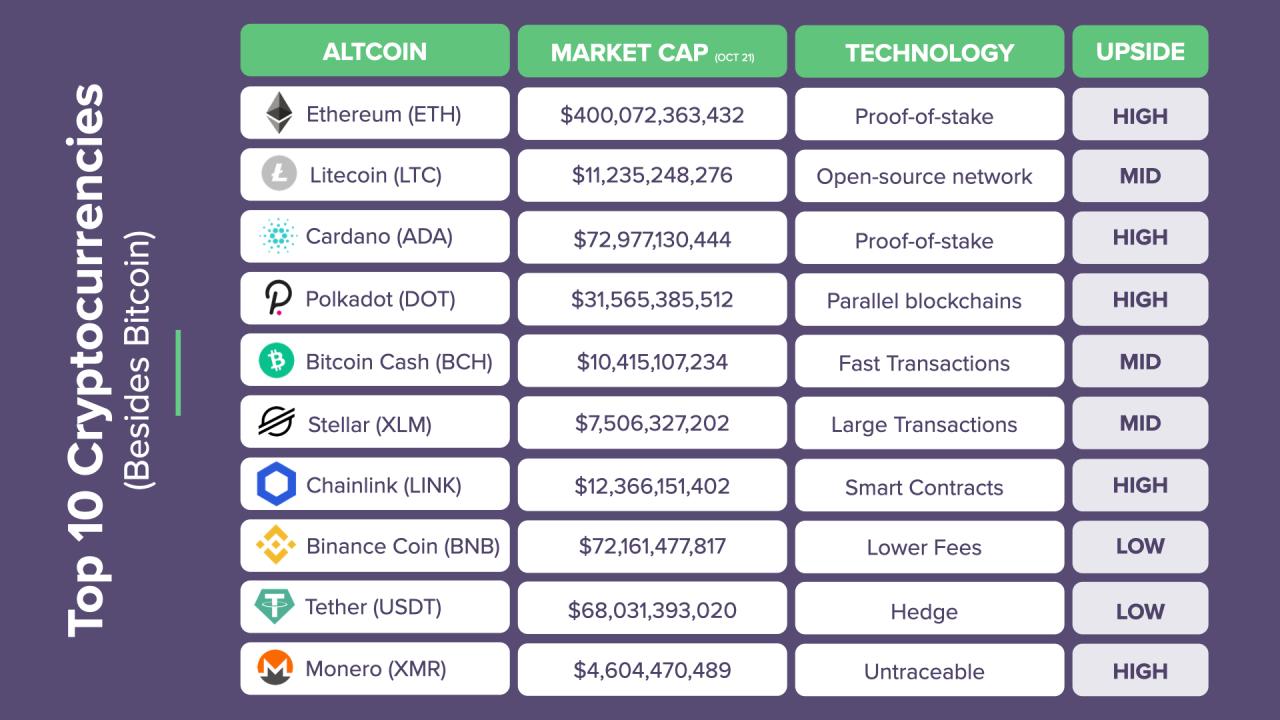

Navigating the ever-evolving landscape of cryptocurrencies can be daunting, but understanding the potential of certain projects can help you make informed investment decisions. Here are five cryptocurrencies with promising growth potential in 2024, based on their technology, use cases, and market capitalization.

Top 5 Cryptos

The crypto market is brimming with innovation, but these five stand out as potential leaders in 2024:

- Bitcoin (BTC): The OG cryptocurrency, Bitcoin remains the dominant force in the market. Its decentralized nature, limited supply, and growing adoption as a store of value make it a strong contender for long-term growth.

- Ethereum (ETH): Ethereum’s smart contract functionality and decentralized application (dApp) ecosystem have made it a powerhouse in the DeFi and NFT space. As the network upgrades to Ethereum 2.0, it’s poised to become even more scalable and efficient.

- Solana (SOL): Solana’s high-speed transaction processing and low fees have made it a popular choice for developers building decentralized applications. Its growing ecosystem and focus on scalability make it a potential competitor to Ethereum.

- Cardano (ADA): Cardano prioritizes scientific research and peer-reviewed development, leading to a robust and secure platform. Its focus on sustainability and scalability makes it a potential leader in the future of decentralized finance.

- Polkadot (DOT): Polkadot aims to connect different blockchains, creating an interoperable ecosystem. Its focus on cross-chain communication and scalability makes it a potential driver of the future of blockchain technology.

Investment Strategies and Risk Management

Navigating the world of cryptocurrency investing requires a well-defined strategy and a thorough understanding of risk management. Different approaches can be employed, each with its own advantages and disadvantages. This section delves into popular investment strategies and highlights the importance of mitigating potential losses.

Investment Strategies

Understanding the various investment strategies available in the cryptocurrency market is crucial for investors to determine the best approach for their individual goals and risk tolerance.

- Long-Term Holding (Hodling): This strategy involves purchasing cryptocurrencies and holding them for an extended period, typically years, with the expectation that their value will appreciate over time. Hodling is based on the belief that the underlying technology and adoption of cryptocurrencies will continue to grow, driving up prices.

- Day Trading: Day traders aim to profit from short-term price fluctuations by buying and selling cryptocurrencies within the same day. This strategy requires significant technical analysis skills, market knowledge, and a high-risk tolerance.

- Arbitrage: This strategy involves exploiting price differences between different cryptocurrency exchanges. Arbitrageurs buy cryptocurrencies on one exchange where they are cheaper and sell them on another exchange where they are more expensive, profiting from the price discrepancy. This strategy requires speed, efficiency, and access to multiple exchanges.

Risk Management in Cryptocurrency Investing

Cryptocurrency markets are known for their volatility, making risk management a critical aspect of investing.

- Diversification: Spreading investments across multiple cryptocurrencies can reduce overall risk by mitigating the impact of any single asset’s price fluctuations. Diversifying into different sectors within the cryptocurrency ecosystem, such as DeFi, NFTs, and Metaverse projects, can further enhance risk mitigation.

- Stop-Loss Orders: Stop-loss orders are pre-programmed instructions that automatically sell a cryptocurrency if its price falls below a certain threshold. This strategy helps limit potential losses by preventing further price declines from eroding the investment value.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of its price. This strategy helps average out the purchase price over time, reducing the impact of price fluctuations and potentially mitigating risk.

Determining Investment Amount

Deciding how much to invest in cryptocurrencies is a personal decision that should be based on individual financial circumstances, risk tolerance, and investment goals.

- Financial Situation: Investors should only invest money they can afford to lose and should not risk essential funds or savings. It is crucial to maintain a healthy emergency fund and prioritize other financial obligations before allocating funds to cryptocurrencies.

- Risk Tolerance: Cryptocurrency markets are highly volatile, and investors should only invest amounts they are comfortable losing. High-risk tolerance can lead to larger investments, while a lower tolerance may dictate smaller investments.

- Investment Goals: Investors should define their investment objectives, such as short-term trading gains or long-term wealth accumulation. This will help determine the appropriate investment amount and the suitable investment strategy.

Emerging Crypto Trends and Technologies

The cryptocurrency landscape is constantly evolving, with new trends and technologies emerging regularly. These innovations have the potential to reshape the future of finance and create exciting opportunities for investors. Understanding these trends is crucial for navigating the dynamic world of cryptocurrencies.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing sector of the cryptocurrency industry that aims to provide financial services without the need for intermediaries like banks. DeFi protocols leverage blockchain technology to enable peer-to-peer lending, borrowing, trading, and other financial activities.

Key Aspects of DeFi

- Transparency and Openness: All transactions on DeFi platforms are recorded on a public blockchain, ensuring transparency and accountability.

- Accessibility: DeFi services are often accessible to anyone with an internet connection, regardless of their location or financial background.

- Innovation: DeFi has spurred the development of new financial products and services, such as yield farming, liquidity pools, and decentralized exchanges.

Opportunities for Investors

- Yield Farming: DeFi protocols offer opportunities to earn interest on crypto assets by providing liquidity to lending platforms or participating in decentralized exchanges.

- Decentralized Lending and Borrowing: Users can lend or borrow cryptocurrencies at competitive interest rates without relying on traditional financial institutions.

- Investment in DeFi Tokens: Many DeFi platforms have their own native tokens, which can be purchased and traded on cryptocurrency exchanges.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are unique digital assets that represent ownership of a specific item, such as a piece of art, a collectible, or a digital asset. NFTs are built on blockchain technology, ensuring their authenticity and immutability.

Key Features of NFTs

- Uniqueness: Each NFT is unique and cannot be replicated, making it a valuable asset.

- Scarcity: The limited supply of NFTs enhances their value, as they are not easily duplicated.

- Programmability: NFTs can be programmed with specific functionalities, such as royalties or access to exclusive content.

Opportunities for Investors

- Collecting and Trading: NFTs can be collected and traded on online marketplaces, potentially generating profits.

- Investment in NFT Projects: Investors can invest in NFT projects by purchasing tokens or contributing to their development.

- Creating and Selling NFTs: Artists, musicians, and other creators can use NFTs to sell their digital works directly to fans.

The Metaverse

The metaverse is a collective term for immersive virtual worlds that allow users to interact with each other, create content, and participate in a virtual economy. Cryptocurrencies play a crucial role in the metaverse, enabling transactions, ownership of digital assets, and governance.

Key Aspects of the Metaverse

- Virtual Reality and Augmented Reality: The metaverse leverages virtual reality (VR) and augmented reality (AR) technologies to create immersive experiences.

- Decentralized Ownership: Users can own and trade digital assets, such as virtual land, avatars, and other items.

- Interoperability: Different metaverse platforms are working towards interoperability, allowing users to seamlessly move between them.

Opportunities for Investors

- Investment in Metaverse Platforms: Investors can purchase tokens or invest in companies developing metaverse platforms.

- Virtual Land Acquisition: Users can purchase virtual land in the metaverse, which can be used for various purposes, such as building virtual businesses or hosting events.

- Creation and Sale of Digital Assets: Creators can develop and sell digital assets, such as avatars, wearables, and other items, within the metaverse.

Blockchain Scalability Solutions

As the cryptocurrency industry grows, blockchain scalability has become a critical concern. Scaling solutions aim to increase the transaction throughput of blockchains, enabling them to handle a larger number of transactions without compromising security or decentralization.

Key Scalability Solutions

- Layer-2 Scaling: These solutions build on top of existing blockchains to offload transaction processing, such as Optimism, Arbitrum, and Polygon.

- Sharding: This approach divides the blockchain into smaller shards, allowing for parallel processing of transactions.

- Rollups: These solutions bundle multiple transactions into a single transaction on the main blockchain, reducing transaction fees.

Impact on the Crypto Market

- Increased Adoption: Scalability solutions make blockchains more efficient, enabling them to handle a larger number of users and transactions.

- Lower Transaction Costs: By reducing congestion on blockchains, scalability solutions can lead to lower transaction fees.

- Faster Transaction Speeds: Scalability solutions can improve transaction speeds, making blockchains more user-friendly.

Privacy-Enhancing Technologies

Privacy-enhancing technologies aim to protect user data and transactions on blockchains. These technologies use various techniques to ensure anonymity and confidentiality, addressing concerns about data privacy and security.

Key Privacy-Enhancing Technologies

- Zero-Knowledge Proofs: These proofs allow users to verify the validity of a statement without revealing any underlying information.

- Homomorphic Encryption: This technique allows computations to be performed on encrypted data without decrypting it.

- Mix Networks: These networks route transactions through multiple nodes, making it difficult to track the origin and destination of funds.

Impact on the Crypto Market

- Enhanced Privacy: Privacy-enhancing technologies provide users with greater control over their data and transactions.

- Increased Security: These technologies can help to protect against attacks and ensure the confidentiality of sensitive information.

- Wider Adoption: By addressing privacy concerns, these technologies can encourage wider adoption of cryptocurrencies.

Considerations for Responsible Investing

Investing in cryptocurrencies should go beyond simply chasing returns. It’s essential to consider the broader impact of your investments, especially in light of the growing awareness of environmental, social, and governance (ESG) factors.

ESG Factors in Cryptocurrency Investing

ESG factors are becoming increasingly important in traditional finance, and their relevance is extending to the cryptocurrency space. ESG considerations help investors assess the sustainability and ethical implications of their investments.

- Environmental Impact: The energy consumption associated with Proof-of-Work (PoW) consensus mechanisms, which are used by some cryptocurrencies like Bitcoin, has raised concerns about their environmental impact. This has led to a growing interest in more energy-efficient consensus mechanisms like Proof-of-Stake (PoS), which are used by Ethereum and other cryptocurrencies.

- Social Impact: Cryptocurrencies have the potential to promote financial inclusion by providing access to financial services for individuals and communities that are traditionally underserved by traditional banking systems. This can be achieved through decentralized finance (DeFi) platforms and stablecoins.

- Governance: The governance structure of a cryptocurrency project is crucial for its long-term sustainability. Investors should consider the transparency and accountability of the project’s developers and the decision-making processes.

Cryptocurrencies Aligned with Sustainable and Ethical Investment Principles, Cryptos to buy in 2024

Several cryptocurrencies are emerging that prioritize sustainability and ethical considerations:

- Ethereum: Ethereum’s transition from PoW to PoS is a significant step towards reducing its energy consumption.

- Cardano: Cardano is designed with sustainability in mind and uses a PoS consensus mechanism. It is also known for its robust governance structure and focus on scientific research.

- SolarCoin: SolarCoin rewards individuals and organizations for generating solar energy, promoting renewable energy adoption.

Cryptocurrency and Financial Inclusion

Cryptocurrencies have the potential to revolutionize financial inclusion by providing access to financial services for individuals and communities that are traditionally underserved by traditional banking systems.

- Decentralized Finance (DeFi): DeFi platforms allow individuals to access financial services like lending, borrowing, and trading without the need for intermediaries. This can empower individuals in developing countries or those with limited access to traditional banking services.

- Stablecoins: Stablecoins are cryptocurrencies pegged to fiat currencies, offering stability and reducing volatility. They can facilitate cross-border payments and remittances, potentially reducing costs and increasing access to financial services in underserved regions.

Investment Resources and Tools

Navigating the world of cryptocurrency can be overwhelming, but the right tools and resources can make the journey smoother and more informed. This section explores some of the essential platforms and resources available to help investors make informed decisions.

Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms where users can buy, sell, and trade digital assets. These platforms offer a wide range of features and functionalities, and choosing the right one is crucial for a seamless investment experience.

- Coinbase: A user-friendly platform known for its intuitive interface and comprehensive educational resources. It’s suitable for beginners and experienced traders alike.

- Binance: A leading exchange offering a vast selection of cryptocurrencies, advanced trading tools, and competitive fees. It caters to more experienced traders.

- Kraken: Known for its security features and support for institutional investors, Kraken offers a robust trading platform with a wide range of trading pairs.

- KuCoin: A popular exchange offering a diverse range of cryptocurrencies, staking options, and a user-friendly interface.

Cryptocurrency Wallets

Cryptocurrency wallets are essential for securely storing and managing digital assets. These wallets come in various forms, each with its own strengths and weaknesses.

- Hardware Wallets: Considered the most secure option, hardware wallets store private keys offline, minimizing the risk of hacking. Popular examples include Ledger Nano S and Trezor Model T.

- Software Wallets: These wallets store private keys on a device, offering convenience but potentially posing a higher security risk. Popular examples include Exodus, Electrum, and MyEtherWallet.

- Mobile Wallets: Designed for mobile devices, these wallets provide accessibility but may compromise security if not used responsibly. Popular examples include Coinbase Wallet, Trust Wallet, and Atomic Wallet.

Cryptocurrency Analytics Platforms

Cryptocurrency analytics platforms provide valuable insights into market trends, cryptocurrency performance, and investment opportunities.

- CoinMarketCap: A comprehensive platform that tracks cryptocurrency prices, market capitalization, and trading volume. It also provides information on various crypto projects.

- CoinGecko: Another popular platform offering similar features to CoinMarketCap, including price data, market capitalization, and social media sentiment analysis.

- TradingView: A powerful platform for technical analysis, offering real-time charting, indicators, and customizable dashboards.

- Glassnode: A platform that provides on-chain data and analytics for Bitcoin and other cryptocurrencies, offering insights into network activity and market sentiment.

Research and Evaluation

Before investing in any cryptocurrency, thorough research is essential. Consider the following tips:

- Understand the project’s fundamentals: Research the team behind the project, its whitepaper, and the technology it utilizes.

- Evaluate the project’s use case: Determine the problem the project solves and its potential for adoption.

- Analyze the project’s tokenomics: Understand the token’s supply, distribution, and use within the ecosystem.

- Assess the project’s community: A strong and active community can indicate a project’s potential for growth and adoption.

- Review the project’s security: Consider the project’s security measures and track record for protecting user funds.

Last Word

Investing in cryptocurrencies is a complex endeavor that requires careful research, due diligence, and a sound understanding of the risks involved. This guide has provided a comprehensive overview of the cryptocurrency market in 2024, highlighting key trends, potential growth areas, and emerging technologies. By staying informed, diversifying your portfolio, and employing effective risk management strategies, you can position yourself for success in this exciting and rapidly evolving space.

FAQ Section

What are the risks associated with investing in cryptocurrencies?

Cryptocurrency investments are subject to significant volatility, market manipulation, and regulatory uncertainty. There is also a risk of losing your entire investment due to hacks, scams, or the failure of a cryptocurrency project. It’s crucial to conduct thorough research, diversify your portfolio, and invest only what you can afford to lose.

How do I choose a cryptocurrency exchange?

When selecting a cryptocurrency exchange, consider factors such as security, fees, trading volume, user interface, and regulatory compliance. Research different exchanges, read reviews, and compare their features before making a decision. Look for exchanges that have strong security measures in place, low trading fees, and a user-friendly platform.

What is the best way to store my cryptocurrencies?

The best way to store your cryptocurrencies depends on your individual needs and risk tolerance. Hardware wallets offer the highest level of security, while software wallets are more convenient but less secure. Consider the level of security you require, the frequency with which you trade, and the amount of cryptocurrency you own when choosing a storage solution.