Best Crypto to Buy for 2024: The cryptocurrency market is constantly evolving, presenting both opportunities and challenges for investors. Navigating this dynamic landscape requires a keen understanding of market trends, investment strategies, and the underlying technology behind promising projects. This guide aims to provide a comprehensive overview of the factors to consider when choosing the best cryptocurrencies to buy in 2024, helping you make informed decisions and potentially maximize your returns.

We’ll explore the current state of the market, delve into different investment approaches, analyze the potential of various crypto projects, and offer insights into technical analysis and price predictions. By the end of this guide, you’ll have a better grasp of the cryptocurrency landscape and be equipped to make strategic investment choices.

Market Overview and Trends

The cryptocurrency market is currently in a state of flux, navigating a complex interplay of factors that are shaping its trajectory in 2024. While the market experienced a surge in 2021, followed by a downturn in 2022, it is poised for potential growth in the coming year.

The cryptocurrency market is influenced by a multitude of factors, including regulatory landscape, economic conditions, and technological advancements.

Regulatory Landscape

The regulatory landscape surrounding cryptocurrencies is evolving rapidly. Governments worldwide are grappling with how to regulate this nascent industry. Regulatory clarity can provide stability and attract institutional investors, while uncertainty can deter participation. In 2024, we can expect to see continued regulatory developments, with a focus on consumer protection, anti-money laundering, and taxation.

Economic Conditions, Best crypto to buy for 2024

The global economic outlook is another key factor influencing the cryptocurrency market. Macroeconomic factors such as inflation, interest rates, and geopolitical events can impact investor sentiment and investment flows. For instance, during periods of economic uncertainty, investors may seek safe-haven assets, potentially leading to an increase in demand for cryptocurrencies.

Technological Advancements

The cryptocurrency space is characterized by continuous technological innovation. New blockchain platforms, decentralized applications (dApps), and emerging technologies like artificial intelligence (AI) and the metaverse are driving growth and creating new opportunities.

Emerging Trends

Several emerging trends within the cryptocurrency space hold the potential for significant growth in 2024.

Decentralized Finance (DeFi)

DeFi is a rapidly growing sector that aims to provide financial services without intermediaries. DeFi protocols offer various services, including lending, borrowing, and trading, built on blockchain technology. The increasing adoption of DeFi platforms and the development of new protocols are likely to drive growth in this sector.

Non-Fungible Tokens (NFTs)

NFTs have gained immense popularity in recent years, representing unique digital assets that can be used for various purposes, including art, collectibles, and gaming. In 2024, we can expect to see continued innovation in the NFT space, with new use cases emerging and the development of new platforms.

Metaverse

The metaverse, a virtual reality space that blends the physical and digital worlds, is another area where cryptocurrencies are playing a crucial role. Cryptocurrencies are used for transactions, governance, and ownership within metaverse platforms. As the metaverse continues to evolve, we can expect to see increased adoption of cryptocurrencies in this space.

Investment Strategies and Risk Assessment

Investing in cryptocurrencies can be a rewarding experience, but it’s essential to understand the various strategies and associated risks. This section explores different investment approaches, risk management techniques, and potential pitfalls.

Investment Strategies

Cryptocurrency investment strategies vary based on individual risk tolerance, time horizon, and financial goals. Some popular approaches include:

- Long-Term Holding (Hodling): This strategy involves buying and holding cryptocurrencies for an extended period, typically years, hoping for long-term appreciation in value. It’s a passive approach that requires minimal effort and relies on the belief that the underlying cryptocurrency will grow in value over time. For example, investing in Bitcoin in 2011 and holding it until 2021 would have yielded significant returns.

- Day Trading: This active strategy involves buying and selling cryptocurrencies within a single trading day, aiming to profit from short-term price fluctuations. It requires technical analysis skills, constant market monitoring, and a high tolerance for risk, as price swings can be rapid and unpredictable. Day traders use various technical indicators and charting tools to identify trading opportunities.

- Arbitrage: This strategy exploits price discrepancies between different cryptocurrency exchanges. Arbitrageurs simultaneously buy cryptocurrencies on one exchange where the price is lower and sell them on another exchange where the price is higher, capturing the difference as profit. This requires quick execution and a deep understanding of market dynamics.

Risk Management and Diversification

Investing in cryptocurrencies comes with inherent risks, and proper risk management is crucial for protecting your investment. Diversification is a key principle in risk management. By spreading your investment across different cryptocurrencies, you reduce your exposure to the volatility of any single asset.

Diversification is not just about spreading your investment across different cryptocurrencies, but also across different asset classes.

This includes investing in traditional assets like stocks, bonds, and real estate. A well-diversified portfolio can mitigate losses and enhance overall returns.

Potential Risks

Cryptocurrencies are highly volatile and subject to significant price fluctuations. Market sentiment, news events, and regulatory changes can all impact prices. Other risks include:

- Volatility: Cryptocurrency prices are known for their extreme volatility, often experiencing sharp price swings in short periods. This volatility can lead to significant losses if not managed effectively. For example, Bitcoin’s price dropped by over 50% in December 2017 and again in March 2020.

- Security Threats: Cryptocurrencies are susceptible to security threats, including hacking, theft, and scams. It’s essential to use secure wallets and exchange platforms and be cautious about phishing attempts and fraudulent activities.

- Regulatory Uncertainty: Governments around the world are still developing regulations for cryptocurrencies. This uncertainty can create challenges for investors and businesses operating in the crypto space. For example, in 2021, China banned cryptocurrency trading and mining, which led to significant market volatility.

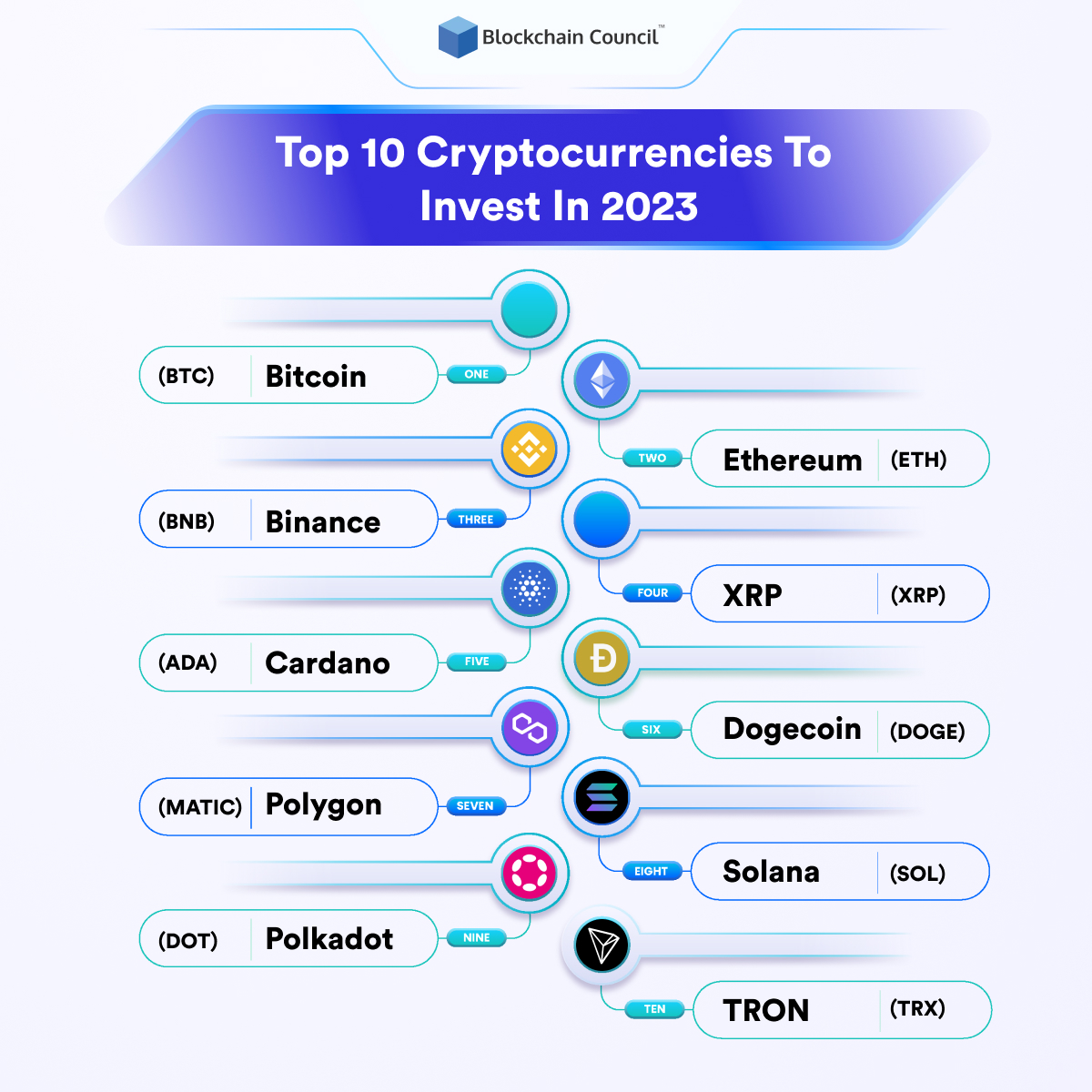

Cryptocurrency Projects to Consider

In this section, we will delve into promising cryptocurrency projects that have garnered significant attention for their potential to disrupt various industries. We will explore projects with strong fundamentals, experienced teams, and innovative technologies.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing sector within the cryptocurrency ecosystem, aiming to revolutionize traditional financial services by leveraging blockchain technology. DeFi platforms enable users to access a wide range of financial products and services, such as lending, borrowing, trading, and insurance, without the need for intermediaries.

“DeFi is an umbrella term for the decentralized applications (dApps) and protocols that enable users to access financial services on a blockchain without the need for intermediaries.”

Here are some prominent DeFi projects to consider:

- Aave (AAVE): Aave is a leading decentralized lending and borrowing protocol that allows users to earn interest on their crypto assets by lending them out or borrow crypto assets by providing collateral. It offers a wide range of assets and flexible borrowing terms, making it a popular choice for DeFi users.

- Compound (COMP): Compound is another prominent DeFi lending and borrowing protocol that utilizes smart contracts to facilitate automated lending and borrowing transactions. Users can earn interest by supplying assets or borrow assets by providing collateral. It has gained popularity for its user-friendly interface and transparent governance model.

- Uniswap (UNI): Uniswap is a decentralized exchange (DEX) that enables users to trade crypto assets directly with each other without the need for a centralized intermediary. It utilizes automated market makers (AMMs) to facilitate trades, providing a seamless and efficient trading experience.

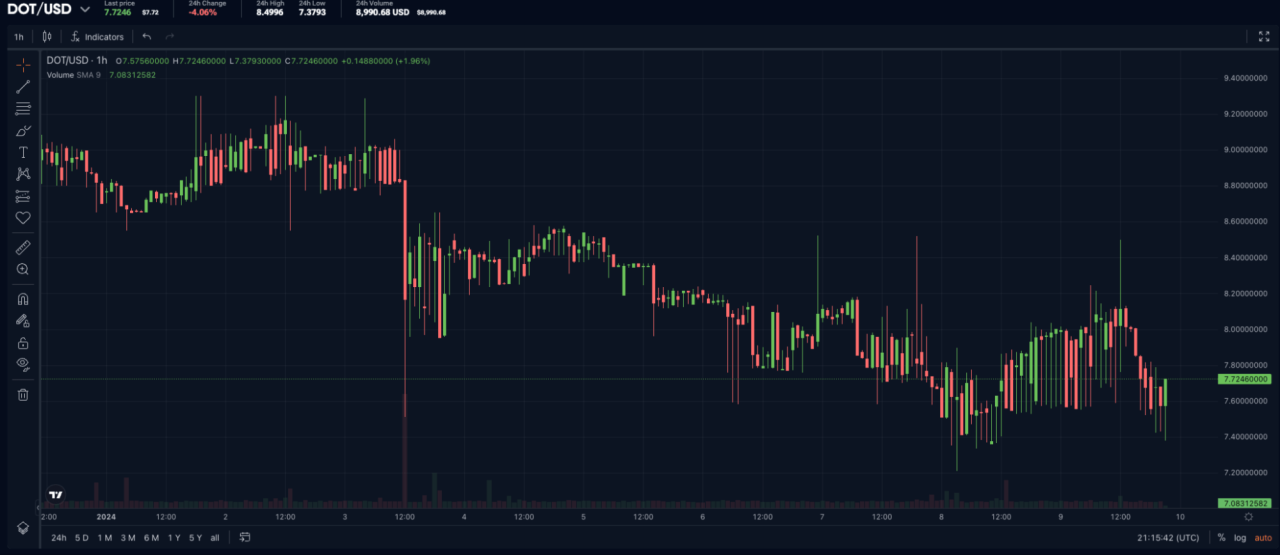

Technical Analysis and Price Predictions

Technical analysis is a method used to predict future price movements of cryptocurrencies by analyzing historical price data and charting patterns. It relies on the assumption that past price behavior can indicate future trends. This section will delve into common technical analysis tools and methodologies, offering insights into potential price movements for specific cryptocurrencies in 2024.

Technical Analysis Tools and Methodologies

Technical analysis utilizes various tools and methodologies to identify potential price trends and support/resistance levels.

- Moving Averages: These are calculated by averaging the closing prices of a cryptocurrency over a specific period. The most common moving averages are the 50-day and 200-day moving averages. When the price crosses above a moving average, it can signal a bullish trend, and vice versa.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. Values above 70 suggest overbought conditions, while values below 30 indicate oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator identifies trend changes by comparing two moving averages of prices. Crossovers between the MACD line and the signal line can signal potential buy or sell opportunities.

- Support and Resistance Levels: These are price levels where the price of a cryptocurrency has historically found difficulty breaking through. Support levels act as a floor, while resistance levels act as a ceiling.

- Chart Patterns: Technical analysts study various chart patterns, such as head and shoulders, double tops, and triangles, to identify potential price reversals or continuations.

Price Predictions for Specific Cryptocurrencies

Based on technical analysis, some experts predict potential price movements for specific cryptocurrencies in 2024. However, it’s crucial to remember that these are just predictions and not guarantees.

- Bitcoin (BTC): Some analysts predict that Bitcoin could reach $100,000 by the end of 2024, supported by the halving event scheduled for 2024, which will reduce the rate of new Bitcoin issuance. The halving event has historically been associated with bullish price movements.

- Ethereum (ETH): Ethereum’s transition to a proof-of-stake consensus mechanism, known as the “Merge,” has already occurred. This event is expected to increase Ethereum’s scalability and efficiency, potentially driving price growth. Some analysts anticipate Ethereum reaching $5,000 by the end of 2024.

- Solana (SOL): Solana is a high-performance blockchain platform known for its speed and low transaction fees. It has gained significant popularity among developers and investors. Some analysts predict that Solana could reach $200 by the end of 2024, driven by its growing ecosystem and increasing adoption.

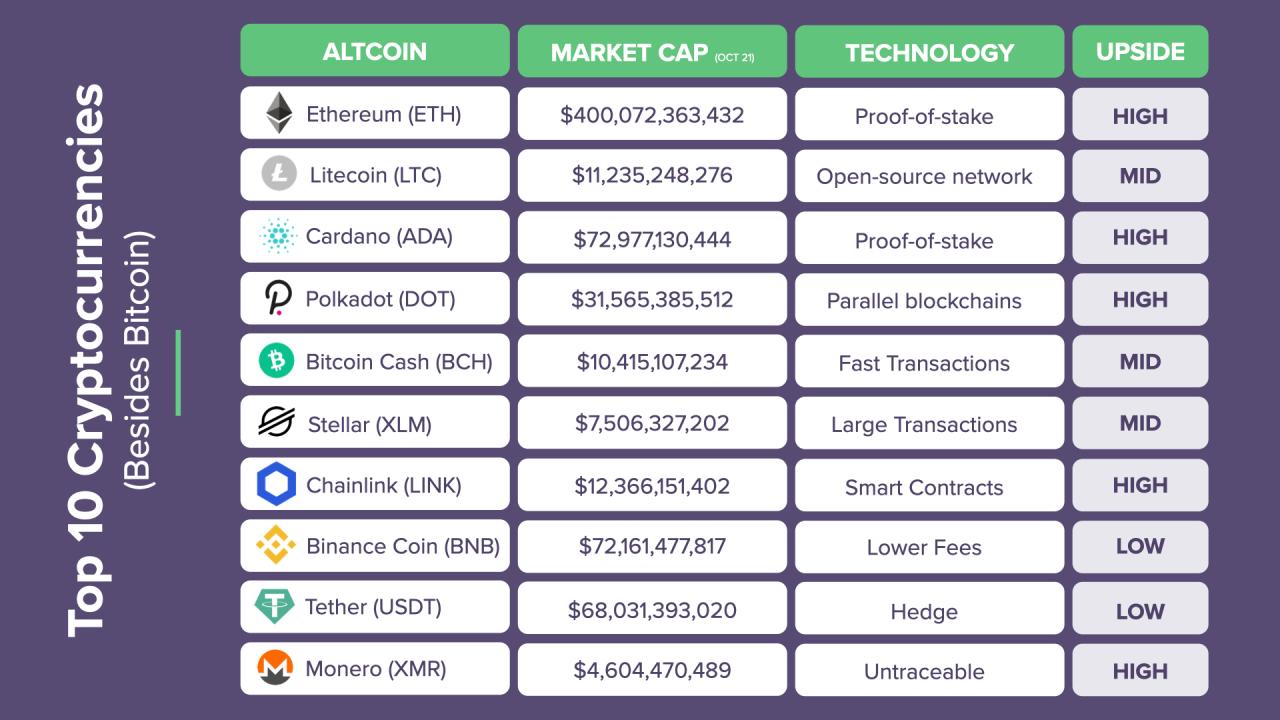

Choosing the Right Cryptocurrency for You

Choosing the right cryptocurrency for your portfolio is a crucial step in navigating the world of digital assets. It involves understanding your investment goals, risk tolerance, and time horizon. This section will provide a framework to help you select cryptocurrencies that align with your unique investment profile.

Cryptocurrency Selection Framework

| Cryptocurrency | Use Case | Key Features | Potential Risks |

|---|---|---|---|

| Bitcoin (BTC) | Digital Gold, Store of Value | Decentralized, Limited Supply, High Market Capitalization | Price Volatility, Regulatory Uncertainty |

| Ethereum (ETH) | Smart Contracts, Decentralized Applications (DApps) | Programmable Blockchain, Growing Ecosystem, High Transaction Volume | Scalability Challenges, Competition from Other Smart Contract Platforms |

| Solana (SOL) | High-Speed Transactions, Decentralized Finance (DeFi) | Fast and Efficient Network, Low Transaction Fees, Growing DeFi Ecosystem | Centralized Development, Potential for Network Congestion |

| Cardano (ADA) | Smart Contracts, Decentralized Applications (DApps) | Peer-Reviewed Development, Focus on Sustainability, Scalable Architecture | Slow Development Cycle, Limited Adoption Compared to Ethereum |

| Polkadot (DOT) | Interoperability, Cross-Chain Communication | Connects Different Blockchains, Enables Data Transfer, Facilitates Collaboration | Complex Architecture, Early Stage Development |

| Chainlink (LINK) | Oracle Network, Data Connectivity | Provides Real-World Data to Smart Contracts, Secure and Reliable Data Feeds | Dependence on Third-Party Data Providers, Potential for Data Manipulation |

The table above provides a glimpse into the diverse landscape of cryptocurrencies, highlighting their unique use cases, key features, and potential risks. When choosing a cryptocurrency, consider the following factors:

* Investment Goals: Are you seeking short-term gains, long-term growth, or a store of value?

* Risk Tolerance: How comfortable are you with price fluctuations and potential losses?

* Time Horizon: How long are you willing to hold your investment?

* Research and Due Diligence: Thoroughly research the cryptocurrency’s technology, team, community, and market dynamics.

By carefully considering these factors and utilizing the selection framework provided, you can identify cryptocurrencies that align with your investment goals and risk appetite. Remember, investing in cryptocurrencies involves inherent risks, and it is crucial to conduct your own research and consult with a financial advisor before making any investment decisions.

Investment Resources and Tools

Navigating the world of cryptocurrency requires access to reliable resources and tools to stay informed, make informed decisions, and manage your investments effectively. This section will guide you through essential resources, including reputable cryptocurrency exchanges, secure wallets, and valuable research platforms.

Cryptocurrency Exchanges

Cryptocurrency exchanges serve as marketplaces where you can buy, sell, and trade digital assets. Choosing a reputable exchange is crucial for ensuring the security of your funds and accessing a wide range of cryptocurrencies.

- Binance: One of the largest and most popular cryptocurrency exchanges globally, offering a vast selection of cryptocurrencies, advanced trading features, and a user-friendly interface.

- Coinbase: A user-friendly platform known for its intuitive interface and ease of use, making it ideal for beginners.

- Kraken: A well-established exchange with a focus on security and advanced trading features, attracting experienced traders.

- KuCoin: A global exchange with a wide range of cryptocurrencies, supporting fiat currencies and offering various trading tools.

Cryptocurrency Wallets

Cryptocurrency wallets are digital containers that securely store your private keys, allowing you to access and manage your cryptocurrencies.

- Ledger Nano S/X: Hardware wallets are considered the most secure option, offering offline storage of your private keys.

- Trezor Model T: Another popular hardware wallet known for its security features and user-friendly interface.

- MetaMask: A popular software wallet that integrates seamlessly with various decentralized applications (DApps) and exchanges.

- Coinbase Wallet: A mobile wallet offered by Coinbase, providing secure storage and access to your cryptocurrencies.

Research Platforms

Research platforms provide valuable insights, data analysis, and news updates to help you stay informed about the cryptocurrency market.

- CoinMarketCap: A comprehensive platform that tracks cryptocurrency prices, market capitalization, and trading volume.

- CoinGecko: Another popular platform that offers real-time data, price charts, and information on various cryptocurrencies.

- Messari: A research platform that provides in-depth analysis, reports, and data on cryptocurrencies and blockchain projects.

- The Block: A leading news and research platform covering the latest developments in the cryptocurrency and blockchain industry.

Tracking Cryptocurrency Prices and Analyzing Market Data

These platforms provide essential tools for tracking cryptocurrency prices, analyzing market data, and making informed investment decisions.

- Price Charts: Most platforms offer interactive price charts that display historical price movements, allowing you to identify trends and patterns.

- Market Capitalization: Market capitalization represents the total value of a cryptocurrency, providing a measure of its size and popularity.

- Trading Volume: Trading volume indicates the amount of cryptocurrency being traded, reflecting market activity and interest.

- Technical Indicators: Platforms often offer technical indicators, such as moving averages and relative strength index (RSI), to identify potential buy and sell signals.

Managing Your Cryptocurrency Investments

These resources can help you effectively manage your investments.

- Portfolio Tracking: Many platforms allow you to track your cryptocurrency portfolio, providing an overview of your holdings and their performance.

- Limit Orders: You can set limit orders to buy or sell cryptocurrencies at a specific price, ensuring you get the desired price.

- Stop-Loss Orders: Stop-loss orders automatically sell your cryptocurrencies when they reach a predetermined price, limiting potential losses.

- Diversification: Spread your investments across multiple cryptocurrencies to reduce risk and increase potential returns.

Educational Materials and Communities

Investing in cryptocurrency requires ongoing learning and staying updated on the latest trends.

- Online Courses: Platforms like Coursera and Udemy offer comprehensive courses on cryptocurrency investing and blockchain technology.

- Cryptocurrency Blogs: Numerous blogs and websites provide insights, news, and analysis on the cryptocurrency market.

- Online Forums: Join online forums and communities to engage with other investors, share knowledge, and get answers to your questions.

- Cryptocurrency Books: Several books offer in-depth knowledge and guidance on cryptocurrency investing and blockchain technology.

Last Recap: Best Crypto To Buy For 2024

Investing in cryptocurrencies can be both exciting and rewarding, but it’s essential to approach it with a balanced perspective. Remember to conduct thorough research, diversify your portfolio, and manage your risk effectively. The information presented here is intended for educational purposes only and should not be considered financial advice. Always consult with a qualified financial professional before making any investment decisions.

Key Questions Answered

What are the most popular cryptocurrencies to buy in 2024?

The popularity of cryptocurrencies can change quickly, so it’s best to research current trends and consult with financial experts. Some popular options include Bitcoin, Ethereum, and stablecoins like Tether and USD Coin.

How can I avoid scams in the cryptocurrency market?

Be wary of promises of high returns with little risk. Only invest in reputable projects with transparent teams and strong fundamentals. Use trusted cryptocurrency exchanges and wallets, and never share your private keys with anyone.

Is cryptocurrency investing right for everyone?

Cryptocurrency investing involves a high level of risk, so it’s not suitable for everyone. Consider your risk tolerance, investment goals, and financial situation before investing.