Crypto Best Buys: Navigating the Digital Gold Rush delves into the exciting and volatile world of cryptocurrency investments. With the rise of digital assets, navigating this space requires a keen understanding of market dynamics, risk assessment, and investment strategies. This guide explores the factors influencing cryptocurrency investment decisions, analyzes the performance and potential of different cryptocurrencies, and provides practical strategies for maximizing returns.

From understanding the fundamentals of blockchain technology to navigating the complexities of decentralized finance (DeFi), this comprehensive guide provides a roadmap for investors seeking to capitalize on the potential of cryptocurrencies. It covers key aspects like identifying top cryptocurrencies, analyzing market trends, and understanding the importance of diversification in building a robust crypto portfolio.

Understanding Crypto Best Buys

Navigating the world of cryptocurrencies can be daunting, especially when it comes to identifying the best buys. It’s crucial to understand the factors that influence investment decisions and gain a comprehensive overview of the market landscape. This guide will equip you with the knowledge needed to make informed choices and maximize your chances of success in the crypto space.

Factors Influencing Crypto Investment Decisions

Understanding the factors that drive crypto investment decisions is paramount. These factors can be categorized into intrinsic and extrinsic elements. Intrinsic factors are specific to the cryptocurrency itself, such as its technology, team, and use cases. Extrinsic factors are external influences that impact the entire market, like regulatory changes, economic conditions, and market sentiment.

- Technology: The underlying technology of a cryptocurrency plays a significant role in its value proposition. For example, Ethereum’s smart contract capabilities have made it a popular platform for decentralized applications (dApps).

- Team: The team behind a cryptocurrency is crucial. Experienced and reputable developers are more likely to deliver on their promises and build a successful project.

- Use Cases: The practical applications of a cryptocurrency determine its potential for adoption and growth. For instance, Bitcoin’s use as a store of value and a decentralized payment system has contributed to its popularity.

- Market Sentiment: The overall mood of the crypto market can significantly impact the price of individual cryptocurrencies. Positive sentiment can lead to price increases, while negative sentiment can result in price declines.

- Regulation: Government regulations can have a profound impact on the crypto market. Clear and favorable regulations can foster innovation and growth, while restrictive regulations can stifle development.

Crypto Market Landscape, Crypto best buys

The crypto market is a dynamic and constantly evolving ecosystem. Understanding the different types of cryptocurrencies and their market dynamics is essential for making informed investment decisions.

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often referred to as “digital gold” due to its limited supply and decentralized nature.

- Ethereum (ETH): Ethereum is a platform for building decentralized applications and smart contracts. It is the second-largest cryptocurrency by market capitalization.

- Stablecoins: Stablecoins are cryptocurrencies designed to maintain a stable price, typically pegged to a fiat currency like the US dollar. They are often used for trading and as a means of reducing volatility.

- Decentralized Finance (DeFi): DeFi refers to financial applications built on blockchain technology, offering alternative ways to borrow, lend, and trade.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of specific items, such as digital art, collectibles, or virtual real estate.

Risk Assessment and Diversification

Investing in cryptocurrencies involves significant risks. It is crucial to conduct thorough risk assessments and diversify your portfolio to mitigate potential losses.

“Don’t put all your eggs in one basket.” – Warren Buffett

- Market Volatility: The crypto market is known for its extreme volatility. Prices can fluctuate significantly in short periods, leading to potential losses.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft. It is essential to use secure wallets and follow best practices for online security.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can impact the market.

- Diversification: Diversifying your crypto portfolio across different asset classes can help reduce risk. This involves investing in a mix of cryptocurrencies, such as Bitcoin, Ethereum, stablecoins, and DeFi tokens.

Identifying Top Cryptocurrencies

Identifying the top cryptocurrencies is a crucial aspect of navigating the dynamic and evolving world of digital assets. This involves analyzing various factors that contribute to a cryptocurrency’s long-term value and growth potential.

Understanding Key Performance Indicators

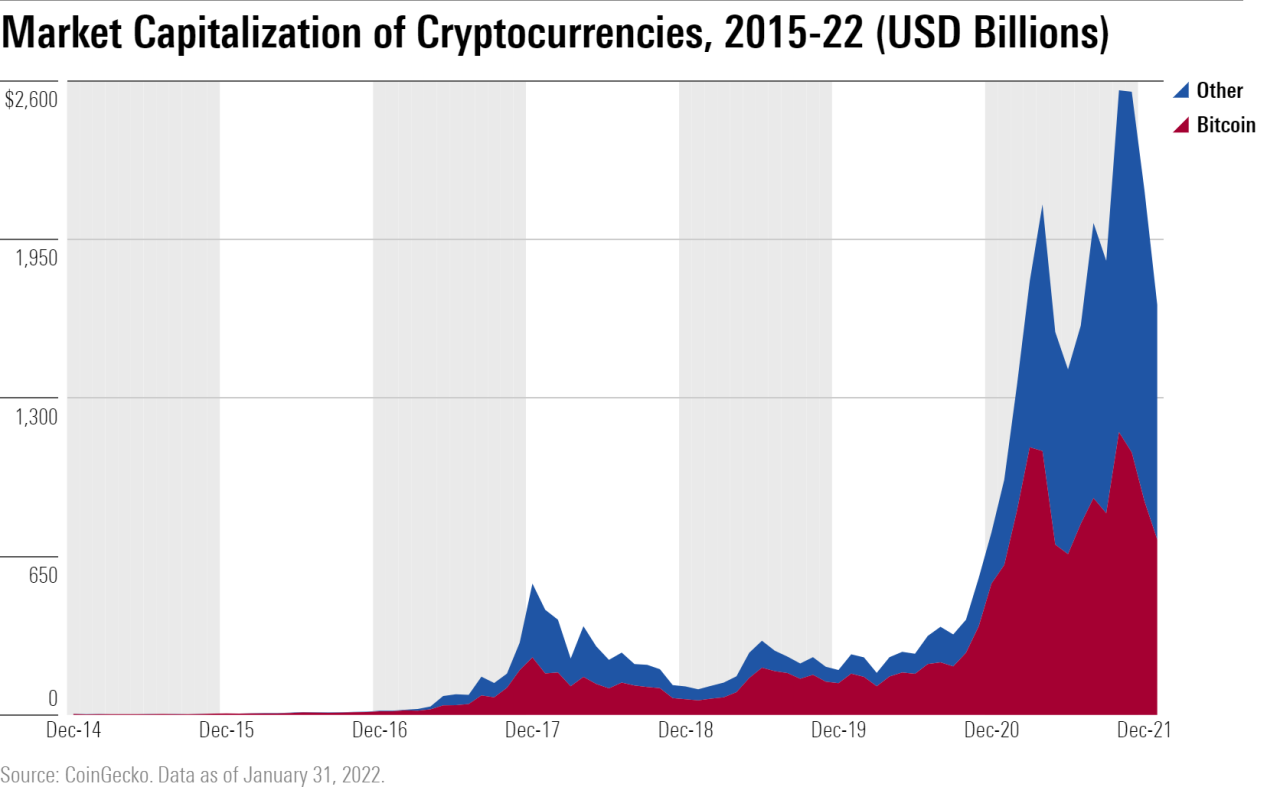

The performance of a cryptocurrency is often gauged by its market capitalization, trading volume, and technical analysis. Market capitalization reflects the total value of all outstanding coins or tokens, providing a snapshot of the overall size and liquidity of a cryptocurrency. Trading volume, on the other hand, measures the amount of cryptocurrency exchanged over a specific period, indicating its popularity and trading activity. Technical analysis uses charts and indicators to identify patterns and trends in price movements, providing insights into potential future price movements.

Factors Influencing Long-Term Value

Several factors contribute to the long-term value of a cryptocurrency. These include:

- Technology and Innovation: The underlying technology and innovation behind a cryptocurrency play a significant role in its value proposition. Cryptocurrencies with robust and innovative technologies, such as blockchain platforms with advanced functionalities or decentralized applications with practical use cases, tend to attract greater investor interest and long-term value.

- Community and Adoption: A strong and active community behind a cryptocurrency is crucial for its success. A large and engaged community can drive adoption, increase liquidity, and contribute to the overall development of the ecosystem.

- Team and Development: The team behind a cryptocurrency is critical for its long-term viability. A competent and experienced team with a clear roadmap and a commitment to innovation can inspire confidence in investors and foster long-term growth.

- Regulation and Legal Compliance: Regulatory clarity and legal compliance are essential for the long-term stability and acceptance of cryptocurrencies. A cryptocurrency that operates within a well-defined regulatory framework is more likely to gain mainstream adoption and investor trust.

Investing Strategies for Crypto Best Buys

Investing in cryptocurrencies requires a thoughtful approach and a deep understanding of various strategies. Whether you’re a seasoned investor or just starting, choosing the right strategy is crucial to maximizing your returns and mitigating risks. This section explores some popular investment strategies for crypto best buys, providing insights into their advantages, disadvantages, and practical applications.

Understanding Different Investment Strategies

Choosing the right investment strategy depends on your individual financial goals, risk tolerance, and time horizon. Here are some popular strategies:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency’s price. DCA helps mitigate the risk of buying high and selling low by averaging out the purchase price over time.

- Day Trading: Day trading involves buying and selling cryptocurrencies within the same trading day, aiming to profit from short-term price fluctuations. This strategy requires a high level of market knowledge, technical analysis skills, and risk tolerance.

- Hodling: Hodling refers to buying and holding cryptocurrencies for the long term, often years or even decades, with the expectation that their value will increase significantly over time. This strategy requires patience, a belief in the underlying technology, and a long-term perspective.

Comparing Investment Strategies

The following table provides a comparison of different investment strategies, highlighting their key features, advantages, and disadvantages:

| Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Investing a fixed amount at regular intervals, regardless of price. | Reduces risk of buying high and selling low, averages purchase price over time, disciplined approach. | May miss out on potential gains during market rallies, slower accumulation of assets, requires consistent commitment. |

| Day Trading | Buying and selling within the same trading day, aiming to profit from short-term price fluctuations. | Potential for high returns in volatile markets, flexibility to adapt to market conditions, requires constant monitoring. | High risk due to market volatility, requires significant technical analysis skills, time-consuming and demanding. |

| Hodling | Buying and holding for the long term, expecting value appreciation. | Lower risk than day trading, potential for significant long-term gains, requires minimal active management. | Potential for losses in bear markets, requires patience and belief in the underlying technology, limited opportunities for short-term gains. |

Developing a Sample Portfolio Allocation Strategy

A well-diversified portfolio is essential for mitigating risk and maximizing returns. Here’s a sample portfolio allocation strategy for a crypto investor:

- Bitcoin (BTC): 50% – As the largest and most established cryptocurrency, Bitcoin is considered a safe haven asset in the crypto market. Its price is often less volatile than other cryptocurrencies.

- Ethereum (ETH): 20% – Ethereum is the second-largest cryptocurrency and the leading platform for decentralized applications (dApps). It offers potential for growth as the DeFi and NFT ecosystems expand.

- Altcoins: 30% – This category includes various other cryptocurrencies with potential for growth, such as Solana, Cardano, and Polkadot. It’s crucial to conduct thorough research and select altcoins based on their fundamentals, technology, and team.

Important Note: This is just a sample portfolio allocation strategy and should not be considered financial advice. It’s essential to conduct your own research, consult with a financial advisor, and adjust your portfolio based on your individual risk tolerance and investment goals.

Resources and Tools for Crypto Best Buys

Navigating the world of cryptocurrencies can be daunting, but with the right resources and tools, you can make informed decisions and maximize your investment potential. This section will explore various resources available to help you identify crypto best buys and enhance your investment strategy.

Reliable Resources for Crypto Market Data and Analysis

Access to accurate and up-to-date market data is crucial for informed decision-making in the crypto space. Several reliable resources provide comprehensive market insights, including price charts, trading volumes, and fundamental analysis.

- CoinMarketCap: This website offers a comprehensive overview of the cryptocurrency market, including real-time price data, trading volumes, and market capitalization for thousands of cryptocurrencies.

- CoinGecko: Similar to CoinMarketCap, CoinGecko provides a wide range of crypto market data, including price charts, historical data, and developer activity metrics.

- TradingView: A popular platform for technical analysis, TradingView offers real-time price charts, technical indicators, and charting tools to help traders identify potential trading opportunities.

- Glassnode: This platform provides on-chain data analysis for Bitcoin and other cryptocurrencies, offering insights into network activity, supply dynamics, and market sentiment.

Popular Crypto Trading Platforms and Wallets

Once you’ve identified potential crypto best buys, you’ll need a reliable platform to trade and store your crypto assets. Numerous trading platforms and wallets cater to different needs and preferences.

- Binance: One of the largest cryptocurrency exchanges globally, Binance offers a wide range of trading pairs, advanced charting tools, and a user-friendly interface.

- Coinbase: A popular platform for beginners, Coinbase offers a simple and secure way to buy, sell, and store cryptocurrencies.

- Kraken: Known for its advanced trading features and high liquidity, Kraken is a preferred platform for experienced traders.

- Ledger Nano S/X: These hardware wallets provide an extra layer of security for your crypto assets by storing your private keys offline.

- Trezor Model T: Another popular hardware wallet, Trezor Model T offers a secure and user-friendly way to manage your crypto assets.

Security Measures and Best Practices for Crypto Investments

Security is paramount in the crypto space, as your investments are susceptible to various threats. Implementing robust security measures is crucial to protect your assets.

- Use Strong Passwords: Create strong, unique passwords for your exchange accounts and wallets, using a combination of uppercase and lowercase letters, numbers, and symbols.

- Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second authentication factor, such as a code sent to your phone or email, before you can access your account.

- Store Crypto Assets Offline: Hardware wallets provide the most secure way to store your crypto assets, as they keep your private keys offline and inaccessible to hackers.

- Be Cautious of Phishing Scams: Be wary of suspicious emails or websites that request your login credentials or personal information. Never share your private keys with anyone.

- Keep Your Software Updated: Regularly update your exchange software and wallet applications to benefit from the latest security patches and bug fixes.

The Future of Crypto Best Buys

The crypto market is constantly evolving, with new trends and developments emerging all the time. Understanding these trends and how they will impact the market is crucial for investors seeking to identify crypto best buys.

Regulatory Changes and Technological Advancements

Regulatory changes and technological advancements will significantly influence the future of crypto investments. Governments worldwide are actively working on frameworks to regulate the crypto industry, aiming to provide clarity and stability. These regulations could potentially increase investor confidence and drive broader adoption of cryptocurrencies.

Technological advancements, such as the development of new blockchain platforms, improved scalability solutions, and advancements in artificial intelligence, will likely lead to new opportunities and applications for cryptocurrencies. These advancements could drive innovation and lead to the emergence of new crypto best buys.

Emerging Cryptocurrencies

Several emerging cryptocurrencies have the potential to disrupt traditional financial systems and offer significant growth opportunities. These cryptocurrencies often focus on specific use cases, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse.

- Decentralized Finance (DeFi): DeFi platforms aim to create a more accessible and transparent financial system by leveraging blockchain technology. Cryptocurrencies like Aave (AAVE), Compound (COMP), and Maker (MKR) have emerged as key players in this space. These platforms offer lending, borrowing, and other financial services without the need for traditional intermediaries.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of digital or physical assets. They have gained popularity in the art, gaming, and collectibles markets. Cryptocurrencies like Ethereum (ETH) and Solana (SOL) are widely used for creating and trading NFTs.

- Metaverse: The metaverse is a collective virtual space where users can interact with each other, create, and trade digital assets. Cryptocurrencies like Decentraland (MANA) and Sandbox (SAND) power these virtual worlds. These platforms offer opportunities for users to create and monetize their experiences.

Summary

In conclusion, navigating the world of crypto best buys requires a blend of research, risk management, and a long-term vision. By understanding the factors influencing cryptocurrency investments, identifying top cryptocurrencies, and employing strategic approaches, investors can position themselves to capitalize on the growth potential of this dynamic market. While the crypto space is inherently volatile, a well-informed approach can help investors navigate the complexities and potentially achieve substantial returns.

Essential Questionnaire

What are some of the risks associated with crypto investments?

Cryptocurrency investments are inherently volatile and carry significant risks. These include price fluctuations, market manipulation, regulatory uncertainty, and security breaches. It’s crucial to conduct thorough research, diversify your portfolio, and only invest what you can afford to lose.

How can I learn more about cryptocurrencies and the market?

There are numerous resources available for learning about cryptocurrencies. Online platforms, educational websites, and reputable crypto communities offer valuable information and insights. It’s also beneficial to follow industry news and publications to stay updated on market trends and developments.

What are some of the popular crypto trading platforms?

Popular crypto trading platforms include Binance, Coinbase, Kraken, and Gemini. These platforms offer a range of features, including trading pairs, order types, and security measures. It’s essential to choose a platform that aligns with your trading needs and preferences.