Best sites to buy crypto, the world of cryptocurrency can seem intimidating for newcomers. But navigating the process of buying and selling crypto can be simplified with the right information and resources. This guide will explore the top platforms for buying crypto, breaking down essential factors to consider and offering insights for both beginners and experienced traders.

Understanding the different types of crypto exchanges, the features they offer, and the security measures they implement is crucial for making informed decisions. We will delve into popular exchanges, highlighting their strengths and weaknesses to help you choose the platform that best suits your needs.

Factors to Consider When Choosing a Crypto Exchange

Choosing the right cryptocurrency exchange is crucial for a seamless and secure trading experience. You need to carefully evaluate various factors to ensure that the platform aligns with your needs and preferences.

User-friendliness and Ease of Navigation

The user interface and navigation of a cryptocurrency exchange play a significant role in determining its user-friendliness. A well-designed platform should be intuitive and easy to navigate, even for beginners.

- Intuitive Layout: The exchange should have a clear and organized layout with easy-to-understand menus and sections. It should be easy to find the information you need, such as trading pairs, order books, and account settings.

- Mobile App Availability: A mobile app can enhance the user experience by providing on-the-go access to your account and trading activities. Look for exchanges with user-friendly and feature-rich mobile apps.

- Comprehensive Help Center: A comprehensive help center with FAQs, tutorials, and support articles can be invaluable for resolving any issues or understanding the platform’s features.

Security Measures

Security is paramount when choosing a cryptocurrency exchange. You need to ensure that the platform has robust security measures in place to protect your funds and personal information.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring an additional code, typically sent to your phone or email, when logging in. This makes it significantly harder for unauthorized individuals to access your account.

- Cold Storage: Cold storage refers to storing cryptocurrencies offline, making them inaccessible to hackers. Reputable exchanges typically use cold storage for a large portion of their users’ funds, ensuring their safety.

- Security Audits: Regular security audits conducted by independent third parties can help identify and address potential vulnerabilities in the exchange’s systems.

Fees

Cryptocurrency exchanges charge fees for various services, including trading, deposits, and withdrawals. It’s essential to compare the fees charged by different exchanges to find the most cost-effective option.

- Trading Fees: Trading fees are charged on each buy or sell order. These fees can vary depending on the exchange, trading volume, and the type of order (e.g., market order, limit order). Some exchanges offer tiered fee structures, where the fees decrease as your trading volume increases.

- Deposit Fees: Deposit fees are charged when you transfer funds into your exchange account. These fees can vary depending on the payment method used. Some exchanges offer free deposits for certain methods, such as bank transfers.

- Withdrawal Fees: Withdrawal fees are charged when you transfer funds out of your exchange account. These fees can vary depending on the cryptocurrency being withdrawn and the withdrawal method.

Top Crypto Exchanges for Beginners

Navigating the world of cryptocurrency can feel overwhelming, especially for newcomers. Choosing the right exchange is crucial for a smooth and secure experience. This section will highlight some of the top crypto exchanges that cater specifically to beginners, offering user-friendly interfaces and educational resources.

Top Crypto Exchanges for Beginners

Finding a suitable crypto exchange can be daunting, especially for those new to the crypto space. This section will provide insights into some of the most reputable exchanges known for their beginner-friendly features and resources.

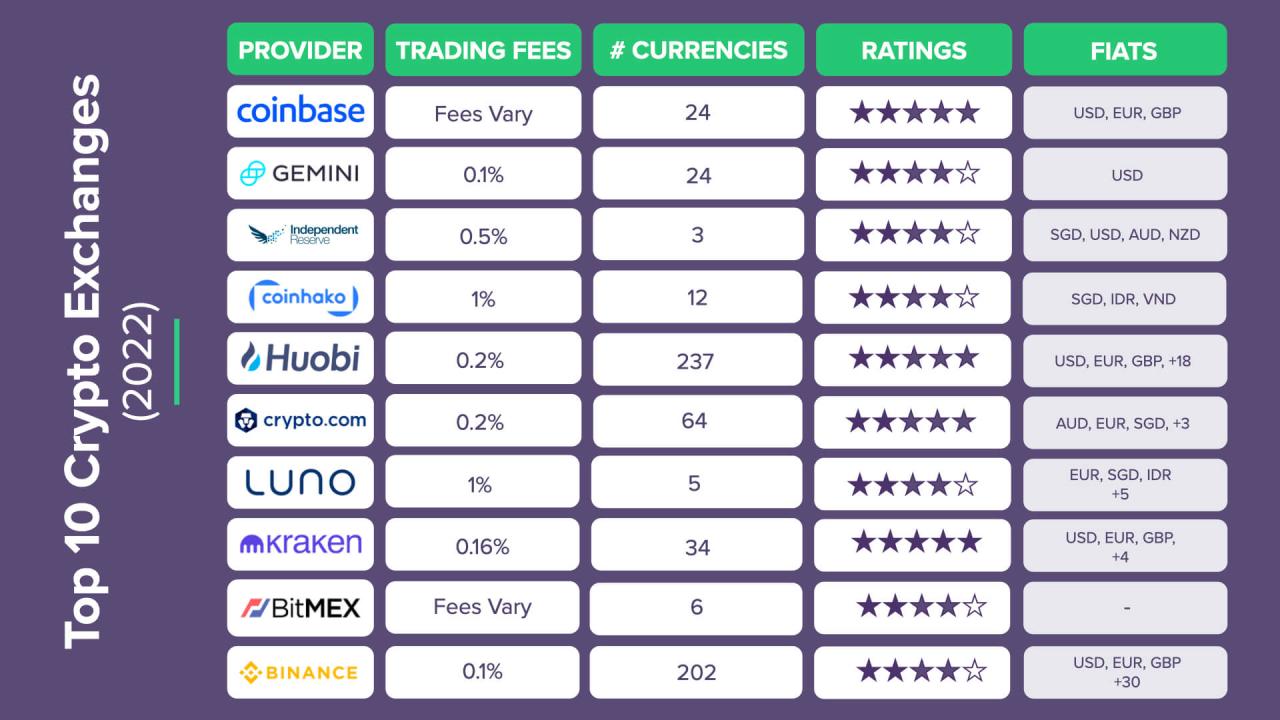

| Exchange Name | Fees | Supported Cryptocurrencies | Security Features |

|---|---|---|---|

| Coinbase | Variable, depending on payment method and trading volume | Over 100 cryptocurrencies | Two-factor authentication (2FA), cold storage, insurance |

| Binance.US | Variable, depending on trading volume and payment method | Over 100 cryptocurrencies | Two-factor authentication (2FA), cold storage, security audits |

| Kraken | Variable, depending on trading volume and payment method | Over 100 cryptocurrencies | Two-factor authentication (2FA), cold storage, security audits |

| Crypto.com | Variable, depending on trading volume and payment method | Over 250 cryptocurrencies | Two-factor authentication (2FA), cold storage, security audits |

Coinbase is renowned for its user-friendly interface and comprehensive educational resources. It’s a great option for beginners who are just starting to explore the crypto world. Its intuitive platform and detailed guides make it easy to navigate and understand even the most complex concepts.

Binance.US, a subsidiary of the global Binance exchange, is known for its wide selection of cryptocurrencies and competitive trading fees. While its interface might be slightly more complex than Coinbase, Binance.US offers a vast array of trading tools and resources for those looking to delve deeper into crypto trading.

Kraken is a reputable exchange that prioritizes security and offers advanced trading features. Its interface is designed for both beginners and experienced traders, providing a balance between simplicity and functionality. Kraken is known for its robust security measures and commitment to regulatory compliance.

Crypto.com stands out for its extensive range of cryptocurrencies and its user-friendly mobile app. It offers a variety of features, including staking, lending, and a rewards program, making it a versatile option for beginners and more experienced users alike.

Advanced Crypto Exchange Features: Best Sites To Buy Crypto

Once you’ve gained some experience with basic crypto trading, you might be interested in exploring more advanced features offered by certain exchanges. These features can unlock new opportunities and strategies, but they also come with increased risks. It’s crucial to understand these features and their implications before using them.

Margin Trading

Margin trading allows traders to borrow funds from the exchange to increase their position size. This can amplify both profits and losses.

- Benefits:

- Potential for higher returns on investments

- Greater leverage to capitalize on market movements

- Risks:

- Increased risk of losses: Since you’re borrowing money, losses can be magnified, potentially leading to significant financial losses.

- Liquidation: If the market moves against your position and your losses exceed your initial margin, the exchange can automatically sell your assets to cover the debt, resulting in significant losses.

- Interest charges: Exchanges typically charge interest on borrowed funds, which can add to your trading costs.

Futures Contracts

Futures contracts are agreements to buy or sell a specific cryptocurrency at a predetermined price and date in the future. They can be used for speculation, hedging, or arbitrage.

- Benefits:

- Price speculation: Futures contracts allow traders to speculate on future price movements of cryptocurrencies.

- Hedging: Traders can use futures contracts to mitigate potential losses on existing cryptocurrency holdings.

- Arbitrage: Futures contracts can be used to profit from price discrepancies between spot and futures markets.

- Risks:

- Market volatility: The price of cryptocurrencies can fluctuate significantly, leading to large losses on futures contracts.

- Liquidation: If the market moves against your position, you may be liquidated, resulting in significant losses.

- Counterparty risk: Futures contracts are subject to counterparty risk, meaning that the other party to the contract may default on their obligations.

Staking

Staking is a process where you hold a certain amount of cryptocurrency in a wallet to support the network and receive rewards. It’s similar to earning interest on a savings account.

- Benefits:

- Passive income: Staking allows you to earn rewards for holding cryptocurrencies.

- Support for blockchain networks: Staking helps to secure and maintain the integrity of blockchain networks.

- Risks:

- Impermanent loss: Staking can lead to impermanent loss, which is a loss in value that occurs when the price of the staked cryptocurrency fluctuates.

- Security risks: Staking requires you to hold your cryptocurrencies in a wallet, which can be vulnerable to hacking or theft.

Examples of Exchanges Offering Advanced Trading Options

Several exchanges offer advanced trading features, including:

- Binance: Binance is one of the largest cryptocurrency exchanges globally and offers margin trading, futures contracts, and staking.

- Coinbase Pro: Coinbase Pro is a professional trading platform that allows margin trading and futures contracts.

- Kraken: Kraken is a well-established exchange known for its advanced trading features, including margin trading, futures contracts, and staking.

Safety and Security Tips for Crypto Exchanges

The world of cryptocurrency is constantly evolving, and with it, the need for robust security measures to protect your digital assets. While crypto exchanges offer convenience for trading, it’s crucial to prioritize safety to safeguard your investments. This section will explore essential safety and security tips for using crypto exchanges.

Protecting Your Crypto Exchange Account

Safeguarding your crypto exchange account is paramount. Following best practices can significantly reduce the risk of unauthorized access and financial losses.

- Strong Passwords: Utilize a unique, complex password for your exchange account. Avoid using common words, birthdates, or easily guessable combinations. A strong password should include a mix of uppercase and lowercase letters, numbers, and symbols.

- Two-Factor Authentication (2FA): Enable two-factor authentication whenever possible. 2FA adds an extra layer of security by requiring you to enter a code from your phone or authenticator app in addition to your password. This makes it much harder for unauthorized individuals to access your account, even if they obtain your password.

- Secure Your Device: Ensure your computer, phone, or tablet is protected with up-to-date antivirus software and a strong firewall. Avoid accessing your exchange account from public Wi-Fi networks, as they are more susceptible to hacking attempts.

- Be Wary of Phishing Scams: Be cautious of suspicious emails, text messages, or phone calls that claim to be from your exchange. Phishing scams often try to trick users into revealing their login credentials or other sensitive information. Never click on links or download attachments from unknown sources. Verify the sender’s legitimacy before interacting with any communication.

- Regularly Review Account Activity: Keep a close eye on your account activity and look for any unusual transactions or login attempts. If you notice something suspicious, immediately contact your exchange’s customer support team.

Risks of Storing Crypto on Exchanges

While exchanges provide a convenient platform for buying, selling, and trading cryptocurrencies, storing your digital assets directly on an exchange carries inherent risks.

- Exchange Hacks: Exchanges are not immune to hacking attempts. In the past, several high-profile exchange hacks have resulted in significant losses for users. While exchanges often implement security measures, the risk of hacking remains a concern.

- Exchange Failure: Exchanges can face financial difficulties or even go bankrupt, potentially leading to the loss of your funds. It’s essential to research the financial stability and reputation of any exchange before using it.

- Security Breaches: Even if an exchange doesn’t suffer a full-blown hack, security breaches can still occur. For example, an employee could steal user data or an exchange might have vulnerabilities that attackers exploit.

Alternative Storage Methods, Best sites to buy crypto

To mitigate the risks associated with storing crypto on exchanges, consider using alternative storage methods:

- Hardware Wallets: Hardware wallets are physical devices that store your private keys offline, making them significantly more secure than storing your crypto on an exchange. They are considered the most secure option for long-term storage. Popular hardware wallet brands include Ledger and Trezor.

- Software Wallets: Software wallets are digital wallets that you can download and install on your computer or mobile device. They are more convenient than hardware wallets but offer less security. Some popular software wallets include Exodus and MyEtherWallet.

- Paper Wallets: Paper wallets are essentially printed pieces of paper containing your public and private keys. They offer excellent security as long as you keep them safe and secure.

Regulation and Legality of Crypto Exchanges

The regulatory landscape for cryptocurrency exchanges is rapidly evolving, with different jurisdictions adopting diverse approaches. This dynamic environment presents both opportunities and challenges for the crypto industry, influencing exchange operations, investor protection, and overall market stability.

Regulatory Landscape Across Jurisdictions

The regulatory landscape for crypto exchanges varies significantly across different countries and regions. Some jurisdictions have established comprehensive frameworks, while others are still developing their regulatory approaches. This section explores the regulatory landscape in key regions:

- United States: The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) play a significant role in regulating crypto exchanges. The SEC classifies many cryptocurrencies as securities, subjecting them to stringent registration and disclosure requirements. The CFTC regulates crypto futures and derivatives trading. The Financial Crimes Enforcement Network (FinCEN) also requires crypto exchanges to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- European Union: The EU’s Fifth Anti-Money Laundering Directive (AMLD5) requires crypto exchanges to comply with AML/KYC regulations. The European Securities and Markets Authority (ESMA) provides guidance on the application of AMLD5 to crypto activities. The EU is also working on a comprehensive regulatory framework for crypto assets, including a Markets in Crypto Assets (MiCA) proposal.

- United Kingdom: The UK’s Financial Conduct Authority (FCA) regulates crypto exchanges under its anti-money laundering and terrorist financing regulations. The FCA also requires crypto exchanges to register with them and meet certain capital adequacy requirements.

- Singapore: Singapore’s Monetary Authority of Singapore (MAS) has established a regulatory framework for digital payment token (DPT) services, including crypto exchanges. MAS requires DPT service providers to obtain a license and comply with AML/KYC regulations.

- Japan: Japan’s Financial Services Agency (FSA) regulates crypto exchanges under the Payment Services Act. The FSA requires crypto exchanges to register with them and meet certain capital adequacy and security requirements.

Licensing and Compliance Requirements

Crypto exchanges operating in regulated jurisdictions must obtain licenses and comply with various requirements. These requirements typically include:

- Registration: Exchanges must register with the relevant regulatory authorities, providing information about their operations, ownership structure, and compliance procedures.

- Capital Adequacy: Exchanges may be required to maintain a certain level of capital reserves to mitigate financial risks and protect customer funds.

- Anti-Money Laundering (AML) and Know-Your-Customer (KYC): Exchanges must implement robust AML/KYC procedures to verify the identities of their customers and prevent money laundering and terrorist financing.

- Cybersecurity: Exchanges must implement strong cybersecurity measures to protect customer data and assets from cyberattacks.

- Customer Protection: Exchanges may be required to provide customer protection measures, such as insurance or compensation schemes, to mitigate losses in case of exchange failures or breaches.

Impact of Regulations on the Crypto Industry

Crypto regulations can have a significant impact on the crypto industry, including:

- Increased Legitimacy and Trust: Regulations can enhance the legitimacy and trust of the crypto industry by establishing clear rules and standards for exchange operations.

- Investor Protection: Regulations can protect investors by requiring exchanges to meet certain standards of financial stability, cybersecurity, and customer protection.

- Market Stability: Regulations can contribute to market stability by reducing the risk of fraud and manipulation.

- Innovation and Growth: While some regulations may initially hinder innovation, they can also create a more predictable and stable environment for the industry to grow and develop.

- Competition and Consolidation: Regulations can lead to increased competition among exchanges as they strive to meet compliance requirements. This can also lead to consolidation within the industry, with smaller exchanges struggling to compete with larger, more established players.

Emerging Trends in Crypto Exchanges

The crypto exchange landscape is constantly evolving, driven by advancements in technology, regulatory changes, and the growing adoption of digital assets. This dynamic environment fosters innovation and pushes the boundaries of traditional finance, giving rise to exciting new trends that are reshaping the industry.

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are gaining traction as a more secure and transparent alternative to centralized exchanges (CEXs). DEXs operate on blockchain technology, eliminating the need for intermediaries and central points of control. This decentralized architecture enhances security by reducing the risk of hacks and manipulation.

DEXs offer a more transparent and secure trading experience, empowering users with greater control over their funds.

Non-Fungible Token (NFT) Marketplaces

The surge in popularity of NFTs has created a demand for specialized platforms that facilitate their trading and creation. NFT marketplaces are emerging as dedicated platforms for buying, selling, and trading NFTs, offering a unique and growing segment of the crypto exchange ecosystem.

Institutional Adoption and Derivatives

Institutional investors are increasingly participating in the crypto market, driving the demand for sophisticated trading tools and derivatives products. Crypto exchanges are adapting to meet this demand by offering institutional-grade services, including margin trading, futures contracts, and options trading.

Cross-Chain Interoperability

The growing number of blockchains and the emergence of cross-chain protocols are paving the way for interoperability between different crypto ecosystems. Crypto exchanges are integrating with these protocols, allowing users to trade and manage assets across multiple blockchains seamlessly.

Regulatory Compliance and Security

As the crypto industry matures, regulatory scrutiny is increasing. Crypto exchanges are prioritizing compliance with regulations, implementing robust security measures, and fostering a more trustworthy and transparent trading environment.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming the crypto exchange landscape by enhancing trading algorithms, fraud detection, and risk management. These technologies enable exchanges to offer personalized trading experiences, improve efficiency, and optimize security protocols.

Yield Aggregators and DeFi

Decentralized finance (DeFi) protocols are offering innovative ways to generate yield on crypto assets. Yield aggregators, platforms that automate yield farming strategies, are integrating with crypto exchanges, providing users with access to diverse and high-yielding opportunities.

Social Trading and Copy Trading

Social trading platforms allow users to follow and copy the trades of experienced traders. Crypto exchanges are integrating these features, enabling novice investors to learn from experienced traders and benefit from their insights.

Closing Summary

As the crypto landscape continues to evolve, staying informed about the latest trends and technologies is essential. By understanding the factors to consider when choosing a crypto exchange, implementing safety measures, and keeping up with industry developments, you can navigate the world of cryptocurrency with confidence and make informed decisions about your investments.

Q&A

What are the risks associated with buying and selling crypto?

Cryptocurrency markets are volatile and subject to price fluctuations. The value of your investments can go up or down, and there is always the risk of losing money. Additionally, security breaches and scams are concerns within the crypto space.

How do I choose the right crypto exchange for me?

Consider factors like user-friendliness, fees, security features, supported cryptocurrencies, and the level of experience you have. Research different exchanges, compare their offerings, and read reviews before making a decision.

What are some tips for securing my crypto exchange account?

Use strong passwords, enable two-factor authentication, be wary of phishing scams, and avoid storing large amounts of cryptocurrency on exchanges. Consider using hardware wallets for greater security.