Best time to buy crypto is a question that every investor grapples with. The cryptocurrency market, known for its volatility, can be both rewarding and challenging. Timing the market is an elusive art, but by understanding the intricacies of market cycles, analyzing sentiment, and employing a combination of fundamental and technical analysis, you can position yourself for potential success. This guide will delve into the key factors that influence the best time to buy crypto, empowering you to make informed decisions and navigate the dynamic world of digital assets.

The cryptocurrency market, unlike traditional markets, is influenced by a complex interplay of factors. These include regulatory changes, macroeconomic trends, technological advancements, and, most importantly, market sentiment. Understanding these factors and their impact on price movements is crucial for identifying potential buying opportunities. This guide will explore each of these aspects in detail, providing you with a comprehensive understanding of the best time to buy crypto.

Crypto Investment Strategies

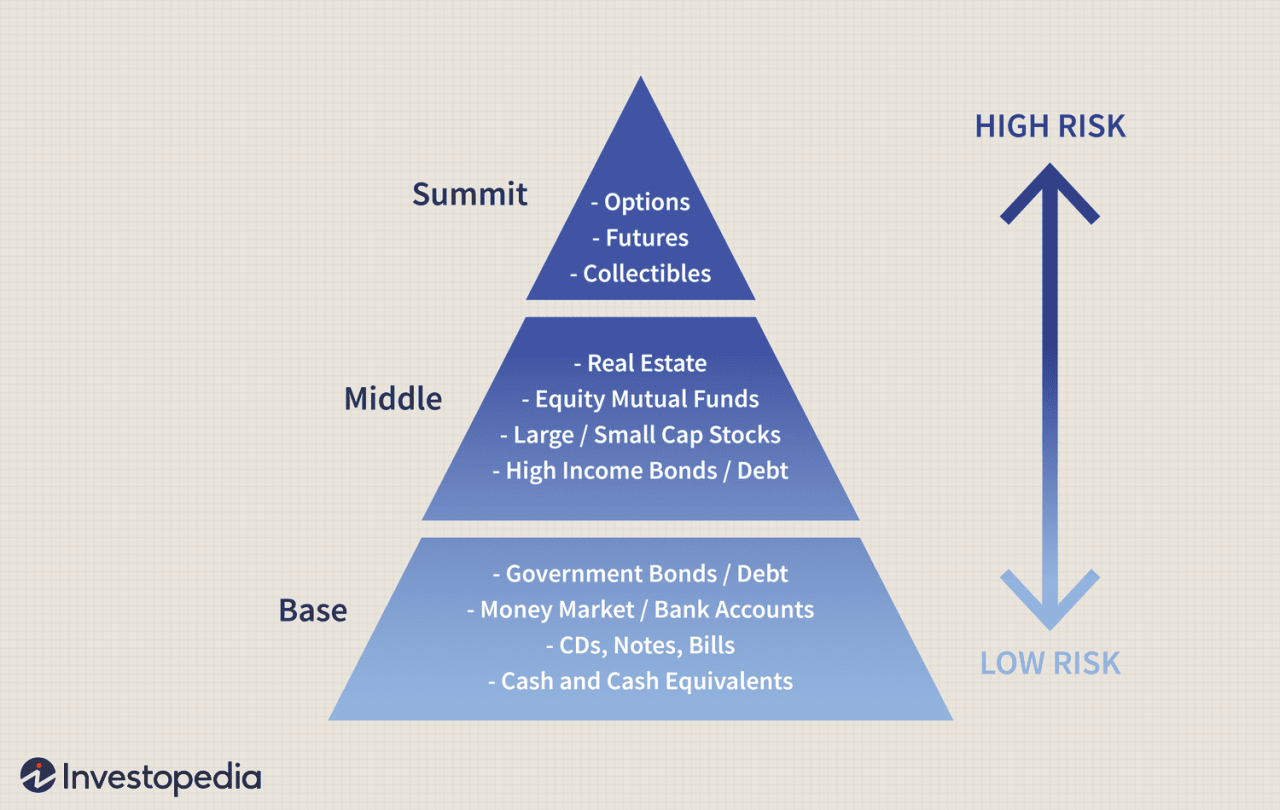

Investing in cryptocurrencies can be an exciting and potentially lucrative endeavor, but it also comes with inherent risks. To navigate the volatile world of crypto, investors employ a range of strategies, each with its own set of advantages and disadvantages. Understanding these strategies is crucial for making informed investment decisions and maximizing your chances of success.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a popular strategy that involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of market fluctuations. This approach helps to mitigate the risk of buying high and selling low.

- Advantages:

- Reduces the impact of market volatility by averaging out purchase prices over time.

- Disciplined approach to investing, promoting consistency.

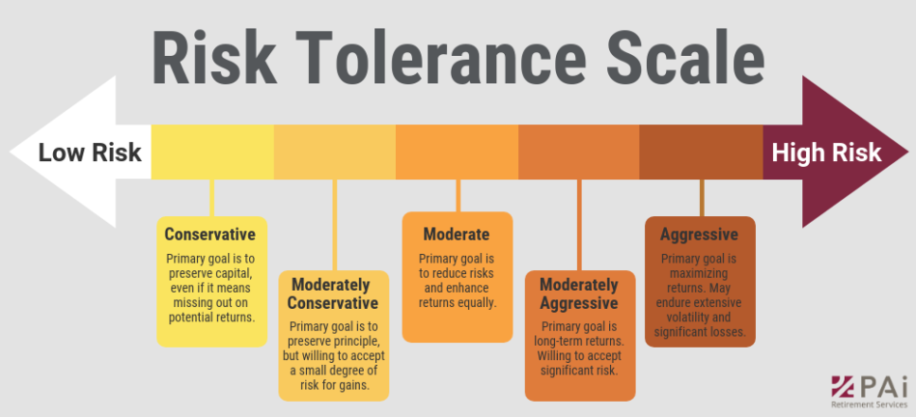

- Suitable for long-term investors with a lower risk tolerance.

- Disadvantages:

- May not yield the highest returns if the market experiences a sustained bull run.

- Requires consistent investment, even during market downturns.

Hodling

Hodling refers to the strategy of buying and holding cryptocurrencies for an extended period, often years, regardless of short-term price fluctuations. This approach is based on the belief that the long-term value of cryptocurrencies will appreciate significantly over time.

- Advantages:

- Minimizes the impact of short-term market volatility.

- Suitable for investors with a long-term investment horizon and a higher risk tolerance.

- Disadvantages:

- Requires patience and a belief in the long-term potential of cryptocurrencies.

- Potential for significant losses if the market experiences a prolonged downturn.

Trading

Crypto trading involves buying and selling cryptocurrencies with the goal of profiting from short-term price fluctuations. This strategy requires a deep understanding of technical analysis, market trends, and risk management.

- Advantages:

- Potential for high returns if executed correctly.

- Flexibility to adapt to market conditions and capitalize on short-term opportunities.

- Disadvantages:

- High risk due to the volatile nature of the crypto market.

- Requires significant technical expertise and time commitment.

- Potential for significant losses if trades are not executed properly.

Real-World Examples and Case Studies

Learning from the successes and failures of others can be a powerful tool for navigating the world of crypto investments. Examining real-world examples of successful crypto investments can provide valuable insights into market trends, investment strategies, and the factors that contribute to significant returns.

Early Bitcoin Adoption

Early adopters of Bitcoin, who invested in the cryptocurrency when its price was relatively low, have reaped substantial rewards. For example, someone who invested $100 in Bitcoin in 2010 would have seen their investment grow to over $1 million by 2021. This example illustrates the potential for significant returns from early adoption of a cryptocurrency.

- Early Adoption: Investing in Bitcoin at its inception or during its early stages, when the price was relatively low, allowed early adopters to accumulate a large number of coins. As the price of Bitcoin rose, the value of their holdings increased exponentially.

- Market Growth: The rapid growth of the cryptocurrency market, driven by increased adoption and institutional interest, contributed to the significant price appreciation of Bitcoin.

- Limited Supply: Bitcoin’s limited supply, capped at 21 million coins, has created scarcity and fueled demand, further driving up its price.

Ethereum’s Smart Contracts, Best time to buy crypto

Ethereum, a decentralized platform that allows for the creation and execution of smart contracts, has seen significant growth in recent years. Its native cryptocurrency, Ether (ETH), has experienced substantial price appreciation, making it one of the most successful crypto investments.

- Smart Contract Functionality: Ethereum’s smart contract functionality has revolutionized decentralized applications (DApps) and opened up new possibilities for blockchain technology. This innovation has attracted developers and investors, driving up demand for ETH.

- Decentralized Finance (DeFi): The rise of DeFi, which leverages smart contracts to create decentralized financial services, has further fueled the demand for ETH. Many DeFi protocols are built on the Ethereum blockchain.

- Growing Ecosystem: Ethereum’s robust ecosystem, with a wide range of DApps and developers, has contributed to its long-term growth and sustainability.

The Rise of Stablecoins

Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, have gained popularity as a means of mitigating volatility in the cryptocurrency market. Investments in stablecoins like Tether (USDT) and USD Coin (USDC) have provided investors with a relatively stable store of value.

- Price Stability: Stablecoins offer price stability, which is attractive to investors seeking to hedge against the volatility of other cryptocurrencies. This stability makes them suitable for everyday transactions and as a safe haven during market downturns.

- Adoption and Liquidity: The increasing adoption of stablecoins for payments, trading, and other financial activities has led to increased liquidity and widespread availability.

- Integration with Traditional Finance: Stablecoins have facilitated the integration of cryptocurrencies into traditional financial systems, providing a bridge between the two worlds.

Crypto Market Trends and Predictions: Best Time To Buy Crypto

The crypto market is constantly evolving, with new technologies and trends emerging all the time. Understanding these trends is crucial for investors who want to make informed decisions. This section explores some of the most significant trends shaping the crypto landscape and delves into expert predictions about the future of cryptocurrencies.

DeFi: Decentralized Finance

DeFi, or Decentralized Finance, is a rapidly growing sector of the crypto market that aims to disrupt traditional financial systems. DeFi platforms offer a wide range of financial services, such as lending, borrowing, trading, and insurance, all built on blockchain technology.

DeFi platforms are decentralized, meaning they are not controlled by any single entity. This eliminates the need for intermediaries like banks and allows users to access financial services directly.

The potential impact of DeFi on the future of cryptocurrencies is significant. It has the potential to democratize finance and make it more accessible to a wider range of people.

“DeFi has the potential to revolutionize the financial system by making it more transparent, efficient, and accessible to everyone.” – Brian Armstrong, CEO of Coinbase

NFTs: Non-Fungible Tokens

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership of real-world or digital items. NFTs have gained immense popularity in recent years, particularly in the art, gaming, and music industries.

NFTs allow creators to monetize their work directly and provide collectors with a way to own and trade unique digital assets. They also enable new forms of digital ownership and provide opportunities for creators to build communities around their work.

“NFTs are a game-changer for creators and artists, allowing them to connect directly with their fans and monetize their work in new ways.” – Gary Vaynerchuk, entrepreneur and investor

Web3: The Next Generation of the Internet

Web3, or the decentralized web, is a vision for a more open, secure, and user-centric internet. It leverages blockchain technology to create a more distributed and transparent internet where users have more control over their data and online experiences.

Web3 is expected to have a profound impact on the future of cryptocurrencies. It will create new opportunities for decentralized applications (dApps) and services, leading to increased adoption of cryptocurrencies.

“Web3 is the next generation of the internet, and it will be powered by blockchain technology.” – Vitalik Buterin, co-founder of Ethereum

Closing Notes

Ultimately, the best time to buy crypto is a subjective decision based on your individual risk tolerance, investment goals, and market outlook. There is no one-size-fits-all answer. By combining a deep understanding of market dynamics with a disciplined approach to risk management, you can develop a personalized strategy that aligns with your financial objectives. Remember, investing in cryptocurrencies carries inherent risks, and it’s essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

FAQ Guide

What is the best time to buy crypto?

There is no single best time to buy crypto. It depends on your individual investment strategy and market conditions. However, understanding market cycles, analyzing sentiment, and using fundamental and technical analysis can help you identify potential buying opportunities.

Is it better to buy crypto during a bull market or a bear market?

Both bull and bear markets present opportunities. During a bull market, prices are rising, but the risk of a correction is higher. During a bear market, prices are falling, but there may be opportunities to buy at lower prices. Ultimately, it depends on your risk tolerance and investment goals.

What are some common crypto investment strategies?

Some popular strategies include dollar-cost averaging (DCA), hodling, and trading. DCA involves investing a fixed amount of money at regular intervals. Hodling involves buying and holding crypto for the long term. Trading involves buying and selling crypto frequently to profit from short-term price fluctuations.