- Understanding the Crypto Market in 2024

- Factors to Consider When Choosing Cryptocurrencies

- Top Cryptocurrencies to Consider in 2024

- Emerging Cryptocurrencies with High Potential

- Investment Strategies for Cryptocurrencies

- Responsible Crypto Investing

- Closing Summary: Best Crypto To Buy In 2024

- Essential FAQs

Best crypto to buy in 2024? It’s a question on everyone’s mind as the cryptocurrency market continues to evolve. With the rise of new technologies and changing market dynamics, choosing the right cryptocurrencies to invest in can be both exciting and daunting. This guide aims to provide you with the knowledge and insights you need to navigate the crypto landscape in 2024, exploring potential opportunities and the factors to consider before making investment decisions.

The crypto market in 2024 is poised for continued growth, driven by factors such as increased adoption, technological advancements, and evolving regulatory landscapes. However, it’s important to approach investments with a balanced perspective, understanding both the potential rewards and risks associated with this dynamic asset class.

Understanding the Crypto Market in 2024

The crypto market has experienced a rollercoaster ride in recent years, marked by periods of explosive growth followed by sharp corrections. While 2023 brought challenges, 2024 holds the potential for a rebound and continued evolution. Understanding the key factors that will shape the market’s trajectory is crucial for investors seeking to navigate this dynamic space.

Factors Influencing the Crypto Market in 2024

Several factors will influence the crypto market’s performance in 2024. These include:

Regulatory Developments

Regulatory clarity is a major concern for the crypto industry. Governments worldwide are actively working on regulations to govern cryptocurrencies and related activities. The impact of these regulations on the crypto market will be significant, potentially influencing investor confidence, market liquidity, and the development of new crypto projects. For instance, the US Securities and Exchange Commission’s (SEC) increased scrutiny of crypto exchanges and token offerings has led to uncertainty and volatility in the market. Conversely, more favorable regulations in certain jurisdictions could attract investment and foster innovation.

Macroeconomic Conditions

Global macroeconomic conditions play a crucial role in shaping the crypto market. Factors such as inflation, interest rates, and economic growth influence investor sentiment and risk appetite. For example, during periods of high inflation and rising interest rates, investors may shift away from riskier assets like cryptocurrencies towards more stable investments. Conversely, a favorable economic environment could lead to increased investment in cryptocurrencies as investors seek higher returns.

Technological Advancements

Technological advancements within the crypto space continue to drive innovation and adoption. Developments such as layer-2 scaling solutions, improved privacy features, and the emergence of new use cases for blockchain technology can enhance the utility and attractiveness of cryptocurrencies. For instance, the increasing adoption of decentralized finance (DeFi) protocols and the development of non-fungible tokens (NFTs) have created new opportunities for investors and users.

Sentiment within the Crypto Community

The sentiment within the crypto community can significantly influence market trends. Positive sentiment, driven by factors such as technological advancements, regulatory clarity, or strong price performance, can attract new investors and lead to increased demand. Conversely, negative sentiment, triggered by events such as market crashes, regulatory crackdowns, or security breaches, can lead to sell-offs and price declines.

Factors to Consider When Choosing Cryptocurrencies

Choosing the right cryptocurrencies to invest in is crucial for maximizing potential returns and minimizing risks. While there are countless digital assets available, careful consideration of various factors is essential to make informed investment decisions.

Diversification in Crypto Portfolios

Diversification is a fundamental principle in investing, and it applies equally to cryptocurrencies. Spreading your investments across different cryptocurrencies can mitigate risk by reducing exposure to the volatility of any single asset. A diversified portfolio can help cushion the impact of potential price fluctuations in one cryptocurrency, as losses in one asset may be offset by gains in another.

- Market Capitalization: Consider investing in a mix of large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap cryptocurrencies like Bitcoin and Ethereum tend to be more stable, while smaller-cap coins may offer higher growth potential but also carry greater risk.

- Project Type: Diversify across different types of cryptocurrencies, such as stablecoins, DeFi protocols, NFTs, and metaverse projects. This approach reduces reliance on any single sector or technology.

- Risk Tolerance: Allocate your investments based on your individual risk tolerance. If you are comfortable with higher risk, you may allocate a larger portion of your portfolio to smaller-cap or more volatile cryptocurrencies.

Risks and Rewards of Cryptocurrency Investing

Investing in cryptocurrencies presents both potential rewards and inherent risks. Understanding these factors is crucial for making informed investment decisions.

- Volatility: Cryptocurrencies are known for their price volatility. Prices can fluctuate significantly within short periods, leading to both potential gains and losses.

- Regulation: The regulatory landscape for cryptocurrencies is still evolving. Changes in regulations can impact the value of cryptocurrencies and the availability of certain services.

- Security: Cryptocurrencies are susceptible to security breaches and hacks. It is crucial to choose secure wallets and platforms to store your assets.

- Market Manipulation: The relatively small market capitalization of some cryptocurrencies can make them susceptible to market manipulation.

- Potential for High Returns: Despite the risks, cryptocurrencies offer the potential for high returns. The early adopters of Bitcoin and Ethereum have experienced significant gains.

- Decentralization: Cryptocurrencies are decentralized, meaning they are not controlled by any central authority. This can provide greater financial freedom and autonomy.

Fundamental Analysis and Technical Analysis

Evaluating cryptocurrencies involves a combination of fundamental and technical analysis.

- Fundamental Analysis: Focuses on the underlying technology, team, use cases, and overall market potential of a cryptocurrency.

- Technical Analysis: Examines price charts and trading patterns to identify potential trends and predict future price movements.

Top Cryptocurrencies to Consider in 2024

Navigating the crypto landscape can be overwhelming, especially with the plethora of options available. As we enter 2024, it’s essential to identify cryptocurrencies with strong fundamentals, promising use cases, and the potential for growth. This section explores some of the top cryptocurrencies to consider, categorized based on their market capitalization, technology, and use cases.

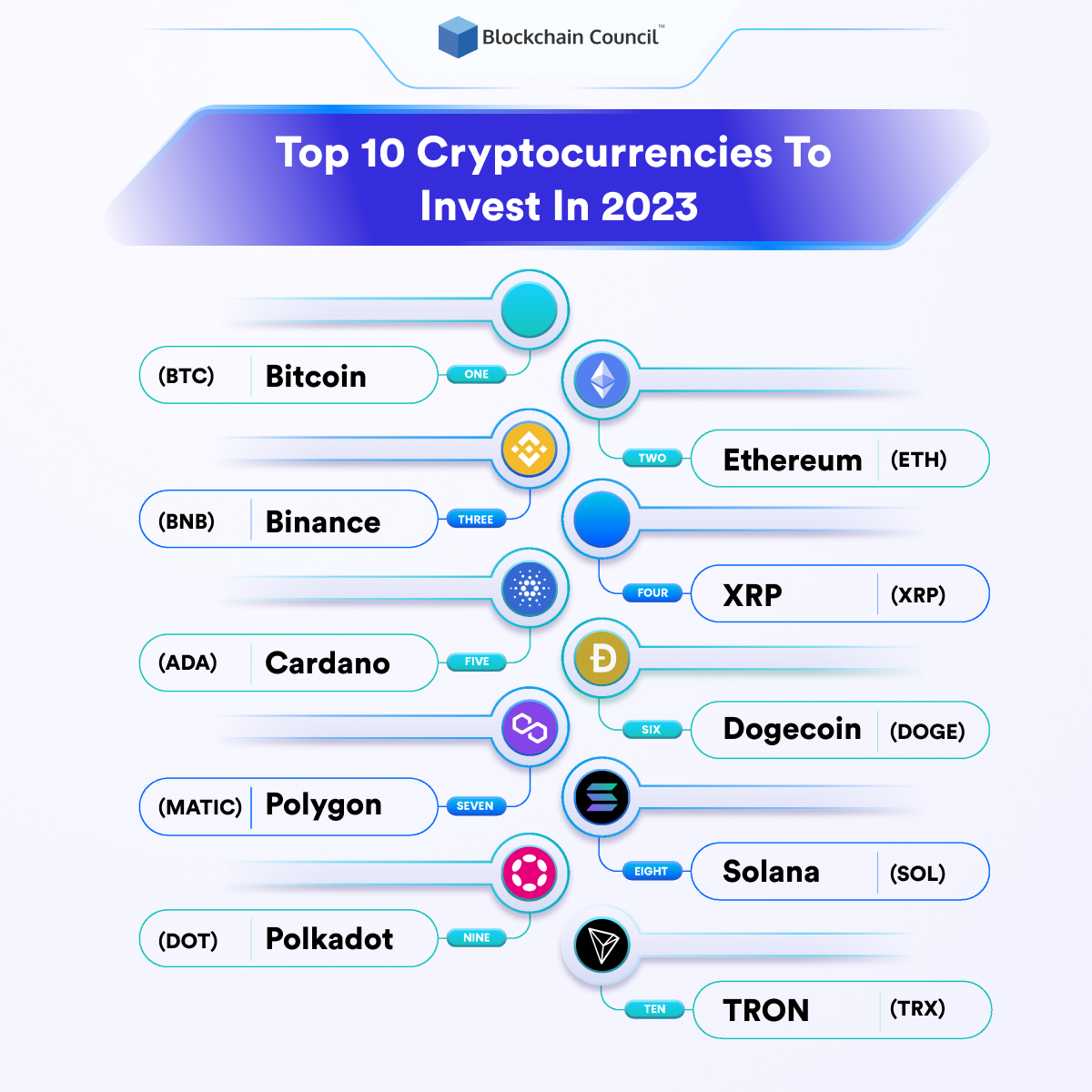

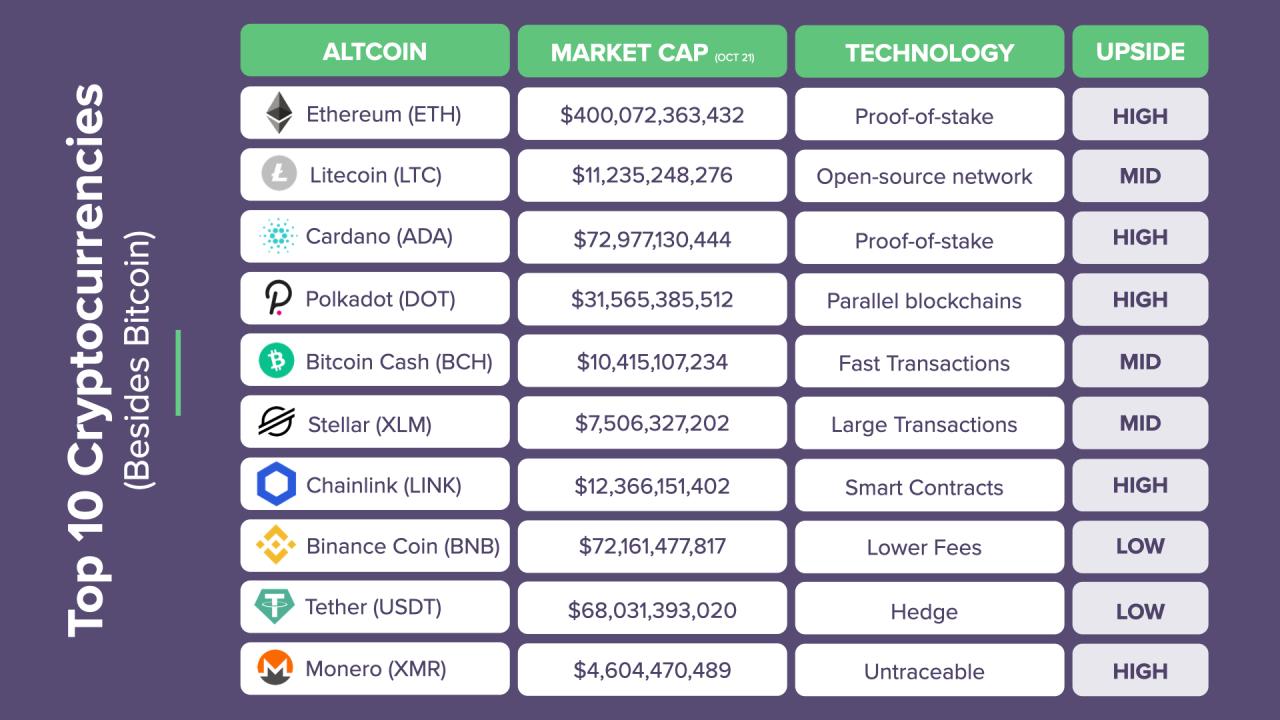

Top Cryptocurrencies by Market Capitalization

Market capitalization, often referred to as “market cap,” is a crucial metric that reflects the total value of a cryptocurrency in circulation. Cryptocurrencies with a large market cap generally enjoy greater liquidity, stability, and wider adoption. Here are some leading cryptocurrencies with significant market capitalization:

- Bitcoin (BTC): Widely regarded as the “digital gold,” Bitcoin has established itself as the dominant cryptocurrency with a large market cap. Its decentralized nature, limited supply, and proven track record have made it a safe haven asset for many investors.

- Ethereum (ETH): As the leading platform for decentralized applications (dApps), Ethereum boasts a robust ecosystem of developers and users. Its smart contract functionality and ability to host decentralized finance (DeFi) applications have driven its popularity and value.

- Tether (USDT): Tether is a stablecoin pegged to the US dollar, offering price stability and ease of use for crypto transactions. Its widespread adoption as a stable and reliable store of value has solidified its position as a top cryptocurrency.

Top Cryptocurrencies by Technology, Best crypto to buy in 2024

The underlying technology behind a cryptocurrency plays a vital role in its potential for growth and innovation. Here are some cryptocurrencies known for their advanced technological advancements:

- Solana (SOL): Solana is a high-performance blockchain platform known for its speed, scalability, and low transaction fees. Its unique proof-of-history consensus mechanism enables faster transaction processing, making it an attractive option for decentralized applications.

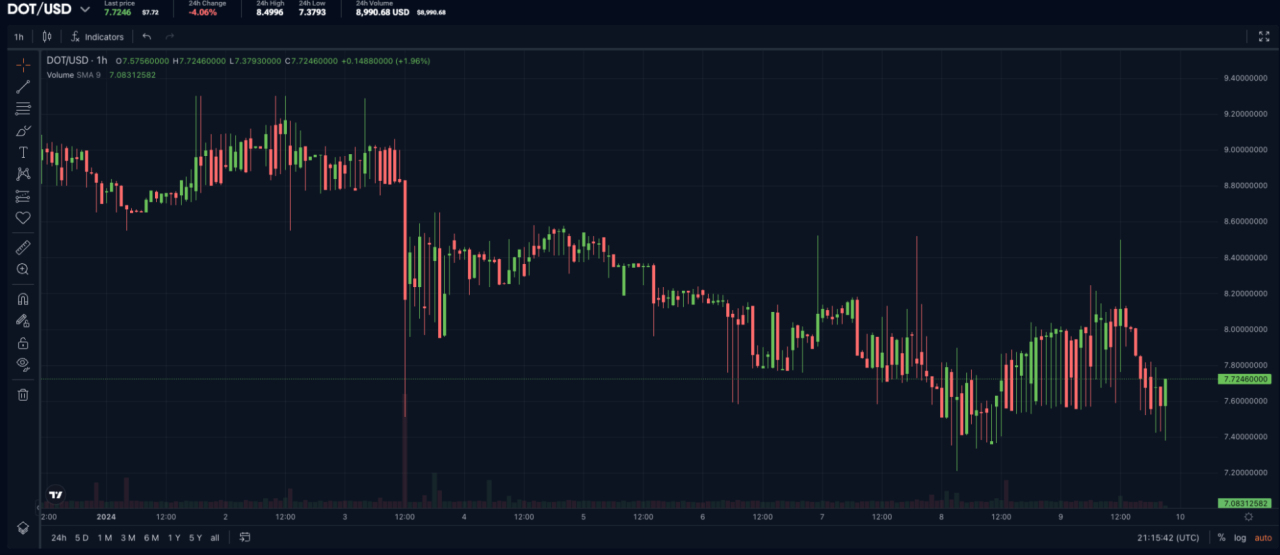

- Polkadot (DOT): Polkadot is a multi-chain protocol that allows for interoperability between different blockchains. Its parachain architecture enables the transfer of data and assets across diverse networks, fostering a more interconnected crypto ecosystem.

- Cardano (ADA): Cardano is a blockchain platform focused on sustainability and scalability. Its peer-reviewed, layered architecture and emphasis on scientific rigor have positioned it as a potential contender for widespread adoption.

Top Cryptocurrencies by Use Cases

Cryptocurrencies are not just digital assets; they are also designed to solve real-world problems and enable new applications. Here are some cryptocurrencies with promising use cases:

- Chainlink (LINK): Chainlink is a decentralized oracle network that connects blockchains to real-world data. Its role in bridging the gap between on-chain and off-chain information has made it a crucial component of the DeFi ecosystem.

- Uniswap (UNI): Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies without intermediaries. Its automated market maker (AMM) model has revolutionized the way cryptocurrencies are traded, providing greater accessibility and liquidity.

- Filecoin (FIL): Filecoin is a decentralized storage network that incentivizes users to store and share data. Its blockchain-based approach aims to provide a secure and reliable alternative to traditional cloud storage solutions.

Top Cryptocurrencies Comparison Table

Here is a table comparing some of the top cryptocurrencies based on their key metrics:

| Cryptocurrency | Market Cap (USD) | Technology | Use Cases |

|---|---|---|---|

| Bitcoin (BTC) | $500 Billion+ | Proof-of-Work (PoW) | Digital Gold, Store of Value |

| Ethereum (ETH) | $200 Billion+ | Proof-of-Stake (PoS) | Smart Contracts, Decentralized Applications (dApps) |

| Tether (USDT) | $80 Billion+ | Stablecoin pegged to USD | Stable Store of Value, Crypto Transactions |

| Solana (SOL) | $10 Billion+ | Proof-of-History (PoH) | High-Performance Blockchain, Decentralized Applications (dApps) |

| Polkadot (DOT) | $5 Billion+ | Multi-Chain Protocol | Interoperability between Blockchains |

| Cardano (ADA) | $4 Billion+ | Proof-of-Stake (PoS) | Scalable and Sustainable Blockchain |

| Chainlink (LINK) | $3 Billion+ | Decentralized Oracle Network | Connecting Blockchains to Real-World Data |

| Uniswap (UNI) | $2 Billion+ | Decentralized Exchange (DEX) | Cryptocurrency Trading, Liquidity Provision |

| Filecoin (FIL) | $1 Billion+ | Decentralized Storage Network | Secure and Reliable Data Storage |

Emerging Cryptocurrencies with High Potential

While established cryptocurrencies like Bitcoin and Ethereum continue to dominate the market, several emerging cryptocurrencies with innovative technology and compelling use cases are gaining traction. These projects are attracting investors and developers due to their potential for significant growth and disruption within specific sectors.

Layer-2 Scaling Solutions

Layer-2 scaling solutions aim to address the limitations of existing blockchain networks, such as slow transaction speeds and high gas fees. These solutions operate on top of the main blockchain, enhancing its scalability and efficiency.

- Polygon (MATIC): Polygon is a popular Layer-2 scaling solution for Ethereum, offering faster transactions and lower costs. It enables developers to build and deploy decentralized applications (dApps) on its network, fostering a vibrant ecosystem.

- Optimism (OP): Optimism is another Layer-2 scaling solution for Ethereum that utilizes optimistic rollups to improve transaction speed and reduce gas fees. It aims to make Ethereum more accessible to a wider range of users.

- Arbitrum (ARB): Arbitrum is a Layer-2 scaling solution for Ethereum that utilizes optimistic rollups to enhance scalability. It provides a secure and efficient platform for developers to build and deploy dApps.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing sector within the cryptocurrency ecosystem. It seeks to replace traditional financial institutions with decentralized, blockchain-based alternatives.

- Aave (AAVE): Aave is a leading DeFi lending and borrowing platform, allowing users to earn interest on their crypto assets or borrow cryptocurrencies at competitive rates.

- Compound (COMP): Compound is another prominent DeFi lending and borrowing platform that utilizes smart contracts to automate the lending process. It enables users to earn interest on their crypto assets or borrow cryptocurrencies.

- MakerDAO (MKR): MakerDAO is a decentralized stablecoin platform that issues Dai, a stablecoin pegged to the US dollar. It uses a system of collateralized debt positions (CDPs) to maintain the stability of Dai.

Privacy Coins

Privacy coins prioritize user privacy and anonymity by obscuring transaction details on the blockchain.

- Monero (XMR): Monero is a privacy-focused cryptocurrency that uses advanced cryptographic techniques to conceal sender, receiver, and transaction amounts. It aims to provide users with financial privacy and security.

- Zcash (ZEC): Zcash is another privacy-focused cryptocurrency that utilizes zero-knowledge proofs to shield transaction details from public view. It allows users to choose whether to make their transactions public or private.

Investment Strategies for Cryptocurrencies

Navigating the dynamic world of cryptocurrencies demands a thoughtful approach to investment. Different strategies cater to various risk tolerances and investment goals. Let’s delve into popular strategies and their implications.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of market fluctuations. This strategy helps mitigate the risk of buying at market highs and reduces the emotional impact of price volatility.

- Benefits: DCA eliminates the need to time the market and reduces the impact of market fluctuations. It promotes a disciplined investment approach and reduces the risk of significant losses.

- Drawbacks: DCA may not generate significant returns during bull markets, as the average purchase price is likely to be higher than the initial investment. It can also be a slow and steady approach, which may not suit investors seeking quick profits.

Trading

Cryptocurrency trading involves buying and selling cryptocurrencies to capitalize on price fluctuations. Traders aim to profit from short-term price movements by predicting market trends and executing trades accordingly.

- Benefits: Trading can generate significant returns in a short period if done correctly. It offers flexibility and allows investors to adapt to market conditions quickly.

- Drawbacks: Trading is highly risky and requires extensive knowledge and experience. It can be emotionally challenging and prone to impulsive decisions, leading to potential losses.

Holding (Hodling)

Hodling refers to buying and holding cryptocurrencies for the long term, regardless of short-term price fluctuations. This strategy is based on the belief that the value of cryptocurrencies will increase over time.

- Benefits: Hodling reduces the risk of short-term market volatility and allows investors to benefit from long-term growth. It requires minimal effort and can be a passive investment strategy.

- Drawbacks: Hodling requires patience and can be challenging during market downturns. It may not be suitable for investors seeking quick profits or those with a low risk tolerance.

Managing Crypto Investments

- Diversification: Invest in a variety of cryptocurrencies to mitigate risk and diversify your portfolio. Consider allocating funds to different asset classes, including Bitcoin, Ethereum, and other altcoins with potential growth prospects.

- Risk Management: Determine your risk tolerance and allocate funds accordingly. Avoid investing more than you can afford to lose and consider using stop-loss orders to limit potential losses.

- Secure Storage: Choose secure storage solutions for your cryptocurrencies, such as hardware wallets or reputable exchanges with strong security features. Regularly update your security protocols and be wary of phishing scams.

- Stay Informed: Stay up-to-date with the latest news and developments in the cryptocurrency market. Research different projects, understand their underlying technology, and assess their potential for growth.

Responsible Crypto Investing

The world of cryptocurrencies offers exciting opportunities, but it’s crucial to approach investing with responsibility and a clear understanding of the risks involved. While potential rewards can be substantial, the volatile nature of the market necessitates careful consideration and a well-informed approach.

Due Diligence and Research

Before investing in any cryptocurrency, conducting thorough research is paramount. Understanding the technology behind the coin, the project’s team, its use cases, and the overall market dynamics is essential. Examining the project’s whitepaper, community engagement, and any existing partnerships can provide valuable insights into its potential.

- Evaluate the project’s whitepaper: A well-structured whitepaper outlining the project’s goals, technology, and roadmap is a good indicator of its legitimacy and potential.

- Research the team: A strong and experienced team with a proven track record in the industry can inspire confidence in a project’s success.

- Assess the project’s use cases: Understanding how the cryptocurrency is being used and its potential applications can help determine its long-term viability.

Ethical Considerations

Investing in cryptocurrencies also involves ethical considerations. The environmental impact of cryptocurrency mining, particularly with Proof-of-Work (PoW) consensus mechanisms, has been a subject of debate. Additionally, regulatory compliance and the potential for illicit activities within the crypto space should be considered.

- Environmental impact: Choosing cryptocurrencies that utilize energy-efficient consensus mechanisms like Proof-of-Stake (PoS) can help mitigate environmental concerns.

- Regulatory compliance: Staying informed about evolving regulations in the crypto space and ensuring investments are compliant with local laws is crucial for responsible investing.

- Transparency and accountability: Opting for projects with transparent governance structures and a commitment to ethical practices can contribute to a more responsible crypto ecosystem.

Responsible Investing Practices

Responsible crypto investing involves adopting a strategic approach to managing risk, diversifying investments, and understanding tax implications.

- Risk management: Setting realistic investment goals, defining risk tolerance, and allocating only a portion of your portfolio to cryptocurrencies can help mitigate potential losses.

- Portfolio diversification: Spreading investments across multiple cryptocurrencies with different use cases and market caps can help reduce overall portfolio risk.

- Tax considerations: Understanding the tax implications of cryptocurrency investments in your jurisdiction is essential for responsible financial planning.

Closing Summary: Best Crypto To Buy In 2024

As you embark on your crypto journey in 2024, remember that thorough research, diversification, and a long-term perspective are crucial for success. By carefully considering the factors Artikeld in this guide and making informed decisions, you can position yourself to capitalize on the exciting opportunities that the crypto market presents. Remember, responsible investing includes understanding your risk tolerance, staying informed about market trends, and seeking professional advice when needed.

Essential FAQs

What are the best cryptocurrencies to buy for long-term growth?

Identifying the “best” cryptocurrencies for long-term growth is subjective and depends on individual investment goals and risk tolerance. It’s important to conduct thorough research and consider factors like technology, market capitalization, use cases, and regulatory landscape.

Is it too late to invest in crypto in 2024?

It’s never too late to invest in crypto if you have a well-defined strategy and understand the risks involved. The cryptocurrency market is still evolving, and there are opportunities for growth across various sectors.

How can I protect my crypto investments from market volatility?

Diversification is key to mitigating risk in any investment, including crypto. Spreading your investments across different cryptocurrencies and asset classes can help reduce the impact of market fluctuations.

What are the best resources for learning about cryptocurrencies?

There are many excellent resources available for learning about cryptocurrencies. You can find information on reputable websites, online courses, and educational platforms.