Should I buy crypto? This question is on the minds of many, as the world of digital currencies continues to evolve at a rapid pace. Cryptocurrency, fueled by blockchain technology, offers a decentralized and potentially lucrative investment opportunity. But before you dive in, it’s crucial to understand the intricacies of this volatile market and weigh the risks against potential rewards.

This guide will delve into the fundamentals of cryptocurrency, explore key factors to consider before investing, and provide practical advice to help you make informed decisions. Whether you’re a seasoned investor or a curious newcomer, this comprehensive resource will equip you with the knowledge you need to navigate the world of crypto.

Understanding Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. It’s a complex and rapidly evolving field, but understanding the fundamentals is crucial for making informed decisions.

Blockchain Technology

Blockchain technology is the foundation of cryptocurrency. It’s a distributed, public ledger that records transactions in a secure and transparent manner. Each block in the chain contains a set of transactions, and once a block is added to the chain, it’s virtually impossible to alter or delete it. This immutability ensures the integrity of the records and prevents fraud.

Decentralized Finance

Decentralized finance (DeFi) is a rapidly growing sector of the cryptocurrency ecosystem that aims to provide financial services without intermediaries like banks. DeFi applications allow users to lend, borrow, trade, and earn interest on their crypto assets directly through smart contracts on blockchain networks.

Digital Assets

Cryptocurrencies are digital assets, meaning they exist only in the digital realm and are not backed by physical assets like gold or silver. They are represented by unique cryptographic keys and are stored in digital wallets.

Types of Cryptocurrencies

There are various types of cryptocurrencies, each with unique features and potential use cases. Here are some prominent examples:

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often referred to as “digital gold” due to its limited supply and decentralized nature. It’s primarily used as a store of value and a medium of exchange.

- Ethereum (ETH): Ethereum is a platform for building decentralized applications (dApps) and smart contracts. It’s also a cryptocurrency that can be used for various purposes, including payments, trading, and staking.

- Stablecoins: These cryptocurrencies are pegged to a stable asset, such as the US dollar, to minimize price volatility. Examples include Tether (USDT) and USD Coin (USDC). They are often used for trading and as a bridge between fiat currencies and cryptocurrencies.

- Meme Coins: These cryptocurrencies are often created as a joke or based on internet memes. They can experience rapid price fluctuations and are often considered high-risk investments. Examples include Dogecoin (DOGE) and Shiba Inu (SHIB).

Popular Cryptocurrencies and Their Market Values

The cryptocurrency market is constantly evolving, and the value of cryptocurrencies can fluctuate significantly. However, here are some of the most popular cryptocurrencies and their current market values (as of November 15, 2023):

| Cryptocurrency | Symbol | Market Value (USD) |

|---|---|---|

| Bitcoin | BTC | $29,000 |

| Ethereum | ETH | $1,600 |

| Tether | USDT | $80 billion |

| USD Coin | USDC | $50 billion |

Note: Market values can change rapidly. It’s essential to research and stay updated on the latest market trends.

Factors to Consider Before Investing

Investing in cryptocurrency can be an exciting prospect, offering the potential for significant returns. However, it’s crucial to understand the risks involved before committing any funds. Cryptocurrencies are known for their volatility, and the market can experience rapid fluctuations in value.

Potential Risks

Cryptocurrencies are still a relatively new asset class, and their long-term viability is yet to be fully established. It’s important to be aware of the potential risks associated with investing in cryptocurrencies:

- Volatility: Cryptocurrency prices are highly volatile and can fluctuate significantly in a short period. This can lead to substantial losses for investors, especially those who buy high and sell low. For example, Bitcoin, the largest cryptocurrency by market capitalization, experienced a price drop of over 80% in 2018.

- Security Concerns: Cryptocurrency exchanges and wallets are susceptible to hacking and theft. In 2022, the FTX exchange collapsed due to mismanagement and fraud, resulting in billions of dollars in losses for investors. It’s crucial to use reputable exchanges and wallets and implement strong security measures, such as two-factor authentication.

- Regulatory Uncertainty: Governments around the world are still developing regulations for cryptocurrencies, creating uncertainty for investors. Regulatory changes can significantly impact the value of cryptocurrencies and the operations of exchanges and other platforms.

- Scams and Fraud: The cryptocurrency space is rife with scams and fraudulent schemes. Investors need to be cautious about investment opportunities that promise unrealistic returns or involve high-pressure sales tactics.

Different Ways to Buy Cryptocurrency

There are various ways to buy cryptocurrencies, each with its own advantages and disadvantages:

- Exchanges: Cryptocurrency exchanges are platforms where users can buy, sell, and trade cryptocurrencies. Popular exchanges include Binance, Coinbase, and Kraken. Exchanges offer a wide selection of cryptocurrencies and typically have lower fees than other methods.

- Wallets: Cryptocurrency wallets are software programs that allow users to store, send, and receive cryptocurrencies. There are various types of wallets, including desktop wallets, mobile wallets, and hardware wallets. Hardware wallets are considered the most secure option as they store private keys offline.

- Decentralized Platforms: Decentralized platforms, such as Uniswap and PancakeSwap, allow users to trade cryptocurrencies directly with each other without the need for a central authority. These platforms offer greater privacy and control over funds but can be more complex to use.

Thorough Research and Due Diligence

Before investing in any cryptocurrency, it’s crucial to conduct thorough research and due diligence:

- Understand the underlying technology: Cryptocurrency technology, such as blockchain, can be complex. It’s important to understand the basics of how cryptocurrencies work before investing.

- Analyze the project’s fundamentals: Research the team behind the cryptocurrency, its use case, and its market potential. Look for projects with a strong team, a clear roadmap, and a solid community.

- Assess the risks: Consider the risks associated with the cryptocurrency, such as volatility, security concerns, and regulatory uncertainty. Don’t invest more than you can afford to lose.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your investments across different cryptocurrencies to mitigate risk.

Your Financial Situation and Goals

Before diving into the exciting world of cryptocurrency, it’s crucial to take a step back and assess your personal financial situation. Understanding your current financial standing and investment goals will help you determine if cryptocurrency aligns with your overall financial strategy and risk appetite.

Analyzing Your Financial Situation

A thorough understanding of your current financial situation is essential before considering any investment, including cryptocurrency. It involves evaluating your income, expenses, and existing assets and liabilities. This analysis provides a clear picture of your financial health and helps determine how much you can afford to invest.

- Income: This includes your regular earnings from employment, investments, or other sources. Consider your income stability and potential future income growth.

- Expenses: Analyze your regular monthly expenses, including housing, food, transportation, utilities, and debt payments. Understanding your spending habits helps determine your disposable income for investing.

- Assets: List your current assets, such as savings, investments, real estate, and other valuable possessions. These assets represent your financial resources and can influence your investment decisions.

- Liabilities: Identify your debts, including student loans, mortgages, credit card balances, and other outstanding obligations. Understanding your debt burden helps determine your financial flexibility and ability to take on new investments.

Defining Your Investment Goals

Your investment goals are the financial objectives you aim to achieve through investing. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Short-Term Goals: These goals typically have a time horizon of less than five years, such as saving for a down payment on a house, a vacation, or an emergency fund.

- Long-Term Goals: These goals have a time horizon of five years or more, such as retirement planning, education savings, or building wealth for future generations.

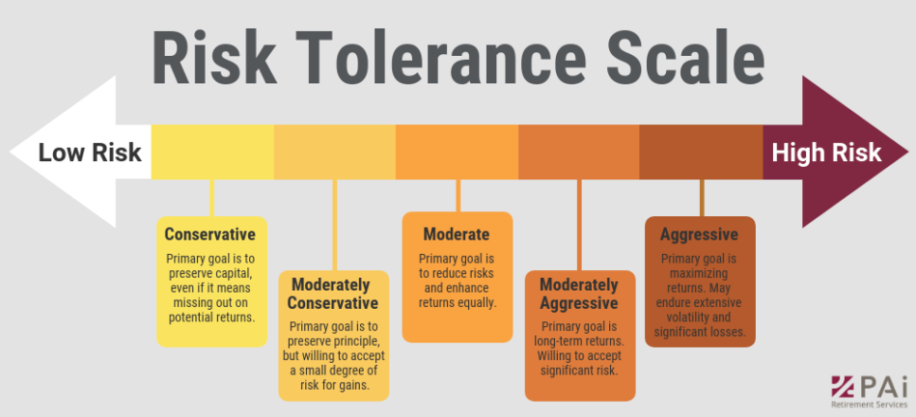

Evaluating Your Risk Tolerance

Risk tolerance refers to your ability and willingness to accept potential losses in pursuit of higher returns. It’s crucial to understand your risk tolerance before investing in any asset class, including cryptocurrency.

- High Risk Tolerance: Investors with a high risk tolerance are comfortable with potential losses in exchange for potentially higher returns. They might be willing to invest a larger portion of their portfolio in volatile assets like cryptocurrency.

- Low Risk Tolerance: Investors with a low risk tolerance prefer investments with lower potential returns but also lower risk. They might allocate a smaller portion of their portfolio to volatile assets and focus on more stable investments.

Alternative Investment Options

Cryptocurrency is a relatively new asset class, and it’s essential to understand how it compares to traditional investment options before making any decisions. This section will explore the benefits and drawbacks of various investment options, including stocks, bonds, real estate, and gold, and compare them to cryptocurrency.

Comparing Cryptocurrency to Traditional Investments, Should i buy crypto

Investing in cryptocurrency can be compared to other asset classes, such as stocks, bonds, real estate, and gold. Each option offers distinct benefits and risks, making it crucial to understand these factors before making investment decisions.

Stocks

Stocks represent ownership in a company. When you buy stock, you become a shareholder and have the potential to earn dividends and capital appreciation.

- Benefits: Stocks have the potential for high returns, offer diversification, and are relatively liquid.

- Drawbacks: Stocks are subject to market volatility and can be risky.

Bonds

Bonds are debt securities that represent a loan made to a borrower, typically a company or government.

- Benefits: Bonds generally offer lower returns than stocks but are less risky. They provide income through interest payments and can offer stability to a portfolio.

- Drawbacks: Bonds are less liquid than stocks and are subject to interest rate risk.

Real Estate

Real estate refers to land and any structures built on it.

- Benefits: Real estate can provide a steady stream of income through rent, appreciate in value over time, and offer tax advantages.

- Drawbacks: Real estate is illiquid, requires significant capital investment, and can be subject to market fluctuations.

Gold

Gold is a precious metal that has been used as a store of value for centuries.

- Benefits: Gold is a hedge against inflation, offers portfolio diversification, and is considered a safe-haven asset during economic uncertainty.

- Drawbacks: Gold does not generate income, can be volatile, and is relatively illiquid.

Cryptocurrency

Cryptocurrency is a digital asset that uses cryptography for security.

- Benefits: Cryptocurrency offers potential for high returns, is decentralized, and can be used for global payments.

- Drawbacks: Cryptocurrency is highly volatile, lacks regulation, and has limited adoption for everyday transactions.

Successful Investment Strategies

Successful investors often diversify their portfolios across various asset classes, including traditional and alternative investments. Here are some examples:

- Value Investing: This strategy involves identifying undervalued companies and holding their stocks for the long term.

- Growth Investing: This strategy focuses on companies with high growth potential, often in emerging industries.

- Index Fund Investing: This approach involves investing in a basket of stocks that tracks a specific market index, such as the S&P 500.

- Real Estate Investment Trusts (REITs): REITs are companies that own and operate income-producing real estate, offering investors exposure to this asset class without direct ownership.

- Cryptocurrency Portfolio Diversification: Investing in a variety of cryptocurrencies, such as Bitcoin, Ethereum, and stablecoins, can help mitigate risk.

Market Trends and Analysis

The cryptocurrency market is highly volatile and influenced by a complex interplay of factors. Understanding these factors is crucial for making informed investment decisions. This section delves into key market trends, influential factors, and essential metrics for assessing the health of the cryptocurrency market.

Factors Influencing Cryptocurrency Prices

Understanding the factors that influence cryptocurrency prices is crucial for navigating the market effectively. These factors can be categorized into several key areas:

- Regulatory Changes: Governments worldwide are actively developing regulations for the cryptocurrency industry. Positive regulatory developments, such as clear guidelines and licensing frameworks, can boost investor confidence and lead to price increases. Conversely, negative regulatory actions, such as bans or restrictions, can cause market uncertainty and price drops.

- Technological Advancements: The cryptocurrency space is constantly evolving with new technologies and innovations. Advancements in blockchain technology, such as scalability solutions and improved security features, can drive adoption and increase the value of cryptocurrencies.

- Macroeconomic Conditions: Global economic events, such as interest rate changes, inflation, and geopolitical tensions, can significantly impact cryptocurrency prices. For instance, during periods of economic uncertainty, investors may flock to safe-haven assets like gold or stablecoins, potentially leading to a decline in cryptocurrency prices.

- Market Sentiment: The overall sentiment and hype surrounding cryptocurrencies play a crucial role in price fluctuations. Positive news, media coverage, and social media buzz can create bullish sentiment and drive prices up. Conversely, negative news or market crashes can trigger bearish sentiment and lead to price declines.

- Adoption and Use Cases: Increasing adoption of cryptocurrencies for payments, investments, and other real-world applications is a positive indicator for the market. As more businesses and individuals use cryptocurrencies, their value is likely to increase.

Key Indicators and Metrics

Several indicators and metrics can help assess the health and performance of the cryptocurrency market. These metrics provide valuable insights into market trends, investor sentiment, and potential risks.

- Market Capitalization: The total market capitalization of all cryptocurrencies is a key indicator of the overall market size and value. A rising market capitalization suggests strong investor interest and potential growth.

- Trading Volume: High trading volume indicates significant activity in the market, which can be a sign of both bullish and bearish sentiment. Increased trading volume can reflect increased investor interest or panic selling.

- Volatility: Cryptocurrencies are known for their high volatility, which can be both an opportunity and a risk. Measuring volatility helps understand the potential for price swings and assess the risk associated with investing in cryptocurrencies.

- Network Hash Rate: For proof-of-work blockchains, the network hash rate represents the computing power dedicated to securing the network. A higher hash rate indicates a more secure and robust network, which can be a positive indicator for the cryptocurrency’s value.

- Developer Activity: Active development on a cryptocurrency’s underlying technology is a sign of innovation and potential future growth. Analyzing developer activity can provide insights into the long-term viability of a cryptocurrency project.

Impact of Global Events and Geopolitical Risks

Global events and geopolitical risks can have a significant impact on cryptocurrency markets. These events can create uncertainty, volatility, and potential price fluctuations.

“Cryptocurrencies, like any other asset class, are susceptible to global events and geopolitical risks. It is crucial to stay informed about major developments and assess their potential impact on the market.”

- Wars and Conflicts: Geopolitical tensions and conflicts can create market uncertainty and lead to capital flight from risky assets, including cryptocurrencies. For example, the ongoing conflict in Ukraine has led to significant market volatility.

- Economic Sanctions: Sanctions imposed on countries or individuals can disrupt financial markets and impact cryptocurrency prices. For instance, sanctions on Russia have affected the trading of certain cryptocurrencies.

- Natural Disasters: Natural disasters can disrupt global supply chains, impact economic activity, and lead to market volatility. For example, the 2011 Japanese earthquake and tsunami caused significant disruptions in global financial markets, including the cryptocurrency market.

- Political Instability: Political instability in key regions can create uncertainty and risk aversion, potentially leading to a decline in cryptocurrency prices. For example, political turmoil in countries with significant cryptocurrency adoption can impact market sentiment.

Practical Considerations

Once you’ve decided to invest in cryptocurrency, you need to navigate the practicalities of buying and managing your digital assets. This section will guide you through setting up a cryptocurrency wallet, purchasing crypto, and implementing essential security measures. We’ll also discuss strategies for managing your investments effectively, including diversification, dollar-cost averaging, and tax implications.

Setting Up a Cryptocurrency Wallet and Purchasing Cryptocurrency

A cryptocurrency wallet is essential for storing and managing your digital assets. It acts as a digital container for your crypto, allowing you to send and receive transactions.

Here’s a step-by-step guide on how to set up a wallet and purchase cryptocurrency:

- Choose a Wallet Type: There are two main types of cryptocurrency wallets:

- Hot Wallets: These are online wallets, typically accessible through mobile apps or web browsers. They offer convenience but are more vulnerable to hacking. Examples include Coinbase Wallet, MetaMask, and Trust Wallet.

- Cold Wallets: These are offline wallets, often physical devices like hardware wallets. They are considered the most secure option as they are not connected to the internet. Examples include Ledger Nano S and Trezor Model T.

- Create an Account: Once you’ve chosen a wallet type, follow the instructions provided by the wallet provider to create an account. This usually involves providing basic personal information and setting up a strong password.

- Secure Your Wallet: Implement robust security measures to protect your wallet from unauthorized access. This includes:

- Strong Passwords: Use a unique and complex password for your wallet, combining uppercase and lowercase letters, numbers, and symbols. Avoid using common passwords or personal information.

- Two-Factor Authentication (2FA): Enable 2FA for an extra layer of security. This requires you to enter a code from your phone or email in addition to your password when logging in.

- Choose a Cryptocurrency Exchange: Cryptocurrency exchanges are platforms where you can buy, sell, and trade cryptocurrencies. Popular exchanges include Binance, Coinbase, and Kraken.

- Research and Compare: Before choosing an exchange, research its fees, security features, and available cryptocurrencies.

- Verify Your Identity: Most exchanges require you to verify your identity by providing personal information and documentation.

- Fund Your Account: Deposit funds into your exchange account using a bank transfer, debit card, or credit card. Some exchanges may charge fees for deposits and withdrawals.

- Purchase Cryptocurrency: Once your account is funded, you can purchase cryptocurrency. Select the desired cryptocurrency, enter the amount you want to buy, and confirm the transaction.

- Market Orders: These orders are executed immediately at the current market price.

- Limit Orders: These orders allow you to set a specific price at which you want to buy or sell. Your order will only be executed if the market price reaches your specified price.

- Store Your Cryptocurrency: After purchasing cryptocurrency, transfer it to your chosen wallet. This is crucial for security and to prevent losses in case the exchange is compromised.

Security Measures

Protecting your cryptocurrency investments is paramount. Here are some essential security measures to consider:

- Strong Passwords: Use unique and complex passwords for your cryptocurrency wallets and exchange accounts. Avoid using easily guessable passwords or reusing passwords across different accounts.

- Two-Factor Authentication (2FA): Enable 2FA for an extra layer of security. This adds an extra step to the login process, requiring you to enter a code generated by your phone or email in addition to your password.

- Cold Storage: Consider using a cold wallet for storing significant amounts of cryptocurrency. Cold wallets are offline devices that are not connected to the internet, making them less vulnerable to hacking.

- Be Wary of Phishing Scams: Be cautious of suspicious emails, links, or phone calls that may attempt to steal your login credentials or cryptocurrency. Never share your private keys or seed phrases with anyone.

- Keep Your Software Updated: Regularly update your wallet software and operating system to patch security vulnerabilities and protect against malware.

Managing Cryptocurrency Investments

Managing your cryptocurrency investments effectively is crucial for maximizing returns and mitigating risks. Consider these strategies:

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio by investing in a range of cryptocurrencies with different market capitalizations, use cases, and technologies.

- Dollar-Cost Averaging: Instead of investing a lump sum, consider investing a fixed amount at regular intervals. This helps reduce the impact of market volatility and averages out your purchase price.

- Tax Implications: Be aware of the tax implications of cryptocurrency investments. In most jurisdictions, profits from cryptocurrency trading are considered taxable income. Consult with a tax advisor to understand your specific tax obligations.

Ending Remarks

Ultimately, the decision of whether or not to buy crypto is a personal one. There’s no one-size-fits-all answer, and your individual financial situation, goals, and risk tolerance will play a crucial role. By carefully considering the information presented in this guide and conducting thorough research, you can make a well-informed decision that aligns with your investment strategy.

Common Queries: Should I Buy Crypto

What are the most popular cryptocurrencies?

Bitcoin and Ethereum are the two most well-known cryptocurrencies, but there are many others, each with its unique features and use cases. Some other popular options include Litecoin, Ripple, and Binance Coin.

Is cryptocurrency safe?

Cryptocurrency can be susceptible to security risks, including hacking and scams. It’s crucial to take precautions to protect your investments, such as using strong passwords, enabling two-factor authentication, and storing your cryptocurrency in a secure wallet.

How can I learn more about cryptocurrency?

There are numerous resources available online and in libraries to help you learn more about cryptocurrency, including articles, videos, and courses. You can also join online communities and forums to connect with other investors and enthusiasts.