Best cryptos to buy, a phrase that echoes in the minds of many seeking to navigate the volatile world of digital assets. The cryptocurrency market, a realm of innovation and uncertainty, presents both immense opportunities and inherent risks. Understanding the factors driving price fluctuations, identifying promising projects, and implementing sound investment strategies are crucial for success in this dynamic landscape.

This comprehensive guide delves into the intricacies of the cryptocurrency market, providing insights into key factors to consider, popular cryptocurrency categories, and effective investment strategies. From fundamental analysis to risk management, we aim to equip you with the knowledge and tools necessary to make informed decisions in the exciting world of cryptocurrencies.

Understanding the Cryptocurrency Market

The cryptocurrency market is a dynamic and volatile space, constantly evolving with new trends and innovations. It is characterized by its decentralized nature, with digital currencies operating independently of traditional financial institutions.

Factors Influencing Cryptocurrency Prices

The prices of cryptocurrencies are influenced by a complex interplay of factors, including:

- Market Sentiment: Investor sentiment and overall market conditions significantly impact cryptocurrency prices. Positive news and increased adoption can lead to price increases, while negative news or regulatory uncertainty can cause declines.

- Supply and Demand: The supply of a cryptocurrency and the demand for it play a crucial role in determining its price. Scarcity and limited supply can drive up prices, while increased supply can lead to price decreases.

- Adoption and Use Cases: The adoption of cryptocurrencies by businesses and individuals, as well as the development of new use cases, can positively influence prices.

- Technological Advancements: Innovations and upgrades in blockchain technology, such as scalability improvements or new features, can have a significant impact on cryptocurrency prices.

- Regulatory Environment: Government regulations and policies surrounding cryptocurrencies can influence investor confidence and market stability.

Risks Associated with Investing in Cryptocurrencies

Investing in cryptocurrencies comes with inherent risks, including:

- Volatility: Cryptocurrency prices are known for their extreme volatility, with significant price fluctuations occurring frequently.

- Security Risks: Cryptocurrencies are susceptible to security breaches and hacks, which can result in the loss of funds.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, and changes in regulations can impact the market.

- Scams and Fraud: The cryptocurrency market is prone to scams and fraudulent activities, and investors should be cautious when dealing with unfamiliar projects.

- Lack of Regulation: The lack of robust regulation in the cryptocurrency market can make it difficult to protect investors and ensure fair market practices.

Key Factors to Consider

Choosing the right cryptocurrencies to invest in is crucial for maximizing returns and mitigating risk. While the market is volatile and unpredictable, understanding the key factors that influence a cryptocurrency’s value can help you make informed decisions.

Fundamental Analysis in Cryptocurrency Investing

Fundamental analysis is a critical component of cryptocurrency investing. It involves evaluating the underlying technology, team, community, and market adoption of a cryptocurrency to determine its intrinsic value.

Fundamental analysis helps you identify cryptocurrencies with strong potential for long-term growth.

- Technology: Evaluate the cryptocurrency’s underlying technology, its scalability, security, and efficiency. Look for projects with innovative solutions and a strong technical foundation.

- Team: Assess the experience, expertise, and reputation of the team behind the cryptocurrency. A strong team is essential for successful project development and execution.

- Community: A vibrant and engaged community can drive adoption and support the cryptocurrency’s growth. Look for projects with active social media presence, developer communities, and strong user engagement.

- Market Adoption: Analyze the cryptocurrency’s market adoption, including the number of users, exchanges, and merchants accepting it. A wider adoption rate generally indicates a stronger cryptocurrency.

Top 5 Factors to Consider When Choosing Cryptocurrencies

The following table highlights the top 5 factors to consider when selecting cryptocurrencies to invest in:

| Factor | Relevance |

|---|---|

| Technology | Evaluates the cryptocurrency’s underlying technology, its scalability, security, and efficiency. |

| Team | Assesses the experience, expertise, and reputation of the team behind the cryptocurrency. |

| Community | Analyzes the cryptocurrency’s community engagement, social media presence, and developer support. |

| Market Adoption | Examines the cryptocurrency’s usage, number of users, exchanges, and merchants accepting it. |

| Regulation | Assesses the regulatory environment surrounding the cryptocurrency and its potential impact on future growth. |

Popular Cryptocurrency Categories

The cryptocurrency landscape is vast and diverse, encompassing a wide range of projects with distinct characteristics and purposes. To navigate this complex ecosystem effectively, it’s helpful to understand the major categories of cryptocurrencies.

Cryptocurrency Categories

The cryptocurrency market can be categorized into several distinct groups, each with its own unique features, advantages, and risks. Here’s a breakdown of some of the most prominent categories:

- Stablecoins: These cryptocurrencies are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. They aim to minimize price volatility, making them suitable for payments, trading, and as a store of value.

- Meme Coins: Meme coins are cryptocurrencies often inspired by internet memes or cultural phenomena. They typically lack intrinsic value or utility, but can experience significant price fluctuations based on community sentiment and hype.

- DeFi Tokens: Decentralized Finance (DeFi) tokens power applications and platforms within the decentralized finance ecosystem. These tokens often provide governance rights, access to specific services, or represent shares in a decentralized protocol.

- Utility Tokens: These cryptocurrencies are designed to provide access to specific services or platforms. They can be used to pay for goods, services, or access to features within a particular ecosystem.

- Layer-1 Blockchains: These cryptocurrencies are the foundational layer of their respective blockchain networks. They provide the core infrastructure for building decentralized applications and services.

- Layer-2 Scaling Solutions: These cryptocurrencies are built on top of existing Layer-1 blockchains to improve scalability and efficiency. They offer faster transaction speeds and lower fees.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of specific items, such as digital artwork, collectibles, or virtual real estate. They are stored on blockchains and can be traded and collected.

Stablecoins

Stablecoins aim to minimize price volatility, making them suitable for payments, trading, and as a store of value. They are often pegged to a fiat currency like the US dollar, providing a more stable alternative to traditional cryptocurrencies.

- Tether (USDT): One of the largest and most widely used stablecoins, pegged to the US dollar.

- USD Coin (USDC): Another popular stablecoin, also pegged to the US dollar, known for its transparency and regulatory compliance.

- Binance USD (BUSD): A stablecoin issued by Binance, pegged to the US dollar, widely used on the Binance exchange.

| Category | Examples | Key Features | Potential Risks |

|---|---|---|---|

| Stablecoins | Tether (USDT), USD Coin (USDC), Binance USD (BUSD) | Price stability, low volatility, suitable for payments and trading | Depegging risk, regulatory uncertainty, potential for fraud |

| Meme Coins | Dogecoin (DOGE), Shiba Inu (SHIB) | Community-driven, high volatility, potential for rapid price gains | Lack of intrinsic value, speculative bubbles, potential for scams |

| DeFi Tokens | Uniswap (UNI), Aave (AAVE), Compound (COMP) | Governance rights, access to DeFi services, potential for high returns | Smart contract vulnerabilities, market volatility, regulatory uncertainty |

| Utility Tokens | Chainlink (LINK), Filecoin (FIL), Ethereum (ETH) | Access to specific services, payment for goods and services, potential for ecosystem growth | Dependence on the underlying platform, potential for token devaluation, regulatory scrutiny |

| Layer-1 Blockchains | Bitcoin (BTC), Ethereum (ETH), Solana (SOL) | Decentralized infrastructure, high security, potential for innovation | Scalability limitations, high transaction fees, regulatory challenges |

| Layer-2 Scaling Solutions | Polygon (MATIC), Optimism (OP), Arbitrum (ARB) | Improved scalability, faster transaction speeds, lower fees | Dependence on the underlying Layer-1, potential for security vulnerabilities, regulatory uncertainty |

| Non-Fungible Tokens (NFTs) | CryptoPunks, Bored Ape Yacht Club, Decentraland (MANA) | Unique digital assets, ownership verification, potential for high value | Market volatility, potential for scams, regulatory uncertainty |

Meme Coins, Best cryptos to buy

Meme coins are cryptocurrencies often inspired by internet memes or cultural phenomena. They typically lack intrinsic value or utility, but can experience significant price fluctuations based on community sentiment and hype.

- Dogecoin (DOGE): One of the earliest and most popular meme coins, known for its Shiba Inu mascot and strong community support.

- Shiba Inu (SHIB): Another popular meme coin, also featuring a Shiba Inu mascot, known for its rapid price gains and strong community.

DeFi Tokens

Decentralized Finance (DeFi) tokens power applications and platforms within the decentralized finance ecosystem. These tokens often provide governance rights, access to specific services, or represent shares in a decentralized protocol.

- Uniswap (UNI): A decentralized exchange (DEX) token, used for governance and trading on the Uniswap platform.

- Aave (AAVE): A lending and borrowing protocol token, used for governance and access to Aave services.

- Compound (COMP): A lending and borrowing protocol token, used for governance and access to Compound services.

Analyzing Specific Cryptocurrencies

Now that we’ve explored the broader cryptocurrency landscape, let’s dive into the details of some specific cryptocurrencies. We’ll compare and contrast Bitcoin and Ethereum, explore the technology behind Solana, and examine the top 10 cryptocurrencies by market capitalization.

Bitcoin vs. Ethereum

Bitcoin and Ethereum are the two largest cryptocurrencies by market capitalization, and they represent different approaches to blockchain technology.

- Bitcoin is a decentralized digital currency that operates on a blockchain network. Its primary function is as a store of value and a medium of exchange. Bitcoin’s blockchain is designed for security and stability, using a Proof-of-Work (PoW) consensus mechanism to validate transactions.

- Ethereum, on the other hand, is a platform for decentralized applications (dApps) and smart contracts. It uses a more flexible blockchain that supports a wider range of applications. Ethereum’s blockchain uses a Proof-of-Stake (PoS) consensus mechanism, which is generally considered more energy-efficient than PoW.

Here’s a table summarizing the key differences between Bitcoin and Ethereum:

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Primary Function | Store of Value, Medium of Exchange | Decentralized Applications, Smart Contracts |

| Consensus Mechanism | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

| Transaction Speed | Slow | Faster |

| Transaction Fees | High | Lower |

| Smart Contract Support | Limited | Extensive |

Solana

Solana is a high-performance blockchain platform known for its speed and scalability. It utilizes a unique Proof-of-History (PoH) consensus mechanism, which enables faster transaction processing and lower latency compared to traditional blockchains. Solana’s architecture allows for a high throughput of transactions, making it suitable for applications that require real-time processing, such as decentralized finance (DeFi) and non-fungible tokens (NFTs).

“Solana’s PoH mechanism ensures that every transaction is timestamped and ordered in a verifiable and tamper-proof manner.”

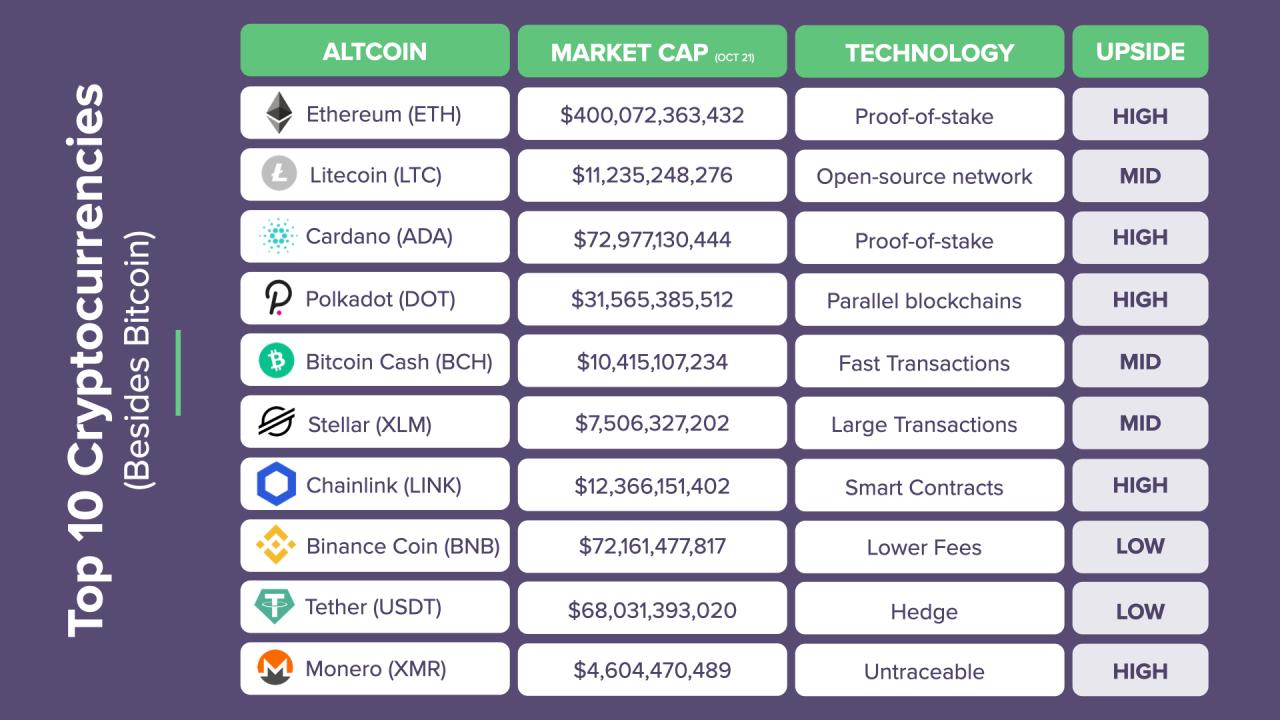

Top 10 Cryptocurrencies by Market Capitalization

The following table lists the top 10 cryptocurrencies by market capitalization as of [Date], along with their price, market cap, and key features:

| Rank | Name | Price | Market Cap | Key Features |

|---|---|---|---|---|

| 1 | Bitcoin (BTC) | $[Price] | $[Market Cap] | Decentralized digital currency, store of value, Proof-of-Work consensus mechanism |

| 2 | Ethereum (ETH) | $[Price] | $[Market Cap] | Platform for decentralized applications, smart contracts, Proof-of-Stake consensus mechanism |

| 3 | Tether (USDT) | $[Price] | $[Market Cap] | Stablecoin pegged to the US dollar, used for trading and reducing volatility |

| 4 | Binance Coin (BNB) | $[Price] | $[Market Cap] | Native token of the Binance exchange, used for trading fees and access to services |

| 5 | USD Coin (USDC) | $[Price] | $[Market Cap] | Stablecoin pegged to the US dollar, used for trading and reducing volatility |

| 6 | XRP (XRP) | $[Price] | $[Market Cap] | Digital asset for cross-border payments, used by financial institutions |

| 7 | Cardano (ADA) | $[Price] | $[Market Cap] | Platform for smart contracts and decentralized applications, Proof-of-Stake consensus mechanism |

| 8 | Solana (SOL) | $[Price] | $[Market Cap] | High-performance blockchain platform, Proof-of-History consensus mechanism, fast transactions |

| 9 | Dogecoin (DOGE) | $[Price] | $[Market Cap] | Meme-based cryptocurrency, known for its community and low transaction fees |

| 10 | Polygon (MATIC) | $[Price] | $[Market Cap] | Scalability solution for Ethereum, allows for faster and cheaper transactions |

Investment Strategies

Navigating the cryptocurrency market requires a well-defined investment strategy to maximize returns and mitigate risks. This section explores various approaches to investing in cryptocurrencies, including dollar-cost averaging, diversification, and risk management techniques.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of the market price. This strategy helps to reduce the impact of market volatility by averaging the purchase price over time.

- How it works: By investing a fixed amount regularly, you buy more crypto when prices are low and less when they are high. This strategy helps to smooth out the average purchase price, reducing the risk of buying at the peak of a bull market.

- Example: Let’s say you invest $100 per week in Bitcoin. If the price of Bitcoin is $20,000 one week, you’ll buy 0.005 Bitcoin. The next week, if the price drops to $15,000, you’ll buy 0.0067 Bitcoin. Over time, your average purchase price will be lower than if you had invested all $100 at once.

Diversification

Diversification is a crucial aspect of any investment portfolio, including cryptocurrency. Spreading your investments across different cryptocurrencies reduces the risk of losing your entire investment if one particular asset performs poorly.

- Benefits of Diversification:

- Reduces portfolio volatility

- Provides exposure to various sectors of the cryptocurrency market

- Minimizes the impact of individual asset performance

- Example: Instead of investing all your money in Bitcoin, consider diversifying your portfolio by investing in a mix of other cryptocurrencies, such as Ethereum, Solana, and Cardano. Each cryptocurrency has its unique use cases and potential for growth.

Risk Management

Risk management is essential in the volatile world of cryptocurrency. It involves identifying potential risks and implementing strategies to mitigate their impact.

“Never invest more than you can afford to lose.”

- Understanding Cryptocurrency Risks:

- Market Volatility: Cryptocurrency prices are highly volatile and can fluctuate significantly in a short period.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, creating uncertainty for investors.

- Risk Management Strategies:

- Set Stop-Loss Orders: Stop-loss orders automatically sell your cryptocurrency when it reaches a predetermined price, limiting potential losses.

- Use Cold Storage: Store your cryptocurrency offline in a cold wallet to protect it from hacking.

- Diversify Your Investments: Diversifying your portfolio across different cryptocurrencies and other asset classes reduces the impact of any single investment’s poor performance.

Setting Realistic Investment Goals

Establishing realistic investment goals is crucial for successful cryptocurrency investing. Avoid unrealistic expectations and focus on a long-term perspective.

- Consider your investment horizon: Are you investing for the short term (less than a year) or long term (several years)?

- Define your risk tolerance: How much risk are you comfortable taking?

- Set achievable goals: Don’t expect to become a millionaire overnight. Focus on gradual and sustainable growth.

Resources and Tools: Best Cryptos To Buy

Navigating the cryptocurrency market effectively requires access to reliable information and tools. This section will explore valuable resources for research and analysis, delve into the benefits and drawbacks of cryptocurrency trading platforms, and provide guidance on utilizing cryptocurrency wallets for secure storage.

Cryptocurrency Research and Analysis Resources

Access to reliable information is crucial for making informed decisions in the dynamic cryptocurrency market. Here are some resources that can help you stay updated on market trends, analyze projects, and make informed investment choices:

- CoinMarketCap: This website provides real-time cryptocurrency prices, market capitalization, trading volume, and other essential data for a wide range of cryptocurrencies. It also offers comprehensive project information, including white papers, team members, and community engagement.

- CoinGecko: Similar to CoinMarketCap, CoinGecko provides comprehensive data on cryptocurrencies, including price charts, market rankings, and developer activity. It also offers a user-friendly interface for comparing different cryptocurrencies based on various metrics.

- Glassnode: This platform specializes in on-chain analysis, providing insights into the behavior of cryptocurrency networks. Glassnode offers data visualizations and reports that can help identify trends, assess market sentiment, and predict potential price movements.

- Cryptocurrency News Websites: Websites like Cointelegraph, The Block, and Bitcoin Magazine provide news, analysis, and commentary on the cryptocurrency industry. Staying updated with these publications can help you stay informed about industry developments and emerging trends.

- Cryptocurrency Forums and Communities: Online forums and communities like Reddit’s r/Cryptocurrency and BitcoinTalk can be valuable resources for discussions, insights, and community-driven analysis. However, it’s important to be critical of information shared in these forums and to verify information from reputable sources.

Cryptocurrency Trading Platforms

Cryptocurrency trading platforms provide a platform for buying, selling, and trading cryptocurrencies. Choosing the right platform is crucial for a seamless and secure trading experience.

- Benefits:

- Wide Selection of Cryptocurrencies: Most platforms offer a diverse range of cryptocurrencies to trade, allowing you to diversify your portfolio.

- Ease of Use: Many platforms have user-friendly interfaces and mobile apps, making it convenient to buy, sell, and manage your crypto assets.

- Security Features: Reputable platforms implement robust security measures to protect your assets, such as two-factor authentication and cold storage.

- Trading Tools: Some platforms offer advanced trading tools, including charting software, technical indicators, and order types, which can be helpful for experienced traders.

- Drawbacks:

- Fees: Trading platforms often charge fees for transactions, deposits, and withdrawals. These fees can vary depending on the platform and the cryptocurrency being traded.

- Security Risks: Despite security measures, cryptocurrency exchanges remain targets for hackers. It’s crucial to choose a platform with a strong track record of security and to implement your own security practices.

- Limited Customer Support: Some platforms may have limited customer support, especially for complex issues or during periods of high market volatility.

Cryptocurrency Wallets

Cryptocurrency wallets are essential for storing and managing your crypto assets securely. They act as digital containers that hold your private keys, allowing you to access and control your cryptocurrency.

- Types of Cryptocurrency Wallets:

- Software Wallets: These wallets are installed on your computer or mobile device and provide easy access to your cryptocurrency. Examples include Exodus, Electrum, and Mycelium.

- Hardware Wallets: These wallets are physical devices that store your private keys offline, providing a high level of security. Popular hardware wallets include Ledger Nano S, Trezor, and KeepKey.

- Paper Wallets: These wallets consist of a piece of paper containing your private keys and public addresses. While they offer offline storage, they are vulnerable to physical damage or theft.

- Exchange Wallets: These wallets are provided by cryptocurrency exchanges and allow you to store your crypto assets within the exchange platform. However, they are less secure than dedicated wallets, as they are subject to the security of the exchange itself.

- Choosing the Right Cryptocurrency Wallet:

- Security: Prioritize wallets that offer strong security features, such as two-factor authentication and offline storage.

- Ease of Use: Consider wallets that are user-friendly and compatible with your devices and preferred cryptocurrencies.

- Features: Choose wallets that offer features such as multi-signature support, transaction history, and support for multiple cryptocurrencies.

Final Review

Navigating the cryptocurrency market requires a blend of research, analysis, and a well-defined investment strategy. By understanding the fundamentals, recognizing the risks, and utilizing reliable resources, you can approach the world of cryptocurrencies with confidence. Remember, investing in cryptocurrencies should be considered a long-term endeavor, and diversification, risk management, and realistic expectations are paramount to success in this dynamic and evolving space.

Quick FAQs

What is the best cryptocurrency to buy right now?

There is no one-size-fits-all answer to this question. The best cryptocurrency for you depends on your individual investment goals, risk tolerance, and time horizon. It is crucial to conduct thorough research and consider factors such as market capitalization, technology, team, and potential use cases.

Is cryptocurrency a good investment?

Cryptocurrencies can be a potentially rewarding investment, but they also carry significant risks. It is essential to understand the fundamentals of the market, conduct due diligence on specific projects, and diversify your portfolio. Remember, investing in cryptocurrencies should be considered a long-term endeavor, and past performance is not indicative of future results.

How do I buy cryptocurrency?

You can buy cryptocurrencies through cryptocurrency exchanges, which allow you to trade various digital assets. Popular exchanges include Coinbase, Binance, and Kraken. You will need to create an account, verify your identity, and deposit funds to start trading.

Where can I store my cryptocurrency safely?

You can store your cryptocurrencies in a cryptocurrency wallet, which is essentially a digital container that holds your private keys. There are different types of wallets, including hardware wallets, software wallets, and exchange wallets. It is crucial to choose a secure and reliable wallet to protect your assets.