Best crypto coin to buy today? It’s a question on everyone’s mind, especially as the cryptocurrency market continues to evolve. The digital currency landscape is constantly shifting, with new coins emerging and established ones vying for dominance. Navigating this complex terrain requires a keen understanding of market trends, cryptocurrency fundamentals, and investment strategies.

This guide aims to provide insights into the factors influencing cryptocurrency prices, highlight promising coins with potential for growth, and offer valuable tips for making informed investment decisions. We’ll delve into the key considerations that will help you make an educated choice about which cryptocurrency to invest in, keeping in mind the inherent risks and rewards associated with this dynamic market.

Understanding the Crypto Market

The cryptocurrency market is a dynamic and constantly evolving landscape, characterized by significant price fluctuations and rapid technological advancements. It is essential to understand the forces that drive this market to make informed investment decisions.

Factors Influencing Crypto Prices

Cryptocurrency prices are influenced by a complex interplay of factors, including:

- Market Sentiment: Investor sentiment plays a crucial role in driving price movements. Positive news, adoption by major institutions, and growing user base can lead to bullish sentiment and price increases. Conversely, negative news, regulatory uncertainty, or security breaches can trigger bearish sentiment and price declines.

- Supply and Demand: Like any asset class, the price of cryptocurrencies is determined by the interplay of supply and demand. Increased demand, driven by factors such as adoption, investment, and speculation, can lead to price increases. Conversely, a decrease in demand or an increase in supply can lead to price declines.

- Technological Advancements: Innovations in blockchain technology, such as scalability solutions and new use cases, can positively impact the price of cryptocurrencies. For example, the development of faster and more efficient blockchains can attract more users and investors, driving up demand and prices.

- Regulatory Landscape: Regulatory clarity and favorable regulations can boost investor confidence and attract institutional capital, leading to price increases. Conversely, regulatory uncertainty or unfavorable regulations can create volatility and discourage investment, potentially leading to price declines.

- Macroeconomic Factors: Global economic events, such as inflation, interest rates, and geopolitical tensions, can also influence cryptocurrency prices. For example, during periods of high inflation, investors may seek refuge in cryptocurrencies as a hedge against inflation.

Market Trends and Volatility

The cryptocurrency market is known for its high volatility, with prices often experiencing significant swings in both directions. This volatility is driven by several factors, including:

- Speculative Trading: The market is characterized by a significant amount of speculative trading, where investors buy and sell cryptocurrencies based on short-term price movements, often without a fundamental understanding of the underlying technology. This speculative activity can lead to rapid price fluctuations.

- Limited Regulation: The lack of robust regulation in the cryptocurrency market can create uncertainty and volatility. The absence of clear regulatory frameworks can lead to investor anxiety and price swings.

- FOMO (Fear of Missing Out): The fear of missing out on potential gains can drive investors to buy cryptocurrencies at inflated prices, leading to price bubbles and subsequent crashes.

- News Events: Major news events, such as regulatory announcements, technological advancements, or adoption by large companies, can have a significant impact on cryptocurrency prices. Positive news can lead to price rallies, while negative news can trigger sell-offs.

Analyzing Top Cryptocurrencies

Understanding the crypto market is crucial for making informed investment decisions. To help you navigate this dynamic landscape, we will analyze the top cryptocurrencies by market capitalization, highlighting their key features, potential, and use cases.

Market Capitalization Ranking

Market capitalization, often referred to as market cap, is a crucial metric for assessing the overall value of a cryptocurrency. It is calculated by multiplying the current price of a coin by its total circulating supply.

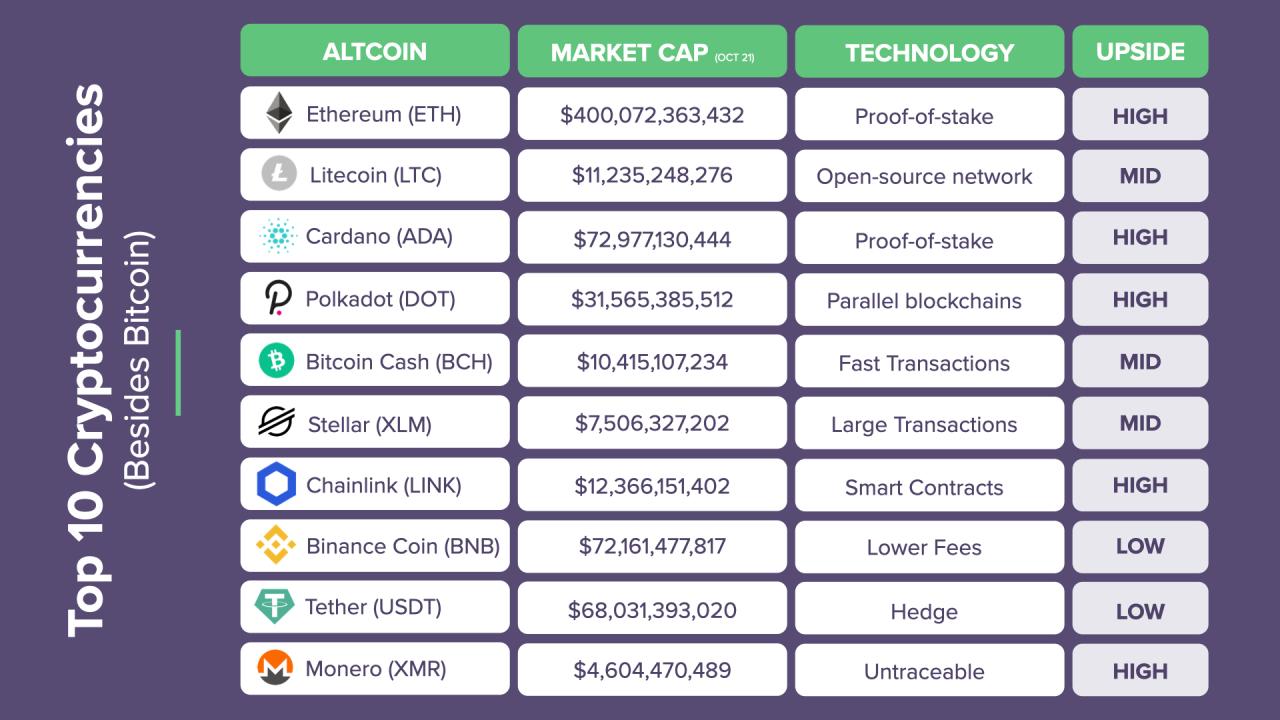

Here’s a list of the top cryptocurrencies by market cap as of [date], with their respective features and potential:

- Bitcoin (BTC): The first and most established cryptocurrency, Bitcoin is known for its decentralized nature, limited supply, and robust security. Its use cases include digital payments, store of value, and hedge against inflation. Bitcoin’s potential lies in its widespread adoption as a global currency and its ability to disrupt traditional financial systems.

- Ethereum (ETH): Ethereum is a decentralized platform that enables the creation and execution of smart contracts and decentralized applications (DApps). Its native cryptocurrency, Ether, is used to pay for transaction fees and access the Ethereum network. Ethereum’s potential lies in its ability to revolutionize various industries, including finance, supply chain management, and gaming.

- Tether (USDT): Tether is a stablecoin pegged to the US dollar, meaning its value is intended to remain stable. It is widely used for trading and as a bridge between fiat currencies and cryptocurrencies. Tether’s potential lies in its ability to facilitate seamless transactions and reduce volatility in the crypto market.

- Binance Coin (BNB): Binance Coin is the native cryptocurrency of the Binance exchange. It is used for trading fees, paying for services on the Binance ecosystem, and participating in various projects. Binance Coin’s potential lies in its growing adoption within the Binance ecosystem and its ability to gain traction in the broader crypto market.

- XRP (XRP): XRP is a cryptocurrency designed for fast and efficient cross-border payments. It is used by financial institutions and payment providers to facilitate international transactions. XRP’s potential lies in its ability to streamline global payments and reduce transaction costs.

Key Features and Potential

Each cryptocurrency possesses unique features and potential that contribute to its value and adoption.

- Decentralization: Cryptocurrencies are designed to be decentralized, meaning they are not controlled by any single entity. This ensures transparency, security, and resistance to censorship.

- Security: Cryptocurrencies utilize cryptography to secure transactions and protect against fraud. This makes them a secure alternative to traditional financial systems.

- Transparency: All transactions on the blockchain are publicly auditable, ensuring transparency and accountability.

- Accessibility: Cryptocurrencies are accessible to anyone with an internet connection, regardless of their location or financial status.

- Innovation: The crypto space is constantly evolving, with new technologies and applications emerging regularly. This innovation drives growth and potential for disruption.

Use Cases and Applications

Cryptocurrencies have a wide range of use cases and applications across various industries.

- Digital Payments: Cryptocurrencies can be used for peer-to-peer payments, eliminating the need for intermediaries and reducing transaction fees.

- Store of Value: Cryptocurrencies can be used as a store of value, offering an alternative to traditional assets like gold.

- Decentralized Finance (DeFi): Cryptocurrencies are used to create decentralized financial applications, offering access to financial services without relying on traditional institutions.

- Non-Fungible Tokens (NFTs): Cryptocurrencies are used to create and trade NFTs, which represent unique digital assets like art, music, and collectibles.

- Supply Chain Management: Cryptocurrencies can be used to track and manage goods throughout the supply chain, ensuring transparency and security.

- Gaming: Cryptocurrencies are used in blockchain-based games, offering players ownership of in-game assets and rewards.

Investment Considerations

Investing in cryptocurrencies can be both rewarding and risky. While the potential for high returns is alluring, it’s crucial to understand the inherent risks before diving in. This section delves into the key considerations for navigating the crypto market effectively.

Risks and Rewards of Crypto Investing

The cryptocurrency market is known for its volatility, which can lead to significant gains but also substantial losses. Here’s a breakdown of the risks and potential rewards:

- Volatility: Cryptocurrency prices can fluctuate wildly within short periods, making it challenging to predict market movements. This volatility can result in substantial losses if investments are not carefully managed.

- Market Manipulation: The relatively small size of the crypto market makes it susceptible to manipulation by large players. This can lead to artificial price swings that can impact investors’ portfolios.

- Security Risks: Cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking and theft. Investors need to take appropriate security measures to protect their assets.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty for investors. Changes in regulations can significantly impact the value of cryptocurrencies.

- Potential for High Returns: The potential for high returns is one of the main attractions of crypto investing. The rapid growth of some cryptocurrencies has led to significant gains for early investors.

- Innovation and Disruption: Cryptocurrencies have the potential to disrupt traditional financial systems and create new opportunities. This innovation can drive long-term value growth.

Fundamental and Technical Analysis

Understanding the fundamentals and technical aspects of cryptocurrencies is crucial for informed investment decisions.

Fundamental Analysis

Fundamental analysis focuses on evaluating the underlying value of a cryptocurrency based on factors like:

- Technology: The underlying technology of the cryptocurrency, its scalability, security, and innovation potential.

- Team: The experience, expertise, and reputation of the development team behind the cryptocurrency.

- Use Cases: The real-world applications and adoption of the cryptocurrency.

- Community: The size and engagement of the cryptocurrency’s community.

- Regulation: The regulatory environment surrounding the cryptocurrency.

Technical Analysis

Technical analysis uses charts and indicators to identify trends and patterns in price movements, helping investors make predictions about future price behavior. Common technical indicators include:

- Moving Averages: These indicators smooth out price fluctuations and highlight trends.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator identifies potential buy and sell signals by comparing two moving averages.

Diversifying a Crypto Portfolio

Diversification is a crucial strategy for mitigating risk in any investment portfolio, including cryptocurrencies.

- Invest in Different Cryptocurrencies: Don’t put all your eggs in one basket. Diversify your portfolio by investing in a variety of cryptocurrencies with different use cases and underlying technologies.

- Consider Different Asset Classes: Beyond cryptocurrencies, diversify your portfolio by including traditional assets like stocks, bonds, and real estate. This can help balance out the volatility of crypto investments.

- Allocate Your Investments: Determine the percentage of your overall portfolio you want to allocate to cryptocurrencies. This allocation should be based on your risk tolerance and investment goals.

Emerging Cryptocurrencies

The world of cryptocurrencies is constantly evolving, with new projects emerging and gaining traction every day. These emerging cryptocurrencies often present exciting opportunities for investors seeking high growth potential and exposure to innovative technologies. This section delves into some promising cryptocurrencies with the potential to disrupt traditional industries and shape the future of finance.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing sector of the cryptocurrency market, offering alternative financial services built on blockchain technology. DeFi protocols aim to provide access to financial services without intermediaries, empowering individuals to control their assets and participate in a more transparent and open financial system.

Here are some key DeFi projects to consider:

- Aave (AAVE): Aave is a decentralized lending and borrowing protocol that allows users to earn interest on their crypto assets or borrow cryptocurrencies at variable or fixed interest rates. Its innovative features, such as flash loans, have attracted significant attention in the DeFi space.

- Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their crypto assets by lending them to borrowers. Its governance token, COMP, allows holders to participate in the protocol’s decision-making process.

- Uniswap (UNI): Uniswap is a decentralized exchange (DEX) that facilitates peer-to-peer trading of cryptocurrencies without the need for intermediaries. Its automated market maker (AMM) mechanism allows for efficient and transparent trading experiences.

DeFi projects have the potential to revolutionize traditional financial services by offering greater accessibility, transparency, and control over financial assets. As the DeFi ecosystem continues to expand, these projects are likely to play a significant role in shaping the future of finance.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are unique digital assets that represent ownership of real-world or digital items. NFTs have gained immense popularity in recent years, particularly in the art, gaming, and collectibles sectors.

NFTs have the potential to disrupt traditional industries by providing new ways to represent and trade digital assets. Here are some key NFT projects to consider:

- Ethereum (ETH): Ethereum is the leading platform for NFT development, hosting a wide range of NFT projects. Its smart contract functionality allows for the creation and trading of unique digital assets.

- Flow (FLOW): Flow is a blockchain platform specifically designed for NFTs and gaming. It offers high throughput and scalability, making it suitable for handling large volumes of NFT transactions.

- Tezos (XTZ): Tezos is a blockchain platform known for its on-chain governance and upgradeability. It has gained popularity for its ability to support complex NFT projects with unique functionalities.

NFTs have the potential to transform industries such as art, gaming, and collectibles by providing new avenues for creators to monetize their work and for collectors to acquire and trade unique digital assets.

Metaverse and Gaming

The metaverse is a rapidly evolving concept that refers to a shared virtual space where users can interact, socialize, and participate in a range of activities. Cryptocurrencies are playing a crucial role in the development of the metaverse, enabling the creation of virtual economies, digital assets, and decentralized governance mechanisms.

Here are some promising metaverse and gaming projects:

- Sandbox (SAND): The Sandbox is a decentralized gaming platform that allows users to create, own, and trade virtual assets within a 3D virtual world. Its voxel-based graphics and user-friendly interface have attracted a growing community of developers and players.

- Decentraland (MANA): Decentraland is a virtual world where users can create, experience, and monetize their virtual experiences. Its decentralized governance system allows users to shape the future of the platform.

- Axie Infinity (AXS): Axie Infinity is a blockchain-based game that allows players to collect, breed, and battle digital creatures called Axies. Its play-to-earn model has attracted millions of players worldwide.

Metaverse and gaming projects have the potential to create immersive and interactive experiences, fostering new forms of entertainment, social interaction, and economic activity. As the metaverse continues to evolve, these projects are likely to play a significant role in shaping the future of virtual worlds.

Factors Influencing Investment Decisions

Making informed decisions when investing in cryptocurrencies is crucial for maximizing potential returns and mitigating risks. Several factors play a significant role in shaping your investment strategy and determining which cryptocurrency to buy.

Key Factors to Consider

Understanding the key factors that influence investment decisions can help you make more informed choices. Here’s a table outlining some of the most important considerations:

| Factor | Description | Importance | Example |

|---|---|---|---|

| Project Fundamentals | The underlying technology, team, and roadmap of the cryptocurrency. | High | Bitcoin’s robust blockchain technology, experienced team, and clear long-term goals. |

| Market Capitalization | The total value of all circulating coins. | Moderate | A large market cap can indicate stability, while a smaller cap might suggest higher potential for growth. |

| Trading Volume | The amount of cryptocurrency traded within a specific timeframe. | Moderate | High trading volume can indicate liquidity and ease of buying and selling. |

| Community Support | The size and engagement of the cryptocurrency’s community. | Moderate | A strong community can provide support, advocacy, and contribute to the project’s development. |

| Adoption and Use Cases | The real-world applications and adoption of the cryptocurrency. | High | Ethereum’s use in decentralized finance (DeFi) and non-fungible tokens (NFTs) has driven its adoption. |

| Regulatory Environment | The legal and regulatory framework surrounding the cryptocurrency. | High | Clear regulations can provide stability and investor confidence, while uncertainty can create volatility. |

| Technical Analysis | Analyzing price charts and other technical indicators to identify potential trends. | Moderate | Using moving averages and other indicators to predict price movements. |

| Fundamental Analysis | Evaluating the underlying value and potential of the cryptocurrency based on its technology and use cases. | High | Analyzing a cryptocurrency’s blockchain technology, team, and roadmap. |

| Risk Tolerance | Your willingness to accept potential losses. | High | High-risk investors might be comfortable with volatile cryptocurrencies, while risk-averse investors might prefer more stable options. |

| Investment Goals | Your desired outcome from investing in cryptocurrencies. | High | Short-term goals might focus on quick gains, while long-term goals might prioritize long-term growth. |

Thorough Research

Conducting thorough research before investing is crucial. This involves understanding the cryptocurrency’s technology, team, roadmap, and community. You should also research the market conditions, including price history, trading volume, and regulatory environment.

Risk Tolerance and Investment Goals

Understanding your own risk tolerance and investment goals is essential. Risk tolerance refers to your willingness to accept potential losses, while investment goals represent your desired outcome from investing. If you’re risk-averse, you might prefer stable cryptocurrencies with a proven track record. Conversely, if you’re comfortable with higher risk, you might consider investing in emerging cryptocurrencies with high growth potential. Your investment goals should align with your risk tolerance and time horizon.

Disclaimer

It is important to understand that the information presented in this guide is for educational purposes only and should not be considered as financial advice.

The cryptocurrency market is highly volatile and involves significant risks. Before making any investment decisions, it is crucial to conduct thorough research, consult with a qualified financial advisor, and carefully consider your individual financial circumstances, risk tolerance, and investment goals.

Disclaimer, Best crypto coin to buy today

The content provided in this guide is intended for informational purposes only and should not be interpreted as investment advice. Cryptocurrencies are highly volatile assets, and investing in them carries significant risks.

It is essential to conduct your own due diligence, consult with a qualified financial advisor, and make investment decisions based on your individual financial situation, risk tolerance, and investment goals.

The author and publisher of this guide are not responsible for any losses or damages that may result from reliance on the information provided. Investing in cryptocurrencies involves inherent risks, including but not limited to market volatility, regulatory uncertainty, and potential security breaches.

Before making any investment decisions, it is crucial to seek advice from a qualified financial professional who can provide personalized guidance based on your specific circumstances.

Conclusion

The best crypto coin to buy today is ultimately a personal decision, based on your individual risk tolerance, investment goals, and research. While this guide provides a framework for understanding the market and identifying potential opportunities, it’s crucial to conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The cryptocurrency market is exciting and potentially lucrative, but it’s also volatile and unpredictable. By approaching your investments with caution and a well-informed strategy, you can navigate this exciting landscape with confidence and potentially reap the rewards.

FAQ Explained: Best Crypto Coin To Buy Today

What is the best cryptocurrency to buy today?

There is no single “best” cryptocurrency to buy. The ideal choice depends on your individual investment goals, risk tolerance, and market research.

How can I learn more about cryptocurrencies?

Start with reputable online resources, cryptocurrency news websites, and educational platforms. Consider joining online communities and forums to engage with experienced investors.

Is it safe to invest in cryptocurrencies?

Cryptocurrency investments carry inherent risks, including market volatility, security threats, and regulatory uncertainty. It’s essential to conduct thorough research and invest only what you can afford to lose.