Best new crypto to buy: a phrase that evokes both excitement and trepidation in the minds of investors. The cryptocurrency market is a dynamic landscape, constantly evolving with new projects and innovations. But amidst the hype and volatility, how can you discern the gems from the duds?

This guide delves into the key factors to consider when choosing a new cryptocurrency, exploring the potential benefits and risks, and providing strategies for making informed investment decisions. We’ll examine the current market landscape, discuss the importance of fundamental and technical analysis, and identify emerging cryptocurrencies with promising use cases.

Understanding the Crypto Market

The cryptocurrency market is a dynamic and ever-evolving space, characterized by significant volatility and rapid technological advancements. Understanding the key trends and factors influencing its fluctuations is crucial for any investor looking to navigate this complex landscape.

Risks Associated with Cryptocurrency Investments

Investing in cryptocurrencies comes with inherent risks, and it’s essential to be aware of these before making any investment decisions.

- Price Fluctuations: The cryptocurrency market is known for its extreme volatility. Prices can fluctuate dramatically within short periods, leading to significant losses for investors.

- Regulatory Uncertainty: Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty and potential legal risks for investors.

- Security Concerns: Cryptocurrencies are susceptible to hacking and theft, and investors need to take precautions to protect their assets.

Different Cryptocurrency Categories

The cryptocurrency market encompasses a wide range of digital assets, each with its unique characteristics and purposes.

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often considered a store of value and a hedge against inflation.

- Ethereum (ETH): Ethereum is a decentralized platform that enables smart contracts and decentralized applications (DApps).

- Stablecoins: Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to fiat currencies like the US dollar.

- Meme Coins: Meme coins are cryptocurrencies inspired by internet memes and often have no intrinsic value, relying on hype and community support for their price.

Factors to Consider When Choosing a Cryptocurrency

Choosing the right cryptocurrency to invest in can be daunting, given the sheer number of options available. A thorough evaluation process is crucial to make informed decisions and maximize your chances of success.

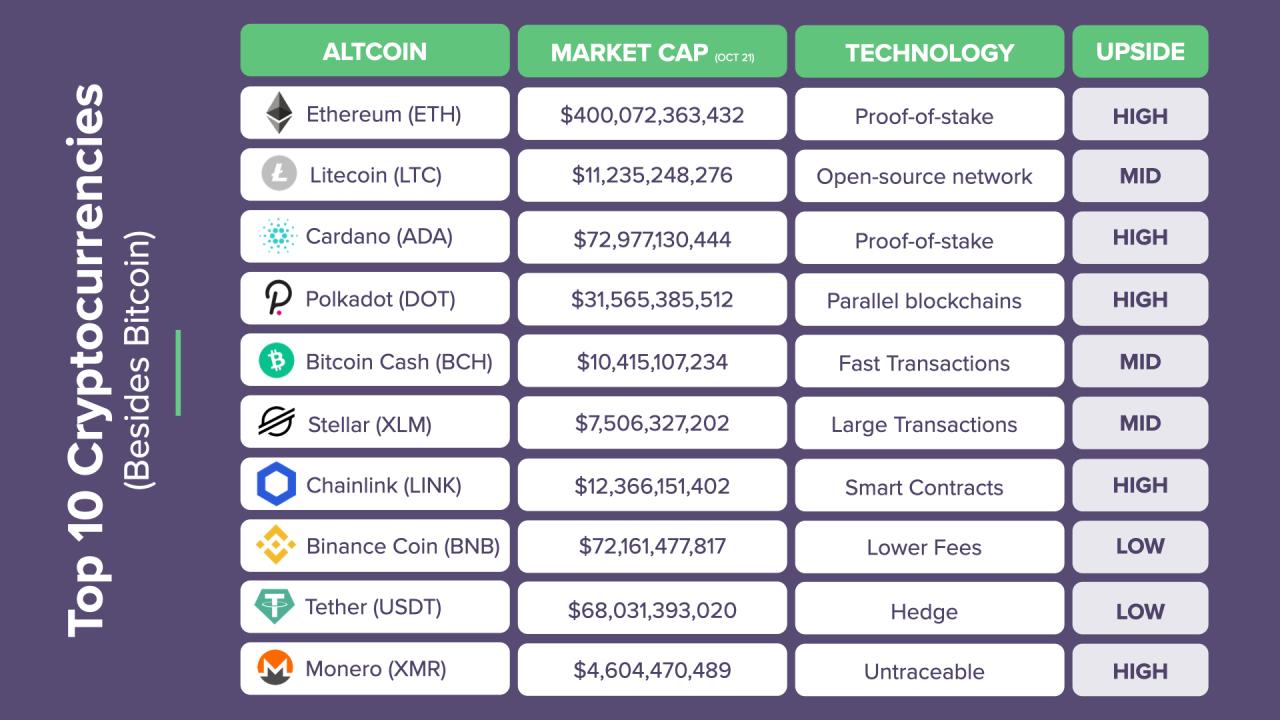

Market Capitalization and Trading Volume

Market capitalization, often referred to as “market cap,” represents the total value of all outstanding coins or tokens. It’s calculated by multiplying the current price of a cryptocurrency by its total circulating supply. Higher market capitalization generally indicates a more established and widely adopted cryptocurrency.

Trading volume, on the other hand, reflects the amount of cryptocurrency being traded within a specific timeframe. Higher trading volume often suggests greater liquidity, meaning you can easily buy or sell your holdings without significantly impacting the price.

Developer Activity and Community Engagement, Best new crypto to buy

Active development is a vital indicator of a cryptocurrency’s long-term potential. Look for projects with frequent updates, bug fixes, and ongoing development of new features. This suggests a dedicated team committed to improving the project and addressing any challenges.

Community engagement is another crucial factor. A thriving community with active participation in forums, social media, and developer discussions indicates a strong network of supporters and potential adopters.

Fundamental Analysis

Fundamental analysis delves into the underlying factors that influence a cryptocurrency’s value. It involves assessing the project’s whitepaper, team, and technology.

Project’s Whitepaper

The whitepaper is a crucial document that Artikels the project’s vision, goals, technology, and roadmap. Carefully analyze the whitepaper to understand the project’s core functionalities, its target market, and its competitive advantage.

Team

The team behind a cryptocurrency plays a significant role in its success. Research the team members’ backgrounds, experience, and expertise in relevant fields. A team with a strong track record and relevant skills increases confidence in the project’s execution and long-term viability.

Technology

Evaluate the technology underpinning the cryptocurrency, such as its blockchain architecture, consensus mechanism, and security features. A robust and innovative technology provides a solid foundation for the project’s success and can attract developers and users.

Technical Analysis

Technical analysis involves studying historical price charts and trading patterns to identify potential buying and selling opportunities. This approach focuses on price movements, trading volume, and technical indicators to predict future price trends.

Price Patterns and Indicators

Technical analysts use various price patterns and indicators to identify potential trends. Common patterns include head and shoulders, double tops and bottoms, and moving averages. Indicators such as MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) provide insights into momentum and overbought/oversold conditions.

Emerging Cryptocurrencies with Potential: Best New Crypto To Buy

The cryptocurrency landscape is constantly evolving, with new projects emerging that promise to revolutionize various industries. These emerging cryptocurrencies often feature innovative technologies or address real-world problems, attracting investors seeking high-growth potential.

Promising New Cryptocurrencies

Investing in emerging cryptocurrencies can be highly rewarding, but it also comes with significant risks. It is crucial to conduct thorough research and understand the potential benefits and risks associated with each project before making any investment decisions.

- Decentraland (MANA): Decentraland is a virtual reality platform that allows users to create, experience, and monetize virtual worlds. Users can buy and sell virtual land, build applications, and participate in a decentralized economy. Its potential lies in its ability to revolutionize the metaverse, offering new opportunities for entertainment, gaming, and social interaction.

- The Sandbox (SAND): Similar to Decentraland, The Sandbox is another metaverse platform that allows users to create and monetize their own gaming experiences. The platform utilizes NFTs to represent in-game assets, enabling users to own and trade unique digital items. Its potential lies in its focus on gaming and user-generated content, attracting a growing community of creators and players.

- Chainlink (LINK): Chainlink is a decentralized oracle network that connects smart contracts to real-world data. It allows blockchain applications to access external data feeds, such as price information, weather data, and other off-chain information. Its potential lies in its ability to bridge the gap between blockchain technology and traditional systems, enabling a wider range of applications.

- Solana (SOL): Solana is a high-performance blockchain platform that aims to provide faster and more scalable transactions than other blockchains. It utilizes a unique Proof-of-History consensus mechanism to achieve high throughput and low transaction fees. Its potential lies in its ability to handle a large volume of transactions, making it suitable for decentralized applications and financial services.

Benefits and Risks of Investing in Emerging Cryptocurrencies

Investing in emerging cryptocurrencies can be a risky proposition, but it can also offer significant rewards.

- Potential for High Returns: Emerging cryptocurrencies often experience rapid growth due to their innovative technologies and growing adoption. Early investors in successful projects can reap substantial profits.

- Disruption of Traditional Industries: Many emerging cryptocurrencies aim to disrupt existing industries by offering decentralized and more efficient solutions. This disruption can create new opportunities and drive significant value creation.

- Early Adoption Advantage: Investing in emerging cryptocurrencies early can provide an advantage in a rapidly growing market. As the technology matures and adoption increases, early adopters can benefit from higher valuations.

- Volatility and Market Risk: The cryptocurrency market is highly volatile, and emerging cryptocurrencies are particularly susceptible to price swings. Market fluctuations can lead to significant losses for investors.

- Technology Risk: New cryptocurrencies are often built on unproven technologies, and their long-term viability is uncertain. Technological challenges or vulnerabilities can hinder their adoption and impact their value.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can significantly impact the market. This uncertainty can create challenges for investors and businesses operating in the space.

Comparing Emerging Cryptocurrencies

Each emerging cryptocurrency offers unique features and functionalities, catering to different use cases and market segments.

| Cryptocurrency | Key Features | Value Proposition |

|---|---|---|

| Decentraland (MANA) | Virtual reality platform, decentralized ownership of virtual land, user-generated content | Revolutionizing the metaverse, providing opportunities for entertainment, gaming, and social interaction |

| The Sandbox (SAND) | Metaverse platform, NFT-based gaming experiences, user-generated content | Focusing on gaming and user-generated content, attracting creators and players |

| Chainlink (LINK) | Decentralized oracle network, connecting smart contracts to real-world data | Bridging the gap between blockchain technology and traditional systems, enabling a wider range of applications |

| Solana (SOL) | High-performance blockchain, Proof-of-History consensus mechanism, low transaction fees | Handling a large volume of transactions, suitable for decentralized applications and financial services |

Final Review

Investing in cryptocurrencies can be a rewarding endeavor, but it’s crucial to approach it with a sound understanding of the market and a well-defined investment strategy. By carefully evaluating the factors discussed in this guide, you can increase your chances of success in this exciting and rapidly evolving space. Remember, due diligence is paramount, and diversification is key to managing risk. So, as you embark on your journey into the world of new cryptocurrencies, equip yourself with knowledge, stay informed, and approach your investments with a thoughtful and calculated approach.

Helpful Answers

What is the best way to research new cryptocurrencies?

Start by exploring reputable websites and platforms that provide comprehensive information on cryptocurrency projects, such as CoinMarketCap, CoinGecko, and Messari. Look for whitepapers, developer activity, community engagement, and independent audits. Additionally, utilize analytical tools and charting software to track price movements and identify trends. Stay informed about industry news, regulatory developments, and technological advancements.

What are some common scams in the crypto space?

Be wary of pump-and-dump schemes, rug pulls, and phishing scams. These schemes often involve inflated claims, unrealistic promises, and attempts to manipulate prices for personal gain. It’s crucial to conduct thorough research, verify information from multiple sources, and exercise caution before investing in any cryptocurrency.

Is it better to invest in established cryptocurrencies or new ones?

There is no definitive answer, as both established and new cryptocurrencies offer different risk and reward profiles. Established cryptocurrencies like Bitcoin and Ethereum have proven track records and strong community support, but they may have limited growth potential. New cryptocurrencies, on the other hand, offer the potential for higher returns but also carry greater risk. The best approach is to diversify your portfolio across a mix of established and emerging projects, balancing risk and reward.