Top crypto to buy has become a hot topic in the world of finance, attracting investors seeking potential high returns. As the cryptocurrency market continues to evolve, it’s crucial to understand the key factors influencing prices and identify promising investments. This guide delves into the current state of the crypto market, exploring top contenders based on market capitalization, growth potential, and underlying technology. We’ll also discuss investment strategies, risk management, and the future of cryptocurrencies, empowering you to make informed decisions.

The cryptocurrency market has experienced significant growth in recent years, fueled by factors such as increasing adoption, technological advancements, and growing institutional interest. However, it’s important to remember that the crypto market is highly volatile and subject to rapid fluctuations. This guide aims to provide a comprehensive overview of the top cryptocurrencies to buy, helping you navigate the complexities of this evolving market.

Understanding the Crypto Market

The cryptocurrency market is a dynamic and volatile space, characterized by rapid price fluctuations and constant innovation. Understanding the factors driving these changes is crucial for anyone considering investing in cryptocurrencies.

Current State of the Cryptocurrency Market

The cryptocurrency market has experienced significant growth in recent years, attracting investors from all walks of life. However, the market is also known for its volatility, with prices often fluctuating wildly. As of [date], the total market capitalization of all cryptocurrencies is estimated to be [amount]. This represents a [percentage] increase/decrease compared to [previous date].

Factors Influencing Cryptocurrency Prices

Several factors can influence the price of cryptocurrencies. These include:

- Supply and Demand: Like any other asset, the price of a cryptocurrency is determined by the forces of supply and demand. When demand exceeds supply, the price tends to rise. Conversely, when supply exceeds demand, the price tends to fall.

- Adoption: The wider adoption of cryptocurrencies by businesses and consumers can drive demand and increase prices. Factors like the development of new use cases, the creation of user-friendly platforms, and the increasing acceptance of cryptocurrency payments by merchants can all contribute to adoption.

- Regulation: Government regulations and policies can have a significant impact on the cryptocurrency market. Clear and favorable regulations can create a more stable and predictable environment, attracting more investors. However, overly restrictive regulations can stifle innovation and hinder growth.

- Media Sentiment: News coverage and public perception can influence investor sentiment and affect prices. Positive media coverage and widespread adoption can lead to increased demand and higher prices, while negative news or scandals can cause a decline in price.

- Technical Factors: Technical indicators, such as trading volume, moving averages, and resistance levels, can provide insights into price trends and potential future movements.

- Market Events: Major events, such as the launch of a new cryptocurrency, a significant hack, or a regulatory announcement, can trigger significant price fluctuations.

Key Trends and Potential Growth Areas

The cryptocurrency market is constantly evolving, with new trends and technologies emerging all the time. Some key trends and potential growth areas include:

- Decentralized Finance (DeFi): DeFi is a rapidly growing sector of the cryptocurrency market that aims to provide financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of digital or physical items, such as artwork, music, or collectibles. NFTs have gained significant popularity in recent years, particularly in the art and gaming industries.

- Metaverse: The metaverse is a virtual world that allows users to interact with each other and participate in a variety of activities, including gaming, socializing, and shopping. Cryptocurrencies are expected to play a key role in the metaverse, facilitating transactions and providing a decentralized governance framework.

- Web3: Web3 refers to a decentralized internet that is built on blockchain technology. It aims to empower users by giving them more control over their data and online experiences.

- Institutional Adoption: More and more institutional investors, such as hedge funds and pension funds, are starting to allocate capital to cryptocurrencies. This trend is expected to continue as institutions become more comfortable with the asset class and recognize its potential.

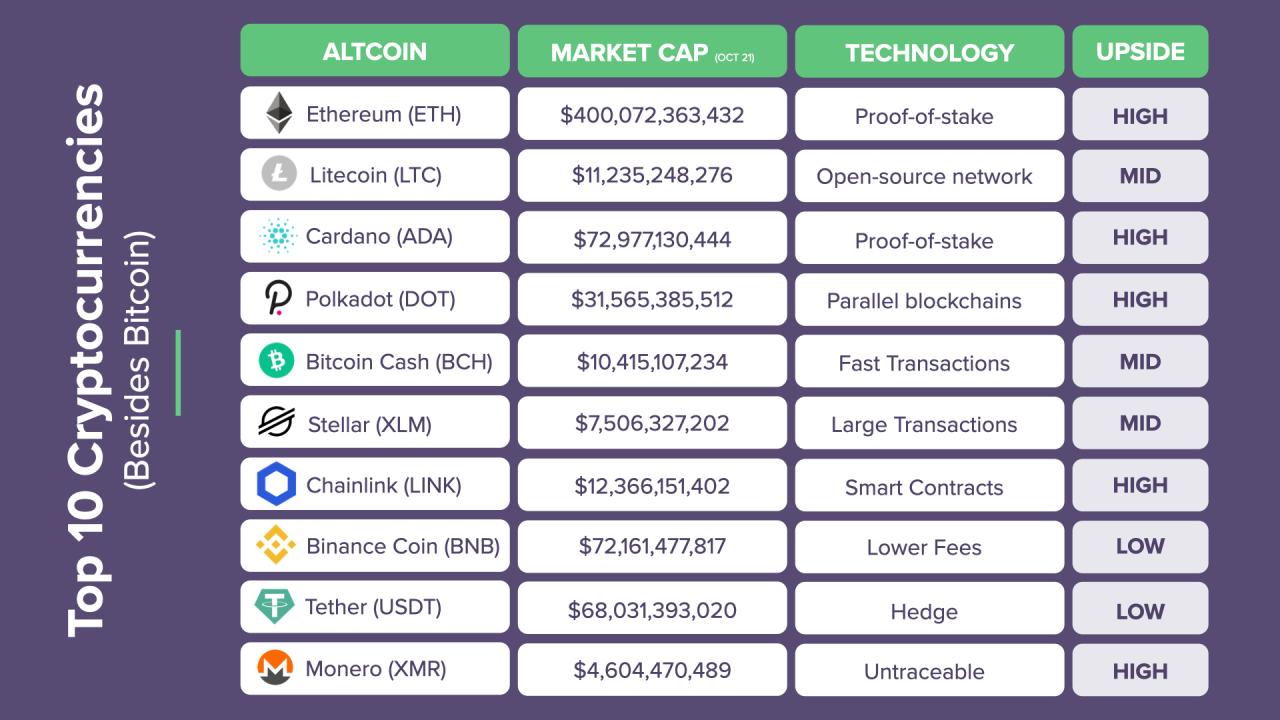

Top Cryptocurrencies to Consider

Investing in cryptocurrencies can be a lucrative endeavor, but it’s crucial to conduct thorough research before committing your funds. The cryptocurrency market is constantly evolving, and choosing the right coins can significantly impact your portfolio’s growth. This section delves into five of the top cryptocurrencies, analyzing their market capitalization, growth potential, and underlying technology.

Top 5 Cryptocurrencies

These cryptocurrencies have garnered significant attention and have demonstrated substantial growth potential, making them attractive options for investors.

- Bitcoin (BTC): Often referred to as the “digital gold,” Bitcoin is the oldest and most well-known cryptocurrency. Its decentralized nature and limited supply have contributed to its value proposition. Bitcoin’s underlying technology, blockchain, provides a secure and transparent platform for transactions.

- Ethereum (ETH): Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Its native cryptocurrency, Ether, is used to pay for transaction fees and execute smart contracts. Ethereum’s smart contract functionality has revolutionized the way applications are developed and deployed, paving the way for innovative solutions across various industries.

- Binance Coin (BNB): Binance Coin is the native cryptocurrency of the Binance exchange, one of the largest cryptocurrency exchanges globally. BNB offers numerous benefits to Binance users, including discounts on trading fees and access to exclusive features. Binance Coin has experienced substantial growth due to its utility within the Binance ecosystem and its increasing adoption in various DeFi projects.

- Cardano (ADA): Cardano is a blockchain platform that emphasizes scalability, sustainability, and security. Its unique proof-of-stake consensus mechanism and peer-reviewed development process aim to address the limitations of other blockchains. Cardano’s focus on scientific research and academic rigor has attracted developers and investors seeking a robust and secure platform.

- Solana (SOL): Solana is a high-performance blockchain platform that utilizes a unique proof-of-history consensus mechanism to achieve high transaction speeds and low fees. Its speed and efficiency have made it a popular choice for developers building decentralized applications. Solana’s growing ecosystem and its focus on scalability position it as a potential contender in the blockchain space.

Comparative Analysis

It is essential to compare and contrast these cryptocurrencies to understand their strengths and weaknesses.

| Cryptocurrency | Advantages | Disadvantages |

|---|---|---|

| Bitcoin | Decentralized, limited supply, strong community, established infrastructure | High transaction fees, slow transaction speeds, energy consumption |

| Ethereum | Smart contract functionality, large developer community, diverse ecosystem | Scalability challenges, high gas fees, potential for congestion |

| Binance Coin | Utility within Binance ecosystem, discounts on trading fees, growing adoption | Centralized exchange, reliance on Binance platform, potential for volatility |

| Cardano | Scalability, sustainability, scientific approach, robust security | Slower development cycle, less mature ecosystem compared to Ethereum |

| Solana | High transaction speeds, low fees, efficient consensus mechanism, growing ecosystem | Centralized development, potential for network instability, lack of decentralization |

Investing in Cryptocurrencies

Investing in cryptocurrencies involves buying and holding digital assets with the expectation of future price appreciation. The cryptocurrency market is highly volatile, and returns can vary greatly depending on the chosen investment strategy.

Investment Strategies

Cryptocurrency investment strategies involve various approaches to profit from price fluctuations.

- Long-Term Holding (Hodling): This strategy involves buying and holding cryptocurrencies for an extended period, typically years, with the belief that their value will increase over time. It aims to ride out market fluctuations and benefit from long-term growth. This strategy is often associated with the term “Hodling,” a misspelling of “holding” that became popular in the cryptocurrency community.

- Day Trading: This strategy involves buying and selling cryptocurrencies within a single day, aiming to profit from short-term price fluctuations. Day traders typically use technical analysis and trading signals to identify opportunities for quick profits. However, this strategy requires significant time, effort, and technical expertise, and it carries a high risk of losses.

- Arbitrage: This strategy involves exploiting price differences between different cryptocurrency exchanges. Arbitrageurs buy cryptocurrencies at a lower price on one exchange and sell them at a higher price on another exchange, profiting from the price discrepancy. However, arbitrage opportunities are often short-lived and require quick execution and knowledge of different exchange fees.

Risks Associated with Investing in Cryptocurrencies

Investing in cryptocurrencies involves various risks, including:

- Volatility: Cryptocurrency prices can fluctuate significantly within short periods, leading to substantial losses for investors. This volatility is due to factors such as market sentiment, regulatory changes, and technological advancements.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft. Investors need to take precautions to protect their digital assets, such as using secure wallets and two-factor authentication.

- Regulatory Uncertainty: Cryptocurrency regulations vary across jurisdictions, creating uncertainty for investors. Governments are still developing frameworks for regulating this emerging asset class, which can impact market stability and investment decisions.

- Scams and Fraud: The cryptocurrency market is prone to scams and fraud. Investors need to be cautious and verify the legitimacy of any investment opportunity before committing funds.

Managing Risk and Diversifying a Cryptocurrency Portfolio

Managing risk and diversifying a cryptocurrency portfolio are crucial for mitigating potential losses and maximizing returns.

- Do Your Research: Before investing in any cryptocurrency, conduct thorough research on the project, its team, its technology, and its market potential. Consider factors such as the project’s whitepaper, its community, and its adoption rate.

- Start Small: Begin with a small investment amount that you can afford to lose. This approach allows you to test the waters and gain experience before committing larger sums.

- Diversify: Don’t put all your eggs in one basket. Spread your investment across multiple cryptocurrencies with different use cases and market caps. This diversification helps to mitigate risk by reducing exposure to any single asset’s price fluctuations.

- Use a Secure Wallet: Choose a secure and reputable cryptocurrency wallet to store your digital assets. Consider using a hardware wallet, which offers a higher level of security than software wallets.

- Set Stop-Loss Orders: Stop-loss orders automatically sell your cryptocurrencies at a predetermined price, limiting potential losses if the market moves against your position.

- Invest Only What You Can Afford to Lose: Never invest more than you can afford to lose. Cryptocurrency investments are highly speculative, and there is no guarantee of profits.

Cryptocurrency Exchanges and Wallets

Once you’ve decided on the cryptocurrencies you want to invest in, you need to choose a reliable exchange and a secure wallet to store your assets. Let’s explore these essential elements of the crypto ecosystem.

Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms that allow users to buy, sell, and trade cryptocurrencies. Choosing the right exchange is crucial for a smooth and secure trading experience.

Here’s a comparison of some of the top 5 cryptocurrency exchanges based on features, fees, and security:

| Exchange | Features | Fees | Security |

|---|---|---|---|

| Binance | Wide selection of cryptocurrencies, spot and futures trading, margin trading, staking, and more. | Low trading fees, maker/taker fees, deposit and withdrawal fees vary. | Robust security measures, including two-factor authentication (2FA), cold storage, and insurance. |

| Coinbase | User-friendly interface, easy-to-use platform for beginners, wide range of cryptocurrencies, and fiat currency support. | Higher trading fees compared to Binance, but offers a more user-friendly experience. | Strong security features, including 2FA, cold storage, and security audits. |

| Kraken | Advanced trading features, margin trading, futures trading, and institutional-grade security. | Competitive trading fees, maker/taker fees, and variable deposit and withdrawal fees. | High security standards, including 2FA, cold storage, and comprehensive security protocols. |

| KuCoin | Large selection of cryptocurrencies, spot and futures trading, margin trading, and a wide range of trading tools. | Low trading fees, maker/taker fees, and variable deposit and withdrawal fees. | Strong security measures, including 2FA, cold storage, and regular security audits. |

| Gemini | Focus on security and compliance, regulated exchange, offers spot trading and institutional-grade services. | Slightly higher fees compared to some other exchanges, but emphasizes security and compliance. | Robust security measures, including 2FA, cold storage, and a comprehensive security program. |

Cryptocurrency Wallets

A cryptocurrency wallet is a software program or hardware device that allows you to store, manage, and send your cryptocurrencies. Choosing a secure and reliable wallet is crucial to protect your digital assets.

Importance of Choosing a Secure and Reliable Cryptocurrency Wallet

A secure wallet protects your cryptocurrencies from theft and unauthorized access. It’s essential to choose a wallet that offers robust security features, such as two-factor authentication (2FA), cold storage, and regular security updates.

Different Types of Cryptocurrency Wallets

There are several types of cryptocurrency wallets, each with its own advantages and disadvantages:

- Software Wallets: These wallets are downloaded and installed on your computer or mobile device. They are generally more convenient and accessible, but can be more vulnerable to security risks if your device is compromised.

- Hardware Wallets: These wallets are physical devices that store your private keys offline, making them highly secure. They are considered the most secure type of wallet but can be more expensive and less convenient to use.

- Web Wallets: These wallets are accessed through a web browser and are often provided by cryptocurrency exchanges. They are convenient but can be less secure than other types of wallets.

- Paper Wallets: These wallets are created by printing out your private keys on paper. They are extremely secure, as they are offline and not accessible digitally, but they can be lost or damaged.

The Future of Cryptocurrencies

Cryptocurrencies, once a niche concept, have gained significant traction in recent years, and their potential impact on the global economy is undeniable. The technology behind cryptocurrencies, blockchain, is revolutionizing various sectors, from finance to supply chain management. While challenges remain, the future of cryptocurrencies holds immense promise for innovation and disruption.

The Impact of Cryptocurrencies on the Global Economy, Top crypto to buy

Cryptocurrencies have the potential to reshape the global financial landscape in several ways.

- Increased Financial Inclusion: Cryptocurrencies can provide access to financial services for individuals and communities that are traditionally underserved by traditional banking systems. By enabling peer-to-peer transactions without intermediaries, cryptocurrencies can facilitate cross-border payments and remittances at lower costs. For instance, in developing countries with limited access to traditional banking infrastructure, cryptocurrencies can provide a viable alternative for financial transactions.

- Enhanced Transparency and Security: Blockchain technology, the underlying framework of cryptocurrencies, provides a transparent and immutable record of transactions, enhancing security and reducing the risk of fraud. This transparency can improve trust in financial systems and streamline processes.

- New Investment Opportunities: Cryptocurrencies offer investors alternative asset classes with potentially higher returns. However, it is important to note that the cryptocurrency market is volatile, and investments carry inherent risks.

- Decentralized Finance (DeFi): DeFi applications built on blockchain technology aim to disrupt traditional financial institutions by offering decentralized alternatives for lending, borrowing, and other financial services. DeFi platforms can potentially reduce reliance on intermediaries and provide greater control over financial assets.

The Role of Blockchain Technology

Blockchain technology is a distributed ledger that records transactions across a network of computers. It is a key enabler of cryptocurrencies and offers numerous advantages, including:

- Immutability: Once a transaction is recorded on a blockchain, it cannot be altered, ensuring data integrity and security.

- Transparency: All transactions are publicly visible on the blockchain, fostering accountability and trust.

- Decentralization: Blockchain networks are not controlled by a single entity, making them resistant to censorship and manipulation.

Challenges and Opportunities

While the future of cryptocurrencies is promising, several challenges and opportunities need to be addressed.

- Regulation: The lack of clear regulatory frameworks in many jurisdictions creates uncertainty and hinders wider adoption of cryptocurrencies. Governments and regulators are actively working to develop regulations that balance innovation with consumer protection and financial stability.

- Volatility: The cryptocurrency market is highly volatile, making it challenging for investors to manage risk and plan for the long term.

- Scalability: As the number of transactions on blockchain networks increases, scalability becomes a concern. Solutions are being developed to address this issue, such as layer-2 scaling solutions and improvements to consensus mechanisms.

- Environmental Concerns: Some cryptocurrencies, particularly those that rely on Proof-of-Work consensus mechanisms, consume significant energy, raising environmental concerns. Alternative consensus mechanisms, such as Proof-of-Stake, are being explored to reduce energy consumption.

Final Review: Top Crypto To Buy

As the cryptocurrency market continues to mature, investing in top cryptocurrencies presents both opportunities and challenges. Understanding the fundamentals of the market, researching promising projects, and implementing sound investment strategies are essential for success. This guide has provided a framework for navigating the exciting world of crypto, empowering you to make informed decisions and potentially reap the rewards of this emerging asset class.

Essential Questionnaire

What are the risks associated with investing in cryptocurrencies?

Investing in cryptocurrencies involves significant risks, including volatility, market manipulation, security breaches, and regulatory uncertainty. It’s crucial to conduct thorough research, diversify your portfolio, and only invest what you can afford to lose.

How do I choose a secure cryptocurrency wallet?

When choosing a cryptocurrency wallet, prioritize security features such as two-factor authentication, multi-signature support, and reputable security practices. Consider the wallet’s compatibility with your preferred cryptocurrencies and its ease of use.

What is the difference between a hot wallet and a cold wallet?

A hot wallet is connected to the internet, offering convenience but potentially compromising security. A cold wallet, disconnected from the internet, offers enhanced security but requires more effort to access.