Bachelor Degree Accounting is a comprehensive program that equips you with the knowledge and skills needed to navigate the world of finance. This degree provides a solid foundation in accounting principles, financial reporting, and business analysis, preparing you for a diverse range of career paths.

The curriculum typically includes core courses in financial accounting, managerial accounting, auditing, taxation, and business law. You’ll also have opportunities to explore elective courses in areas such as forensic accounting, international accounting, or data analytics. These specialized areas can help you tailor your education to specific career goals.

Overview of Bachelor’s Degree in Accounting

A Bachelor’s degree in Accounting provides a comprehensive foundation in the principles and practices of financial reporting, analysis, and management. This program equips graduates with the skills and knowledge necessary to succeed in various accounting roles across diverse industries.

Core Concepts and Principles

Accounting principles are the fundamental rules and guidelines that govern the recording, measurement, and reporting of financial transactions. These principles ensure consistency, transparency, and reliability in financial information. Core concepts include:

- Generally Accepted Accounting Principles (GAAP): A set of standards and conventions that govern accounting practices in the United States. GAAP aims to ensure consistency and comparability in financial reporting.

- International Financial Reporting Standards (IFRS): A set of accounting standards used by companies in over 140 countries. IFRS aims to promote global comparability and transparency in financial reporting.

- Double-entry bookkeeping: A system that records every transaction in at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) always balances.

- Accrual accounting: A method of accounting that recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid.

- Financial statements: Summarized reports that present an organization’s financial position, performance, and cash flows. Key financial statements include the balance sheet, income statement, statement of cash flows, and statement of retained earnings.

Curriculum Structure

Accounting bachelor’s degree programs typically include a combination of core courses and elective options.

- Core Courses:

- Financial Accounting

- Managerial Accounting

- Auditing

- Taxation

- Cost Accounting

- Accounting Information Systems

- Business Law

- Statistics

- Economics

- Elective Options:

- Forensic Accounting

- International Accounting

- Financial Analysis

- Investment Management

- Data Analytics for Accounting

Real-World Applications

Accounting knowledge is crucial in various industries, including:

- Corporate Accounting: Companies employ accountants to track financial transactions, prepare financial statements, and ensure compliance with accounting regulations.

- Public Accounting: Accountants in public accounting firms provide audit, tax, and advisory services to businesses and individuals.

- Government Accounting: Government agencies employ accountants to manage public funds, track expenditures, and prepare financial reports.

- Nonprofit Accounting: Nonprofit organizations rely on accountants to manage donations, track expenses, and ensure financial transparency.

- Financial Analysis: Accountants with strong analytical skills can work in investment banking, asset management, or consulting, evaluating financial data to make informed investment decisions.

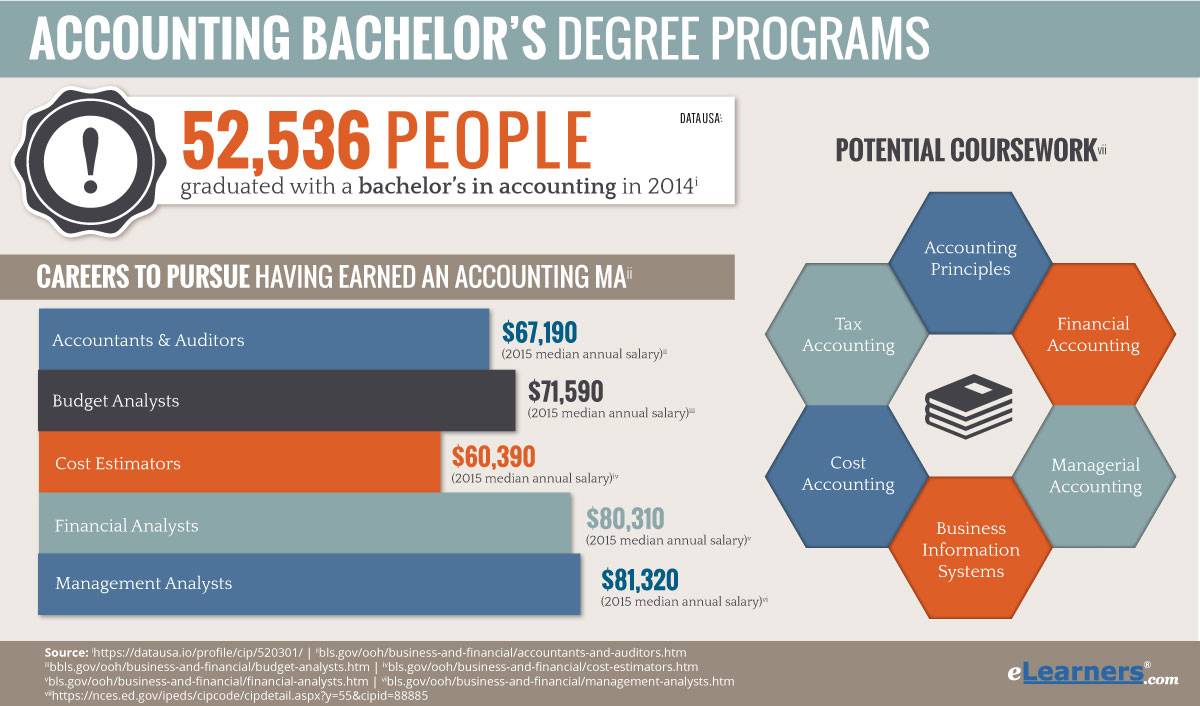

Career Paths for Accounting Graduates: Bachelor Degree Accounting

An accounting degree opens doors to a wide range of rewarding and challenging careers. Graduates can pursue diverse roles across various industries, utilizing their analytical, problem-solving, and financial management skills.

Roles and Responsibilities of Accounting Professionals

The responsibilities of accounting professionals vary depending on their specific roles and the industry they work in. However, common responsibilities include:

- Financial Reporting and Analysis: Preparing financial statements, analyzing financial data, and providing insights to management for decision-making.

- Auditing and Assurance: Examining financial records to ensure accuracy, compliance with regulations, and providing assurance to stakeholders.

- Taxation: Preparing tax returns, advising on tax strategies, and ensuring compliance with tax laws.

- Cost Accounting: Analyzing and managing costs, optimizing efficiency, and improving profitability.

- Management Accounting: Providing financial information and analysis to support internal management decision-making.

- Forensic Accounting: Investigating financial crimes, fraud, and other irregularities.

Industries that Employ Accounting Graduates

Accounting graduates are highly sought after in a variety of industries. Some of the most common industries include:

- Financial Services: Banks, investment firms, insurance companies, and other financial institutions.

- Manufacturing: Companies involved in the production of goods, including automotive, electronics, and pharmaceuticals.

- Retail: Companies that sell goods directly to consumers, including department stores, supermarkets, and online retailers.

- Technology: Software companies, hardware manufacturers, and other technology-focused businesses.

- Healthcare: Hospitals, clinics, and other healthcare providers.

- Government: Federal, state, and local government agencies.

- Non-profit Organizations: Charities, foundations, and other non-profit organizations.

Skills and Competencies Developed

An accounting bachelor’s degree program equips graduates with a comprehensive set of skills and competencies essential for success in various accounting roles. These skills go beyond technical knowledge and encompass critical thinking, communication, and problem-solving abilities, making graduates highly sought-after professionals in the business world.

Analytical and Critical Thinking Skills

Accounting involves analyzing financial data, identifying trends, and making informed decisions based on that analysis. Through rigorous coursework, accounting students develop strong analytical and critical thinking skills. They learn to:

- Interpret financial statements and reports to identify key performance indicators and areas for improvement.

- Analyze complex financial data to identify patterns, anomalies, and potential risks.

- Evaluate financial information from multiple perspectives to make informed decisions.

- Apply critical thinking to solve complex accounting problems and develop creative solutions.

These skills are crucial for accounting professionals who need to make sound judgments and recommendations based on accurate and thorough analysis.

Communication Skills

Effective communication is vital for accountants to convey complex financial information clearly and concisely to stakeholders, including management, investors, and regulatory bodies. Accounting graduates develop strong written and verbal communication skills, enabling them to:

- Prepare clear and concise financial reports, presentations, and other documents.

- Communicate complex financial concepts in a simple and understandable manner.

- Present financial information effectively to diverse audiences, tailoring their approach to the specific audience’s needs and understanding.

- Collaborate effectively with colleagues and clients, fostering strong relationships and achieving common goals.

Problem-Solving and Decision-Making Skills

Accounting professionals are often faced with complex financial challenges that require them to think critically and make sound decisions. An accounting degree program develops these skills by:

- Exposing students to real-world case studies and simulations, requiring them to apply their knowledge to solve complex problems.

- Teaching students to identify and analyze problems, develop alternative solutions, and evaluate the potential risks and benefits of each option.

- Encouraging students to think creatively and develop innovative solutions to complex accounting challenges.

Technology Skills, Bachelor degree accounting

The accounting profession is increasingly reliant on technology, and accounting graduates are well-versed in using various accounting software and tools. They are equipped with the skills to:

- Utilize accounting software like QuickBooks, Xero, and SAP to manage financial records, generate reports, and automate tasks.

- Analyze and interpret data from various sources, including spreadsheets, databases, and financial modeling software.

- Stay abreast of technological advancements in the accounting field and adapt to new tools and processes.

Final Review

A Bachelor Degree Accounting opens doors to exciting opportunities in various industries, including finance, banking, consulting, and government. With a strong foundation in accounting principles and analytical skills, you’ll be well-equipped to succeed in a competitive job market. Whether you aspire to become a certified public accountant, a financial analyst, or a management accountant, a bachelor’s degree in accounting is a valuable investment in your future.

Answers to Common Questions

What are the job prospects for accounting graduates?

Accounting graduates are highly sought after in various industries, including finance, banking, consulting, and government. Common career paths include accountant, auditor, financial analyst, budget analyst, and tax accountant.

What are the benefits of pursuing a professional accounting certification?

Professional certifications like the CPA (Certified Public Accountant) or CMA (Certified Management Accountant) demonstrate expertise and credibility in the field. They can enhance your earning potential, open doors to leadership roles, and improve your job security.

What are the technology trends impacting the accounting profession?

The accounting profession is rapidly evolving with the adoption of technologies like accounting software, data analytics, and cloud computing. These advancements are streamlining processes, improving efficiency, and creating new opportunities for accountants with specialized tech skills.