The average cost of a bachelor’s degree is a significant financial investment, and understanding its components is crucial for any prospective student. This guide explores the various factors that contribute to the overall cost, including tuition, fees, housing, and books. We’ll delve into the differences between public and private institutions, as well as the impact of major, residency status, and financial aid on the final price tag.

By examining historical trends and projected future costs, we’ll gain insights into the evolving landscape of higher education financing. Ultimately, this guide aims to equip readers with the knowledge and strategies needed to navigate the complexities of college affordability and make informed decisions about their educational journey.

Understanding the Cost of a Bachelor’s Degree: Average Cost Of A Bachelor’s Degree

A bachelor’s degree is a valuable investment, but it can also be a significant financial commitment. The cost of a bachelor’s degree varies widely depending on a number of factors, including the type of institution, the location, and the specific program of study. Understanding the different cost components and how they vary can help you make informed decisions about your education.

Cost Components

The total cost of a bachelor’s degree includes tuition, fees, room and board, books, and other expenses.

- Tuition: This is the primary cost of attending a college or university. Tuition rates vary significantly depending on the type of institution, the state, and the program of study. Public institutions generally have lower tuition rates than private institutions.

- Fees: In addition to tuition, there are a number of other fees that students may have to pay, such as application fees, registration fees, activity fees, and technology fees.

- Room and Board: This includes the cost of housing and meals. Students who live on campus will typically pay a higher room and board rate than students who live off campus.

- Books and Supplies: The cost of books and supplies can vary depending on the program of study. Some programs, such as engineering or medicine, may require expensive textbooks and lab equipment.

- Other Expenses: There are a number of other expenses that students may incur, such as transportation, personal expenses, and healthcare.

Cost Variations

The cost of a bachelor’s degree can vary significantly depending on the type of institution and the location.

Public vs. Private Institutions

Public institutions are typically funded by state and local governments, which often results in lower tuition rates. Private institutions, on the other hand, are not funded by the government and therefore tend to have higher tuition rates.

For example, the average tuition and fees for in-state students at public four-year colleges and universities in the United States was $10,740 in the 2021-2022 academic year, while the average tuition and fees for private four-year colleges and universities was $38,790.

State and Regional Variations

Tuition rates can also vary significantly between different states and regions. States with higher populations and higher levels of economic activity often have higher tuition rates.

For example, the average tuition and fees for in-state students at public four-year colleges and universities in California was $14,280 in the 2021-2022 academic year, while the average tuition and fees for in-state students at public four-year colleges and universities in Wyoming was $6,720.

Average Cost by Institution Type

The cost of a bachelor’s degree can vary significantly depending on the type of institution you choose. Public institutions are generally more affordable than private institutions, while community colleges offer the most cost-effective option.

Public Four-Year Institutions

Public four-year institutions are funded by state and local governments, making them generally more affordable than private institutions. The average cost of a bachelor’s degree at a public four-year institution for in-state students is approximately $10,730 per year. This includes tuition and fees, but does not include room and board, books, or other expenses.

Private Four-Year Institutions

Private four-year institutions are not funded by government entities and rely on tuition and other sources of revenue. As a result, they tend to have higher tuition rates than public institutions. The average cost of a bachelor’s degree at a private four-year institution is approximately $38,870 per year. This includes tuition and fees, but does not include room and board, books, or other expenses.

Community Colleges

Community colleges are two-year institutions that offer associate degrees and certificates. They are generally more affordable than four-year institutions and offer a more cost-effective way to earn the first two years of a bachelor’s degree. The average cost of an associate degree at a community college is approximately $3,700 per year. This includes tuition and fees, but does not include books or other expenses.

Factors Influencing Cost

The cost of a bachelor’s degree can vary significantly based on a number of factors. Understanding these factors can help prospective students make informed decisions about their education.

Major

The chosen major can significantly impact the cost of a bachelor’s degree. Some majors, such as engineering, medicine, or law, often require specialized equipment, labs, or clinical experiences, which can increase tuition and fees. Additionally, some majors may have higher course fees or require additional semesters of study, further contributing to the overall cost. For instance, a student pursuing a degree in engineering may need to take more specialized courses and labs, which can translate to higher tuition costs compared to a student majoring in humanities.

Residency Status

Tuition rates often differ based on a student’s residency status. In-state students typically pay lower tuition rates compared to out-of-state students. This is because state universities often receive funding from state taxes, and they prioritize residents by offering them lower tuition. For example, a student from California attending a public university in California would likely pay a lower tuition rate compared to a student from another state.

Financial Aid and Scholarships

Financial aid and scholarships can significantly reduce the overall cost of a bachelor’s degree. Federal, state, and institutional aid programs, as well as private scholarships, can help students cover tuition, fees, books, and living expenses. Students should explore all available options to maximize their financial aid package. For example, a student who qualifies for a Pell Grant can receive a substantial amount of federal financial aid, reducing their overall out-of-pocket expenses.

Cost Over Time

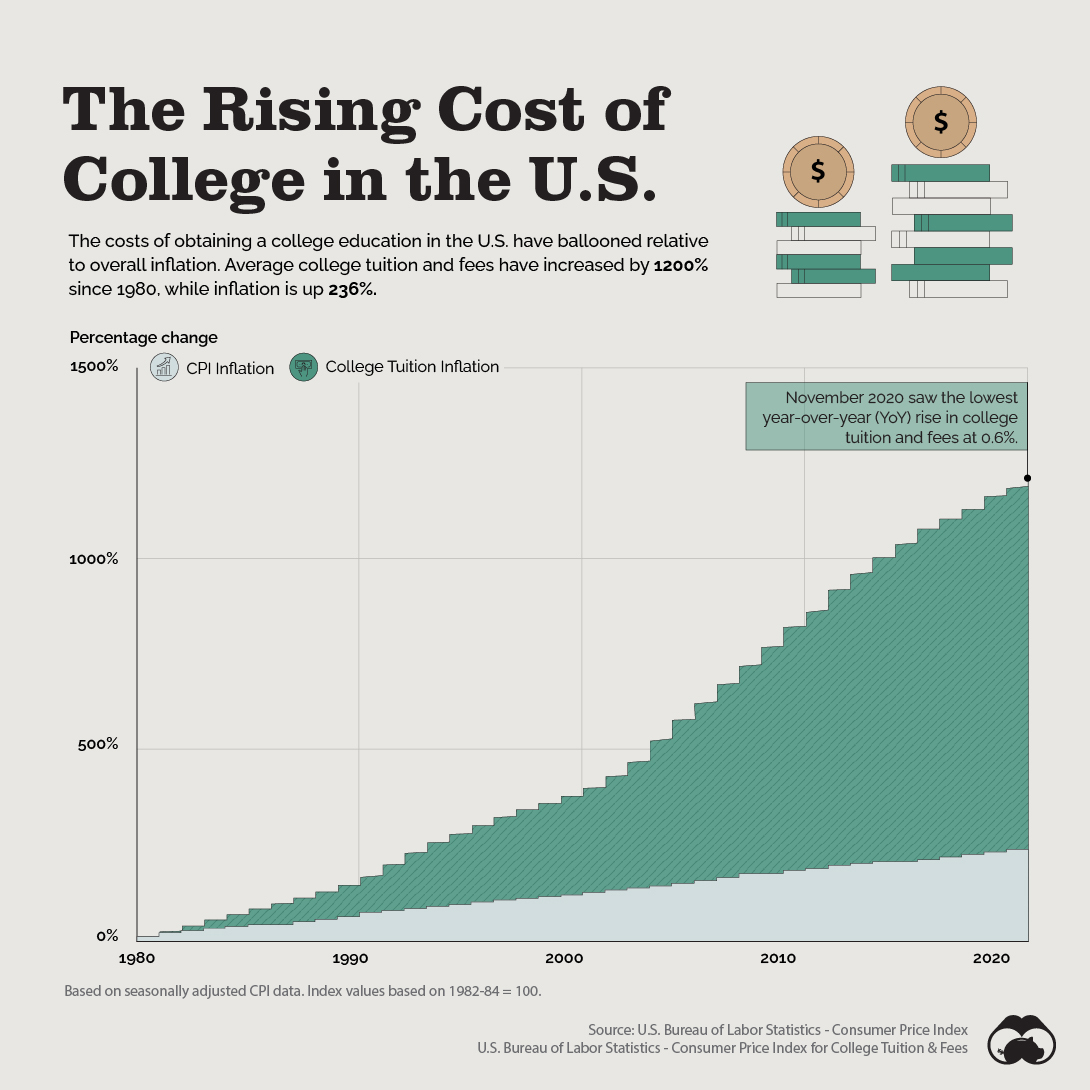

The cost of a bachelor’s degree has been steadily rising for decades, impacting the financial decisions of students and families. Understanding how costs have changed in the past and how they are projected to change in the future is crucial for informed planning.

Historical Cost Trends, Average cost of a bachelor’s degree

The average cost of a bachelor’s degree has significantly increased over the past few decades. This rise is attributed to several factors, including rising inflation, increased demand for higher education, and growing administrative costs at universities.

- According to the College Board, the average annual cost of tuition and fees at a four-year public college in the United States increased from $2,000 in 1980 to over $10,000 in 2020.

- Private colleges experienced a similar trend, with the average annual cost rising from $6,000 in 1980 to over $50,000 in 2020.

Projected Future Cost Trends

Experts predict that the cost of a bachelor’s degree will continue to rise in the coming years.

- The College Board projects that the average annual cost of tuition and fees at a four-year public college will reach over $15,000 by 2030.

- Private colleges are expected to see even steeper increases, with the average annual cost potentially exceeding $70,000 by 2030.

Impact of Inflation and Economic Factors

Inflation plays a significant role in driving up college costs. When the cost of goods and services increases, universities need to adjust their tuition and fees to maintain their operations.

- The Consumer Price Index (CPI) is a measure of inflation that tracks the average change in prices paid by urban consumers for a basket of consumer goods and services.

- Since 1980, the CPI has risen by over 300%, indicating a substantial increase in the cost of living.

- Universities, like other businesses, need to adjust their prices to keep pace with inflation.

“The rising cost of college is a significant challenge for students and families, and it is important to understand the factors that are driving this trend.”

Economic factors, such as interest rates and government spending, can also influence college costs.

- For example, low interest rates can make it easier for universities to borrow money, which can lead to increased spending on facilities and programs.

- Government funding cuts to higher education can also force universities to raise tuition to make up for lost revenue.

Strategies for Managing Costs

Earning a bachelor’s degree is a significant investment, and understanding how to manage the costs associated with it is crucial. There are numerous strategies you can employ to minimize the financial burden of your education.

Strategies for Reducing the Cost of a Bachelor’s Degree

There are several ways to reduce the overall cost of a bachelor’s degree, making it more affordable and accessible. These strategies involve careful planning, exploring different options, and taking advantage of available resources.

- Attend a Community College: Community colleges often offer lower tuition rates compared to four-year universities. You can complete your first two years of general education courses at a community college and then transfer to a four-year institution to finish your bachelor’s degree. This approach can significantly reduce your overall tuition costs.

- Take Advantage of Financial Aid and Scholarships: Explore all available financial aid options, including federal grants, state grants, and scholarships. These resources can significantly reduce your out-of-pocket expenses. Research scholarship opportunities through your school, community organizations, and private foundations.

- Pursue Online Courses: Online courses can be a cost-effective option, as they often have lower tuition fees compared to traditional on-campus courses. Moreover, online learning can provide flexibility and convenience, allowing you to study at your own pace and from any location.

- Work Part-Time: Working part-time during your studies can help offset some of the costs associated with education. This approach allows you to earn income while gaining valuable work experience.

- Live at Home: If possible, living at home with your family can significantly reduce your living expenses. This option eliminates the cost of rent, utilities, and other associated living costs.

- Choose a Major with Lower Costs: Some majors, such as engineering and medicine, can be more expensive due to higher lab fees and specialized equipment. Consider choosing a major with lower costs, such as education or liberal arts.

- Consider a State University: State universities often have lower tuition rates for in-state residents compared to private institutions. If you are eligible for in-state tuition, this option can significantly reduce your costs.

Strategies for Managing Student Loan Debt

Managing student loan debt is crucial after graduation. There are several strategies to help you navigate this financial obligation effectively.

| Strategy | Description |

|---|---|

| Income-Driven Repayment Plans | These plans adjust your monthly payments based on your income and family size. You may qualify for lower monthly payments, potentially reducing your overall debt burden. |

| Consolidation | Combining multiple loans into one with a single interest rate can simplify your repayment process and potentially lower your overall interest payments. |

| Refinancing | This involves obtaining a new loan with a lower interest rate to replace your existing loans. Refinancing can potentially save you money on interest payments over the life of the loan. |

| Public Service Loan Forgiveness (PSLF) | If you work full-time for a qualifying public service employer, you may be eligible for PSLF, which forgives your remaining loan balance after 10 years of qualifying payments. |

| Pay More Than the Minimum | Paying more than the minimum payment each month can help you pay off your loans faster and reduce the total amount of interest you pay. |

Epilogue

The average cost of a bachelor’s degree can be daunting, but it’s important to remember that numerous strategies exist to manage these expenses. By exploring options such as attending community colleges, pursuing financial aid and scholarships, and leveraging online courses, students can significantly reduce their overall costs. Moreover, proactive planning and responsible debt management can help mitigate the financial burden of higher education. Ultimately, the journey towards a bachelor’s degree requires careful consideration of costs, but with informed decision-making and strategic planning, achieving this goal remains attainable for many.

Answers to Common Questions

What is the average cost of a bachelor’s degree in the United States?

The average cost of a bachelor’s degree in the United States varies significantly depending on the institution type, location, and program of study. However, it’s generally estimated to range from $20,000 to $100,000 or more.

Are there any scholarships specifically for students pursuing certain majors?

Yes, many scholarships are available for students pursuing specific majors, such as STEM fields, arts, or humanities. It’s recommended to research scholarships offered by professional organizations, government agencies, and private foundations related to your chosen field.

What are some tips for managing student loan debt after graduation?

Some tips for managing student loan debt include consolidating loans to secure a lower interest rate, exploring income-driven repayment plans, and making extra payments when possible. It’s crucial to prioritize repayment and avoid defaulting on loans.