How much does it cost to get a bachelor’s degree? This question weighs heavily on the minds of countless aspiring students, and the answer is not always straightforward. The cost of a bachelor’s degree is influenced by a complex interplay of factors, including the type of institution, location, and field of study. From tuition fees to living expenses, every aspect contributes to the overall cost, making it crucial to understand the various components and explore strategies for managing expenses.

This guide aims to provide a comprehensive overview of the factors that influence the cost of a bachelor’s degree, offering insights into the average costs associated with different types of institutions and living arrangements. We will also delve into financial aid options, scholarship opportunities, and budgeting tips to help you navigate the financial landscape of higher education.

Cost Factors

The cost of obtaining a bachelor’s degree can vary significantly depending on a range of factors. Understanding these factors is crucial for students and their families when planning for higher education.

Tuition Fees

Tuition fees are the primary cost component for most universities. They represent the cost of instruction, facilities, and administrative expenses. Tuition fees can vary significantly depending on the type of institution, location, and program of study.

- Public Universities: Public universities, funded by state and local governments, generally have lower tuition fees compared to private institutions. The cost of attendance at public universities can vary based on residency status. In-state residents often pay significantly lower tuition rates than out-of-state students.

- Private Universities: Private universities, funded by endowments, tuition revenue, and other sources, tend to have higher tuition fees. They often offer a more comprehensive educational experience, including smaller class sizes, more personalized attention, and access to specialized facilities and resources.

Room and Board

Room and board expenses cover the cost of housing and meals while attending university. These costs can vary significantly depending on the type of housing, location, and meal plan chosen.

- On-Campus Housing: On-campus housing options typically include dormitories, apartments, and suites. These options offer convenience and access to university resources. However, on-campus housing can be more expensive than off-campus options.

- Off-Campus Housing: Off-campus housing options include apartments, houses, and shared living arrangements. These options can offer greater flexibility and affordability, but may require more responsibility in terms of finding and managing housing.

Books and Supplies

Books and supplies are essential for academic success. These expenses can vary depending on the program of study and the number of courses taken.

- Textbooks: Textbooks are often the most significant expense in this category. Universities may offer options for purchasing used textbooks or renting them for the semester.

- Other Supplies: Other supplies may include notebooks, pens, calculators, and other materials required for specific courses.

Personal Expenses

Personal expenses cover costs beyond tuition, room and board, and books and supplies. These expenses include transportation, food, entertainment, and other personal needs.

- Transportation: Transportation expenses can include costs associated with commuting to and from campus, travel to internships or research opportunities, and personal travel.

- Food: Students may choose to eat on campus or off campus, which can impact their food expenses.

- Entertainment: Entertainment expenses can include costs associated with social activities, sporting events, and other forms of recreation.

Tuition Fees

Tuition fees are a significant expense for students pursuing a bachelor’s degree. The cost of tuition can vary widely depending on the type of institution, location, and program of study.

Tuition Fees at Public and Private Universities

Public universities, funded by state and local governments, generally have lower tuition rates than private universities. However, tuition rates for both public and private universities can vary considerably across different states and regions.

- Public Universities: The average tuition and fees for in-state students at public four-year colleges in the 2022-2023 academic year was $10,740.

- Private Universities: The average tuition and fees for private four-year colleges in the 2022-2023 academic year was $39,400.

Tuition rates for public universities are often influenced by state funding. States with higher levels of funding for public higher education tend to have lower tuition rates. For example, the University of California, Berkeley, a public university, has a relatively low tuition rate of $14,254 per year for in-state students. This is due to the state of California’s significant investment in public higher education.

- Lowest Tuition Rates: The University of Texas at Austin, with an in-state tuition of $10,824, is an example of a public university with a relatively low tuition rate.

- Highest Tuition Rates: On the other hand, private universities like Columbia University in New York City, with a tuition rate of $65,516 per year, have significantly higher tuition costs.

Impact of State Funding and Financial Aid

State funding and financial aid play a crucial role in mitigating the impact of tuition costs on students.

- State Funding: State funding can help keep tuition rates lower at public universities.

- Financial Aid: Federal and state financial aid programs, such as Pell Grants, Stafford Loans, and state-specific scholarships, can help students afford college.

Financial aid programs are designed to make college more affordable for students from low-income families. However, the availability of financial aid can vary depending on factors such as the student’s financial need, academic merit, and state of residence.

Living Expenses

Living expenses are a significant part of the overall cost of obtaining a bachelor’s degree. These expenses cover the cost of housing, food, transportation, and utilities, among others. The cost of living varies significantly depending on the location of the university, with major metropolitan areas generally being more expensive than smaller towns or rural areas.

Housing

Housing is often the largest expense for students. Students have the option of living on campus in dormitories or off campus in apartments or houses.

On-campus housing typically includes a meal plan, which can be a significant cost savings. However, on-campus housing may be limited, and students may need to apply early to secure a spot.

Off-campus housing provides more independence and flexibility but comes with additional responsibilities, such as finding roommates, signing leases, and paying utilities.

Food

Food expenses can be substantial, especially if students eat out frequently. Students can save money by cooking meals at home, utilizing campus dining facilities, and taking advantage of discounts and promotions at local grocery stores.

Transportation

Transportation costs can vary depending on the distance between the student’s residence and the university, the availability of public transportation, and the student’s personal vehicle. Students can reduce transportation costs by utilizing public transportation, carpooling, or cycling.

Utilities

Utilities include expenses such as electricity, gas, water, and internet. The cost of utilities varies depending on the size and type of housing and the student’s usage.

Average Monthly Expenses

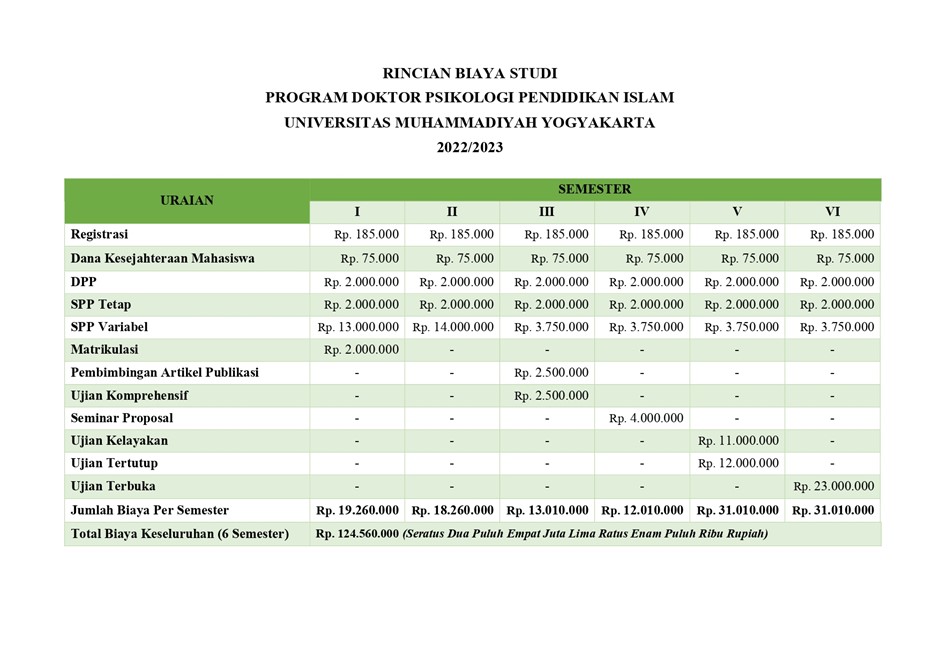

The following table shows the average monthly expenses for students in different cities or regions:

| City/Region | Housing | Food | Transportation | Utilities | Total |

|—|—|—|—|—|—|

| New York City | $1,500 | $500 | $200 | $200 | $2,400 |

| Los Angeles | $1,200 | $400 | $150 | $150 | $1,900 |

| Chicago | $1,000 | $350 | $100 | $100 | $1,550 |

| San Francisco | $1,800 | $600 | $250 | $250 | $2,900 |

| Boston | $1,300 | $450 | $180 | $180 | $2,110 |

Cost-Saving Strategies

Students can adopt several cost-saving strategies to manage their living expenses effectively.

- Sharing an apartment: Sharing an apartment with roommates can significantly reduce housing costs.

- Utilizing public transportation: Public transportation is often more affordable than driving, especially in urban areas.

- Cooking meals at home: Cooking meals at home instead of eating out frequently can save a significant amount of money.

- Taking advantage of discounts and promotions: Students can often find discounts and promotions on groceries, entertainment, and other goods and services.

- Finding part-time jobs: Working part-time can help students cover some of their living expenses.

Financial Aid and Scholarships: How Much Does It Cost To Get A Bachelor’s Degree

Securing financial aid and scholarships is crucial for many students to make their dream of obtaining a bachelor’s degree a reality. These resources can significantly reduce the overall cost of education, making it more accessible.

Types of Financial Aid

Financial aid comes in various forms, each with its own eligibility requirements and application process.

- Grants: Grants are free money that does not need to be repaid. They are typically awarded based on financial need, academic merit, or specific criteria.

- Loans: Loans are borrowed money that must be repaid with interest. Federal student loans offer lower interest rates and more flexible repayment options compared to private loans.

- Scholarships: Scholarships are awarded based on academic achievement, extracurricular activities, community involvement, or specific criteria. They are typically funded by organizations, foundations, or individuals.

Applying for Financial Aid

The application process for financial aid varies depending on the type of aid you are seeking.

- Federal Student Aid: The Free Application for Federal Student Aid (FAFSA) is the primary application for federal grants, loans, and work-study programs. You can complete the FAFSA online at the Federal Student Aid website.

- State Grants: Many states offer their own grant programs, which may have additional eligibility requirements. You can find information about state grant programs on your state’s education website.

- Institutional Aid: Some colleges and universities offer their own financial aid packages, which may include grants, scholarships, and loans. You can find information about institutional aid on the school’s website or by contacting the financial aid office.

Finding Scholarship Opportunities

There are numerous resources available to help students find scholarship opportunities.

- Scholarship Search Engines: Websites like Scholarship America, Fastweb, and College Board offer comprehensive scholarship search engines that allow you to filter by criteria such as major, GPA, and ethnicity.

- College and University Websites: Many colleges and universities have their own scholarship databases that list opportunities available to their students.

- Professional Organizations: If you are pursuing a specific career path, consider joining professional organizations related to your field. Many organizations offer scholarships to their members.

- Local Community Organizations: Check with local community organizations, such as Rotary Clubs, Kiwanis Clubs, and chambers of commerce, for scholarship opportunities.

Eligibility Requirements for Financial Aid, How much does it cost to get a bachelor’s degree

Eligibility requirements for financial aid programs vary depending on the specific program. However, some common requirements include:

- U.S. Citizenship or Permanent Residency: Most federal financial aid programs require students to be U.S. citizens or permanent residents.

- Financial Need: Many financial aid programs are based on financial need, which is determined by the FAFSA.

- Academic Merit: Some scholarships and grants are awarded based on academic merit, such as GPA, test scores, or academic achievements.

- Specific Criteria: Some financial aid programs have specific eligibility criteria, such as being a first-generation college student, having a particular major, or being from a specific geographic region.

Cost Comparison

The cost of obtaining a bachelor’s degree can vary significantly depending on the field of study, the type of institution, and other factors. Understanding these cost differences can help you make informed decisions about your educational path.

Cost Differences Across Fields of Study

The cost of a bachelor’s degree can vary depending on the field of study. For example, STEM (Science, Technology, Engineering, and Mathematics) fields often require specialized equipment and facilities, which can drive up tuition costs. In contrast, humanities programs may have lower tuition costs but may require more time to complete.

- STEM: STEM fields, such as engineering, computer science, and medicine, often have higher tuition costs due to the need for specialized equipment and facilities. Additionally, these programs may require more time to complete, leading to higher overall costs. For instance, a biomedical engineering degree might cost more than a history degree, reflecting the investment in labs and equipment.

- Humanities: Humanities programs, such as English, history, and philosophy, may have lower tuition costs than STEM fields. However, these programs may require more time to complete, leading to higher overall costs.

- Business: Business programs can have varying costs depending on the specialization. Some programs, such as finance or marketing, may have higher tuition costs due to the inclusion of specialized courses and industry partnerships.

Return on Investment

The return on investment (ROI) for a bachelor’s degree is often measured by the potential future salary and job market demand. STEM fields generally have higher salaries and stronger job market demand, leading to a higher ROI. However, this is not always the case, and the ROI can vary significantly depending on the specific field, the institution, and the individual’s career goals.

“The ROI of a degree is a complex calculation that takes into account the cost of tuition, living expenses, and lost wages, as well as the potential future salary and job market demand.”

Cost Comparison by Institution Type

The cost of a bachelor’s degree can also vary depending on the type of institution. Public institutions generally have lower tuition costs than private institutions, while online programs can offer more flexibility and potentially lower costs.

| Institution Type | Average Cost (4-Year) |

|---|---|

| Public In-State | $10,000 – $25,000 |

| Public Out-of-State | $20,000 – $40,000 |

| Private | $30,000 – $60,000 |

| Online | $10,000 – $30,000 |

Budgeting and Financial Planning

Earning a bachelor’s degree is a significant investment, and effective financial planning is crucial to managing the associated costs. Creating a budget and making informed financial decisions can help you navigate the expenses associated with your education and beyond.

Budgeting and Tracking Expenses

A budget is a plan that Artikels how you will allocate your income to cover your expenses. It is an essential tool for managing your finances effectively. Here are some practical tips for creating a budget:

- Track Your Spending: Start by tracking your spending for a month or two to understand where your money is going. You can use a spreadsheet, a budgeting app, or a simple notebook to record your expenses.

- Create a Budget: Once you have a clear picture of your spending, you can create a budget. List all your income sources and your essential expenses, such as rent, utilities, food, and transportation.

- Allocate Funds: Allocate funds to each category based on your priorities. For example, you may need to allocate more funds to tuition and living expenses than to entertainment.

- Review and Adjust: Review your budget regularly and adjust it as needed. Your income and expenses may change over time, so it’s important to keep your budget updated.

Last Recap

Ultimately, the cost of a bachelor’s degree is a significant investment, but it’s one that can pay dividends in the long run. By understanding the factors that contribute to the cost, exploring financial aid options, and developing sound budgeting strategies, you can make informed decisions and pave the way for a successful academic journey. Remember, while the cost may be a concern, the value of a bachelor’s degree extends far beyond its price tag, opening doors to a wider range of career opportunities and personal growth.

Essential FAQs

How can I find scholarships to help pay for college?

There are many resources available to help you find scholarships. Start by checking with your high school guidance counselor, your college’s financial aid office, and online scholarship databases. You can also search for scholarships based on your major, interests, or background.

What are some ways to save money on college expenses?

There are many ways to save money on college expenses. Consider living off campus, taking advantage of free or low-cost resources on campus, and limiting your spending on non-essential items. You can also explore work-study opportunities or part-time jobs to help offset the cost of tuition and living expenses.

What are the different types of financial aid available to students?

There are several types of financial aid available to students, including grants, loans, and scholarships. Grants are free money that does not need to be repaid. Loans must be repaid with interest, and scholarships are awarded based on academic merit or other criteria.