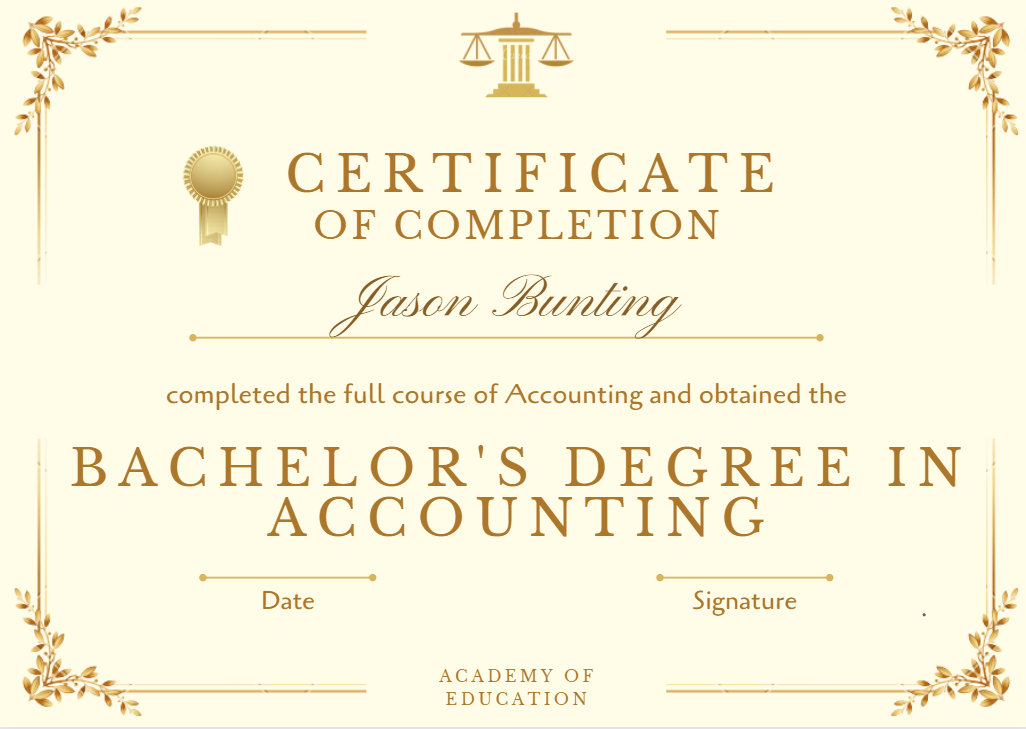

Bachelors degree in accounting – A bachelor’s degree in accounting is the foundation for a rewarding career in finance. It equips you with the essential knowledge and skills to navigate the complexities of the business world, from managing financial records to analyzing investment opportunities. This program goes beyond the traditional classroom setting, offering practical experiences that prepare you for real-world challenges.

The curriculum covers a wide range of topics, including financial accounting, managerial accounting, tax accounting, auditing, and financial reporting. You’ll learn how to analyze financial statements, interpret financial data, and make informed business decisions. The program also emphasizes critical thinking, problem-solving, and communication skills, essential for success in any professional field.

Overview of Accounting

Accounting is the language of business. It provides a structured system for recording, classifying, summarizing, and reporting financial transactions. Through accounting, businesses can track their financial performance, make informed decisions, and communicate their financial position to stakeholders.

The Role of Accounting in Business

Accounting plays a crucial role in the smooth operation and success of any business. It provides a comprehensive understanding of the financial health of a company, allowing for informed decision-making and effective management. Here are some key roles of accounting in business:

- Financial Reporting: Accounting provides a clear picture of a company’s financial performance, including revenue, expenses, assets, liabilities, and equity. This information is essential for stakeholders such as investors, creditors, and government agencies.

- Decision Making: Accounting data helps businesses make informed decisions about investments, pricing, resource allocation, and operational efficiency. By analyzing financial trends and patterns, companies can identify areas for improvement and capitalize on growth opportunities.

- Control and Accountability: Accounting systems provide a framework for monitoring and controlling financial activities. This ensures accuracy, transparency, and accountability within the organization, minimizing risks and promoting ethical behavior.

- Tax Compliance: Accounting is essential for complying with tax regulations. Accountants prepare tax returns, calculate tax liabilities, and ensure that businesses adhere to all relevant tax laws and regulations.

Areas of Specialization in Accounting

Accounting encompasses various specialized areas, each focusing on specific aspects of financial management. These areas offer diverse career paths and cater to different interests within the accounting profession.

- Financial Accounting: Focuses on preparing financial statements for external stakeholders, including investors, creditors, and regulatory agencies. Financial accountants ensure compliance with accounting standards and regulations.

- Managerial Accounting: Provides financial information and analysis to internal stakeholders, such as managers and executives. Managerial accountants assist in decision-making, cost control, and performance evaluation.

- Auditing: Involves examining financial records and systems to ensure accuracy, compliance with regulations, and the prevention of fraud. Auditors provide independent assurance on the reliability of financial information.

- Tax Accounting: Specializes in tax planning, compliance, and preparation. Tax accountants advise clients on minimizing tax liabilities and ensuring compliance with tax laws.

- Forensic Accounting: Investigates financial crimes and fraud. Forensic accountants use accounting skills to gather evidence, analyze financial data, and assist in legal proceedings.

Real-World Applications of Accounting Principles, Bachelors degree in accounting

Accounting principles are applied in various real-world scenarios, influencing decisions across different industries. Here are some examples:

- Investment Decisions: Investors rely on financial statements prepared by accountants to assess the profitability, solvency, and future prospects of companies. This information helps them make informed investment decisions.

- Loan Approvals: Banks and other financial institutions use accounting information to evaluate the creditworthiness of borrowers. This data helps them determine the risk associated with lending money and set appropriate interest rates.

- Mergers and Acquisitions: Accounting plays a crucial role in mergers and acquisitions. Accountants perform due diligence, value companies, and prepare financial projections to facilitate these transactions.

- Government Budgeting: Governments use accounting principles to manage public funds and ensure transparency and accountability. This includes budgeting, revenue collection, and expenditure monitoring.

- Personal Finance: Accounting principles are also applicable to personal finance. Individuals can use budgeting, saving, and investment strategies to manage their finances effectively.

Bachelor’s Degree in Accounting

A Bachelor’s Degree in Accounting provides a comprehensive foundation in the principles, practices, and applications of accounting. It prepares individuals for a variety of roles in the accounting field, including financial analysis, auditing, tax preparation, and management accounting.

Typical Curriculum of a Bachelor’s Degree in Accounting Program

The curriculum of a bachelor’s degree in accounting program typically includes a combination of core accounting courses, business-related courses, and elective courses. The specific courses offered may vary depending on the institution, but generally include the following:

- Financial Accounting: This course covers the fundamental principles of financial accounting, including the accounting cycle, financial statements, and accounting standards.

- Managerial Accounting: This course focuses on the use of accounting information for internal decision-making, including cost accounting, budgeting, and performance analysis.

- Auditing: This course covers the principles and practices of auditing, including the audit process, audit procedures, and audit reporting.

- Taxation: This course explores the principles of federal, state, and local taxation, including income tax, sales tax, and property tax.

- Business Law: This course provides an overview of legal principles relevant to business operations, including contracts, torts, and property law.

- Economics: This course covers the principles of microeconomics and macroeconomics, which are essential for understanding the economic environment in which businesses operate.

- Statistics: This course introduces statistical methods and analysis, which are used in accounting for data analysis and decision-making.

- Information Systems: This course covers the use of technology in accounting, including accounting software, databases, and spreadsheets.

Core Courses Required for a Bachelor’s Degree in Accounting

Core courses are essential for a solid foundation in accounting principles and practices. These courses typically include:

- Financial Accounting I & II: These courses cover the fundamental principles of financial accounting, including the accounting cycle, financial statements, and accounting standards. These courses provide a strong foundation in the core principles of financial accounting, which are essential for understanding financial statements and making informed financial decisions.

- Managerial Accounting I & II: These courses focus on the use of accounting information for internal decision-making, including cost accounting, budgeting, and performance analysis. These courses are critical for understanding how to use accounting information to make effective business decisions.

- Auditing I & II: These courses cover the principles and practices of auditing, including the audit process, audit procedures, and audit reporting. These courses provide the skills and knowledge necessary to conduct audits and ensure the accuracy and reliability of financial statements.

- Taxation I & II: These courses explore the principles of federal, state, and local taxation, including income tax, sales tax, and property tax. These courses are essential for understanding tax laws and regulations and for preparing tax returns.

Skills and Knowledge Gained Through a Bachelor’s Degree in Accounting

A bachelor’s degree in accounting provides students with a wide range of skills and knowledge that are highly valued in the business world. These include:

- Analytical Skills: Accounting professionals need to be able to analyze financial data and identify trends and patterns. This involves understanding financial statements, interpreting financial ratios, and applying analytical techniques to solve accounting problems.

- Problem-Solving Skills: Accounting professionals often face complex challenges that require creative solutions. This involves identifying the root cause of accounting problems, developing solutions, and implementing those solutions effectively.

- Communication Skills: Accounting professionals need to be able to communicate financial information clearly and concisely, both verbally and in writing. This includes preparing financial reports, presenting financial data to stakeholders, and explaining complex accounting concepts in a way that is easy to understand.

- Computer Skills: Accounting professionals use a variety of software programs to perform their work, including accounting software, spreadsheets, and databases. A strong understanding of computer skills is essential for success in the accounting field.

- Ethics and Professionalism: Accounting professionals are expected to adhere to a high standard of ethics and professionalism. This includes maintaining confidentiality, acting with integrity, and following professional accounting standards.

Career Paths for Accounting Graduates

An accounting degree opens doors to a wide range of career paths, offering diverse opportunities in various industries. Accounting graduates are highly sought-after by employers due to their analytical skills, attention to detail, and understanding of financial principles.

Accounting Roles and Responsibilities

Accounting professionals play a crucial role in the financial health of organizations. They are responsible for recording, analyzing, and interpreting financial data to provide insights for decision-making. Here are some common accounting roles:

- Accountant: Accountants are responsible for maintaining financial records, preparing financial statements, and ensuring compliance with accounting standards. They may specialize in specific areas, such as cost accounting, tax accounting, or auditing.

- Financial Analyst: Financial analysts evaluate financial data, perform investment research, and provide recommendations to investors and management. They often work in investment banking, asset management, or corporate finance departments.

- Auditor: Auditors examine financial records to ensure accuracy and compliance with accounting standards and regulations. They work for accounting firms, government agencies, or internal audit departments.

- Controller: Controllers oversee the accounting department and ensure the accuracy and completeness of financial reporting. They are responsible for managing financial risks and providing financial guidance to management.

- Chief Financial Officer (CFO): CFOs are the top financial executives in an organization. They are responsible for all financial aspects of the business, including financial planning, budgeting, and investment decisions.

Job Market and Salary Expectations

The job market for accounting professionals is generally strong, with consistent demand across various industries. According to the U.S. Bureau of Labor Statistics, employment of accountants and auditors is projected to grow 7% from 2020 to 2030, which is faster than the average for all occupations.

Salary expectations for accounting professionals vary depending on factors such as experience, location, industry, and specific role. Entry-level positions typically offer salaries in the range of $45,000 to $65,000 per year. Experienced professionals with specialized skills or certifications can earn significantly more, with salaries exceeding $100,000 per year.

“The demand for accounting professionals is expected to remain strong in the coming years, driven by factors such as the increasing complexity of financial regulations and the growing need for financial expertise in various industries.” – U.S. Bureau of Labor Statistics

Benefits of a Bachelor’s Degree in Accounting: Bachelors Degree In Accounting

A bachelor’s degree in accounting opens doors to a world of opportunities, providing a solid foundation for a fulfilling and successful career. It’s a versatile degree that equips graduates with a wide range of skills, knowledge, and professional networks, making them highly sought-after in various industries.

Career Growth and Advancement

A bachelor’s degree in accounting is a stepping stone to a rewarding career path with excellent growth potential. The field offers a structured hierarchy, allowing individuals to progress from entry-level positions to senior management roles with increasing responsibility and compensation. For instance, starting as an accountant, one can advance to roles like senior accountant, financial analyst, controller, or even chief financial officer (CFO) with experience and professional development. The Bureau of Labor Statistics (BLS) projects a 7% growth in accounting and auditing jobs between 2020 and 2030, indicating a healthy demand for qualified professionals.

Enhanced Personal and Professional Development

A bachelor’s degree in accounting fosters personal and professional growth in several ways:

- Critical thinking and analytical skills: Accounting involves analyzing financial data, identifying trends, and making informed decisions. This process sharpens critical thinking and problem-solving abilities, valuable in various professional settings.

- Communication skills: Accountants communicate financial information effectively to stakeholders, including management, investors, and regulators. This requires strong written and verbal communication skills, essential for building relationships and conveying complex information clearly.

- Ethics and integrity: The accounting profession emphasizes ethical conduct and integrity. A bachelor’s degree instills these values, preparing graduates to make responsible decisions and maintain high ethical standards in their careers.

- Professional networking: Accounting programs offer opportunities to connect with industry professionals, alumni, and recruiters through events, internships, and career fairs. This networking expands professional connections and provides valuable insights into the field.

Professional Certifications for Accountants

Earning professional certifications can significantly enhance an accountant’s career prospects and credibility. These certifications demonstrate specialized knowledge, commitment to professional development, and adherence to ethical standards.

Types of Professional Certifications for Accountants

Professional certifications for accountants are awarded by various organizations, each with specific requirements and benefits. Here are some of the most widely recognized certifications:

- Certified Public Accountant (CPA): This is the most common and prestigious accounting certification in the United States. CPAs are qualified to perform audits, prepare tax returns, and provide other financial advisory services. To become a CPA, you must meet educational requirements, pass the Uniform CPA Examination, and fulfill experience requirements.

- Certified Management Accountant (CMA): The CMA certification focuses on management accounting principles and practices. CMAs are experts in cost accounting, budgeting, financial analysis, and performance management. To obtain a CMA, you must pass two exams and meet work experience requirements.

- Certified Internal Auditor (CIA): CIAs are professionals who specialize in internal auditing, which involves evaluating an organization’s internal controls and processes to ensure efficiency, effectiveness, and compliance. To become a CIA, you must pass three exams and meet experience requirements.

- Chartered Accountant (CA): The CA designation is a globally recognized accounting certification, primarily in countries like Canada, India, and the United Kingdom. CAs are skilled in financial reporting, auditing, tax, and business advisory services. Requirements vary by country, but typically include education, exams, and work experience.

- Certified Financial Planner (CFP): While not strictly an accounting certification, the CFP designation is relevant for accountants who want to provide financial planning services to individuals and families. CFPs are trained in financial planning, investment management, retirement planning, and estate planning. To become a CFP, you must meet educational requirements, pass an exam, and complete experience requirements.

Benefits of Professional Certifications for Accountants

Earning a professional certification offers numerous benefits for accountants, including:

- Increased earning potential: Certified accountants often command higher salaries and have greater earning potential compared to their non-certified counterparts.

- Enhanced career prospects: Certifications demonstrate specialized knowledge and expertise, making certified accountants more competitive in the job market. They are often preferred by employers seeking qualified and experienced professionals.

- Greater credibility and recognition: Professional certifications establish credibility and recognition within the accounting profession. They signal to clients, employers, and peers that an accountant has met rigorous standards and is committed to professional excellence.

- Access to exclusive opportunities: Some employers and organizations may require or prefer candidates to hold specific certifications. Earning a certification can open doors to new opportunities and career advancement paths.

- Continuing education and professional development: Many professional certifications require ongoing education and professional development, ensuring that certified accountants stay up-to-date with the latest industry trends and regulations.

Examples of How Professional Certifications Can Boost Career Prospects

- CPA: A CPA designation can open doors to opportunities in public accounting, corporate finance, tax consulting, and forensic accounting. Many large corporations require their financial executives to hold CPA licenses.

- CMA: A CMA certification is highly valuable for accountants working in management accounting roles, such as cost accounting, budgeting, and financial analysis. CMAs are often sought after by companies seeking professionals with expertise in cost management and performance improvement.

- CIA: A CIA certification is essential for internal auditors and those working in risk management, compliance, and fraud prevention. CIAs are in high demand by organizations seeking to strengthen their internal controls and mitigate risks.

- CA: A CA designation is highly respected in many countries and can open doors to opportunities in public accounting, corporate finance, and consulting. CAs are often involved in complex financial transactions and regulatory compliance.

- CFP: A CFP designation is valuable for accountants who want to provide financial planning services to individuals and families. CFPs are often sought after by clients seeking comprehensive financial advice and guidance.

Resources for Aspiring Accountants

Embarking on a career in accounting can be an exciting journey, and there are many resources available to help you navigate this path. From online platforms to professional organizations, these resources offer valuable information, support, and guidance for aspiring accountants.

Websites and Online Resources

The internet provides a wealth of information for accounting students. Several websites offer valuable insights, tools, and resources to help you in your studies and career development.

- AccountingTools: This comprehensive website provides a vast library of accounting articles, tutorials, and calculators. It covers a wide range of topics, from basic accounting principles to advanced financial analysis.

- Investopedia: This website offers a user-friendly platform for learning about finance, investing, and accounting. It features articles, videos, and interactive tools to enhance your understanding of accounting concepts.

- AICPA (American Institute of Certified Public Accountants): The AICPA is a leading professional organization for accountants. Its website provides information about accounting standards, ethics, and career development. It also offers resources for students, including scholarships and career guidance.

Books and Publications

Books can be a valuable resource for aspiring accountants, providing in-depth knowledge and practical insights. Several publications cater specifically to accounting students and professionals.

- “Accounting Principles” by Weygandt, Kimmel, and Kieso: This widely used textbook covers the fundamentals of accounting, including financial accounting, managerial accounting, and auditing.

- “Financial Accounting: An Introduction to Concepts, Methods, and Uses” by Libby, Libby, and Short: This textbook focuses on financial accounting principles and practices, providing a comprehensive overview of the subject.

- “The CPA Exam Review” by Roger CPA Review: This comprehensive review course helps prepare students for the Uniform CPA Examination. It includes study materials, practice questions, and online resources.

Professional Organizations

Joining professional organizations can provide valuable networking opportunities, access to industry insights, and professional development resources.

- AICPA (American Institute of Certified Public Accountants): The AICPA offers various resources for students, including scholarships, career guidance, and networking events.

- IMA (Institute of Management Accountants): The IMA focuses on management accounting and provides resources for students and professionals in this field. It offers certification programs, networking events, and professional development opportunities.

- NASBA (National Association of State Boards of Accountancy): NASBA administers the Uniform CPA Examination and provides information about licensing requirements and continuing education for accountants.

Scholarships and Financial Aid

Pursuing an accounting degree can be financially challenging, but there are scholarships and financial aid opportunities available to help students.

| Organization | Scholarship Name | Eligibility Criteria | Amount |

|---|---|---|---|

| AICPA | AICPA Scholarship Award Program | Full-time accounting students with a GPA of 3.0 or higher | Varies |

| IMA | IMA Scholarship Program | Full-time accounting students with a GPA of 3.0 or higher | Varies |

| NASBA | NASBA Scholarship Program | Full-time accounting students with a GPA of 3.0 or higher | Varies |

In addition to these scholarships, students can also explore financial aid options such as federal grants, loans, and work-study programs.

Final Thoughts

A bachelor’s degree in accounting opens doors to diverse career paths, offering opportunities for growth and advancement in various industries. Whether you’re drawn to the challenges of corporate finance, the intricacies of tax consulting, or the audit and assurance services, this degree provides a solid foundation for a fulfilling and successful career. With a strong understanding of accounting principles and a commitment to lifelong learning, you can make a significant impact in the business world and contribute to the financial well-being of organizations and individuals.

FAQ Summary

What are the job prospects for accounting graduates?

Accounting graduates are highly sought after in various industries, including finance, banking, manufacturing, and healthcare. They can pursue careers as accountants, auditors, financial analysts, tax consultants, and more.

Is a CPA certification necessary for an accounting career?

While not mandatory for all accounting roles, a CPA certification can significantly enhance your career prospects. It demonstrates your expertise and professionalism, opening doors to higher-paying positions and leadership opportunities.

What are the salary expectations for accounting professionals?

Salaries for accounting professionals vary depending on experience, location, industry, and specialization. However, the field generally offers competitive compensation, with potential for significant growth over time.