- Overview of Accounting Bachelor Degree

- Curriculum and Coursework

- Career Paths and Job Prospects

- Professional Certifications and Licensing

- Skills and Competencies: Accounting Bachelor Degree

- Accreditation and Program Quality

- Personal Qualities and Traits

- Emerging Trends in Accounting

- Ending Remarks

- Essential Questionnaire

Accounting bachelor degree – An accounting bachelor’s degree opens doors to a wide array of exciting career paths, offering a solid foundation in financial principles and practices. This degree equips you with the skills and knowledge needed to navigate the complex world of finance, whether you’re interested in corporate accounting, auditing, tax preparation, or financial analysis. From understanding financial statements to mastering budgeting and forecasting, an accounting degree provides a comprehensive understanding of how businesses operate and manage their finances.

The curriculum typically covers core accounting principles, financial reporting standards, and various specialized areas like managerial accounting, tax accounting, and auditing. You’ll also gain practical experience through internships and real-world projects, preparing you for the demands of the accounting profession.

Overview of Accounting Bachelor Degree

An accounting bachelor’s degree equips students with the essential knowledge and skills to navigate the complex world of financial management. This degree program lays a strong foundation in the core principles and concepts of accounting, preparing graduates for diverse career paths in various industries.

Core Principles and Concepts of Accounting

Accounting revolves around the systematic recording, analyzing, and reporting of financial transactions. The fundamental principles guide the accounting process, ensuring consistency and accuracy in financial statements.

- Accrual Accounting: This principle recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid. This method provides a more accurate representation of a company’s financial performance.

- Matching Principle: This principle states that expenses should be matched with the revenues they generate. This helps to ensure that the financial statements accurately reflect the profitability of a company’s operations.

- Going Concern Principle: This principle assumes that a business will continue operating in the foreseeable future. This assumption is essential for making informed decisions about the future of a company.

- Materiality Principle: This principle states that only information that is significant enough to influence the decisions of users of financial statements should be disclosed. This principle helps to ensure that financial statements are concise and easy to understand.

- Consistency Principle: This principle requires companies to use the same accounting methods from period to period. This ensures that financial statements are comparable over time.

Specializations within Accounting

The field of accounting offers various specializations, each focusing on specific aspects of financial management.

- Financial Accounting: This specialization focuses on the preparation of financial statements for external users, such as investors, creditors, and regulatory agencies. Financial accountants ensure that these statements comply with Generally Accepted Accounting Principles (GAAP) and provide a clear picture of a company’s financial health.

- Managerial Accounting: This specialization focuses on providing financial information to internal users, such as managers, to aid in decision-making. Managerial accountants analyze costs, budgets, and performance metrics to help organizations achieve their goals.

- Tax Accounting: This specialization focuses on the preparation of tax returns for individuals and businesses. Tax accountants ensure that their clients comply with tax laws and minimize their tax liabilities.

- Auditing: This specialization involves examining financial records to ensure accuracy and compliance with regulations. Auditors provide independent assurance to stakeholders that financial statements are reliable and free from material misstatement.

Skills and Knowledge Acquired

An accounting bachelor’s degree program equips students with a wide range of skills and knowledge that are highly valued in the business world.

- Technical Accounting Skills: Students develop a strong understanding of accounting principles, financial reporting standards, and tax regulations. They learn how to analyze financial data, prepare financial statements, and interpret financial information.

- Analytical and Problem-Solving Skills: Accounting requires critical thinking and analytical skills to identify trends, solve problems, and make informed decisions. Students learn to analyze financial data, identify potential issues, and develop solutions.

- Communication Skills: Effective communication is crucial in accounting, as professionals need to convey complex financial information to both internal and external stakeholders. Students develop strong written and verbal communication skills to effectively present financial reports, explain accounting concepts, and negotiate with clients.

- Technology Skills: The accounting profession is increasingly reliant on technology, with software programs used for data analysis, financial modeling, and tax preparation. Students learn to utilize accounting software, spreadsheets, and other technology tools to perform their tasks efficiently.

Curriculum and Coursework

An accounting bachelor’s degree program equips students with a comprehensive understanding of accounting principles, practices, and applications. The curriculum is designed to provide a solid foundation in accounting theory and practical skills, preparing graduates for successful careers in various industries.

The coursework typically includes a combination of core courses and elective options, allowing students to tailor their studies to their specific interests and career goals. The core courses provide a fundamental understanding of accounting principles, while electives offer specialized knowledge in areas such as taxation, auditing, or financial management.

Core Courses

The core courses form the backbone of an accounting bachelor’s degree program. These courses cover the essential principles and concepts of accounting, providing a solid foundation for further studies and professional practice.

- Financial Accounting: This course focuses on the recording, classifying, and summarizing financial transactions. It covers topics such as the accounting cycle, financial statements, and generally accepted accounting principles (GAAP).

- Managerial Accounting: This course explores the use of accounting information for internal decision-making. It covers topics such as cost accounting, budgeting, and performance analysis.

- Auditing: This course examines the process of auditing financial statements to ensure their accuracy and compliance with GAAP. It covers topics such as audit procedures, internal controls, and fraud detection.

- Taxation: This course covers the principles of federal, state, and local taxation. It explores topics such as income tax, sales tax, and property tax.

- Accounting Information Systems: This course focuses on the use of technology in accounting, including accounting software and databases. It covers topics such as data management, financial reporting, and internal controls.

Elective Courses

Elective courses allow students to delve deeper into specific areas of accounting that align with their career aspirations. These courses offer specialized knowledge and skills that can enhance their marketability and career opportunities.

- Forensic Accounting: This course examines the use of accounting principles and techniques in legal investigations. It covers topics such as fraud detection, financial analysis, and expert witness testimony.

- International Accounting: This course explores the accounting practices and standards used in different countries. It covers topics such as international financial reporting standards (IFRS), cross-border transactions, and global business operations.

- Financial Management: This course focuses on the financial decision-making processes of businesses. It covers topics such as capital budgeting, financial planning, and risk management.

- Business Law: This course provides an overview of legal principles relevant to business operations, including contracts, torts, and intellectual property.

Examples of Specific Courses and Their Relevance

Specific courses within an accounting bachelor’s degree program provide in-depth knowledge and practical skills relevant to the accounting profession. Here are some examples:

- Cost Accounting: This course covers the principles and techniques used to track and analyze costs. It is relevant for accountants working in manufacturing, retail, and service industries, where cost control and efficiency are critical.

- Tax Research: This course teaches students how to research and interpret tax laws and regulations. It is essential for accountants working in tax preparation, planning, and compliance.

- Auditing and Assurance Services: This course provides a comprehensive understanding of audit procedures, internal controls, and fraud detection. It is crucial for accountants working in auditing, assurance, and risk management.

- Financial Statement Analysis: This course covers the techniques used to analyze financial statements and assess a company’s financial performance and health. It is valuable for accountants working in investment banking, financial analysis, and corporate finance.

Career Paths and Job Prospects

An accounting bachelor’s degree opens doors to a wide range of career paths across various industries. Graduates can pursue diverse roles, from traditional accounting positions to specialized fields like financial analysis and auditing. This section explores the common career paths, job titles, and responsibilities associated with an accounting degree.

Typical Accounting Roles and Responsibilities

An accounting degree equips individuals with the skills and knowledge necessary to perform a variety of accounting functions. Common job titles include:

- Accountant: Accountants are responsible for recording, classifying, summarizing, and reporting financial transactions. They prepare financial statements, analyze financial data, and provide financial advice to businesses and individuals.

- Bookkeeper: Bookkeepers handle the day-to-day recording of financial transactions. They maintain financial records, prepare bank reconciliations, and generate reports for internal use.

- Auditors: Auditors examine financial records to ensure accuracy and compliance with accounting standards. They assess internal controls, detect fraud, and provide independent opinions on the financial health of organizations.

- Tax Accountant: Tax accountants specialize in preparing tax returns, advising clients on tax planning strategies, and representing them in tax audits.

- Cost Accountant: Cost accountants analyze the cost of producing goods and services. They track expenses, develop cost-reduction strategies, and provide insights to improve profitability.

- Management Accountant: Management accountants provide financial information and analysis to support decision-making within organizations. They prepare budgets, analyze financial performance, and develop strategies for improving efficiency.

Career Paths in Different Industries

Accounting graduates find employment across a wide range of industries, each offering unique career paths and opportunities.

- Public Accounting: Public accounting firms provide audit, tax, and advisory services to businesses and individuals. Graduates can work as staff accountants, auditors, tax specialists, or consultants, gaining experience in diverse industries and developing valuable skills.

- Corporate Accounting: Corporate accounting departments within businesses handle internal financial reporting, budgeting, and analysis. Graduates can work as staff accountants, cost accountants, or management accountants, contributing to the financial health of the organization.

- Government Accounting: Government agencies employ accountants to manage public funds, prepare financial statements, and ensure compliance with regulations. Graduates can work for federal, state, or local governments, contributing to public services and programs.

- Non-Profit Accounting: Non-profit organizations rely on accountants to manage donations, prepare financial statements, and ensure compliance with regulations. Graduates can work for charities, foundations, or advocacy groups, supporting important social causes.

- Financial Analysis: Financial analysts use accounting data to evaluate investments, forecast financial performance, and provide investment recommendations. Graduates can work for investment banks, hedge funds, or asset management firms, contributing to financial markets and wealth management.

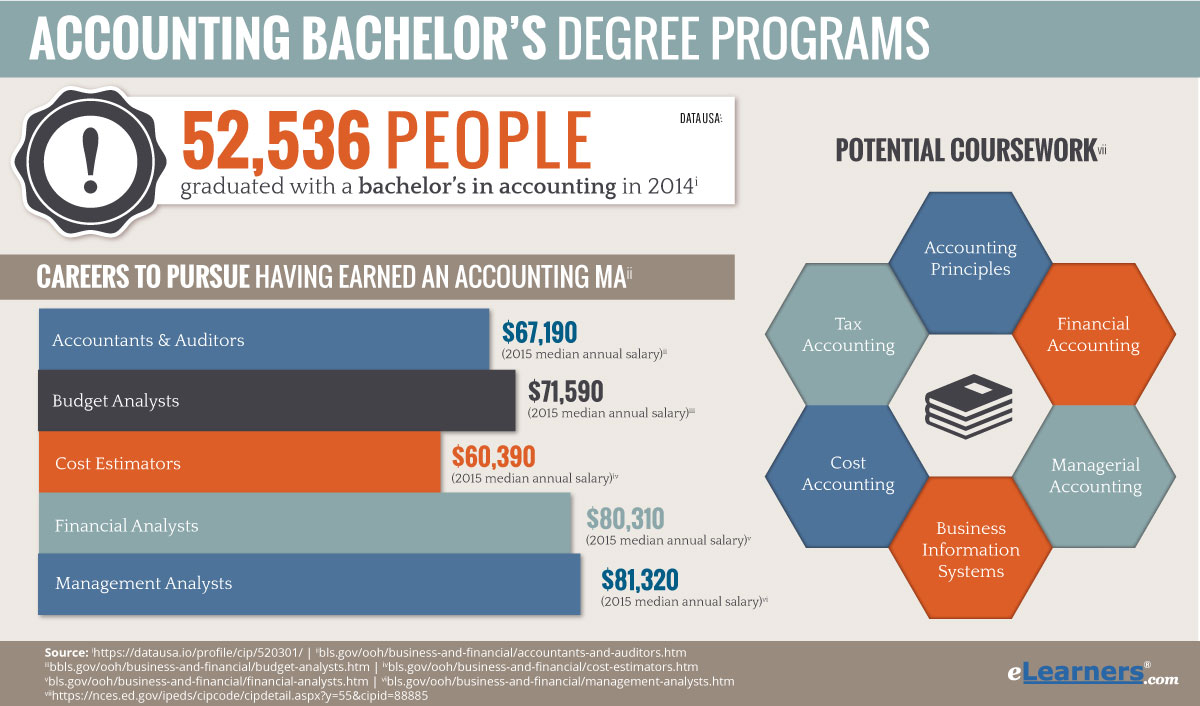

Salary and Career Progression

Salary expectations for accounting professionals vary based on experience, industry, location, and job title.

- Entry-level positions: Entry-level accountants typically earn salaries in the range of $40,000 to $60,000 per year.

- Experienced professionals: With experience, accountants can earn salaries of $70,000 to $100,000 or more. Senior accountants, managers, and partners in public accounting firms can earn significantly higher salaries.

Career progression in accounting typically involves gaining experience, acquiring certifications, and pursuing advanced education.

- Certifications: The Certified Public Accountant (CPA) license is a highly recognized professional credential for accountants. Passing the CPA exam requires extensive knowledge and experience, and it can significantly enhance earning potential and career advancement opportunities. Other certifications, such as the Certified Management Accountant (CMA) and the Certified Internal Auditor (CIA), are also available for specialized roles.

- Advanced education: An MBA or Master of Accountancy degree can provide a competitive edge and open doors to leadership positions and executive roles.

Examples of Career Paths

Here are some examples of real-life career paths that demonstrate the diverse opportunities available to accounting graduates:

- Public Accounting: A recent graduate with an accounting degree starts as a staff accountant at a large public accounting firm. After gaining experience in auditing and tax services, they become a senior accountant and eventually a manager, leading teams and managing client relationships. With continued success, they may progress to partner, becoming a key decision-maker in the firm.

- Corporate Accounting: An accounting graduate joins the corporate accounting department of a Fortune 500 company. They start as a staff accountant, handling day-to-day accounting tasks. As they gain experience and demonstrate their skills, they advance to roles such as cost accountant, management accountant, and eventually controller, overseeing the company’s financial operations.

- Financial Analysis: An accounting graduate with a strong interest in finance joins an investment bank as a financial analyst. They analyze financial data, prepare investment reports, and contribute to investment decisions. With experience and success, they may advance to roles such as portfolio manager or investment banker, managing large sums of money and influencing financial markets.

Professional Certifications and Licensing

Earning professional certifications and licenses can significantly enhance your career prospects as an accounting professional. These credentials demonstrate your knowledge, skills, and commitment to ethical standards, opening doors to higher-paying positions and greater career advancement opportunities.

Certified Public Accountant (CPA)

The Certified Public Accountant (CPA) designation is the gold standard in the accounting profession. It is a highly respected credential that signifies a high level of competency and professionalism. To become a CPA, you must meet specific educational, experience, and examination requirements.

The requirements for becoming a CPA vary by state, but generally include:

- A bachelor’s degree in accounting or a related field.

- Completion of the Uniform CPA Examination, a rigorous four-part exam that tests your knowledge of accounting principles, auditing, taxation, and business environment.

- A specified amount of supervised accounting experience, typically two years.

- Passing an ethics exam.

- Meeting the licensing requirements of the state in which you wish to practice.

The benefits of becoming a CPA are numerous:

- Increased earning potential: CPAs typically earn significantly more than non-certified accountants.

- Greater job security: The demand for CPAs is consistently high, making it a stable and secure career path.

- Enhanced career opportunities: A CPA license opens doors to a wide range of career opportunities, including public accounting, corporate accounting, government accounting, and financial consulting.

- Greater credibility and respect: The CPA designation is recognized and respected worldwide, giving you a competitive edge in the job market.

- Access to professional development opportunities: The AICPA (American Institute of Certified Public Accountants) offers numerous resources and programs to help CPAs stay current on industry trends and best practices.

Other Accounting Certifications

In addition to the CPA, there are other valuable accounting certifications that can enhance your career prospects:

- Certified Management Accountant (CMA): The CMA certification focuses on management accounting and financial reporting, equipping professionals with the skills needed to make informed business decisions.

- Certified Internal Auditor (CIA): The CIA certification focuses on internal audit and risk management, providing professionals with the expertise to assess and improve an organization’s internal control processes.

- Certified Fraud Examiner (CFE): The CFE certification focuses on fraud prevention, detection, and investigation, equipping professionals with the skills needed to identify and address financial irregularities.

- Certified Information Systems Auditor (CISA): The CISA certification focuses on information systems auditing and security, providing professionals with the expertise to assess and improve an organization’s information technology controls.

Impact of Professional Certifications on Career Advancement and Earning Potential

Professional certifications can significantly impact your career advancement and earning potential. Studies have shown that certified accountants generally earn more than their non-certified counterparts. For example, a 2023 study by the AICPA found that CPAs earned an average of $10,000 more per year than non-certified accountants.

“A professional certification can be a valuable investment in your career, opening doors to new opportunities and increasing your earning potential.”

Furthermore, certifications can help you stand out from the competition and demonstrate your commitment to professional development. They can also help you qualify for leadership positions and other advanced roles within your organization.

Skills and Competencies: Accounting Bachelor Degree

An accounting bachelor’s degree equips students with a robust set of skills and competencies essential for success in the dynamic and ever-evolving world of finance. These skills go beyond technical knowledge and encompass critical thinking, problem-solving, communication, and teamwork abilities, making graduates highly sought-after in various industries.

Analytical Thinking

Analytical thinking is paramount in accounting, as professionals are constantly dealing with complex financial data. This skill involves the ability to dissect information, identify patterns, and draw meaningful conclusions.

- Analyzing financial statements: Accountants use analytical thinking to scrutinize financial statements, such as income statements and balance sheets, to identify trends, potential risks, and areas for improvement. They might analyze changes in revenue, expenses, or asset values to assess a company’s financial health and performance. For example, an accountant might identify a decline in a company’s gross profit margin by analyzing the income statement, which could indicate issues with pricing, cost control, or sales volume.

- Evaluating financial risks: Accountants use analytical thinking to assess financial risks associated with various transactions, investments, or business decisions. This might involve analyzing market trends, economic conditions, or company-specific factors to identify potential threats and opportunities. For instance, an accountant might evaluate the risk of a company’s investment in a new market by considering factors such as political stability, regulatory environment, and competition in the region.

Problem-Solving

Accounting professionals are often faced with complex financial problems that require creative and efficient solutions.

- Resolving accounting discrepancies: Accountants are adept at identifying and resolving discrepancies in financial records, such as mismatched entries, missing information, or errors in calculations. They use their problem-solving skills to investigate the root cause of the discrepancy, gather relevant data, and implement corrective measures. For example, an accountant might discover a discrepancy in a company’s inventory records, which could be due to a data entry error, a theft, or a faulty inventory management system. They would then investigate the discrepancy, identify the cause, and implement a solution to prevent future occurrences.

- Developing cost-saving strategies: Accountants are often tasked with developing cost-saving strategies for businesses. They use their problem-solving skills to identify areas where costs can be reduced, such as optimizing procurement processes, negotiating better deals with suppliers, or streamlining operations. For example, an accountant might analyze a company’s expenses and identify opportunities to reduce costs by renegotiating contracts with suppliers, implementing energy-saving measures, or optimizing inventory management.

Communication

Effective communication is crucial in accounting, as professionals need to convey complex financial information clearly and concisely to various stakeholders.

- Preparing financial reports: Accountants are responsible for preparing accurate and comprehensive financial reports for internal and external stakeholders, such as management, investors, and regulators. This requires them to communicate financial information effectively, using clear language, concise explanations, and relevant data. For example, an accountant might prepare a quarterly financial report for investors, highlighting key financial metrics, trends, and risks.

- Explaining financial data: Accountants often need to explain complex financial data to non-financial stakeholders, such as managers, board members, or clients. They use their communication skills to translate technical accounting concepts into understandable terms, providing clear and concise explanations. For example, an accountant might explain a company’s profitability ratios to a manager, highlighting key drivers of performance and areas for improvement.

Teamwork

Accounting professionals often work in teams, collaborating with other professionals to achieve common goals.

- Collaborating with other departments: Accountants frequently collaborate with other departments, such as sales, marketing, and operations, to gather information, analyze data, and make informed decisions. This requires them to work effectively in cross-functional teams, fostering open communication, shared understanding, and mutual respect. For example, an accountant might work with the sales team to analyze customer data, identify sales trends, and develop strategies to increase revenue.

- Working in audit teams: In audit teams, accountants work together to examine financial records, assess internal controls, and provide independent assurance on the accuracy of financial statements. This requires them to coordinate their efforts, share information, and communicate effectively to ensure a thorough and efficient audit process. For example, an auditor might work with a team of colleagues to examine a company’s financial records, identify potential risks, and assess the effectiveness of internal controls.

Accreditation and Program Quality

Earning a bachelor’s degree in accounting from an accredited program is essential for success in this field. Accreditation signifies that a program meets specific quality standards and prepares graduates for professional careers.

Accreditation plays a crucial role in validating the quality of an accounting program. It serves as an assurance to students, employers, and the public that the program meets rigorous academic standards and prepares graduates for the challenges of the accounting profession.

Reputable Accrediting Bodies

Accreditation agencies evaluate programs based on a set of criteria that ensure the program’s curriculum, faculty, resources, and overall quality meet established standards.

- Accreditation Council for Business Schools and Programs (ACBSP): This organization accredits business programs, including accounting, at the baccalaureate and master’s levels. ACBSP focuses on student learning outcomes, curriculum quality, faculty qualifications, and institutional resources.

- Association to Advance Collegiate Schools of Business (AACSB): AACSB is the premier accrediting body for business schools worldwide. AACSB accreditation is highly regarded and signifies a commitment to excellence in business education. AACSB-accredited accounting programs are known for their rigorous curriculum, experienced faculty, and strong industry connections.

Factors to Consider When Evaluating Program Quality

When evaluating the quality of an accounting program, it’s essential to consider several factors beyond accreditation.

- Curriculum: The curriculum should be comprehensive and cover core accounting topics, including financial accounting, managerial accounting, auditing, taxation, and ethics. Look for programs that offer specialized courses in areas like forensic accounting, data analytics, or international accounting.

- Faculty: The faculty should have strong academic credentials and relevant industry experience. Look for programs with faculty members who are actively involved in research and publishing.

- Resources: The program should have adequate resources, such as a well-equipped library, computer labs, and access to industry databases.

- Career Services: The program should offer career services that help students prepare for job searches, including resume writing, interview skills training, and job placement assistance.

- Industry Connections: Strong industry connections are essential for accounting programs. Look for programs that have partnerships with accounting firms, corporations, and other organizations.

- Student Outcomes: The program’s student outcomes should be strong. Look for programs with high placement rates, competitive starting salaries, and graduates who are successful in their careers.

Personal Qualities and Traits

Beyond technical skills, certain personal qualities are crucial for success in the accounting profession. These traits contribute to accuracy, integrity, and ethical conduct, which are essential for maintaining trust and building a strong reputation.

Importance of Attention to Detail, Accuracy, Integrity, and Ethical Conduct

Attention to detail, accuracy, integrity, and ethical conduct are fundamental principles in accounting. They ensure that financial records are reliable and transparent, fostering trust among stakeholders.

- Attention to Detail: Accounting involves meticulous record-keeping and analysis of complex financial data. A keen eye for detail ensures that every transaction is recorded accurately, preventing errors and discrepancies.

- Accuracy: Accuracy is paramount in accounting, as any error can have significant financial implications. Accountants must be precise in their calculations, data entry, and reporting, ensuring that financial statements are accurate and reliable.

- Integrity: Integrity is essential for maintaining public trust in the accounting profession. Accountants must be honest and transparent in their dealings, adhering to ethical standards and avoiding conflicts of interest.

- Ethical Conduct: Ethical conduct guides accountants in making sound decisions and acting with professionalism. It encompasses principles such as confidentiality, objectivity, and independence, ensuring that financial information is presented fairly and accurately.

Examples of How These Qualities Contribute to Effective Accounting Practices

These qualities are interwoven, contributing to effective accounting practices in various ways.

- Attention to Detail in Auditing: Auditors meticulously examine financial records, ensuring accuracy and compliance with regulations. A detail-oriented approach helps identify discrepancies and potential fraud, safeguarding the integrity of financial statements.

- Accuracy in Financial Reporting: Financial statements are the foundation for informed decision-making by investors, creditors, and other stakeholders. Accurate reporting builds trust and enables stakeholders to make informed choices.

- Integrity in Tax Compliance: Accountants play a crucial role in ensuring tax compliance. Integrity ensures that taxes are calculated and reported accurately, adhering to legal and ethical standards.

- Ethical Conduct in Internal Controls: Ethical conduct guides accountants in establishing and maintaining strong internal controls, which prevent fraud, promote efficiency, and ensure compliance with regulations.

Emerging Trends in Accounting

The accounting profession is constantly evolving, driven by technological advancements, changing business practices, and evolving regulatory landscapes. These trends are shaping the future of the accounting field, requiring professionals to adapt and develop new skills.

Impact of Technology

Technology is transforming the accounting profession, automating tasks, enhancing efficiency, and enabling deeper insights.

- Cloud Computing: Cloud-based accounting software allows businesses to access financial data anytime, anywhere, and from any device. This accessibility improves collaboration, reduces costs, and enhances security. Examples include Xero, QuickBooks Online, and NetSuite.

- Data Analytics: Accountants are increasingly leveraging data analytics to gain insights from financial data. This allows them to identify trends, make informed decisions, and improve forecasting accuracy. For example, analyzing sales data can reveal customer purchasing patterns, enabling businesses to optimize marketing strategies and inventory management.

- Artificial Intelligence (AI): AI is automating routine tasks, such as data entry and invoice processing, freeing up accountants to focus on higher-value activities. AI-powered tools can also detect anomalies and potential fraud, enhancing financial reporting accuracy.

Emerging Trends in Accounting, Accounting bachelor degree

Beyond technology, new trends are emerging in accounting, shaping the future of the profession.

- Sustainability Reporting: Sustainability reporting is becoming increasingly important as investors and stakeholders demand transparency about companies’ environmental, social, and governance (ESG) performance. Accountants are playing a crucial role in developing and auditing sustainability reports, ensuring accuracy and reliability.

- Blockchain Technology: Blockchain technology is transforming the way transactions are recorded and verified. It offers enhanced security, transparency, and efficiency, making it ideal for accounting applications. For example, blockchain can streamline supply chain management by providing a secure and auditable record of transactions.

Ending Remarks

An accounting bachelor’s degree is a valuable investment in your future, opening doors to a rewarding and stable career. With a strong foundation in accounting principles, you’ll be equipped to contribute to organizations across diverse industries, from large corporations to small businesses. The demand for skilled accounting professionals remains high, ensuring ample job opportunities and a competitive salary. Whether you choose to pursue a traditional accounting role or explore specialized areas like forensic accounting or financial consulting, an accounting bachelor’s degree provides a solid springboard for success.

Essential Questionnaire

What are the job prospects for accounting graduates?

Accounting graduates are in high demand across various industries. Common job titles include Staff Accountant, Financial Analyst, Tax Accountant, and Auditor.

Is a CPA license required for all accounting jobs?

While a CPA license is highly valued and opens up more opportunities, it’s not mandatory for all accounting roles. Some positions, particularly in industry, may not require a CPA.

What are some emerging trends in the accounting field?

The accounting profession is evolving rapidly with the rise of technology. Areas like cloud computing, data analytics, and blockchain technology are transforming how accounting tasks are performed.