Business insurance is crucial for safeguarding your company’s financial well-being and future. Understanding the various types of coverage available, from general liability to professional liability and workers’ compensation, is paramount for mitigating risks and ensuring business continuity. This comprehensive guide explores the key aspects of business insurance, helping you navigate the complexities of selecting the right policies and managing potential claims.

This guide provides a detailed examination of the factors influencing insurance costs, including industry type, business size, and claims history. It offers a step-by-step approach to selecting appropriate coverage, emphasizing the importance of risk assessment and comparing quotes from multiple providers. We also delve into the claims process, offering best practices for handling claims effectively and illustrating the importance of business insurance in overall risk management.

Claims Process and Procedures: Business Insurance

Filing a business insurance claim can seem daunting, but understanding the process can significantly ease the burden. This section Artikels the typical steps, required documentation, interaction with adjusters, and best practices for a smoother experience. Remember, specific procedures may vary depending on your policy and insurer.

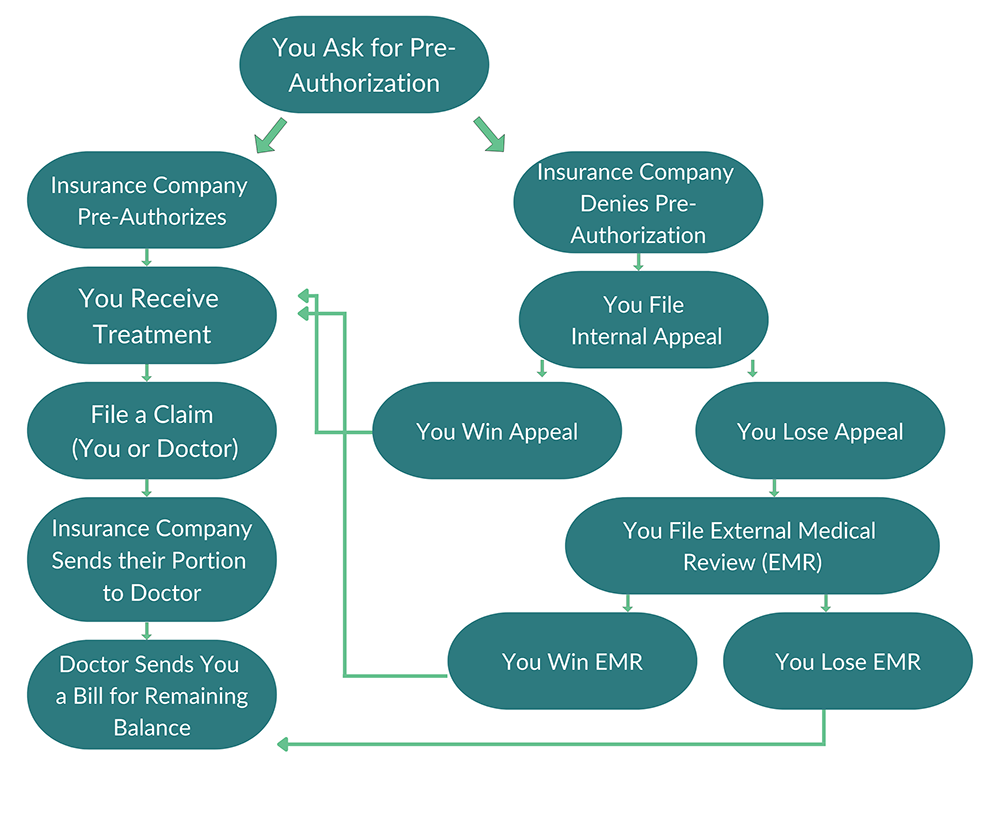

Steps Involved in Filing a Business Insurance Claim

The claims process generally involves several key steps. Prompt and accurate reporting is crucial for a timely resolution. Delays can impact the overall claim processing time.

- Report the Claim: Immediately notify your insurance company of the incident, following the instructions Artikeld in your policy. This often involves a phone call to their claims hotline, followed by a written report.

- Provide Initial Information: Offer a concise account of the event, including date, time, location, and involved parties. Be prepared to answer questions from the claims representative.

- Complete Claim Forms: Your insurer will provide necessary forms to formally document the claim. Accurate and complete information is essential.

- Gather Supporting Documentation: Collect all relevant documents, such as police reports, repair estimates, medical records, and photographs of the damage. More on this in the next section.

- Cooperate with the Adjuster: Work closely with the assigned adjuster, providing any requested information or documentation in a timely manner. This facilitates a prompt assessment of your claim.

- Review the Claim Assessment: Once the adjuster completes their investigation, they will provide a written assessment of your claim, including the amount they will cover. Review this carefully and address any discrepancies promptly.

- Receive Payment: After the assessment is finalized and any appeals are resolved, you will receive payment for the approved portion of your claim.

Required Documentation to Support a Claim

Comprehensive documentation is critical for a successful claim. Missing or incomplete documentation can lead to delays or claim denials. The specific requirements vary based on the type of claim, but generally include:

- Police Report (if applicable): For incidents involving theft, accidents, or vandalism, a police report is often required.

- Photographs/Videos: Visual documentation of the damage is crucial. Take multiple photos from different angles, showing the extent of the damage.

- Repair Estimates/Invoices: Obtain detailed estimates from qualified professionals for repairs or replacements. Keep all invoices and receipts.

- Medical Records (if applicable): For injury claims, provide relevant medical records, including doctor’s notes, treatment plans, and bills.

- Witness Statements (if applicable): Statements from witnesses who can corroborate your account of the event can strengthen your claim.

- Inventory Lists (if applicable): For claims involving lost or damaged property, a detailed inventory list with descriptions and values is essential.

Interacting with Insurance Adjusters, Business insurance

Insurance adjusters are responsible for investigating and assessing your claim. Effective communication is key to a positive outcome.

Maintain clear and professional communication throughout the process. Respond promptly to their requests for information and be prepared to answer their questions thoroughly. Keep detailed records of all communications, including dates, times, and the content of conversations. If you disagree with the adjuster’s assessment, clearly articulate your reasons and provide supporting documentation.

Best Practices for Handling Insurance Claims Effectively

Proactive measures can significantly improve the claims process.

- Maintain Accurate Records: Keep detailed records of all relevant documentation, including policy information, inventory lists, and financial records.

- Understand Your Policy: Familiarize yourself with the terms and conditions of your insurance policy to understand your coverage and the claims process.

- Report Claims Promptly: Notify your insurer as soon as possible after an incident to avoid delays.

- Cooperate Fully: Provide the adjuster with all requested information and documentation in a timely manner.

- Keep Detailed Records of Communication: Document all interactions with the insurer, including dates, times, and the content of conversations.

Importance of Business Insurance for Risk Management

Business insurance plays a vital role in safeguarding your company’s financial health and future. It acts as a crucial safety net, protecting against unforeseen events that could otherwise cripple your operations and lead to significant financial losses. By strategically implementing a comprehensive insurance plan, businesses can mitigate a wide range of risks and maintain operational stability.

Mitigating Financial Risks Through Insurance

Business insurance significantly reduces the financial burden associated with unexpected events. Unforeseen circumstances, such as property damage from fire or natural disasters, equipment malfunction, or employee injury, can lead to substantial repair costs, lost revenue, and legal fees. Insurance policies, tailored to specific business needs, provide financial compensation to cover these expenses, preventing significant financial strain and potentially business failure. For instance, a comprehensive property insurance policy can cover the costs of rebuilding after a fire, while business interruption insurance can compensate for lost income during the recovery period. This financial protection allows businesses to focus on recovery and rebuilding rather than being overwhelmed by immediate financial burdens.

Protection Against Lawsuits and Legal Liabilities

Legal liabilities are a constant concern for businesses of all sizes. Accidents, injuries, or product defects can result in costly lawsuits. Liability insurance, such as general liability or professional liability insurance, provides crucial protection by covering legal fees, settlements, and judgments arising from such claims. Without this insurance, a single lawsuit could bankrupt a small business. Consider a scenario where a customer is injured on your business premises; liability insurance would cover the medical expenses and any legal costs associated with the claim. This protection is essential for maintaining financial stability and protecting the business’s reputation.

Business Continuity Planning and Insurance

Effective business continuity planning is essential for resilience, and insurance is a key component of such a plan. A well-structured plan Artikels procedures for mitigating the impact of disruptive events, and insurance provides the financial resources to execute those plans effectively. For example, a business continuity plan might involve securing temporary facilities or equipment after a disaster. Insurance coverage would facilitate the financial resources needed to implement these provisions, minimizing business downtime and ensuring a quicker return to normal operations. The combination of a solid plan and the financial backing of insurance significantly improves a business’s ability to weather unexpected storms.

Safeguarding Business Assets and Investments

Business insurance protects the significant investments a company has made in its assets. This includes physical assets like buildings, equipment, and inventory, as well as intangible assets like intellectual property. Insurance policies can compensate for loss or damage to these assets, preventing significant financial losses and preserving the value of the business. Imagine a scenario where a valuable piece of machinery is damaged beyond repair. Equipment insurance would cover the cost of replacement, allowing the business to continue operations without major interruption. This protection ensures that the business remains financially viable and able to continue generating revenue.

Examples of Crucial Business Insurance Scenarios

Several real-world scenarios highlight the critical role of business insurance. A small bakery experiencing a fire resulting in significant property damage and business interruption could face ruin without insurance. A software company facing a lawsuit due to a flaw in their software could be forced to close its doors without professional liability insurance. A construction company responsible for an injury on a job site would face crippling legal and medical costs without general liability insurance. These scenarios illustrate the potential for devastating financial consequences without adequate insurance coverage, underscoring its importance for risk management.

Illustrative Examples of Business Insurance Scenarios

Understanding the practical applications of business insurance is crucial for effective risk management. The following scenarios illustrate how different types of insurance can protect your business from significant financial losses. Each example details a situation, the resulting claim, and the ultimate outcome, highlighting the value of adequate coverage.

General Liability Insurance: A Slip and Fall Incident

A customer slipped on a wet floor in a coffee shop, resulting in a broken arm. The customer sued the coffee shop for medical expenses, lost wages, and pain and suffering. The coffee shop’s general liability insurance covered the legal fees, medical costs, and settlement, preventing a potentially devastating financial blow to the business. The outcome was a successful claim settlement, minimizing the financial impact on the coffee shop.

Professional Liability Insurance: An Architect’s Design Flaw

An architect designed a building with a structural flaw that led to significant repair costs for the building owner. The building owner sued the architect for negligence. The architect’s professional liability insurance (also known as errors and omissions insurance) covered the legal fees and the cost of rectifying the design flaw. The outcome was a successful defense against the lawsuit and coverage for the remediation of the structural issue, protecting the architect’s reputation and financial stability.

Commercial Auto Insurance: An Employee’s Traffic Accident

A company employee was involved in a car accident while driving a company vehicle for work-related purposes. The accident resulted in damage to the company vehicle and injuries to the other driver. The company’s commercial auto insurance covered the cost of vehicle repairs, medical expenses for the other driver, and legal fees associated with the accident. The outcome was a successful claim resolution, ensuring the company wasn’t held liable for significant out-of-pocket expenses. The insurance company managed the claim and negotiated a settlement, minimizing disruption to the business.

Closing Notes

Securing the right business insurance is not merely a cost; it’s a strategic investment in your company’s long-term success. By understanding the various types of coverage, assessing your specific risks, and diligently managing the claims process, you can effectively protect your business assets, mitigate financial liabilities, and ensure continued operations. Remember, proactive risk management through comprehensive insurance is key to building a resilient and thriving enterprise.

Questions Often Asked

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions insurance) protects against claims of negligence or mistakes in professional services.

How often should I review my business insurance policy?

It’s recommended to review your policy annually, or whenever your business experiences significant changes (e.g., expansion, new employees, changes in operations).

Can I get business insurance if my company has a history of claims?

Yes, but your premiums may be higher. It’s crucial to be transparent with your insurer about your claims history.

What happens if I don’t have the right insurance and an incident occurs?

You could face significant financial losses, lawsuits, and even business closure. Adequate insurance protects you from these potential consequences.