- Best Life Insurance Policy Options for Your Needs: A Comprehensive Guide to Finding the Best Life Insurance Quotes

- Introduction

- Understanding Life Insurance Quotes

- Finding the Best Life Insurance Quotes

- Types of Life Insurance Policies: Overview and Quotes

- Tips for Finding the Best Life Insurance Quotes

- Conclusion

-

FAQ about Best Life Insurance Quotes

- What is life insurance?

- Why do I need life insurance?

- How can I get life insurance quotes?

- What information do I need to provide to get a life insurance quote?

- What is the best way to compare life insurance quotes?

- How much life insurance do I need?

- What are the different types of life insurance?

- What is the waiting period for life insurance?

- Are there any exclusions to life insurance coverage?

- How can I cancel my life insurance policy?

Best Life Insurance Policy Options for Your Needs: A Comprehensive Guide to Finding the Best Life Insurance Quotes

Introduction

Hey there, readers! Life insurance is a crucial tool for safeguarding your loved ones financially in the event of your passing. With so many life insurance quotes available, finding the best one can be a daunting task. But fear not! This comprehensive guide will provide you with all the information you need to explore the world of life insurance and make an informed decision that suits your specific needs.

Understanding Life Insurance Quotes

Types of Life Insurance

- Term Life Insurance: Provides coverage for a specific period, typically ranging from 10 to 30 years. It is generally more affordable than other types of insurance.

- Whole Life Insurance: Offers coverage for the entire life of the policyholder, regardless of their age. It also has a cash value component that grows over time.

- Universal Life Insurance: A flexible policy that allows you to adjust the premium and death benefit as your needs change. It also has a cash value component.

Factors Affecting Life Insurance Quotes

- Age: Younger applicants typically receive lower quotes due to lower mortality risk.

- Health: Your overall health and lifestyle can significantly impact your premiums.

- Smoking: Smokers face higher premiums due to increased health risks.

- Occupation: High-risk occupations, such as firefighters and military personnel, may result in higher quotes.

- Amount of Coverage: The amount of coverage you need will affect the premium you pay.

Finding the Best Life Insurance Quotes

Online Comparison Tools

Online comparison tools allow you to compare quotes from multiple insurance companies. Enter your information and receive instant quotes to find the best options for you.

Independent Insurance Agents

Independent agents represent multiple insurance companies and can provide a more personalized approach. They can compare quotes and help you understand the different policy options available.

Direct from Insurance Companies

Contacting insurance companies directly can also provide you with quotes. However, you may have to speak with multiple agents and navigate their sales pitches.

Types of Life Insurance Policies: Overview and Quotes

| Policy Type | Coverage Duration | Cash Value | Flexibility | Estimated Premium |

|---|---|---|---|---|

| Term Life | 10-30 years | No | Limited | $1,000,000 for 20-year policy, age 35, non-smoker |

| Whole Life | Lifetime | Yes | Limited | $1,000,000 for lifelong coverage, age 35, non-smoker |

| Universal Life | Flexible | Yes | High | $1,000,000 for coverage with cash value growth, age 35, non-smoker |

Tips for Finding the Best Life Insurance Quotes

- Shop around and compare quotes from multiple providers.

- Consider your age, health, and financial situation.

- Understand the different coverage options and policy types.

- Read the fine print and be aware of any exclusions or limitations.

- Be honest about your medical history and lifestyle.

Conclusion

Finding the best life insurance quotes requires thorough research and a clear understanding of your needs. By using the tips outlined in this guide, you can navigate the world of life insurance confidently and secure the financial protection your loved ones deserve. Don’t forget to explore our other articles for more insights on life insurance and personal finance.

FAQ about Best Life Insurance Quotes

What is life insurance?

Life insurance is a contract between you and an insurance company in which you pay premiums in exchange for a death benefit to be paid to your beneficiaries when you die.

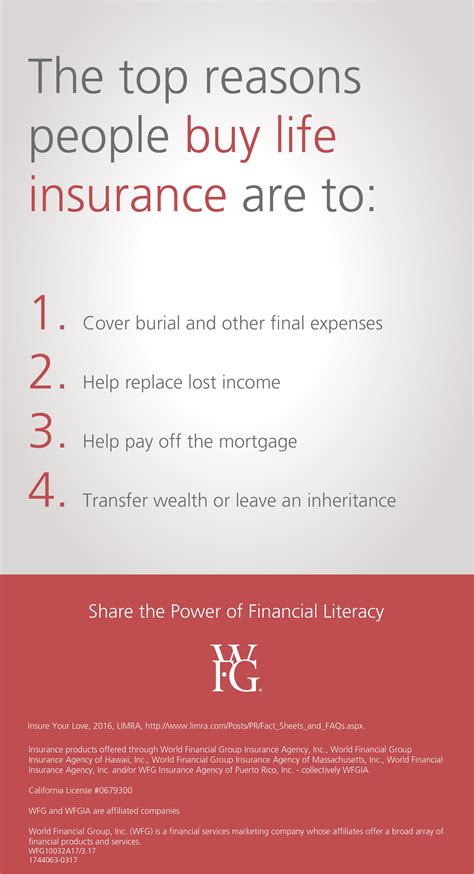

Why do I need life insurance?

Life insurance can help protect your loved ones financially in the event of your death. It can provide them with funds to cover expenses such as funeral costs, outstanding debts, or lost income.

How can I get life insurance quotes?

You can get life insurance quotes from a variety of sources, including:

- Insurance agents

- Online insurance marketplaces

- Insurance companies

What information do I need to provide to get a life insurance quote?

When you get a life insurance quote, you will typically need to provide information about your:

- Age

- Health

- Occupation

- Lifestyle

- Income

What is the best way to compare life insurance quotes?

When comparing life insurance quotes, it’s important to consider not only the premium amount, but also the coverage limits, policy features, and reputation of the insurance company.

How much life insurance do I need?

The amount of life insurance you need will depend on your individual circumstances and financial goals. A good rule of thumb is to purchase coverage equal to 10-15 times your annual income.

What are the different types of life insurance?

There are two main types of life insurance: term life and whole life. Term life insurance offers temporary coverage for a specific period of time, while whole life insurance offers lifelong coverage and can accumulate cash value.

What is the waiting period for life insurance?

Most life insurance policies have a waiting period of two years after the policy is issued before the death benefit will be paid. This is to prevent people from taking out a life insurance policy and then committing suicide.

Are there any exclusions to life insurance coverage?

Most life insurance policies do not cover death due to suicide, war, or high-risk activities. It is important to read the policy carefully to understand what exclusions apply.

How can I cancel my life insurance policy?

You can cancel your life insurance policy at any time by contacting the insurance company. However, you may be subject to a cancellation fee.