- Introduction

- Comparing Car Insurance Quotes

- Understanding Discounts

- Other Ways to Save Money on Car Insurance

- California Cheap Car Insurance Rates by Company

- Conclusion

-

FAQ about California Cheap Car Insurance

- What is the average cost of car insurance in California?

- What are the factors that affect the cost of car insurance in California?

- What is the minimum amount of car insurance required in California?

- What is comprehensive car insurance?

- What is collision car insurance?

- What is uninsured motorist coverage?

- What is underinsured motorist coverage?

- What are the best ways to save money on car insurance in California?

- How can I get a cheap car insurance quote in California?

- What are some tips for finding the best car insurance policy in California?

Introduction

Hey there, readers! If you’re looking for ways to save money on car insurance in California, you’re in the right place. In this article, we’ll explore all the ins and outs of finding the cheapest car insurance in California, covering everything from comparing quotes to understanding discounts.

California has some of the highest car insurance rates in the country, but don’t despair. With a little research and effort, you can find an affordable policy that meets your needs. Let’s dive right in!

Comparing Car Insurance Quotes

The first step to finding cheap car insurance in California is to compare quotes from multiple insurance companies. This is the best way to get a sense of what’s available and to find the policy that’s right for you.

There are a few different ways to compare quotes. You can go online and use a comparison website, or you can call or visit different insurance companies directly.

When comparing quotes, be sure to pay attention to the following factors:

- Coverage: Make sure that the policy you’re considering provides the coverage you need.

- Deductible: The deductible is the amount you’ll pay out of pocket before your insurance kicks in. A higher deductible will result in a lower premium, but it also means you’ll have to pay more if you need to file a claim.

- Premium: The premium is the amount you’ll pay each month for your insurance policy.

Understanding Discounts

Car insurance companies in California offer a variety of discounts that can help you save money on your premium. Some of the most common discounts include:

- Multi-car discount: If you insure multiple cars with the same company, you may be eligible for a multi-car discount.

- Good driver discount: Drivers with a clean driving record may be eligible for a good driver discount.

- Low mileage discount: Drivers who drive less than a certain number of miles per year may be eligible for a low mileage discount.

- Senior citizen discount: Drivers over the age of 55 may be eligible for a senior citizen discount.

Be sure to ask your insurance company about any discounts that you may be eligible for.

Other Ways to Save Money on Car Insurance

In addition to comparing quotes and understanding discounts, there are a few other things you can do to save money on car insurance in California:

- Increase your deductible: As we mentioned earlier, a higher deductible will result in a lower premium. If you can afford to pay a higher deductible, it’s a great way to save money on your insurance.

- Drive less: If you drive less, you’re less likely to get into an accident. And if you have fewer accidents, you’ll pay less for insurance.

- Take a defensive driving course: Taking a defensive driving course can help you improve your driving skills and make you a safer driver. Many insurance companies offer discounts to drivers who complete defensive driving courses.

- Maintain a good credit score: Insurance companies use your credit score to assess your risk. A higher credit score will result in a lower premium.

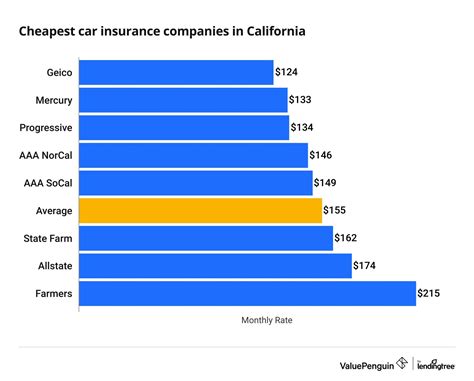

California Cheap Car Insurance Rates by Company

| Insurance Company | Average Annual Premium |

|---|---|

| Geico | $1,234 |

| State Farm | $1,356 |

| Farmers | $1,423 |

| Allstate | $1,542 |

| USAA | $1,114 |

*Rates are based on a sample of drivers with good driving records and credit scores.

Conclusion

Finding cheap car insurance in California doesn’t have to be difficult. By following the tips in this article, you can save money on your premiums without sacrificing coverage.

If you’re looking for more information on car insurance, be sure to check out our other articles on the topic. We’ve got everything you need to know about car insurance, from how to file a claim to how to choose the right coverage.

FAQ about California Cheap Car Insurance

What is the average cost of car insurance in California?

The average cost of car insurance in California is $2,050 per year, which is higher than the national average of $1,592.

What are the factors that affect the cost of car insurance in California?

Factors that affect the cost of car insurance in California include:

- Driving record

- Age

- Gender

- Location

- Type of car

- Amount of coverage

What is the minimum amount of car insurance required in California?

California requires drivers to have the following minimum amounts of car insurance:

- Bodily injury liability: $15,000 per person/$30,000 per accident

- Property damage liability: $5,000 per accident

What is comprehensive car insurance?

Comprehensive car insurance covers damage to your car from events other than collisions, such as theft, vandalism, and natural disasters.

What is collision car insurance?

Collision car insurance covers damage to your car from collisions with other vehicles or objects.

What is uninsured motorist coverage?

Uninsured motorist coverage pays for your injuries and damages if you are hit by a driver who does not have insurance.

What is underinsured motorist coverage?

Underinsured motorist coverage pays for your injuries and damages if you are hit by a driver who does not have enough insurance to cover your costs.

What are the best ways to save money on car insurance in California?

Some of the best ways to save money on car insurance in California include:

- Shopping around for quotes

- Increasing your deductible

- Taking a defensive driving course

- Bundling your car insurance with other policies

How can I get a cheap car insurance quote in California?

You can get a cheap car insurance quote in California by using an insurance comparison website or by contacting an insurance agent.

What are some tips for finding the best car insurance policy in California?

Some tips for finding the best car insurance policy in California include:

- Comparing quotes from multiple insurance companies

- Reading the policy carefully before you buy it

- Making sure you understand the coverage you are getting