- Car Insurance Companies: Unlocking Affordable Coverage

-

FAQ about Cheap Car Insurance Companies

- Q: How can I find the cheapest car insurance company for me?

- Q: How much does car insurance cost on average?

- Q: What discounts can I get on car insurance?

- Q: What coverage do I need on my car insurance policy?

- Q: How can I lower my car insurance premiums?

- Q: What is the best car insurance company for me?

- Q: What should I look for when choosing a car insurance company?

- Q: Can I cancel my car insurance policy at any time?

- Q: What happens if I drive without car insurance?

- Q: How can I get a free quote for car insurance?

Car Insurance Companies: Unlocking Affordable Coverage

Greetings, Readers!

Welcome to our comprehensive guide to finding cheap car insurance companies. Understanding your insurance options can be overwhelming, but we’re here to simplify the process and help you navigate the world of insurance. Join us as we delve into the fundamentals of securing affordable coverage for your prized possession.

Affordable Coverage: Where to Start

Finding affordable car insurance requires research and comparison shopping. Begin by obtaining quotes from multiple insurers. The best way to secure the most competitive rates is by comparing options from different providers. Consider the following factors when comparing:

- Deductible: The amount you pay out of pocket before insurance coverage kicks in. Higher deductibles typically result in lower premiums.

- Coverage Limits: Determine the appropriate coverage limits to meet your needs. Higher limits provide more financial protection but come with higher premiums.

- Discounts: Many insurers offer discounts for safe driving, multi-car policies, and loyalty. Explore these options to minimize costs.

Tricks of the Trade: Lowering Your Premiums

Beyond comparison shopping, there are several clever ways to reduce your car insurance premiums:

Maintain a Clean Driving Record

Traffic violations and accidents raise red flags for insurers, leading to higher premiums. Practice cautious driving habits to keep your record clean.

Increase Your Credit Score

Insurers often consider credit scores when determining premiums. Improving your creditworthiness can lead to lower rates.

Take a Defensive Driving Course

Completing a defensive driving course demonstrates your commitment to safe driving and may qualify you for discounts from some insurers.

The Ultimate Breakdown: Comparing Costs

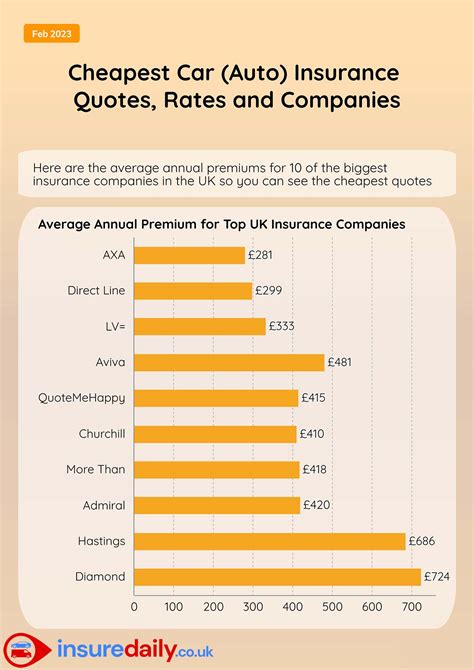

The table below provides a snapshot of the average national premiums for various insurance companies. Remember that premiums can vary significantly based on factors such as driving history, vehicle type, and location.

| Insurance Company | Annual Premium |

|---|---|

| Geico | $1,732 |

| Progressive | $1,821 |

| State Farm | $2,056 |

| Allstate | $2,147 |

| Farmers | $2,213 |

Conclusion

Securing cheap car insurance companies is within reach. By conducting thorough research, leveraging cost-saving tactics, and understanding industry practices, you can find affordable coverage that suits your needs. Remember, each insurance experience is unique, so explore your options thoroughly and make an informed decision that fits your circumstances.

Dive into our other articles for additional insights on insurance, personal finance, and navigating the complexities of daily life. We’re always here to provide guidance and support on your path to financial well-being.

FAQ about Cheap Car Insurance Companies

Q: How can I find the cheapest car insurance company for me?

A: The best way is to compare quotes from multiple insurance companies. You can do this online, or by speaking to an insurance agent.

Q: How much does car insurance cost on average?

A: The average cost of car insurance in the United States is $1,674 per year. However, rates can vary significantly depending on factors such as your age, driving history, and the type of car you drive.

Q: What discounts can I get on car insurance?

A: Many insurance companies offer discounts for good drivers, students, and military members. You may also be able to get a discount if you bundle your car insurance with other insurance policies, such as home or renters insurance.

Q: What coverage do I need on my car insurance policy?

A: The minimum coverage required by law varies from state to state. However, most experts recommend carrying at least liability coverage, collision coverage, and comprehensive coverage.

Q: How can I lower my car insurance premiums?

A: There are several things you can do to lower your car insurance premiums, such as:

- Improving your driving habits

- Taking a defensive driving course

- Installing safety features on your car

- Raising your deductible

- Bundling your car insurance with other insurance policies

Q: What is the best car insurance company for me?

A: The best car insurance company for you will depend on your individual needs and circumstances. It is important to compare quotes from multiple insurance companies before making a decision.

Q: What should I look for when choosing a car insurance company?

A: When choosing a car insurance company, you should consider factors such as:

- The company’s financial strength

- The company’s customer service record

- The company’s coverage options and rates

Q: Can I cancel my car insurance policy at any time?

A: Yes, you can cancel your car insurance policy at any time. However, you may be charged a cancellation fee.

Q: What happens if I drive without car insurance?

A: Driving without car insurance is illegal in most states. If you are caught driving without insurance, you may be fined or have your license suspended.

Q: How can I get a free quote for car insurance?

A: You can get a free quote for car insurance online, or by speaking to an insurance agent.