- Introduction

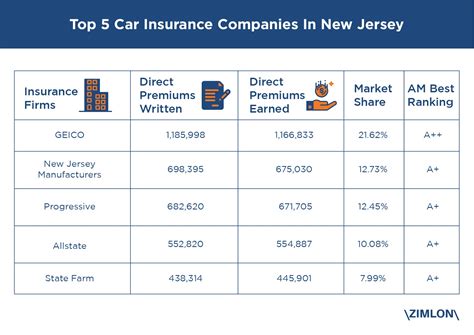

- Top Car Insurance Companies in New Jersey

- Factors to Consider When Choosing a Car Insurance Company in New Jersey

- Types of Car Insurance Coverage in New Jersey

- Other Car Insurance Considerations in New Jersey

- Conclusion

- Check Out Other Articles

-

FAQ about Car Insurance Companies NJ

- 1. What are the largest car insurance companies in New Jersey?

- 2. How do I choose the right car insurance company?

- 3. What type of car insurance is required in New Jersey?

- 4. How much does car insurance cost in New Jersey?

- 5. What factors affect my car insurance premium?

- 6. Can I get a discount on my car insurance?

- 7. What should I do if I have an accident?

- 8. What is a deductible?

- 9. How can I file a claim?

- 10. How can I cancel my car insurance?

Introduction

Hey there, readers! Are you looking for the best car insurance companies in New Jersey? In this comprehensive guide, we’ll delve into the insurance landscape of New Jersey, exploring the top providers, their coverage options, and the factors you need to consider when choosing an insurer. Whether you’re a first-time driver or a seasoned motorist, this article will equip you with the knowledge and insights to make an informed decision about your car insurance needs.

Top Car Insurance Companies in New Jersey

State Farm

State Farm is a household name in the insurance industry, and it’s no different in New Jersey. They offer a wide range of coverage options, including liability, collision, comprehensive, and uninsured motorist protection. State Farm is also known for its excellent customer service and competitive rates.

Geico

Geico has become a popular choice for drivers in New Jersey thanks to its low rates and user-friendly website. They offer a variety of discounts, including those for good drivers, military members, and students. Geico also provides a mobile app that makes it easy to manage your policy and file claims.

Progressive

Progressive is another well-known insurer in New Jersey. They offer a wide range of coverage options, including specialty policies for high-risk drivers and classic cars. Progressive is also known for its innovative products, such as Snapshot, which allows drivers to earn discounts by tracking their driving habits.

Factors to Consider When Choosing a Car Insurance Company in New Jersey

Coverage Options

The first factor to consider when choosing a car insurance company is the coverage options they offer. Make sure the insurer provides the coverage you need, including liability, collision, comprehensive, and uninsured motorist protection.

Rates

Car insurance rates can vary significantly between companies. Be sure to compare quotes from multiple insurers to find the best deal. You can also ask about discounts that may be available to you, such as those for good drivers, multiple policies, or being a member of certain organizations.

Customer Service

The quality of customer service is another important factor to consider. You want to be sure that your insurer is responsive and helpful when you need them. Read online reviews to see what other customers have to say about the company’s customer service.

Types of Car Insurance Coverage in New Jersey

Liability Coverage

Liability coverage is the minimum amount of insurance required by law in New Jersey. It covers damages to other vehicles and property in the event of an accident that is your fault.

Collision Coverage

Collision coverage pays for damages to your own vehicle in the event of an accident. It is not required by law, but it is highly recommended.

Comprehensive Coverage

Comprehensive coverage pays for damages to your own vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. It is not required by law, but it is a good idea to have if you live in an area where these events are common.

Uninsured Motorist Protection

Uninsured motorist protection covers damages to your vehicle and injuries to you and your passengers if you are hit by a driver who does not have insurance. It is required by law in New Jersey.

Other Car Insurance Considerations in New Jersey

PIP Coverage

Personal Injury Protection (PIP) is a type of coverage that pays for medical expenses, lost wages, and other damages in the event of an accident, regardless of who is at fault. PIP is required by law in New Jersey.

SR-22 Coverage

An SR-22 is a document that your insurance company files with the New Jersey Motor Vehicle Commission (MVC) as proof that you have car insurance. You may need an SR-22 if you have been convicted of certain traffic violations, such as DUI or driving without insurance.

Conclusion

Choosing the right car insurance company in New Jersey is an important decision. Be sure to consider the factors discussed in this article, such as coverage options, rates, customer service, and your own individual needs. By taking the time to do your research, you can find an insurer that provides you with the protection you need at a price you can afford.

Check Out Other Articles

- How to Get a New Jersey Driver’s License

- The Ultimate Guide to Car Maintenance

- Top Things to Do in New Jersey

FAQ about Car Insurance Companies NJ

1. What are the largest car insurance companies in New Jersey?

- State Farm

- Geico

- Allstate

2. How do I choose the right car insurance company?

- Compare quotes from multiple companies

- Consider your coverage needs

- Check the company’s financial stability

3. What type of car insurance is required in New Jersey?

- Personal injury protection (PIP)

- Property damage liability (PDL)

4. How much does car insurance cost in New Jersey?

- The average cost is around $1,500 per year

5. What factors affect my car insurance premium?

- Age

- Driving history

- Vehicle type

- Credit score

6. Can I get a discount on my car insurance?

- Yes, there are many discounts available, such as:

- Multi-car discount

- Good driver discount

- Safe driver discount

7. What should I do if I have an accident?

- Call the police and your insurance company

- Get a copy of the police report

- Take photos of the damage

8. What is a deductible?

- A deductible is the amount you have to pay out of pocket before your insurance kicks in

9. How can I file a claim?

- Call your insurance company and report the claim

- Provide the necessary documentation

- Follow the claims process

10. How can I cancel my car insurance?

- Call your insurance company and request a cancellation

- Return your insurance card

- You may be eligible for a refund