- Liability Insurance for Registered Nurses: Shielding Yourself from Legal Perils

-

FAQ about Liability Insurance for Registered Nurses

- What is liability insurance for registered nurses?

- Why do registered nurses need liability insurance?

- What types of incidents are covered under liability insurance?

- How much liability insurance do registered nurses need?

- How much does liability insurance cost for registered nurses?

- What are the benefits of having liability insurance?

- Are there any exclusions to liability insurance coverage?

- Do registered nurses need to carry their own liability insurance if they work in a healthcare facility?

- How can I find the right liability insurance policy for me?

- What should I do if I am sued for medical malpractice?

Liability Insurance for Registered Nurses: Shielding Yourself from Legal Perils

Introduction

Hey readers,

Are you a registered nurse (RN) navigating the complexities of your profession? If so, you know that providing exceptional patient care goes hand in hand with managing potential risks. One crucial aspect of safeguarding yourself in this line of work is liability insurance. Let’s delve into why it’s essential for RNs and explore the intricacies of this coverage.

Why Liability Insurance is Crucial for RNs

As an RN, you are entrusted with the well-being of patients, and decisions you make can have a significant impact on their lives. Even with the utmost care and diligence, unforeseen events or medical errors can occur, leading to legal actions against you. Liability insurance provides a financial safety net, protecting you from the costs and consequences of such claims.

Understanding the Coverage

Liability insurance for registered nurses typically covers two primary areas:

Malpractice Insurance

Malpractice insurance protects RNs against allegations of negligence or erroneous actions that result in patient harm. It covers legal expenses, damages awarded to the plaintiff, and settlement costs.

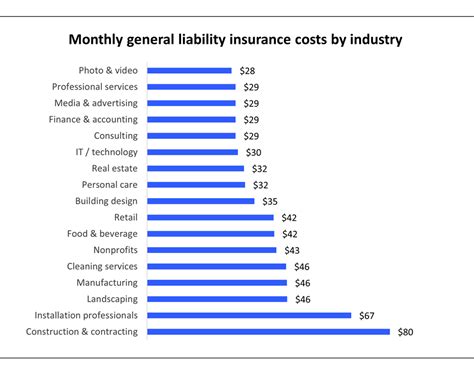

General Liability Insurance

General liability insurance provides coverage for non-medical incidents that may occur within the scope of your nursing duties. This includes accidents, property damage, or injuries sustained by patients or visitors.

Types of Claims Faced by RNs

RNs may face various types of claims, including:

Negligence Claims

Negligence claims allege that an RN failed to provide adequate care, resulting in patient injury. These claims may include missed diagnoses, medication errors, or improper treatment.

Medical Malpractice Claims

Medical malpractice claims are similar to negligence claims but involve a higher level of fault. These claims allege that an RN’s actions were grossly negligent or reckless, causing significant harm to the patient.

Wrongful Death Claims

Wrongful death claims are filed when the alleged negligence of an RN results in the death of a patient. These claims are particularly complex and can involve substantial damages.

Table: Key Features of Liability Insurance for RNs

| Feature | Description |

|---|---|

| Coverage | Malpractice and general liability insurance |

| Coverage Limits | Typically $1 million/$3 million or more |

| Deductibles | Vary depending on the policy and carrier |

| Premiums | Based on factors such as experience, specialty, and claims history |

Conclusion

Liability insurance is an indispensable tool for registered nurses, offering peace of mind and financial protection against potential legal actions. By understanding the coverage, types of claims faced, and key features of liability insurance, RNs can make informed decisions to safeguard their professional interests. Remember, securing liability insurance is not just a good idea; it’s a crucial step in safeguarding your career and providing the best possible care to your patients.

Don’t miss out on our other articles that delve into the intricacies of liability insurance and provide valuable insights into protecting your nursing practice.

FAQ about Liability Insurance for Registered Nurses

What is liability insurance for registered nurses?

- Liability insurance protects nurses from financial losses resulting from negligence or errors in their professional practice.

Why do registered nurses need liability insurance?

- Nurses face a high risk of being sued for malpractice due to the nature of their work. Liability insurance provides a safety net against costly lawsuits.

What types of incidents are covered under liability insurance?

- Coverage typically includes claims for:

- Medical malpractice

- Negligence

- Errors and omissions

- False accusations

How much liability insurance do registered nurses need?

- The amount of coverage you need depends on your individual circumstances. It’s advisable to consult with an insurance professional to determine the right level for you.

How much does liability insurance cost for registered nurses?

- Premiums vary depending on factors such as:

- Years of experience

- Practice specialty

- History of claims

- Amount of coverage chosen

What are the benefits of having liability insurance?

- Provides financial protection against lawsuits

- Gives peace of mind and allows you to focus on providing quality patient care

- May be required by employers or healthcare facilities

Are there any exclusions to liability insurance coverage?

- Yes, most policies exclude coverage for:

- Intentional acts

- Criminal behavior

- Exclusions specified in the policy

Do registered nurses need to carry their own liability insurance if they work in a healthcare facility?

- While some healthcare facilities may provide limited coverage, it’s often advisable to carry your own personal liability insurance to ensure adequate protection.

How can I find the right liability insurance policy for me?

- Compare quotes from multiple insurance companies

- Consult with a broker or agent

- Read the policy carefully and understand the coverage

What should I do if I am sued for medical malpractice?

- Notify your insurance company immediately

- Do not admit fault or discuss the case with the plaintiff’s attorney

- Seek legal advice from an attorney experienced in medical malpractice defense