- Introduction

- Types of Life Insurance Policies for Parents Over 70

- Factors to Consider When Choosing a Policy

- Benefits of a Life Insurance Policy for Parents Over 70

- Table: Life Insurance Options for Parents Over 70

- Conclusion

-

FAQ about Life Insurance Policy for Parents Over 70

- 1. Can I still get life insurance if I’m over 70?

- 2. How much life insurance do I need?

- 3. What types of life insurance are available for seniors?

- 4. How much does life insurance cost for seniors?

- 5. Are there health requirements for life insurance for seniors?

- 6. Can I get life insurance if I have health problems?

- 7. What is the difference between term life and whole life insurance?

- 8. What is final expense insurance?

- 9. Are there any tax benefits to buying life insurance?

- 10. Where can I get life insurance for seniors?

Introduction

Hey there, readers! As we navigate the golden years of life, it’s crucial to ensure that our loved ones are taken care of in the event of our passing. A life insurance policy for parents over 70 can provide peace of mind and financial stability for your family when you’re no longer there. Let’s delve into the benefits and considerations of getting a life insurance policy for your aging parents.

Types of Life Insurance Policies for Parents Over 70

Term Life Insurance

- Fixed coverage amount for a specific number of years

- Premiums are typically lower than whole life insurance

- Suitable for short-term financial needs or supplementing existing coverage

Whole Life Insurance

- Coverage lasts for the insured’s entire life

- Premiums are higher but stable over time

- Builds cash value that can be borrowed against or withdrawn

Final Expense Insurance

- Designed specifically to cover funeral and burial expenses

- Often has simplified underwriting and lower premiums

- Can provide peace of mind and reduce the financial burden on loved ones

Factors to Consider When Choosing a Policy

Age and Health

The older your parents are, the more expensive the premiums will be. Pre-existing medical conditions can also affect coverage and premiums.

Coverage Amount

Determine the amount of coverage needed to cover final expenses, outstanding debts, and any additional financial support desired.

Premiums

Consider the monthly or annual premiums that your parents can afford. Term life insurance generally has lower premiums, while whole life insurance has higher but stable premiums.

Benefits of a Life Insurance Policy for Parents Over 70

Financial Protection for Loved Ones

In the event of your parents’ passing, a life insurance policy provides a lump sum payment that can cover expenses such as funeral costs, outstanding debts, and any additional financial support needed by your family.

Peace of Mind

Knowing that your parents have a life insurance policy can give you and your family peace of mind. It eliminates the financial burden and allows you to focus on grieving and supporting each other during a difficult time.

Potential Legacy

Some life insurance policies, particularly whole life insurance, accumulate cash value over time. This cash value can be used as a source of income or to provide a legacy for your loved ones.

Table: Life Insurance Options for Parents Over 70

| Policy Type | Coverage Duration | Premiums | Cash Value |

|---|---|---|---|

| Term Life | Fixed number of years | Typically lower | None |

| Whole Life | Entire lifetime | Higher but stable | Builds over time |

| Final Expense | Funeral and burial expenses | Lower with simplified underwriting | None |

Conclusion

Getting a life insurance policy for parents over 70 is a thoughtful gesture that can provide financial support and peace of mind for your family in the future. By carefully considering the types of policies, coverage amounts, and premiums, you can ensure that your loved ones are well-protected in their golden years. Don’t hesitate to reach out to an insurance agent to learn more about your options and find the best policy for your parents’ needs.

Be sure to check out our other articles on senior health and financial planning to help you navigate the challenges and opportunities of aging.

FAQ about Life Insurance Policy for Parents Over 70

1. Can I still get life insurance if I’m over 70?

Yes, you can still get life insurance over the age of 70, but the policies and options available may be different compared to younger applicants.

2. How much life insurance do I need?

The amount of life insurance you need depends on several factors, such as your income, debts, and family’s financial needs. It’s recommended to consult with a financial advisor to determine the right coverage for you.

3. What types of life insurance are available for seniors?

There are several types of life insurance available for seniors, including term life insurance, whole life insurance, and final expense insurance. Each type has its own benefits and drawbacks, so it’s important to consider your individual needs when choosing.

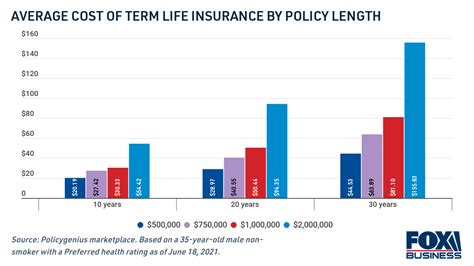

4. How much does life insurance cost for seniors?

The cost of life insurance for seniors depends on several factors, including your age, health, and policy type. Generally, premiums for seniors are higher compared to younger applicants.

5. Are there health requirements for life insurance for seniors?

Yes, most life insurance policies for seniors require a medical exam to assess your health and determine your risk level. The more health conditions you have, the higher your premiums may be.

6. Can I get life insurance if I have health problems?

Yes, you can still get life insurance if you have health problems. However, the cost of your policy may be higher, and the coverage options available may be limited.

7. What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period of time, while whole life insurance provides coverage for your entire life. Whole life insurance also has a cash value component that grows over time.

8. What is final expense insurance?

Final expense insurance is a type of life insurance designed to cover funeral and burial expenses. It is typically available in smaller coverage amounts and is more affordable than traditional life insurance policies.

9. Are there any tax benefits to buying life insurance?

Yes, there are tax benefits to buying life insurance. The death benefit is generally tax-free to your beneficiaries, and the cash value component of whole life insurance grows tax-deferred.

10. Where can I get life insurance for seniors?

You can get life insurance for seniors through insurance agents, online providers, or your employer. It’s a good idea to compare quotes from multiple providers to find the best coverage and rates for your needs.