- Motorcycle Insurance Prices: A Guide for Riders

- Introduction

- Factors Influencing Motorcycle Insurance Prices

- Saving on Motorcycle Insurance Prices

- Breakdown of Motorcycle Insurance Costs

- Conclusion

-

FAQ about Motorcycle Insurance Prices

- What factors affect motorcycle insurance prices?

- How can I get a cheaper motorcycle insurance policy?

- What is the average cost of motorcycle insurance?

- How often should I review my motorcycle insurance policy?

- What happens if I cancel my motorcycle insurance policy?

- Can I get motorcycle insurance if I have a bad driving record?

- Do I need to have motorcycle insurance if I only ride my motorcycle occasionally?

- What types of coverage are included in a motorcycle insurance policy?

- How can I find the best motorcycle insurance policy for me?

Motorcycle Insurance Prices: A Guide for Riders

Introduction

Hey readers, are you a motorcycle enthusiast eager to hit the open road? If so, you’ll need to consider protecting your ride with motorcycle insurance. To help you navigate the complexities of motorcycle insurance prices, we’ve compiled this comprehensive guide.

Factors Influencing Motorcycle Insurance Prices

Rider Profile

- Age: Younger riders typically pay higher premiums due to their increased risk of accidents.

- Experience: Seasoned riders with a clean driving record often qualify for lower rates.

- Location: Insurance rates can vary based on factors such as traffic congestion and crime rates in your area.

Motorcycle Details

- Value: The higher the value of your motorcycle, the higher your insurance premium will likely be.

- Engine size: Larger engines generally equate to higher premiums.

- Safety features: Motorcycles equipped with anti-lock brakes, airbags, and other safety features may qualify for discounts.

Coverage Variables

- Coverage type: Comprehensive coverage, which includes protection against comprehensive and collision damages is more expensive than liability coverage.

- Deductible: A higher deductible will lower your monthly premium but increase the amount you pay out-of-pocket in the event of a claim.

Saving on Motorcycle Insurance Prices

Shop Around

Don’t settle for the first insurance quote you receive. Take the time to compare rates from multiple companies to find the most competitive deal.

Discounts and Bundles

Ask your insurance provider about discounts available for things like safe riding courses, motorcycle safety gear, and bundling your motorcycle insurance with other policies.

Maintain a Good Riding Record

Your driving history is a major factor in determining your insurance premiums. Avoid traffic violations and accidents to keep your rates low.

Breakdown of Motorcycle Insurance Costs

| Motorcycle Value | Coverage Type | Deductible | Monthly Premium | Annual Premium |

|---|---|---|---|---|

| $5,000 | Liability | $500 | $50 | $600 |

| $10,000 | Comprehensive | $1,000 | $100 | $1,200 |

| $15,000 | Collision | $2,000 | $150 | $1,800 |

Conclusion

Finding the right motorcycle insurance coverage at an affordable price is essential for protecting your ride and your finances. By considering the factors discussed above and implementing the cost-saving strategies, you can ensure that you’re getting the best possible deal on motorcycle insurance prices.

For more information and advice on motorcycle insurance, check out our other articles on:

- [Understanding the Different Types of Motorcycle Insurance](link to article)

- [How to Lower Your Motorcycle Insurance Rates](link to article)

- [What to Do If You’re Involved in a Motorcycle Accident](link to article)

FAQ about Motorcycle Insurance Prices

What factors affect motorcycle insurance prices?

- Age, gender, and years of riding experience

- Motorcycle make, model, and engine size

- Location of the policyholder and where the motorcycle is garaged

- Driving history and claims experience

- Amount of coverage selected

How can I get a cheaper motorcycle insurance policy?

- Take a motorcycle safety course

- Increase your deductible

- Bundle your motorcycle insurance with other policies

- Park your motorcycle in a secure location

- Install anti-theft devices

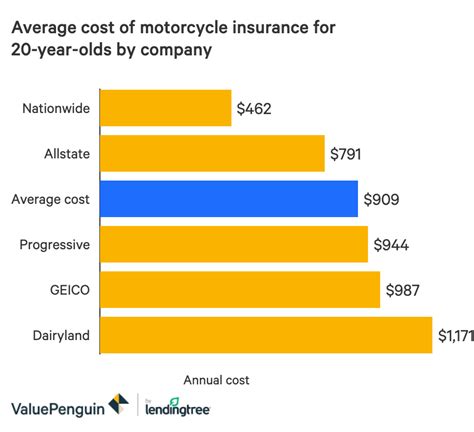

What is the average cost of motorcycle insurance?

The average cost of motorcycle insurance varies depending on many factors, but it generally ranges from $500 to $1,500 per year.

How often should I review my motorcycle insurance policy?

You should review your motorcycle insurance policy annually to ensure that you have the right coverage and that you are getting the best possible rate.

What happens if I cancel my motorcycle insurance policy?

If you cancel your motorcycle insurance policy, you will not be covered in the event of an accident. You may also have to pay a cancellation fee.

Can I get motorcycle insurance if I have a bad driving record?

Yes, you can get motorcycle insurance even if you have a bad driving record. However, you may have to pay a higher premium.

Do I need to have motorcycle insurance if I only ride my motorcycle occasionally?

Yes, in most states, all motorcycles are required to be insured.

What types of coverage are included in a motorcycle insurance policy?

Common types of coverage found in a motorcycle insurance policy include:

- Collision coverage

- Comprehensive coverage

- Liability coverage

How can I find the best motorcycle insurance policy for me?

The best way to find the best motorcycle insurance policy for you is to shop around and compare quotes from multiple insurance companies.