- New Jersey Car Insurance Companies: A Comprehensive Guide

-

FAQ about New Jersey Car Insurance Companies

- 1. What are the minimum car insurance requirements in New Jersey?

- 2. How much does car insurance cost in New Jersey?

- 3. What factors affect my car insurance rates?

- 4. Who are the major car insurance companies in New Jersey?

- 5. How can I compare car insurance quotes?

- 6. What are the benefits of having car insurance?

- 7. What happens if I don’t have car insurance in New Jersey?

- 8. How can I find affordable car insurance in New Jersey?

- 9. How can I file a car insurance claim in New Jersey?

- 10. What should I do if I am in a car accident in New Jersey?

New Jersey Car Insurance Companies: A Comprehensive Guide

Hello, Readers!

Navigating the car insurance landscape in New Jersey can be overwhelming, with countless companies vying for your attention. This comprehensive guide is here to help you make informed decisions and find the best car insurance coverage for your needs.

Understanding New Jersey’s Car Insurance Requirements

Every driver in New Jersey must maintain the following minimum levels of car insurance:

- Bodily Injury Liability: $15,000 per person, $30,000 per accident

- Property Damage Liability: $5,000 per accident

Choosing the Right New Jersey Car Insurance Company

Company Reputation

Research the reputation of different car insurance companies in New Jersey. Read online reviews and check ratings from organizations like J.D. Power and Associates or the Better Business Bureau.

Coverage Options

Compare the coverage options offered by different companies to ensure you have adequate protection. Consider additional coverage such as collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

Price and Discounts

The cost of car insurance varies significantly between companies. Get quotes from multiple providers and compare their rates. Look for discounts that apply to you, such as multi-policy, safe driver, and low-mileage discounts.

Additional Considerations for New Jersey Drivers

High-Risk Drivers

Drivers with poor driving records or a history of accidents may face higher insurance premiums. Explore options for high-risk car insurance programs or consider purchasing additional liability coverage.

Young Drivers

Young drivers typically pay higher insurance rates due to their lack of experience. Encourage young drivers to take defensive driving courses and maintain a clean driving record to reduce their premiums.

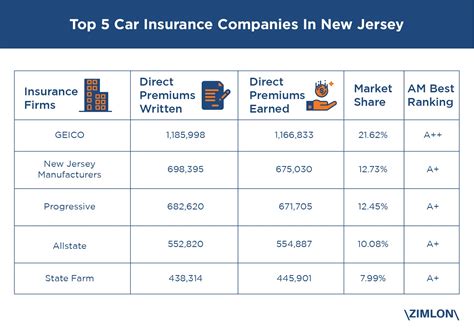

Comparative Table of New Jersey Car Insurance Companies

| Company | Coverage Options | Price | Discounts |

|---|---|---|---|

| Geico | Comprehensive, Collision, Liability | Affordable | Multi-policy, safe driver |

| Progressive | Uninsured/Underinsured Motorist, PIP | Competitive | Good student, low-mileage |

| State Farm | Roadside Assistance, Rental Car Coverage | Moderate | Homeowners, multi-car |

| USAA | Military-Specific Coverage, Low Rates | Excellent | Loyalty, safe driving |

| Allstate | Identity Theft Protection, Accident Forgiveness | High | New customer, paperless billing |

Conclusion

Choosing the right car insurance company in New Jersey is essential for protecting your financial well-being and ensuring peace of mind while on the road. By carefully considering the factors discussed in this guide, you can find the best coverage at the most competitive price.

If you’re still not sure which company to choose, check out our other informative articles on car insurance in New Jersey. We cover topics like high-risk insurance, comparing quotes, and understanding your policy.

FAQ about New Jersey Car Insurance Companies

1. What are the minimum car insurance requirements in New Jersey?

Answer: Bodily injury liability: $15,000 per person/$30,000 per accident; Property damage liability: $5,000 per accident.

2. How much does car insurance cost in New Jersey?

Answer: The average cost of car insurance in NJ is $1,765 per year, higher than the national average.

3. What factors affect my car insurance rates?

Answer: Driving history, vehicle information, age, location, credit score, and insurance coverage.

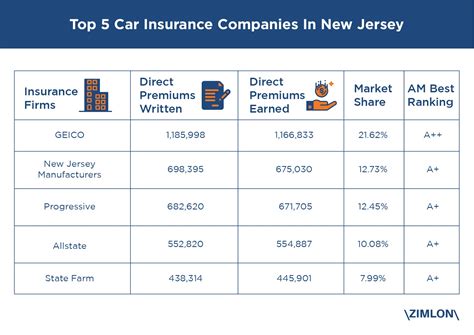

4. Who are the major car insurance companies in New Jersey?

Answer: State Farm, Allstate, Geico, Progressive, and Liberty Mutual.

5. How can I compare car insurance quotes?

Answer: Use online comparison tools, contact insurance agents, or visit company websites.

6. What are the benefits of having car insurance?

Answer: Protects you financially from accidents, medical expenses, and property damage.

7. What happens if I don’t have car insurance in New Jersey?

Answer: Driving without insurance is a crime in NJ and can result in fines, license suspension, and legal penalties.

8. How can I find affordable car insurance in New Jersey?

Answer: Shop around for quotes, increase your deductible, bundle your policies, and take advantage of discounts.

9. How can I file a car insurance claim in New Jersey?

Answer: Contact your insurance company and provide details about the accident, injuries, and property damage.

10. What should I do if I am in a car accident in New Jersey?

Answer: Stay calm, exchange information with the other driver, call the police, and report the accident to your insurance company.