Endowment plans offer a unique blend of savings and insurance, providing a structured approach to long-term financial goals. These plans, essentially a type of life insurance policy, accumulate a cash value over time, offering a lump sum payout upon maturity or earlier in case of unforeseen circumstances. Understanding the nuances of different endowment plan types, their investment strategies, and associated risks is crucial for making informed decisions aligned with individual financial objectives.

This guide delves into the intricacies of endowment plans, covering various aspects from selecting the right plan to understanding maturity benefits and tax implications. We will explore different investment options, analyze potential risks, and provide practical examples to illustrate the long-term financial benefits. Whether you’re aiming for retirement planning, children’s education, or simply securing your family’s future, this comprehensive resource will equip you with the knowledge necessary to navigate the world of endowment plans effectively.

Definition and Types of Endowment Plans

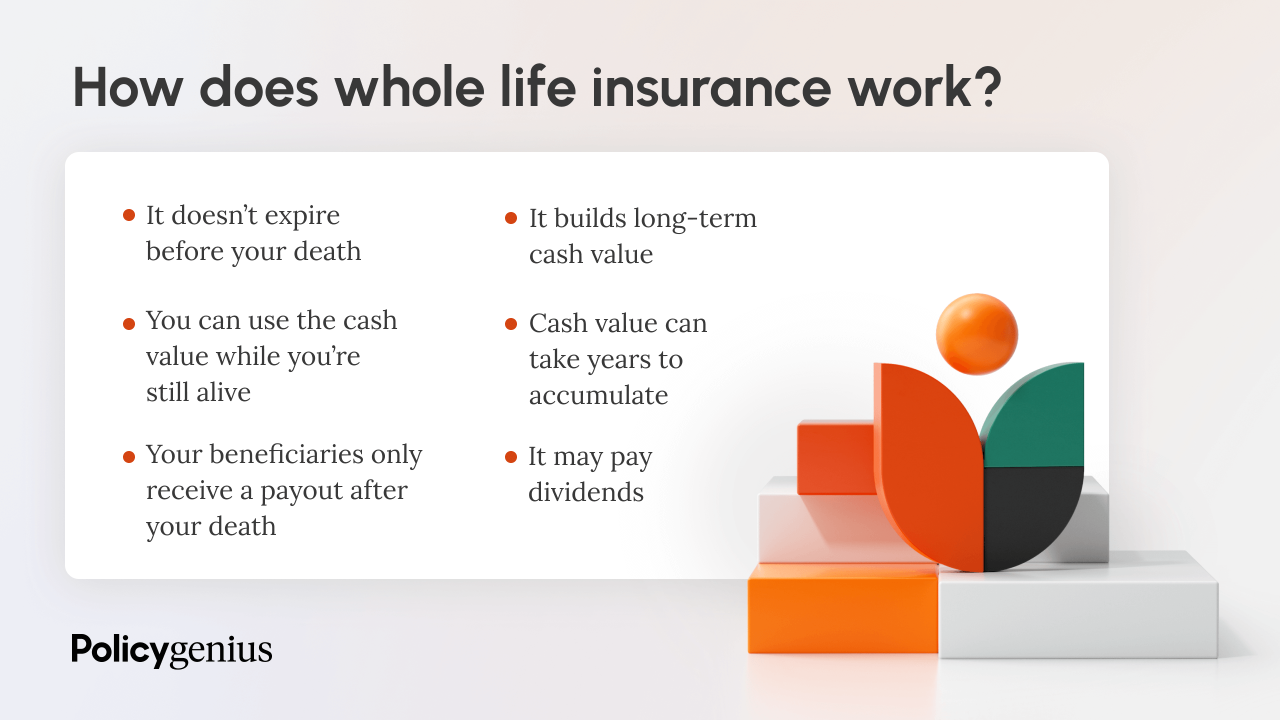

Endowment plans are a type of life insurance policy that offers a combination of savings and life cover. They provide a lump sum payout upon maturity or death, making them a popular choice for long-term financial planning and securing the future for loved ones. Understanding the nuances of different endowment plans is crucial for selecting the most suitable option based on individual financial goals.

An endowment plan works by combining a life insurance component with a savings component. You pay regular premiums over a predetermined period (the policy term). If you die during the policy term, your beneficiaries receive the death benefit (usually the sum assured). If you survive the policy term, you receive the maturity benefit, which is typically the sum assured plus accumulated bonuses (if any).

Endowment Plan Types

Several types of endowment plans cater to various needs and risk appetites. The key differences lie in the payout structure, the length of the policy term, and the level of risk involved.

The following categories represent common variations, although specific product offerings may differ across insurance providers.

- Traditional Endowment Plans: These plans offer a fixed sum assured at maturity, with the potential for bonus additions based on the insurer’s performance. They provide a predictable payout and are generally considered less risky than other types. For example, a 20-year traditional endowment plan might promise a payout of $100,000 at maturity, plus any accumulated bonuses.

- Unit-Linked Endowment Plans: These plans invest a portion of your premiums in a variety of market-linked funds. The maturity benefit depends on the performance of these investments, making it potentially higher but also riskier than traditional endowment plans. The return is not guaranteed, and fluctuations in market conditions can impact the final payout. A unit-linked plan might offer higher returns than a traditional plan in a bull market, but could result in lower returns or even losses during a bear market.

- Money-Back Endowment Plans: These plans provide periodic payouts during the policy term, in addition to the final maturity benefit. This allows policyholders to access a portion of their savings before the plan matures. For instance, a 20-year money-back plan might offer partial payouts at years 5, 10, and 15, along with the final sum assured at maturity. This provides liquidity while still offering the long-term savings benefits.

- Endowment Plans with Riders: Many endowment plans offer optional riders, which add extra benefits such as accidental death coverage, critical illness coverage, or disability benefits. These riders provide enhanced protection and peace of mind, but at an additional premium cost. For example, a rider could double the death benefit in case of accidental death.

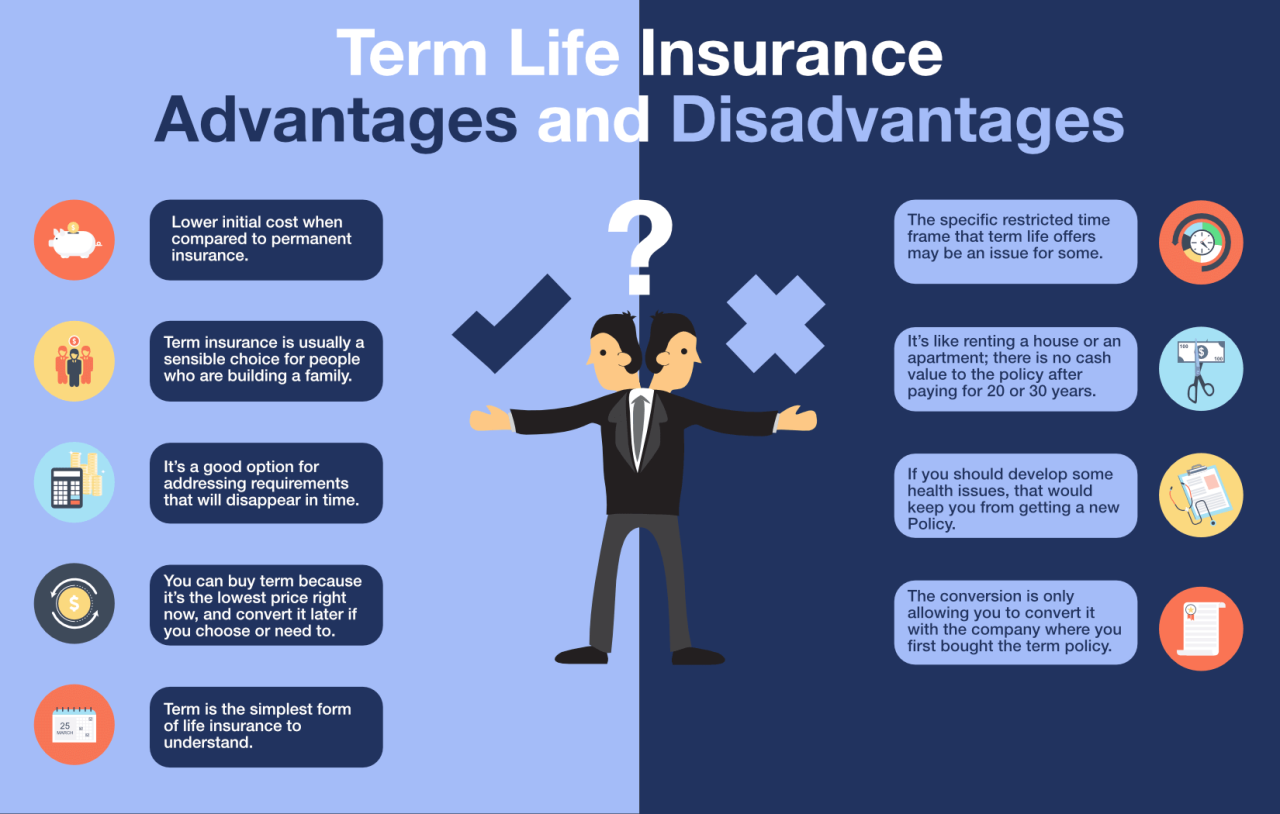

Endowment Plans Compared to Term Life Insurance

Endowment plans and term life insurance serve different purposes. While both offer death benefits, their primary focus differs.

Term life insurance provides pure death coverage for a specific period (the term). Premiums are generally lower than endowment plans, but there is no maturity benefit if the policyholder survives the term. Term insurance is ideal for those seeking affordable life cover for a defined period, such as during a mortgage repayment period. In contrast, endowment plans combine life cover with savings, providing a lump sum at maturity regardless of whether the policyholder survives the term.

| Feature | Endowment Plan | Term Life Insurance |

|---|---|---|

| Primary Purpose | Savings and Life Cover | Life Cover Only |

| Maturity Benefit | Yes (Sum Assured + Bonuses) | No |

| Premium Cost | Higher | Lower |

| Risk | Moderate (depending on type) | Low |

Investment Aspects of Endowment Plans

Endowment plans blend insurance coverage with investment components, offering a structured approach to long-term savings and wealth creation. Understanding the investment strategies, potential risks, and available options is crucial for making informed decisions. This section delves into the financial intricacies of endowment plans, highlighting key aspects for potential investors.

Investment Strategies Employed in Endowment Plans

Endowment plans typically utilize a mix of investment strategies, aiming for a balance between capital preservation and growth. A significant portion of the premiums is often invested in relatively low-risk assets like government bonds and high-quality corporate bonds to ensure stability and minimize losses. A smaller portion might be allocated to higher-yielding, but potentially more volatile, assets such as equities or real estate, depending on the specific plan and the investor’s risk profile. The exact asset allocation varies widely among different providers and plan types. Investment managers continuously monitor and adjust the portfolio based on market conditions and the plan’s objectives.

The Role of Compounding Interest in Endowment Plan Growth

Compounding interest is a cornerstone of endowment plan growth. It’s the process where returns earned on the initial investment are reinvested, generating further returns on the accumulated amount. This snowball effect accelerates wealth accumulation over time. The longer the investment horizon, the more significant the impact of compounding. For example, a consistent annual return of 5% compounded over 20 years will yield a substantially larger final value than the same return earned without compounding. The formula for compound interest is:

A = P (1 + r/n)^(nt)

where A is the future value, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

Potential Risks Associated with Endowment Plan Investments

While endowment plans offer a structured savings approach, several risks are inherent. Market fluctuations can impact the value of the underlying investments, potentially affecting the final payout. Inflation can erode the purchasing power of the accumulated funds over the long term. The guaranteed returns offered by some plans might be lower than the returns achievable through alternative investment options, particularly in periods of strong market growth. Furthermore, the surrender value (the amount received if the policy is terminated early) may be significantly lower than the total premiums paid, especially in the early years. Understanding these risks is crucial for managing expectations.

Examples of Different Investment Options Within Endowment Plans

Endowment plans offer a range of investment options tailored to different risk appetites and financial goals. The following table illustrates some examples:

| Investment Type | Risk Level | Return Potential | Time Horizon |

|---|---|---|---|

| Fixed-income securities (e.g., government bonds) | Low | Moderate | Long-term |

| Equity-linked investments (e.g., unit-linked plans) | Medium to High | High | Long-term |

| Balanced funds (mix of stocks and bonds) | Medium | Moderate to High | Long-term |

| Money market instruments | Low | Low | Short-term |

Maturity Benefits and Payout Options

Endowment plans offer a lump-sum payment upon maturity, providing a financial safety net for various life goals. Understanding the maturity benefits and available payout options is crucial for making informed decisions about your financial future. This section details the typical benefits, payout choices, and tax implications associated with endowment plan maturity.

Typical Maturity Benefits

Endowment plans typically pay out the sum assured, along with accumulated bonuses and any other applicable additions. The sum assured is the guaranteed amount stated in the policy document. Bonuses, which are declared periodically by the insurance company based on its investment performance, enhance the final payout. Some plans may also include terminal bonuses paid at maturity, further increasing the final amount received. The total maturity benefit is the sum of the sum assured, accrued bonuses, and any additional benefits as specified in the policy.

Payout Options Upon Plan Maturity, Endowment plan

Upon maturity, policyholders generally have several payout options to choose from, allowing them to tailor the payout to their specific financial needs. These options can include a lump-sum payment, where the entire maturity benefit is received at once; a phased payout, where the benefit is distributed over a predetermined period; or an annuity option, which provides regular income payments for a specified duration or for life. The choice of payout option depends on individual circumstances and financial goals.

Tax Implications of Endowment Plan Payouts

The tax implications of endowment plan payouts vary depending on the jurisdiction and the specific plan features. Generally, the maturity benefit is considered taxable income, though certain exemptions or deductions may apply. It is crucial to consult with a tax advisor to understand the tax implications specific to your situation and jurisdiction, as tax laws and regulations are subject to change. Proper tax planning is essential to maximize the net benefit received from the endowment plan.

Sample Maturity Benefit Calculation

Let’s consider a hypothetical scenario: Mr. Smith purchased a 20-year endowment plan with a sum assured of $100,000. Over the 20 years, the plan accrued simple bonuses totaling $20,000. At maturity, Mr. Smith receives a lump-sum payout. In this case, his total maturity benefit would be calculated as follows:

Total Maturity Benefit = Sum Assured + Accrued Bonuses = $100,000 + $20,000 = $120,000

Therefore, Mr. Smith would receive $120,000 upon maturity of his endowment plan. Note that this is a simplified example; actual calculations may vary depending on the specific plan terms and conditions, including the type of bonuses (simple or compound) and the presence of any additional benefits. It’s always recommended to refer to your policy document for precise calculations.

Choosing the Right Endowment Plan

Selecting the perfect endowment plan requires careful consideration of your individual financial goals and circumstances. There’s no one-size-fits-all solution, and understanding the key factors will empower you to make an informed decision. This guide provides a structured approach to help you navigate the process.

Step-by-Step Guide to Selecting an Endowment Plan

Choosing the right endowment plan involves a methodical approach. First, clearly define your financial objectives. Are you primarily seeking life insurance coverage, long-term savings, or a combination of both? Next, assess your risk tolerance. Are you comfortable with investments that carry a higher degree of risk for potentially greater returns, or do you prefer a more conservative approach? Once you have a clear understanding of your goals and risk tolerance, you can begin comparing different plans. Finally, review the terms and conditions carefully, paying close attention to fees, charges, and the plan’s performance history. Don’t hesitate to seek professional financial advice if needed.

Factors to Consider When Comparing Endowment Plans

Several crucial factors influence the suitability of an endowment plan. These include the premium amount, the maturity value, the investment options available, the level of risk involved, the policy’s flexibility, and the reputation and financial stability of the insurance provider. Careful comparison across these factors is essential for making a well-informed decision.

Key Decision-Making Criteria

Before making a choice, carefully evaluate these key aspects:

- Financial Goals: Determine your primary objective – life insurance, savings, or both. Consider the desired maturity amount and the time horizon for achieving your goals.

- Premium Affordability: Assess whether the regular premium payments align with your budget and financial capabilities. Consider the impact on your overall financial planning.

- Risk Tolerance: Evaluate your comfort level with varying investment options. Higher-risk investments may offer greater returns but also involve greater potential losses.

- Maturity Benefits and Payout Options: Understand the payout options available upon maturity and choose the one that best aligns with your needs. Consider lump-sum payments versus phased payouts.

- Insurance Provider’s Reputation and Financial Stability: Research the insurer’s financial strength and track record to ensure the security of your investment.

- Flexibility and Surrender Value: Explore the policy’s flexibility, including the possibility of partial withdrawals or the surrender value if you need to cancel the policy before maturity.

- Charges and Fees: Carefully review all charges and fees associated with the plan to ensure transparency and avoid hidden costs.

Illustrative Examples of Individuals Benefiting from Different Endowment Plans

The ideal endowment plan varies greatly depending on individual circumstances.

- A young professional saving for retirement: A long-term endowment plan with a higher-risk investment option might be suitable, offering potential for significant growth over several decades.

- A parent securing their child’s future education: A plan with a fixed maturity value and guaranteed returns could be a more appropriate choice, ensuring a predictable sum available for education expenses.

- An individual seeking a combination of life insurance and savings: A plan that offers a substantial death benefit along with a savings component could provide both protection and financial security.

- A person nearing retirement seeking a secure investment: A conservative endowment plan with a lower-risk investment strategy might be preferred, providing a stable return while minimizing the risk of capital loss.

Illustrative Examples and Case Studies

Understanding the practical application of endowment plans is crucial. The following examples illustrate the long-term benefits and demonstrate how these plans can help achieve specific financial goals. We will examine hypothetical scenarios, a case study, and a real-world example to provide a comprehensive understanding.

Hypothetical Endowment Plan Growth Scenario

Imagine investing $10,000 annually in an endowment plan with a projected annual growth rate of 6%. After 20 years, assuming consistent contributions and growth, the plan’s maturity value could reach approximately $367,856. This demonstrates the power of compounding over time. This calculation assumes a fixed interest rate, which is not always guaranteed in reality; market fluctuations will influence the actual return.

This hypothetical example showcases the potential for significant long-term growth through consistent investment and the benefits of compounding. While this is a simplified scenario, it highlights the potential returns associated with long-term endowment plan investments.

Endowment Plan Benefitting a Specific Financial Goal

This case study focuses on a family aiming to fund their child’s higher education. By starting an endowment plan when their child was born and contributing regularly, they accumulated a substantial sum by the time their child reached college age. The consistent contributions, coupled with the plan’s growth, enabled them to cover a significant portion of the tuition fees, reducing their financial burden and ensuring their child’s educational aspirations were met. The specific amounts invested and the final sum accumulated would depend on the chosen plan and market conditions, but the principle of long-term planning is highlighted here.

Real-World Example of Enhanced Family Financial Security

A family in their early thirties used an endowment plan to secure their financial future. They chose a plan with a life insurance component, providing financial protection in case of unforeseen circumstances. This provided peace of mind, knowing that their family would be financially supported even if one of them were to pass away. Furthermore, the maturity benefit allowed them to fund their children’s education and provided a comfortable retirement nest egg. This demonstrates the dual benefits of financial protection and long-term savings provided by an endowment plan.

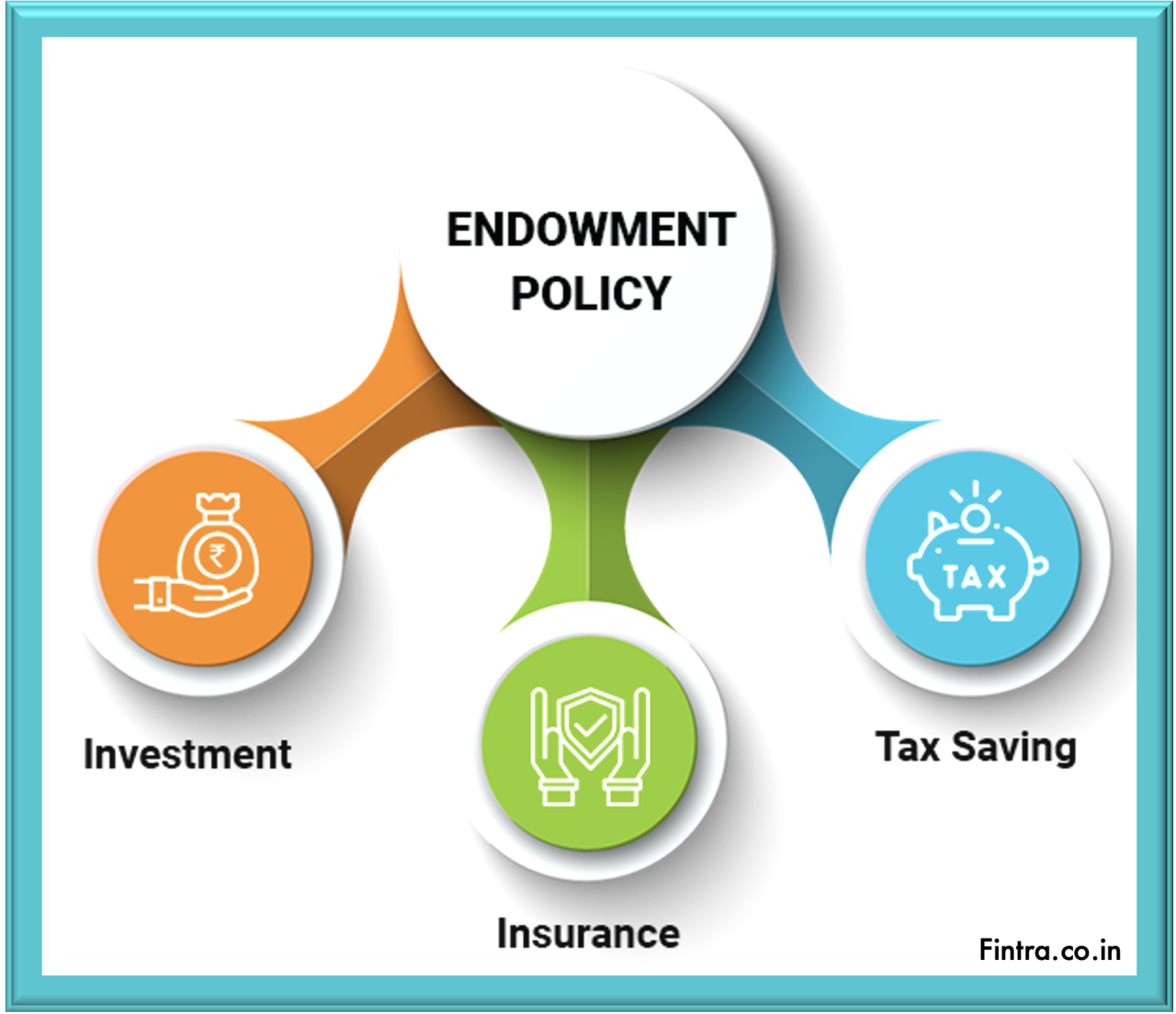

Infographic Depicting Key Features of a Sample Endowment Plan

The infographic would be visually appealing, using a combination of charts, icons, and concise text. A central image might depict a growing tree, symbolizing growth and longevity. A pie chart would illustrate the allocation of funds, showing the proportions invested in different asset classes (e.g., equities, bonds, etc.). Key features, such as guaranteed maturity benefits, life insurance coverage (if applicable), and flexible payout options, would be highlighted using clear icons and short descriptions. A timeline would visually represent the investment period and the accumulation of funds over time. A table would present a comparison of the investment amount, projected growth, and maturity value at different time intervals. The color scheme would be professional and calming, using a combination of blues and greens to evoke feelings of security and stability. The overall design would aim for clarity and simplicity, ensuring that the key information is easily understandable at a glance.

Concluding Remarks

Ultimately, the choice of an endowment plan hinges on individual financial circumstances, risk tolerance, and long-term objectives. While offering a structured savings approach with insurance coverage, careful consideration of investment strategies, maturity options, and tax implications is crucial for maximizing returns and achieving desired financial outcomes. By understanding the various plan types, comparing features, and aligning your choice with your specific needs, you can harness the potential of an endowment plan to build a secure financial future.

Frequently Asked Questions

What is the difference between an endowment plan and a term life insurance policy?

Endowment plans combine savings and insurance, offering a maturity benefit along with life cover. Term life insurance provides only death benefit during a specific term, with no savings component.

Can I withdraw money from my endowment plan before maturity?

Some endowment plans allow partial withdrawals, but this may impact the final maturity benefit. Check the specific policy terms for details on withdrawal options and penalties.

Are endowment plan returns guaranteed?

While some plans offer guaranteed minimum returns, the actual returns can vary depending on the investment performance of the underlying assets. It’s important to understand the risk involved.

What are the tax implications of endowment plan payouts?

Tax implications vary depending on jurisdiction and policy type. Consult a financial advisor for specific tax advice related to your plan and region.