Whole life insurance offers a unique blend of life insurance coverage and a cash value savings component. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection, building cash value that grows tax-deferred over time. This growth potential makes whole life insurance an attractive option for long-term financial planning and estate preservation. Understanding the nuances of policy types, cost implications, and potential benefits is crucial for making an informed decision.

This guide delves into the intricacies of whole life insurance, exploring its various facets. We will examine different policy types, compare premiums to other insurance options, and analyze the long-term financial implications. Furthermore, we will discuss the role of whole life insurance in estate planning, offering practical strategies and illustrative examples to enhance your understanding.

Defining Whole Life Insurance

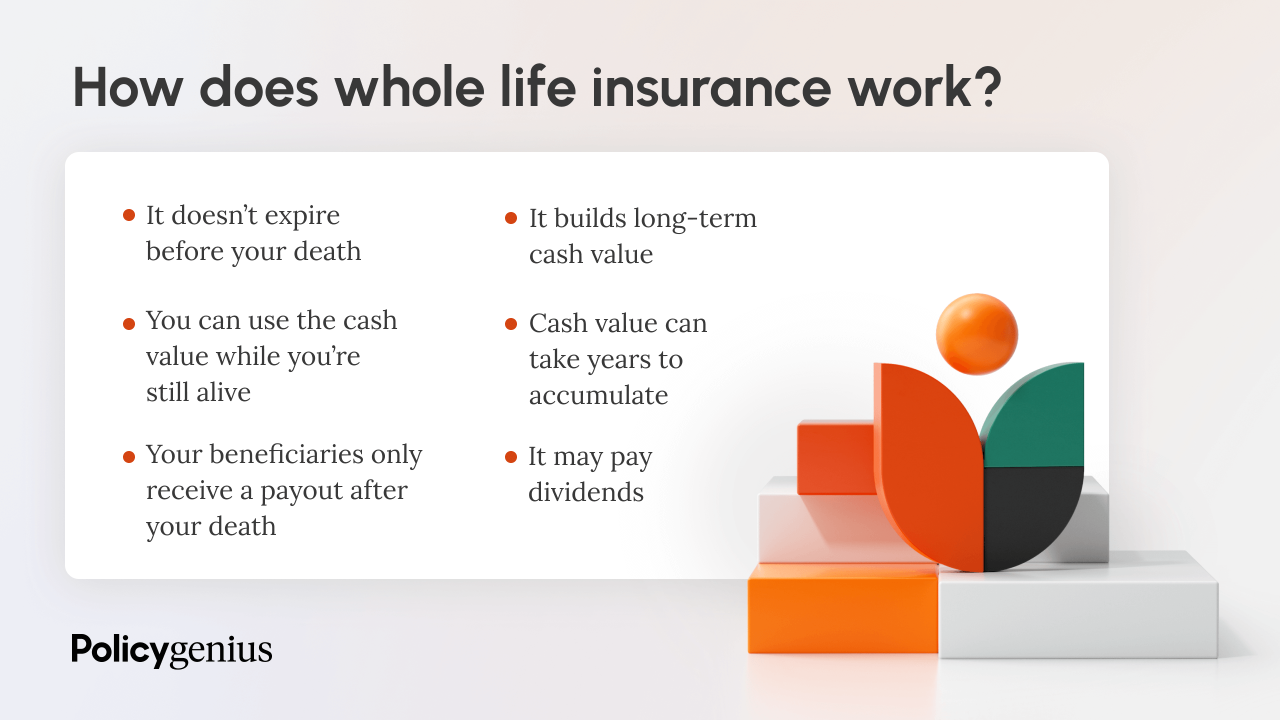

Whole life insurance provides lifelong coverage, offering a guaranteed death benefit payable to your beneficiaries upon your passing. Unlike term life insurance, which covers a specific period, whole life insurance remains in effect as long as premiums are paid. This permanence is a key distinguishing feature, offering peace of mind knowing your loved ones will always be protected financially.

Whole life insurance policies also accumulate a cash value component that grows tax-deferred over time. This cash value can be borrowed against or withdrawn under certain circumstances, providing financial flexibility. However, it’s crucial to understand the implications of borrowing or withdrawing from the cash value, as it can reduce the death benefit and impact the policy’s overall growth.

Whole Life vs. Term Life Insurance

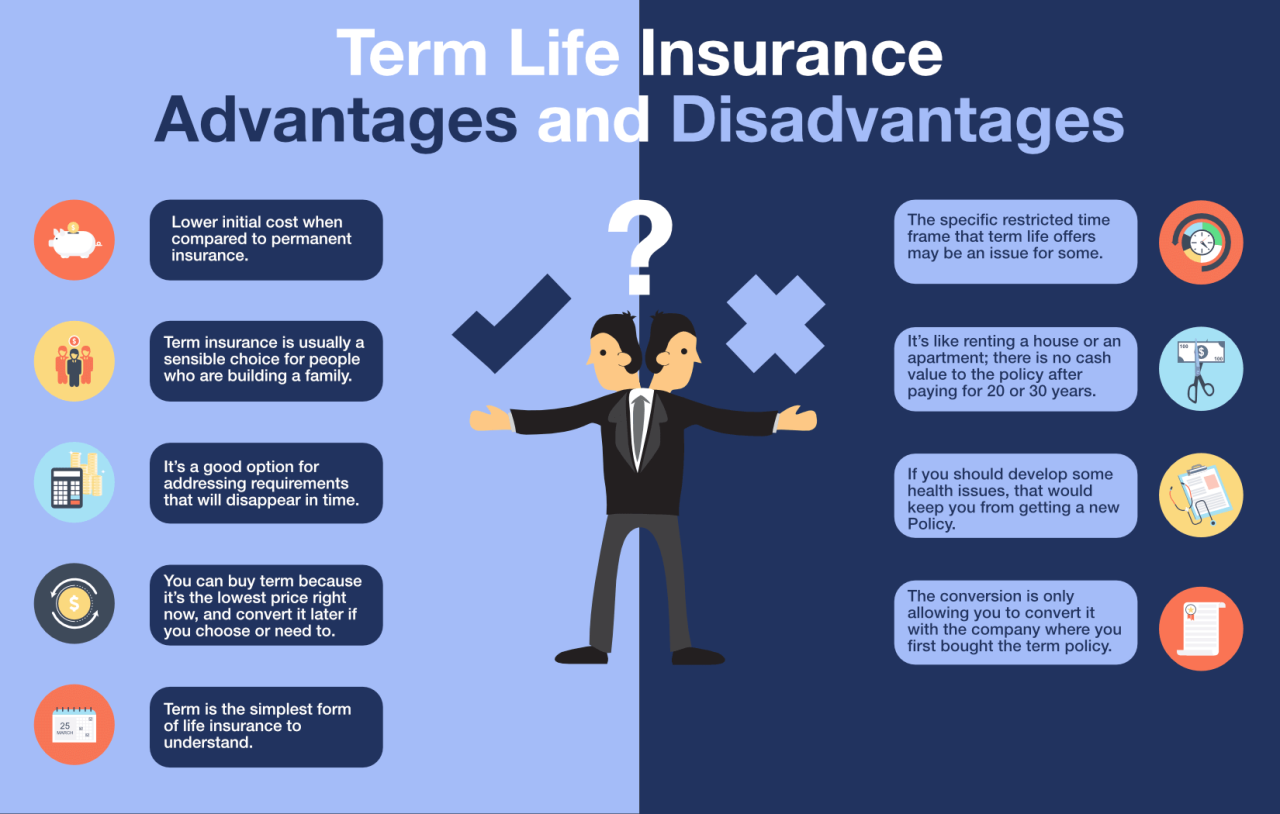

The primary difference lies in the duration of coverage. Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years), after which the policy expires unless renewed. Whole life insurance, conversely, offers lifelong coverage, providing continuous protection. Term life insurance is generally less expensive than whole life insurance, making it a suitable option for those seeking affordable coverage for a defined period, such as during child-rearing years or mortgage repayment. Whole life insurance, while more expensive, offers permanent coverage and a cash value component. The choice between term and whole life insurance depends heavily on individual financial circumstances and long-term goals.

Cash Value Component in Whole Life Insurance

The cash value component of a whole life insurance policy is a significant feature. It’s essentially a savings account that grows tax-deferred over time, funded by a portion of your premiums. The growth rate is typically linked to the insurer’s investment performance, but is generally lower than other investment vehicles, like stocks or mutual funds. This cash value can be accessed through loans or withdrawals, although it’s important to understand the potential tax implications and impact on the death benefit. For example, if you borrow against the cash value, the loan will reduce the death benefit payable to your beneficiaries. Similarly, withdrawing cash value may impact the policy’s overall growth and future death benefit. It’s crucial to consult with a financial advisor to fully understand the implications of accessing your cash value.

Types of Whole Life Insurance Policies

Whole life insurance policies come in various forms. Participating whole life insurance policies offer the potential for dividends, which are essentially a share of the insurer’s profits. These dividends can be taken as cash, used to reduce premiums, or reinvested to increase the cash value. Non-participating whole life insurance policies do not offer dividends. The premiums for non-participating policies are generally lower than for participating policies, reflecting the absence of potential dividend payments. The choice between participating and non-participating policies depends on individual risk tolerance and financial goals. A participating policy offers the potential for higher returns but with a degree of uncertainty, while a non-participating policy provides predictable premiums and a guaranteed death benefit.

Costs and Benefits of Whole Life Insurance

Whole life insurance offers lifelong coverage, but understanding its cost structure and potential financial implications is crucial before making a purchase. This section will compare whole life premiums to other insurance types, explore long-term financial aspects, analyze tax implications, and highlight potential downsides.

Premium Comparisons

Whole life insurance premiums are generally higher than term life insurance premiums. This is because whole life provides lifelong coverage and builds cash value, unlike term life, which only covers a specified period. The premium for a whole life policy remains level throughout the policy’s duration, offering predictability. Conversely, term life premiums tend to increase at renewal or may even become unaffordable as the policyholder ages. Universal life and variable life insurance premiums can also vary, depending on market performance and the policy’s design. The specific premium amount will depend on factors like age, health, coverage amount, and the insurance company.

Long-Term Financial Implications, Whole life insurance

Whole life insurance’s primary long-term financial implication is the accumulation of cash value. This cash value grows tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. This growth can be used for various purposes, such as supplemental retirement income, education funding, or a down payment on a house. However, the rate of cash value growth is generally modest and depends on the policy’s investment performance, which may be lower than other investment options. It’s important to remember that cash value growth is not guaranteed and can fluctuate. For example, a $100,000 whole life policy might accumulate $50,000 in cash value over 20 years, but this is highly dependent on the policy’s specifics and the insurer’s performance.

Tax Advantages and Disadvantages

One significant tax advantage is the tax-deferred growth of the cash value. The death benefit is generally tax-free to beneficiaries. However, withdrawals from the cash value may be subject to income tax and potential penalties if taken before age 59 1/2, depending on the specific policy and the IRS rules. Moreover, while premiums are not tax-deductible, the policy’s cash value may be used as collateral for loans, potentially impacting your overall tax situation.

Potential Downsides and Risks

While offering lifelong coverage and cash value accumulation, whole life insurance has potential downsides. High premiums can be a significant financial burden, especially during early policy years. The cash value growth may not outperform other investment vehicles, limiting its potential for significant wealth accumulation. Furthermore, the policy’s complexity can make it difficult to understand and manage effectively. Finally, surrendering the policy early can result in significant financial penalties.

Whole Life vs. Term Life Insurance

| Feature | Whole Life | Term Life |

|---|---|---|

| Premium Costs | Higher, level premiums | Lower premiums, increase at renewal |

| Death Benefit | Guaranteed lifelong coverage | Coverage for a specified term |

| Cash Value Accumulation | Accumulates cash value tax-deferred | No cash value |

Ending Remarks

In conclusion, whole life insurance presents a multifaceted financial tool with the potential for both long-term security and wealth accumulation. While premium costs are generally higher than term life insurance, the lifelong coverage and cash value growth offer significant advantages for those seeking comprehensive financial protection and estate planning solutions. Careful consideration of individual financial goals and risk tolerance is paramount when deciding whether whole life insurance is the right choice. Thorough research and consultation with a qualified financial advisor are strongly recommended before making a purchase.

Essential FAQs

What are the common reasons people choose whole life insurance?

Common reasons include lifelong coverage, cash value accumulation for future needs (e.g., retirement, education), estate planning, and tax advantages.

Can I borrow against the cash value in my whole life insurance policy?

Yes, most whole life policies allow policyholders to borrow against the accumulated cash value. Interest charges usually apply.

How does the cash value component grow?

Cash value grows through a combination of premium payments and investment earnings, typically at a fixed or variable rate depending on the policy type.

What happens to the cash value if I cancel my policy?

The cash value may be subject to surrender charges, reducing the amount you receive. Consult your policy for details.