Term insurance provides affordable life insurance coverage for a specified period, offering peace of mind without the long-term commitments of whole life or universal life policies. Understanding its core features—coverage amount, term length, and premiums—is crucial for making an informed decision that aligns with your financial goals and family’s needs. This guide explores the intricacies of term insurance, empowering you to navigate the process with confidence.

From comparing different policy features and factors influencing premiums to selecting the right policy and understanding the claims process, we aim to demystify this essential financial tool. We’ll delve into practical tips, illustrative examples, and answer common questions, ensuring you’re well-equipped to make the best choice for your future.

Defining Term Insurance

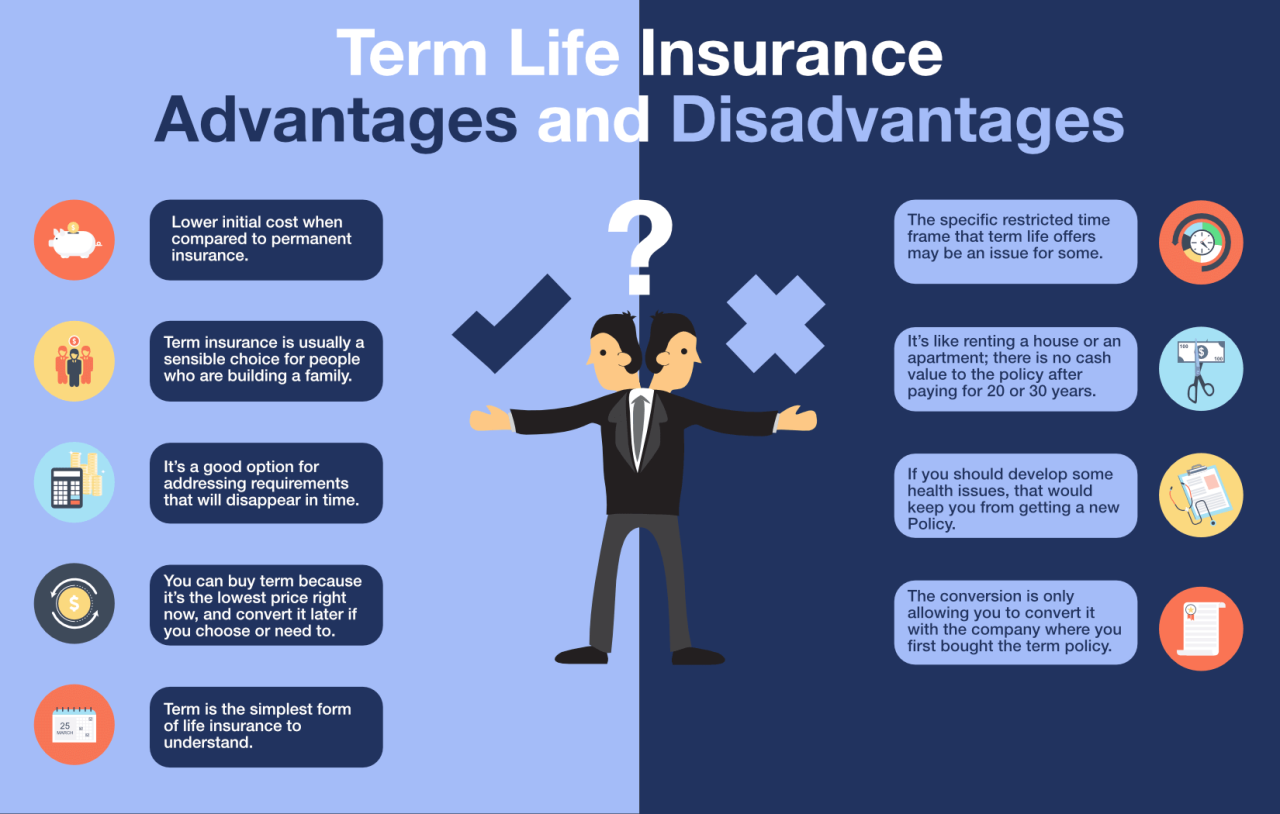

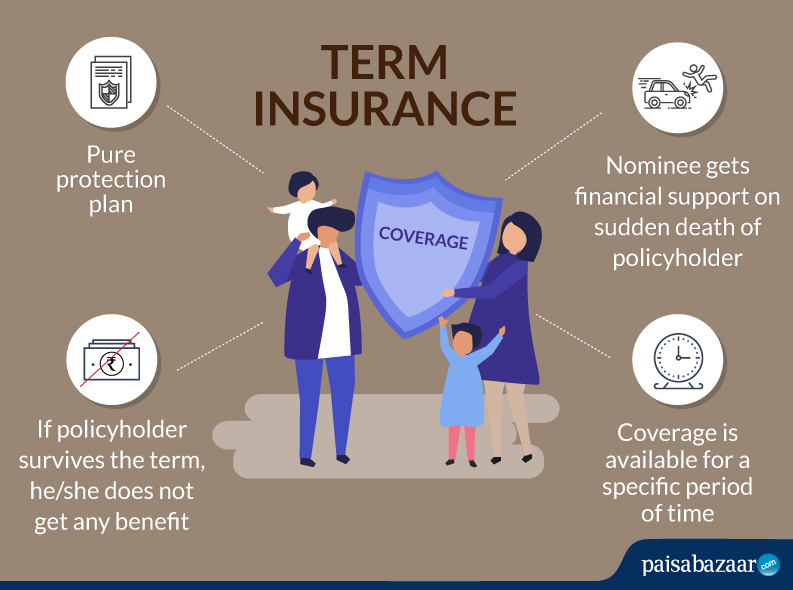

Term insurance is a straightforward and cost-effective type of life insurance designed to provide financial protection for a specific period, or “term.” It offers a guaranteed death benefit payable to your beneficiaries should you pass away during the policy’s term. Unlike other life insurance options, it doesn’t accumulate cash value, focusing solely on providing coverage for a predetermined timeframe.

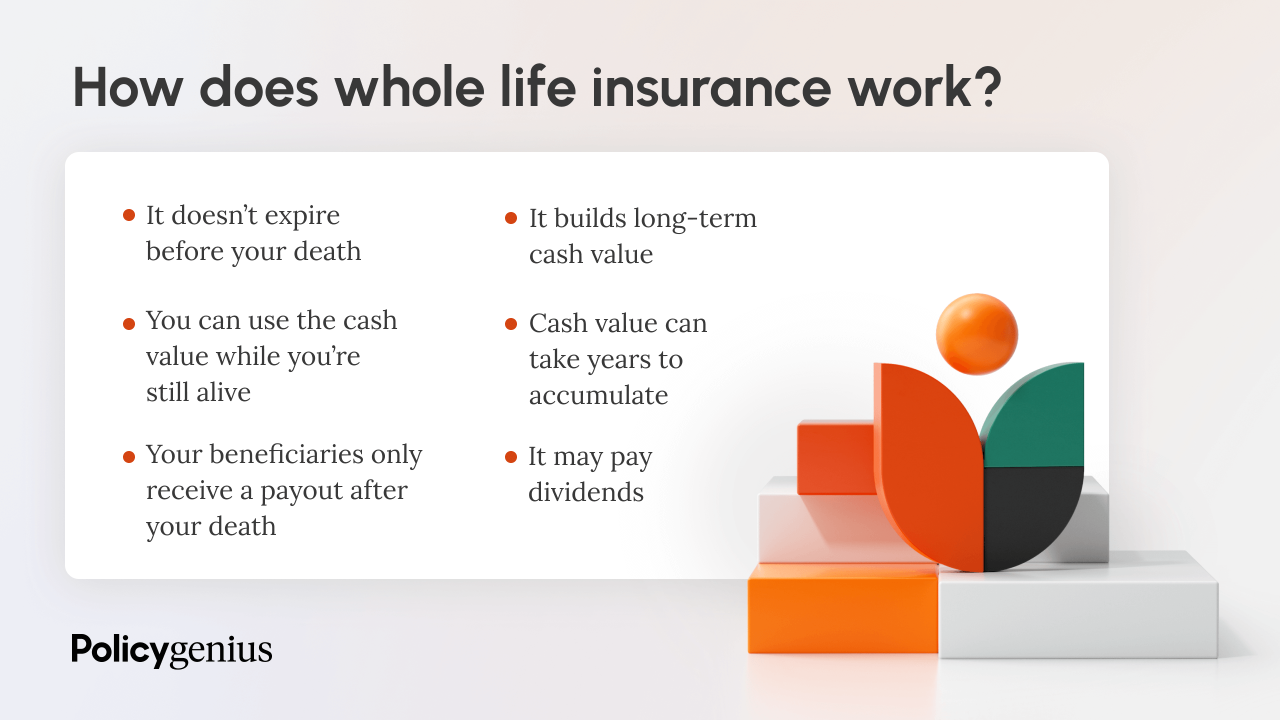

Term insurance is fundamentally different from other life insurance types because of its temporary nature. This contrasts sharply with permanent life insurance policies, such as whole life and universal life, which offer lifelong coverage and often include a cash value component that grows over time. The core difference lies in the purpose: term insurance is for temporary protection, while permanent insurance aims to provide lifelong coverage and wealth accumulation.

Term Insurance Policy Components

The key elements of a term life insurance policy are relatively simple and easily understood. Understanding these components allows for informed decision-making when choosing a policy that suits your needs and budget.

- Coverage Amount: This represents the amount of money your beneficiaries will receive upon your death during the policy’s term. The amount is chosen by the policyholder based on their financial needs and responsibilities, such as covering mortgage payments, outstanding debts, or providing for dependents.

- Term Length: This specifies the duration of the policy’s coverage. Common term lengths range from 10 to 30 years, although shorter and longer terms are also available. The chosen length should align with the period for which you need the coverage, such as until your children are financially independent or your mortgage is paid off.

- Premiums: These are the regular payments made to maintain the policy’s coverage. Premiums are calculated based on factors such as age, health, coverage amount, and term length. Generally, younger and healthier individuals qualify for lower premiums.

Differences Between Term and Other Life Insurance Types

A comparison highlights the key distinctions between term insurance and other common life insurance options. Understanding these differences is crucial in selecting the most suitable type of coverage for individual circumstances.

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20, 30 years) | Lifelong coverage | Lifelong coverage |

| Cash Value | None | Accumulates cash value | Accumulates cash value (variable) |

| Premiums | Generally lower | Generally higher and level | Can be flexible; premiums can change |

| Death Benefit | Fixed amount | Fixed amount (can increase with riders) | Can be adjusted; potentially increases with cash value growth |

Understanding Policy Features

Choosing a term insurance policy involves more than just selecting a coverage amount and term length. Understanding the various features and nuances of the policy is crucial to ensuring you have the right protection for your needs. This section will explore key policy features, highlighting their implications and importance in making an informed decision.

Policy Riders

Riders are optional add-ons that enhance the basic coverage of your term insurance policy. They provide additional protection against specific events or circumstances, often at an extra cost. Understanding the value and cost of these riders is essential for tailoring your policy to your specific risk profile. Common riders include accidental death benefit riders, which increase the death benefit payout if the insured dies due to an accident, and critical illness riders, which provide a lump-sum payment upon diagnosis of a specified critical illness. For example, an accidental death benefit rider might double the death benefit, while a critical illness rider could provide a payout equal to the sum assured upon diagnosis of cancer or a heart attack. The added cost of these riders should be weighed against the potential benefits they offer.

Policy Exclusions and Limitations

Every term insurance policy has exclusions and limitations. These are specific circumstances or events that are not covered by the policy. Understanding these exclusions is vital to avoid disappointment or financial hardship if a claim is denied. Common exclusions might include pre-existing conditions, suicide within a specified period, or death resulting from participation in high-risk activities. For example, a policy might exclude coverage for death caused by engaging in extreme sports like skydiving. Carefully reviewing the policy document to identify these exclusions and limitations is a critical step in the selection process. Ignoring these can lead to significant financial losses should an unforeseen event occur.

Term Lengths and Premium Costs

Term insurance policies are available for various durations, ranging from a few years to several decades. The term length directly impacts the premium cost. Generally, longer term lengths mean higher premiums, as the insurer is assuming a greater risk over a longer period. Shorter term lengths, while offering lower premiums, may require policy renewal in the future, which could lead to higher premiums as the insured ages. For instance, a 10-year term policy will have lower annual premiums compared to a 30-year term policy, but the 10-year policy will need to be renewed after 10 years, potentially at a significantly higher rate. Choosing the right term length involves balancing the desired coverage period with the affordability of the premiums. It’s important to consider future financial needs and potential changes in circumstances when selecting a term length.

Factors Affecting Premiums

The cost of your term life insurance premium is determined by a number of factors, all carefully assessed by the insurance company during the underwriting process. Understanding these factors can help you make informed decisions about your coverage and budget. Essentially, the insurer is assessing your risk profile to determine the likelihood of having to pay out a death benefit.

Several key elements significantly influence the price you’ll pay for your term life insurance. These factors are carefully considered by insurance companies to accurately reflect the level of risk associated with insuring an individual.

Age

Age is a primary factor influencing premium costs. As you get older, your risk of death increases, leading to higher premiums. Younger individuals generally enjoy lower premiums due to their statistically lower mortality risk. This is a fundamental principle of actuarial science underpinning insurance pricing.

Health

Your overall health plays a crucial role in determining your premium. Individuals with pre-existing health conditions or a family history of certain diseases may face higher premiums. A comprehensive medical history review is a standard part of the underwriting process. Insurers assess the potential impact of your health on your longevity and the likelihood of a claim.

Smoking Status

Smoking significantly increases the risk of various health problems, including heart disease and cancer. Consequently, smokers typically pay considerably higher premiums than non-smokers. This reflects the increased likelihood of a claim within the policy term. Many insurers offer lower premiums to those who have quit smoking and can provide evidence of cessation for a specified period.

Underwriting Processes and Premium Pricing

The underwriting process, the way an insurance company assesses your risk, directly impacts premium costs. Different insurers employ varying underwriting methods, leading to different pricing structures. Some companies may utilize simplified underwriting, requiring less extensive medical information, potentially resulting in quicker approval but potentially higher premiums. Others may conduct more thorough reviews, including medical exams and extensive questionnaires, potentially leading to more accurate risk assessment and potentially lower premiums for those deemed low-risk.

Premium Cost Comparison

The following table provides a sample comparison of term life insurance premiums for various age groups and coverage amounts. Please note that these are illustrative examples only and actual premiums will vary depending on the insurer, specific policy features, and individual risk profiles.

| Age | Coverage Amount ($1,000,000) | Annual Premium | Premium Cost per $1000 |

|---|---|---|---|

| 30 | $1,000,000 | $1,200 | $1.20 |

| 40 | $1,000,000 | $1,800 | $1.80 |

| 50 | $1,000,000 | $3,000 | $3.00 |

| 30 | $500,000 | $600 | $1.20 |

| 40 | $500,000 | $900 | $1.80 |

| 50 | $500,000 | $1,500 | $3.00 |

Choosing the Right Policy

Selecting the right term insurance policy is a crucial decision, impacting your family’s financial security in the event of your untimely demise. A well-chosen policy provides adequate coverage at a manageable cost, aligning with your individual needs and financial capabilities. This process requires careful consideration of various factors and a systematic approach.

Step-by-Step Guide to Selecting a Term Insurance Policy

This guide Artikels a structured approach to choosing a term insurance policy that best suits your circumstances. It involves assessing your needs, comparing options, and understanding the fine print.

- Assess Your Needs: Determine the amount of coverage you require. This depends on your existing liabilities (mortgage, loans), dependents’ financial needs (education, living expenses), and desired lifestyle maintenance for your family. Consider factors like inflation and future potential expenses.

- Determine Your Budget: Calculate how much you can comfortably afford to pay as a premium each month or year. This should be factored into your overall financial plan, ensuring it doesn’t strain your budget unduly. Consider using online premium calculators to estimate costs.

- Compare Policy Features: Examine different policy features offered by various insurers. Pay close attention to the coverage amount, policy term length, premium payment options, and any additional riders or benefits (like critical illness cover or accidental death benefit).

- Compare Insurers and Their Offerings: Research different insurance providers, comparing their financial stability, claim settlement ratios, customer service ratings, and the overall reputation of the company. Websites providing independent insurance reviews can be valuable resources.

- Review Policy Documents Carefully: Before making a final decision, thoroughly review all policy documents, including the policy wording, terms and conditions, and exclusions. Ensure you fully understand all aspects of the policy before signing.

Practical Tips for Comparing Insurance Providers

Effective comparison shopping is vital for securing the best value. This involves considering several key aspects beyond just the premium amount.

- Claim Settlement Ratio: This indicates the percentage of claims approved by the insurer. A higher ratio suggests a more efficient and reliable claims process. Check the insurer’s published claim settlement ratio.

- Customer Service: Read online reviews and testimonials to gauge the quality of customer service provided by different insurers. Prompt and helpful service is crucial, especially during a claim.

- Financial Stability: Check the insurer’s financial ratings from reputable agencies. A strong financial standing provides assurance that the insurer will be able to honor its commitments.

- Policy Flexibility: Some insurers offer greater flexibility in terms of premium payment options, policy term lengths, and the ability to add or remove riders.

Questions to Ask Insurance Providers

Asking the right questions can clarify uncertainties and ensure you make an informed decision.

- Details of the Claim Settlement Process: Information regarding the steps involved in filing a claim and the typical processing time should be explicitly understood.

- Policy Exclusions and Limitations: A clear understanding of situations or conditions not covered by the policy is crucial for managing expectations.

- Premium Payment Options and Flexibility: Information regarding various payment methods and the possibility of adjusting premiums based on changing circumstances should be explored.

- Additional Riders and Benefits: Inquiries about available supplementary coverages and their associated costs are necessary for comprehensive planning.

- Customer Service Availability and Responsiveness: Understanding the channels for contacting customer service and the expected response times is important for timely assistance.

Claims Process and Procedures

Filing a term insurance claim can seem daunting, but understanding the process can significantly ease the burden during a difficult time. This section Artikels the typical steps involved, common claim scenarios, and necessary documentation. The goal is to equip you with the knowledge to navigate this process effectively.

The claims process generally involves several key steps, starting with notification and culminating in the disbursement of benefits. Prompt and accurate communication with your insurance provider is crucial throughout the entire process. Remember, every insurer may have slightly different procedures, so referring to your policy documents is essential.

Claim Notification and Initial Documentation, Term insurance

The first step in filing a claim is promptly notifying your insurance provider of the death. This usually involves contacting their claims department via phone or through their online portal. You will then need to provide initial documentation, which typically includes the death certificate, a copy of the insurance policy, and potentially some form of identification. The insurer will then guide you through the next steps, often assigning a dedicated claims handler to assist you.

Common Claim Scenarios and Required Documentation

Different claim scenarios require varying levels of documentation. Understanding these common situations and their associated paperwork can help you prepare efficiently.

- Death due to natural causes: This typically requires a death certificate issued by the relevant authorities, the original insurance policy, and the claimant’s identification.

- Accidental death: In addition to the documents listed above, an accidental death claim might require a police report, an autopsy report (if applicable), and potentially witness statements detailing the circumstances of the accident.

- Suicide: Claims involving suicide often necessitate a thorough investigation by the insurer. This may involve reviewing police reports, medical records, and other supporting documents to verify the cause of death and determine the claim’s eligibility according to the policy’s terms and conditions.

Navigating the Claims Process: A Hypothetical Example

Let’s imagine Mr. Smith, the policyholder, passed away due to a heart attack. His wife, Mrs. Smith, is the designated beneficiary. Upon Mr. Smith’s death, Mrs. Smith immediately contacts the insurance company’s claims department. She provides them with a copy of the death certificate, Mr. Smith’s insurance policy, and her own identification. The insurer assigns a claims handler who guides Mrs. Smith through the submission of additional documentation, such as Mr. Smith’s medical records. After verification of all the documents, the claim is processed and the death benefit is disbursed to Mrs. Smith according to the policy terms.

Understanding Claim Processing Timeframes

The time it takes to process a claim varies depending on several factors, including the complexity of the case and the completeness of the documentation provided. While some claims might be processed within a few weeks, others may take longer, particularly those involving more intricate circumstances. Open communication with your insurance provider is key to understanding the expected timeframe for your specific claim.

Illustrative Examples

Understanding term insurance is best done through practical examples. These illustrations will showcase the benefits and limitations of term life insurance policies, providing a clearer picture of how they function in real-life scenarios.

Term Insurance Policy Illustration

Let’s consider a 35-year-old individual, John, purchasing a 20-year term life insurance policy with a coverage amount of $500,000. His annual premium, based on his age, health, and the policy’s terms, is $800. The policy illustration would visually represent this information, possibly in a table format. The table would show the policy’s duration (20 years), the annual premium ($800), the death benefit ($500,000 payable upon John’s death within the policy term), and perhaps a graph illustrating the remaining death benefit over the policy’s lifetime. If John were to die within the 20-year period, his beneficiaries would receive the full $500,000 death benefit. If John outlives the 20-year term, the policy simply expires, and no further premiums are due. The illustration would also clearly state any exclusions or limitations, such as waiting periods for specific causes of death.

Beneficial Scenario: Financial Protection for a Family

Consider Sarah, a single mother of two young children. She secured a $250,000 term life insurance policy. Tragically, Sarah passed away unexpectedly. Her policy’s death benefit provided her children with immediate financial security, covering funeral expenses, outstanding debts, and providing a substantial fund for their education and future living expenses. The financial protection offered by the policy significantly eased the burden on her family during a difficult time, ensuring their financial stability and allowing them to focus on emotional healing. Without the policy, the family might have faced severe financial hardship.

Scenario Illustrating Policy Limitations

Mark purchased a term life insurance policy without carefully reviewing the fine print. He engaged in a high-risk hobby – skydiving – after purchasing the policy. Unfortunately, he suffered a fatal accident during a skydiving jump. His claim was denied because the policy explicitly excluded death resulting from participation in high-risk activities that were not disclosed during the application process. This scenario highlights the importance of thoroughly understanding the policy’s terms and conditions, including exclusions and limitations, before signing the contract. Mark’s failure to disclose his high-risk hobby resulted in his beneficiaries not receiving the death benefit they expected.

Final Thoughts

Securing your family’s financial future through term insurance is a significant step towards responsible financial planning. By carefully considering your individual circumstances, comparing policy options, and understanding the claims process, you can confidently choose a policy that offers the right level of protection at an affordable price. Remember, proactive planning ensures peace of mind, knowing your loved ones are financially secure, even in your absence.

Key Questions Answered

Can I convert my term insurance policy to a permanent policy?

Some term insurance policies offer a conversion option, allowing you to switch to a permanent policy (like whole life) without undergoing a new medical examination, usually within a specified timeframe.

What happens if I miss a premium payment?

Missing a premium payment can result in your policy lapsing. Most insurers offer a grace period (typically 30 days), but if payment isn’t received within that period, coverage may cease. Contact your insurer immediately if you anticipate difficulties making a payment.

How is the death benefit paid out?

The death benefit is typically paid to the designated beneficiary upon verification of the death claim. The payout method can vary depending on the policy; some offer lump-sum payments, while others provide options for installments or annuities.

Does my health status affect my premium?

Yes, your health significantly influences your premium. Pre-existing conditions or current health issues can lead to higher premiums or even policy rejection in some cases.