Grace period: the term conjures images of reprieves and second chances, a temporary buffer zone before consequences take hold. But the reality of a grace period is far more nuanced, varying significantly depending on the context. From financial loans offering a brief respite to missed payments, to software trials extending their welcome, and even legal proceedings granting additional time, the concept of a grace period weaves its way through various aspects of our lives. This exploration delves into the intricacies of grace periods, examining their applications across diverse fields and the implications of both adherence and non-compliance.

We will examine the common characteristics of grace periods across finance, technology, and law, highlighting the differences in duration, consequences, and overall impact. Understanding these variations is crucial for navigating various situations where a grace period might be offered or expected.

Defining “Grace Period”

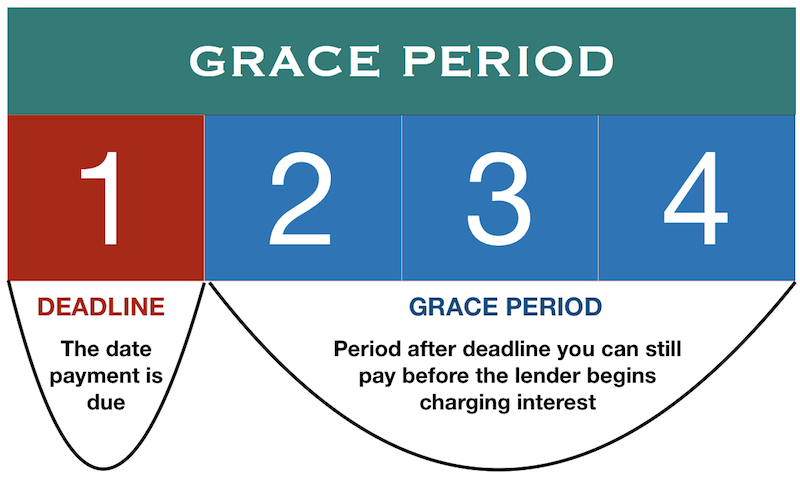

A grace period is a designated timeframe following a deadline or due date, offering an extension for fulfilling an obligation without incurring penalties. This period provides a buffer, allowing for unforeseen circumstances or administrative delays. The specific terms and conditions of a grace period vary widely depending on the context.

Grace Periods in Different Contexts

Grace periods are prevalent across various sectors, each with its own nuances. In finance, they often apply to loan repayments or credit card bills, offering a short window to make a payment before late fees are applied. Legal contexts may include grace periods for filing paperwork or responding to legal actions. In the technology realm, grace periods are common for software subscriptions or trial periods, providing users extra time to utilize the service before committing to a paid plan. These examples illustrate the broad applicability of the concept.

Key Characteristics of Grace Periods

Several characteristics consistently define a grace period regardless of the context. Firstly, a grace period always follows a predetermined deadline. Secondly, it offers a temporary extension to meet an obligation. Thirdly, the extension is typically conditional; non-compliance after the grace period expires usually results in penalties or consequences. Finally, the duration of the grace period is usually specified and clearly defined within the relevant agreement or policy. These shared features ensure consistency and clarity across different industries.

Comparison of Grace Periods Across Industries

The following table illustrates the differences in grace periods across several industries. Note that these are typical durations and consequences; specific terms vary based on individual contracts and agreements.

| Industry | Typical Duration | Consequences of Non-Compliance | Examples |

|---|---|---|---|

| Finance (Credit Cards) | 10-21 days | Late fees, negative impact on credit score | Most major credit card issuers offer a grace period for payments. |

| Finance (Loans) | 7-30 days (varies greatly by loan type) | Late fees, higher interest rates, potential default | Mortgages, auto loans, and personal loans often have grace periods. |

| Software Subscriptions | 7-30 days (often tied to free trials) | Service termination, loss of access to features | Many SaaS (Software as a Service) providers offer grace periods for trial users. |

| Legal (Filing Documents) | Varies greatly by jurisdiction and legal action | Dismissal of case, missed deadlines, potential penalties | Court filings, appeals, and other legal procedures often have grace periods. |

Grace Periods in Finance

Grace periods in the financial world offer borrowers a short reprieve before penalties are applied for late payments. Understanding these periods is crucial for responsible financial management, as they can significantly impact overall borrowing costs. This section will explore the specifics of grace periods in various financial contexts.

Typical Grace Periods for Loan Repayments

Most loan agreements, whether for mortgages, auto loans, or personal loans, include a grace period. This period typically ranges from 10 to 15 days after the payment due date. However, the exact length varies depending on the lender and the type of loan. For instance, some lenders might offer a longer grace period for first-time borrowers or those with consistently good payment histories, while others may have stricter policies. It’s vital to carefully review the loan agreement to understand the specific grace period applicable. Failing to make a payment within the designated grace period usually triggers late payment fees and can negatively affect the borrower’s credit score.

Grace Periods for Credit Card Payments and Their Implications

Credit card companies commonly provide a grace period, typically 21 to 25 days, during which payments can be made without incurring interest charges. This grace period only applies if the previous balance is paid in full by the due date. If a balance is carried over, interest charges accrue from the date of the purchase. Missing a credit card payment, even within the grace period, can lead to late payment fees and potentially higher interest rates. Furthermore, repeated late payments can severely damage a credit score, making it more difficult to obtain loans or credit in the future. For example, a cardholder with a $1000 balance and a 15% APR who misses their payment within the grace period might face a $25 late fee and increased interest charges on the outstanding balance.

Legal Aspects of Grace Periods in Loan Agreements

Grace periods are typically Artikeld within the loan agreement itself. These agreements are legally binding contracts, and the terms regarding grace periods must be adhered to by both the lender and the borrower. While lenders are generally obligated to provide a grace period as stated in the agreement, the specific terms are subject to negotiation during the loan application process. Disputes regarding grace periods often involve interpretations of the contract’s language, and legal counsel might be necessary to resolve such disagreements. It’s essential for borrowers to thoroughly read and understand the terms of their loan agreement before signing.

Scenario: Consequences of Missing a Payment

Consider a scenario involving a small business loan with a 15-day grace period. If the business owner misses the payment within the grace period, they might incur a late payment fee of, for example, $50. However, if the payment remains unpaid after the grace period expires, the consequences escalate significantly. The lender might report the delinquency to credit bureaus, resulting in a negative impact on the business’s credit score. Furthermore, the lender could pursue collection actions, including sending demand letters and potentially initiating legal proceedings. The accumulated late fees could also increase substantially, and the interest rate on the loan might increase, adding to the financial burden. In severe cases, the lender could initiate foreclosure or repossession of assets used as collateral for the loan.

Grace Periods in Technology

Grace periods are a common feature in the technology sector, particularly within software subscriptions and trials. They offer users an extended timeframe beyond the initial subscription or trial expiration, providing a buffer period to renew or complete tasks before access is revoked. This practice is prevalent across various software providers, albeit with differing implementations and durations. Understanding the nuances of these grace periods is crucial for both users and providers.

Common Uses of Grace Periods in Software Subscriptions and Trials

Grace periods in software typically serve to mitigate the immediate impact of missed payments or trial expirations. For subscription services, a grace period allows users a short window to renew their subscription without immediately losing access to the software. This prevents abrupt service disruptions, which can be detrimental to workflow and productivity. In the context of free trials, grace periods provide users additional time to evaluate the software before committing to a paid subscription. This extended trial period allows for a more thorough assessment of the software’s features and suitability. Many software providers utilize a grace period of a few days to a week, though some offer longer periods, depending on their pricing model and customer service policies.

Comparison of Grace Periods Offered by Various Software Providers

The duration and conditions of grace periods vary significantly among software providers. Some providers might offer a 7-day grace period for subscription renewals, while others might extend it to 14 or even 30 days. The specifics often depend on the software’s pricing tier, the user’s history with the provider, and the provider’s overall customer retention strategy. For instance, a provider offering a high-value, enterprise-level software might offer a longer grace period than a provider of a simple, low-cost application. Additionally, some providers might offer different grace periods for different types of subscriptions (e.g., monthly vs. annual). The terms and conditions surrounding the grace period are also important; some providers might restrict functionality during the grace period, while others might maintain full access until the end of the grace period.

User Experience Implications of Grace Periods in Software

Grace periods significantly impact the user experience. A well-implemented grace period can minimize frustration and disruption caused by missed payments or trial expirations. Users appreciate the extra time to address payment issues or complete their evaluation of the software. Conversely, poorly designed or communicated grace periods can lead to confusion and negative experiences. For example, a lack of clear communication about the grace period’s duration and conditions can lead to users unexpectedly losing access to the software, resulting in lost work or productivity. A user-friendly interface clearly displaying the remaining time in the grace period can significantly enhance the user experience and prevent such negative outcomes. Proactive notifications reminding users of upcoming subscription renewals can further enhance the experience and reduce the likelihood of missed payments.

Benefits and Drawbacks of Grace Periods for Software Users and Providers

Grace periods offer several advantages for both software users and providers.

For users, the primary benefit is the avoidance of immediate service interruption. This provides a safety net for unexpected circumstances, preventing data loss and workflow disruption. Additionally, grace periods allow for more thorough evaluation of trial software, leading to more informed purchasing decisions. However, a drawback is the potential for users to exploit the grace period, delaying payments indefinitely.

For providers, grace periods can improve customer retention by mitigating churn caused by missed payments. They demonstrate a commitment to customer satisfaction and can enhance brand loyalty. However, the drawback is the potential for revenue loss if users consistently rely on grace periods to avoid timely payments. Managing grace periods effectively requires a balance between customer service and financial stability.

Grace Periods in Law

Grace periods, while commonly associated with financial transactions, also play a significant role in legal contexts, offering a buffer period for individuals and entities to comply with legal obligations without immediate penalty. This flexibility helps ensure fairness and allows for unforeseen circumstances.

The application of grace periods in law primarily focuses on providing a reasonable extension for meeting deadlines. This extension is granted to alleviate the harsh consequences of strict adherence to deadlines, particularly in situations where a minor delay may not significantly impact the overall legal process. The length of the grace period varies depending on the specific legal context and the relevant jurisdiction.

Factors Influencing the Length of Legal Grace Periods

Several factors determine the duration of a grace period in legal proceedings. These include the complexity of the legal matter, the potential impact of non-compliance, the established practices of the relevant court or administrative body, and any extenuating circumstances presented by the party requesting the extension. For example, a simple administrative filing might have a shorter grace period than a complex appeal process. The severity of the potential consequences for missing the deadline also plays a crucial role; a more serious consequence typically warrants a more generous grace period.

Examples of Legal Grace Periods and Their Impact

Grace periods are frequently applied in various legal scenarios. For instance, filing tax returns often includes a grace period to allow for late submissions with minimal penalty. Missing a court-ordered deadline to file a response might result in a default judgment against the individual or entity failing to meet the deadline, unless a valid grace period extension has been granted. In bankruptcy proceedings, debtors may be granted a grace period to reorganize their finances before facing liquidation. The impact of a grace period can be substantial, preventing potentially severe penalties or the loss of legal standing.

Comparison of Grace Periods Across Legal Systems

The implementation and interpretation of grace periods can differ significantly across various legal systems. For example, the length of a grace period for tax filings might vary considerably between countries, reflecting differing administrative practices and levels of enforcement. Similarly, the grounds for granting an extension beyond a standard grace period might differ, with some jurisdictions placing greater emphasis on demonstrating exceptional circumstances. This variation highlights the importance of understanding the specific legal framework within which a grace period applies.

Illustrative Examples of Grace Periods

Grace periods, while seemingly simple, manifest differently across various contexts. Understanding their application through specific examples clarifies their practical implications and importance. The following illustrations demonstrate grace periods in loan repayment, software trials, and legal proceedings.

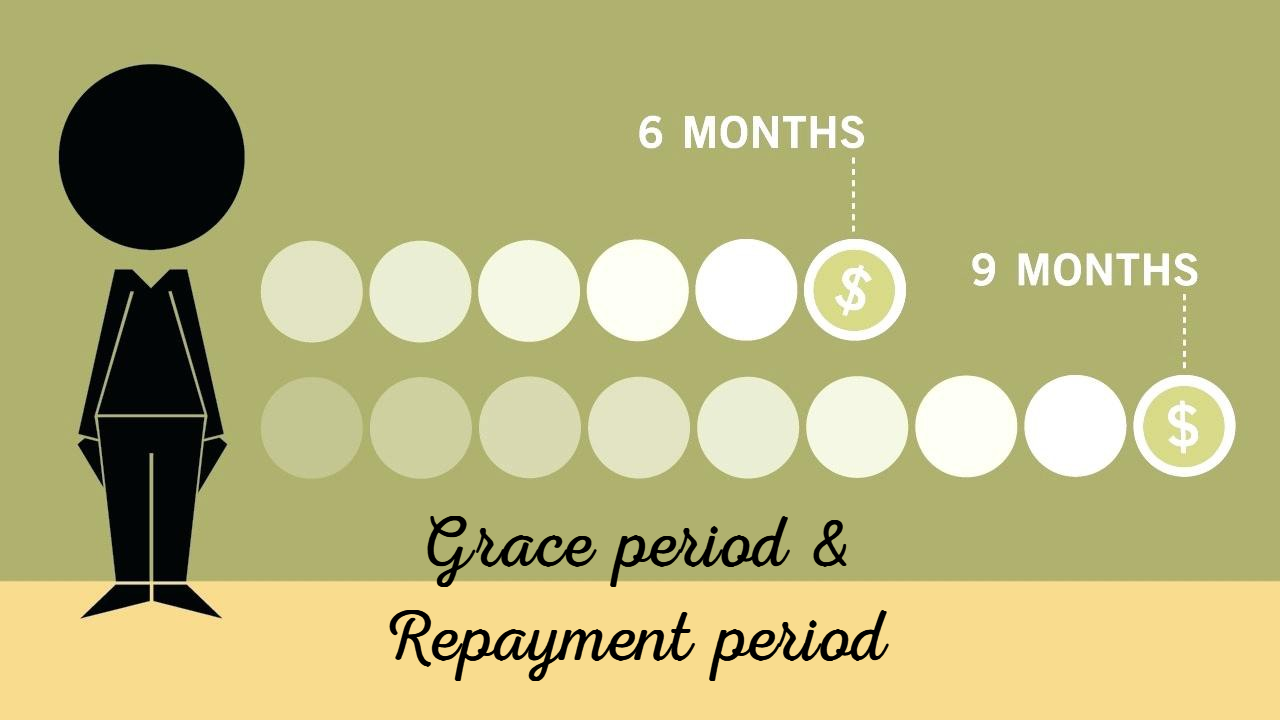

Loan Repayment Grace Period Timeline

Imagine a visual representation of a loan repayment timeline. The horizontal axis represents time, marked in months, from the loan’s inception to its completion. The vertical axis represents the loan balance. A line sloping downwards shows the gradual reduction of the loan balance over time through regular payments. However, the initial portion of this line, representing the first three months (for example), is flat. This flat section visually represents the grace period. After the three-month grace period, the line resumes its downward slope, indicating the commencement of regular loan repayments. The total loan repayment period is clearly visible, including the initial grace period. The difference in the loan balance between the end of the grace period and the loan’s origination visually represents the interest accrued during the grace period.

Software Trial Grace Period

Sarah, a freelance graphic designer, decided to trial “DesignPro,” a new software application. The trial offered a 30-day grace period. During the first week, Sarah explored the software’s interface, familiarizing herself with its features. In the second and third weeks, she used DesignPro for smaller projects, testing its functionality against her existing workflow. She found it efficient and user-friendly. During the final week of the trial, she completed a major client project using DesignPro. She was extremely satisfied with the results and purchased a license before the grace period expired, avoiding any interruption to her workflow. Had she not purchased a license, access to the software would have been terminated at the end of the 30-day grace period.

Legal Grace Period: Tax Filing

Consider a tax filing scenario with a grace period. John, a self-employed individual, is required to file his annual tax return by April 15th. However, due to unforeseen circumstances, he was unable to complete his return by the deadline. The tax authority provides a 30-day grace period for late filings. John utilized this grace period, completing and submitting his tax return on May 15th. As a result, he only incurred a minimal late filing penalty. If John had not utilized the grace period and failed to file his return within the extended timeframe, he would have faced significantly higher penalties, potentially including interest charges and legal repercussions.

Conclusion

Ultimately, the grace period, while seemingly simple, reveals itself as a multifaceted concept with significant implications. Whether it’s the financial relief offered by a delayed loan payment, the extended trial period for software exploration, or the legal reprieve granted for a missed deadline, the understanding and effective utilization of grace periods can be pivotal. By recognizing the nuances of each context and anticipating potential consequences, individuals and organizations can leverage these periods to their advantage, mitigating risks and maximizing opportunities.

Question & Answer Hub: Grace Period

What happens if I miss a payment during a grace period?

Typically, missing a payment during a grace period will result in the loss of the grace period, and the full amount will become immediately due. Late fees may also apply.

Can a grace period be extended?

This depends entirely on the provider or governing body. Some may offer extensions under specific circumstances, while others may not. It’s crucial to contact the relevant party to inquire about extension possibilities.

Are grace periods legally binding?

Yes, grace periods are generally legally binding if clearly Artikeld in a contract or agreement. Failure to comply can lead to legal repercussions.